Table of Contents

Laying the legal groundwork for your business is a pivotal first step. The Limited Liability Company (LLC) is a well-established structure providing valuable liability protection and operational flexibility for many ventures. However, licensed professionals, including doctors, lawyers, and architects, face another option: the Professional Limited Liability Company (PLLC).

While the acronyms appear similar, the distinctions between an LLC vs. a PLLC are meaningful and directly influence how professional practices operate and are legally structured. In this article, let’s delve into the specific differences between LLC and PLLC to clarify the best path forward for your goal business. Read more to find out.

What is an LLC?

Definition of a Limited Liability Company (LLC)

A Limited Liability Company (LLC) is a widely adopted legal structure worldwide, known for its ability to shield owners from business liabilities and ease of operation. It is a separate legal entity from its owners or members.

Benefits of an LLC

The primary benefit is liability protection. If the business incurs debt or faces a lawsuit, the personal assets of the owners such as their homes or savings, are typically protected. In addition, LLCs can choose to be taxed as a pass-through entity or a corporation. It also has greater operational flexibility and fewer legal obligations.

Who can form an LLC?

Generally, any legal “person” can be a member of an LLC. This includes individual adults, corporations, other LLCs, and even foreign entities.

In the United States, it can be formed under intentionally broad rules to encourage incorporation. Citizenship or residency is not required.

How about the difference between LLC and PLLC? In the next section, we will delve into the features of the PLLC. Take note of these aspects of a standard limited liability company vs. a professional limited liability company.

What is a PLLC Business?

Definition of a Professional Limited Liability Company (PLLC)

A Professional Limited Liability Company (PLLC) is a specialized LLC for licensed professionals. What is a PLLC vs. an LLC? Unlike standard LLCs, ownership in a Professional Limited Liability Company vs. an LLC is restricted to those holding the relevant expert licenses.

Benefits of a PLLC

Like a standard LLC, a PLLC safeguards personal assets from business debts and lawsuits, but this protection does not typically extend to your own professional malpractice or negligence.

Financially, PLLCs benefit from pass-through taxation, where profits and losses are reported on the owners’ personal income tax returns, avoiding the double taxation associated with traditional corporations.

Operationally, they provide greater flexibility than Professional Corporations (PCs). For example, they typically don’t require a formal board of directors for day-to-day management.

Who can form a PLLC?

Only licensed professionals can form a PLLC. These professions commonly include, but are not limited to:

States that allow PLLCs

States that do not allow PLLCs

What is the difference between a PLLC and an LLC?

Both Limited Liability Companies and Professional Limited Liability Companies offer personal asset protection, but several distinctions still exist, primarily tailored to the unique needs and responsibilities of experts. Understanding these differences is crucial when deciding between an LLC vs. a Professional LLC.

Eligibility and ownership

- LLC: Open to almost anyone, regardless of professional background or licensing.

- PLLC: Restricted to licensed persons in the particular field of the business.

For those requiring strict licensure to operate, a PLLC is the necessary (and often only) option. For businesses not requiring complex licenses, an LLC has broader accessibility.

Profit allocation

The methods for allocating profits are generally flexible and determined by the operating agreement for both LLCs and PLLCs. This aspect remains largely consistent between the two structures. In short, neither structure inherently offers a better approach to profit allocation. Both allow for flexibility based on the owners’ agreement.

Liability protection

- LLC: Protects members’ personal assets from business debts and lawsuits.

- PLLC: Protects members from each other’s malpractice and business debts but not their own professional negligence.

Both protect personal assets from general business liabilities. However, for protection against operational errors, neither provides a shield for the individual practitioner’s malpractice. In fact, the PLLC structure prioritizes individual accountability.

Business formation

- LLC: Simpler process, typically involving filing articles of organization.

- PLLC: Requires proof of licensing and often approval from the state licensing board, making it a more credible process.

Forming an LLC is generally quicker and less complex. Meanwhile, the more rigorous requirements of a PLLC ensure compliance with local licensing requirements.

Taxation

Both LLCs and PLLCs have the same tax options available (pass-through, S Corp, C Corp). The choice depends on the specific financial situation of the business and its owners.

Tax classificationHow it worksBenefits

| Tax classification | How it works | Benefits |

|---|---|---|

| Pass-through | Profits and losses are reported on the owners’ personal income tax returns. | Simpler tax administration Avoiding double taxation |

| S corporation | Business income and losses are passed through to owners. Owners who are employees can draw a salary and reduce self-employment tax. | Potential for self-employment tax savings for active members. |

| C corporation | The business is taxed separately from its owners. Owners are taxed again on dividends. | Advantageous for certain situations (e.g., attracting certain types of investment). |

Overall, choosing the appropriate tax classification must be based on the business’s long-term goals and financial circumstances, regardless of whether it is an LLC or a PLLC.

