Table of Contents

The distinction between onshore vs. offshore companies has long been a subject of interest for global entrepreneurs and investors. Understanding how these two structures differ is essential for anyone seeking to expand internationally or enhance cost efficiency. Each model offers unique advantages in taxation, regulation, and operational flexibility, and choosing the right one depends on your long-term business goals.

In this article, we will break down the key differences between onshore vs. offshore company and help you identify which structure best supports your strategy. Watch our quick video below for a clear visual guide on these differences!

What is an onshore company?

An onshore company is a legal entity formed and managed within its home country. It operates under the laws, taxation, and financial regulations of that jurisdiction and primarily serves clients or conducts transactions within the same territory. Examples include companies incorporated in countries such as the United States, the United Kingdom, or Hong Kong.

Onshore companies benefit from proximity to local markets and government support programs that encourage domestic business activities. They enjoy easier access to local banks, financing options, and professional networks that strengthen their business presence.

This structure is also recognized for its transparency. Because onshore entities are subject to clear reporting and compliance standards, they build strong credibility with clients, regulators, and investors.

However, onshore businesses often face higher taxes and more extensive regulatory requirements. They must file regular tax returns, maintain accounting records, and comply with employment and corporate laws.

Let’s compare the benefits and drawbacks of an onshore venture.

Advantages of an onshore company advantages

- Transparent legal environment

Onshore entities follow clear and established regulations that protect both businesses and clients. Legal disputes are resolved within a recognized judicial framework, which strengthens commercial trust. - Access to local financial systems

These companies can easily work with domestic banks, obtain loans, and use payment services, giving them smoother access to funding and day-to-day financial operations. - Reputation and trust

Operating under a regulated jurisdiction enhances credibility among investors, customers, and business partners, as it shows compliance with national standards. - Proximity to target markets

Being located near clients and suppliers supports better communication, faster transactions, and direct access to skilled labor and business infrastructure.

Disadvantages of an onshore company

- Higher taxation

Onshore entities are subject to full local taxes, including corporate income tax, payroll tax, and sometimes value-added tax, which can significantly affect profitability. - Limited confidentiality

Company ownership, director details, and financial statements are usually part of the public record, reducing privacy for business owners. - Greater compliance burden

Local authorities often require extensive documentation, annual filings, and accounting audits, which add administrative responsibilities and costs. - Higher setup and operational costs

Registration fees, office rent, and ongoing government charges tend to be more expensive compared to offshore jurisdictions.

What about an offshore company? In the next section, we will review offshore companies and see how they differ in structure, taxation, and international business opportunities.

What is an offshore company?

An offshore company is a business entity incorporated in a jurisdiction different from where its owners reside. For example, an entrepreneur living in Singapore might register a company in Belize. That entity qualifies as an offshore company.

These structures are designed to operate under the legal and tax frameworks of their jurisdiction of registration while servicing markets globally rather than focusing on local trade. Among the most noted advantages are tax efficiency, asset protection, and enhanced confidentiality, with many jurisdictions offering low or zero tax rates on foreign-sourced income.

An offshore company typically functions without physical presence in its registration country, and minimal reporting obligations can apply depending on the jurisdiction. It allows investors to hold assets, conduct cross-border transactions, or manage holding structures in a legal environment tailored for global business.

Although offshore companies present compelling opportunities, it remains critical to use them in full compliance with global regulations, to avoid misunderstanding with illegal practices, and to preserve their legitimacy.

Free ebook

New to offshore business landscapes?

All the essential information you need is right here.

Types of offshore companies

Offshore companies serve a wide range of purposes beyond tax optimization. They are established in jurisdictions that support business through favorable corporate laws, light reporting requirements, and flexible structures:

Offshore trading company

This type of entity focuses on international commerce. It facilitates buying and selling goods across borders without conducting business in its country of registration. Offshore trading companies are popular among import-export firms.

Offshore holding company

A holding structure is used to own shares, intellectual property, or other assets in one or multiple subsidiaries. It helps centralize ownership, simplify profit distribution, and protect valuable assets from domestic legal risks. Many multinational corporations use this model to manage investments in different jurisdictions efficiently.

Offshore investment