LLC vs. PLLC: A state-by-state comparison

Although the core function of a PLLC remains consistent, the regulatory landscape differs widely from state to state. Even in jurisdictions that permit PLLC incorporation, the requirements, restrictions, and approval processes can vary significantly.

Because of these differences, it’s essential to review the regulations in your intended state of operation. To highlight how these variations can affect setup and compliance, let’s look at two examples: Michigan and Arizona.

PLLC vs. LLC Michigan

PLLC in Michigan

Michigan’s Limited Liability Company Act governs PLLC formation, allowing licensed professionals like doctors, lawyers, architects, and accountants to establish this structure. A key requirement is that the Articles of Organization must declare the business’s purpose as rendering a professional service, and generally, all members must hold the relevant permits.

Michigan law also mandates specific naming conventions, often requiring abbreviations like “P.L.L.C.” or “PLLC.” When weighing a PLLC vs. an LLC Michigan, entrepreneurs must verify their profession’s eligibility and adhere to local regulations.

LLC in Michigan

For Michigan businesses that do not involve licensed professional services, a standard LLC is the appropriate entity. The setup is less demanding, without the need for member license verification or service declarations in the company documents. Ownership in a Michigan LLC is also not limited to licensed individuals.

PLLC vs. LLC Arizona

PLLC in Arizona

Arizona law also permits the PLLC formation, restricting membership to licensed professionals providing the company’s services, commonly in fields like law, medicine, and architecture. Formation documents filed with the Arizona Corporation Commission must clearly identify the venture as a professional limited liability company, and naming rules apply.

When considering a PLLC vs. LLC Arizona, licensed professionals must confirm they meet Arizona’s licensing requirements for PLLC membership and comply with the state’s relevant rules.

LLC in Arizona

A traditional LLC remains a suitable choice for Arizona businesses not offering licensed professional services. Forming an Arizona LLC does not require members to hold legitimate permits related to the business activities. Ownership can include individuals or entities without proper qualifications. Starting this venture is easier than a PLLC, as it lacks the licensing proof requirement.

LLC or PLLC: Which is right for you?

Deciding between an LLC and a PLLC hinges primarily on your business’s nature and if it involves licensed professional offerings. Grasping what is the difference between a PLLC and an LLC is vital for correct selection, so let’s start!

When to select an LLC

- Opt for general business activities not requiring expert credentials.

- Flexibility in ownership and management.

- Suitable for ventures like selling goods or providing non-professional services.

- Simpler formation process.

- Broad ownership eligibility.

When to select a PLLC

- The necessary structure for businesses providing services requiring legal licensure.

- Fosters compliance with state regulations governing these practices.

- Liability coverage for business debts.

- Covers actions of other members (excluding individual malpractice).

- Credibility and trust from global clients

- Maintains accountability for one’s own conduct.

To summarize, the professional limited liability company vs. LLC contrast lies mainly in eligibility, ownership rules, and the scope of liability coverage regarding business errors.

Given the state-specific nature of these regulations and their effects, seeking advice from legal and financial experts is strongly advised to determine the best structure for your case.

How to form an LLC and a PLLC

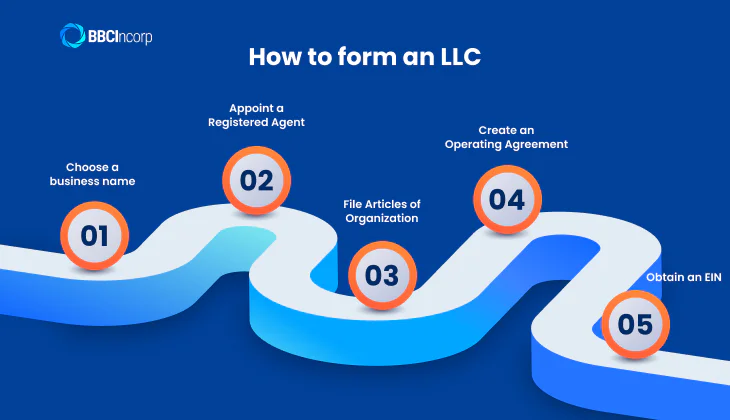

The basic steps for establishing both an LLC and a PLLC share similarities, yet forming a PLLC involves an extra crucial phase due to its nature.

Generally, the procedure forming an LLC encompasses several key stages:

Step 1: Choose a business name

The initial action for both types is to select a business name. This name must adhere to your state’s regulations regarding availability and prohibited terms.

Notably, for those forming a PLLC, many states require the business name to include “Professional Limited Liability Company” or an acceptable abbreviation like “P.L.L.C.” or “PLLC”.

Step 2: Appoint a Registered Agent

Next, you must designate a registered agent. This individual or entity must reside within your state and be available during business hours to receive legal and official correspondence on behalf of your business. The registered agent acts as a point of contact with the state.

Step 3: File Articles of Organization

Following this, you’ll need to file your Articles of Organization (or Certificate of Formation, depending on your state) with the Secretary of State. The document formally creates your business and typically includes essential details such as the business name and address.

What to prepare for your Articles of Organization

Before filing your Articles of Organization, you will need to list out your LLC’s business name, principal office address, registered agent’s information, purpose of business, and the names and addresses of members or managers. Some states require information about the LLC’s duration and the organizer who files the paperwork as well.

What are Articles of Incorporation? They are official documents filed with the state to legally create your LLC or corporation, outlining essential company information and establishing its legal existence.

Step 4: Create an Operating Agreement

While not legally mandated in every state, creating an operating agreement is a highly recommended action for both LLCs and PLLCs.

The operating agreement shall outline the ownership structure, the rights and responsibilities of the members, and the operational procedures of the company, providing clarity and preventing potential disputes.

Step 5: Obtain an EIN

To operate legally, your business will likely need to obtain an EIN (Employer Identification Number) from the Internal Revenue Service.

This unique nine-digit number is akin to a Social Security number for your business and is necessary for opening a business bank account and for tax purposes. Especially if you plan to hire employees or elect to be taxed as a corporation, finding an EIN number is a must.

Additional Step for PLLC Incorporation: Obtain Licensing Board Approval

Before or sometimes concurrently with filing the Articles of Organization (step 3), you will need to submit documentation verifying that all members hold the necessary professional licenses in good standing. The licensing board will review this information to make sure the proposed business structure complies with its specific regulations and ethical guidelines.

Ongoing compliance for a PLLC and an LLC

Staying compliant is vital for both a Professional Limited Liability Company (PLLC) and a Limited Liability Company (LLC). While their core responsibilities are quite the same, PLLCs must also account for professional licensing.

Annual reporting

Most states mandate filing annual or biennial reports. These confirm current ownership, addresses, and registered agent information. Failure to submit these reports on time can result in state-levied penalties or even business suspension.

Maintaining Professional Licenses (PLLCs only)

PLLC owners face the additional responsibility of keeping their professional licenses active, as mandated by their state’s licensing board. This typically involves adhering to renewal deadlines, completing continuing education requirements, and providing proof of good standing within their profession.

Tax filing responsibilities

By default, both LLCs and PLLCs benefit from pass-through taxation. Business income is reported on the owners’ personal tax returns, avoiding corporate-level tax. This is similar to how a sole proprietorship is taxed.

Nevertheless, LLCs and PLLCs also have the flexibility to elect a different tax structure if it suits their financial goals:

- S Corp election: Filing IRS Form 2553 to be taxed as an S corporation. This may reduce self-employment taxes by splitting income between salary and distributions.

- C Corp election: Filing IRS Form 8832 enables taxation as a C corporation, which means double taxation but brings advantages for reinvestment and other deductions.

Start your LLC with BBCIncorp

Establishing a PLLC offers licensed professionals vital advantages, aligning liability management with professional duties. However, exploring premier jurisdictions can yield even greater benefits. With its advantageous business law, Delaware remains a compelling consideration for your venture!

Here at BBCIncorp, we furnish end-to-end support for your LLC formation, encompassing Delaware LLC incorporation, efficient bank account setup, annual compliance, company secretary, and many additional company services you are looking for.

Further, for professionals envisioning global expansion, we also streamline Company registration in Cyprus in an EU member jurisdiction with a favorable tax system and strategic geographic position.

Ready to elevate your practice? Connect with our expert team today at service@bbcincorp.com or visit our website for timely support.

Conclusion

Choosing between an LLC and a PLLC is a key early step for every entrepreneur, especially if you’re a licensed professional. Grasping these nuances, especially regarding who can form them and the scope of liability protection, is vital for a secure business foundation. Selecting the correct structure ensures both personal asset safeguarding and adherence to relevant regulations.

Don’t delay this critical choice. Empower your business by taking action now through consulting with BBCIncorp legal and financial professionals. We are ready to offer helpful insights.

Frequently Asked Questions

Is a PLLC a sole proprietorship?

No, a PLLC (Professional Limited Liability Company) is not a sole proprietorship. They are separate and distinct business structures.

A sole proprietorship is a simple business owned by one person with no legal distinction between the owner and the business, leading to personal liability.

A PLLC, designed for licensed professionals, is a distinct legal entity offering limited liability to its members (though often not for their own malpractice). PLLCs can have one or more owners, unlike sole proprietorships, which are limited to one.

Do I need a registered agent for my PLLC?

Yes, most states require a registered agent for your PLLC.

A registered agent is a designated individual or entity who receives legal and official documents on your PLLC’s behalf, including service of process. The registered agent must have a physical address in the state where your PLLC is registered and be available during business hours.

While you or another member can act as your own registered agent if eligible, many PLLCs opt for a commercial registered agent service for privacy and consistent availability.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.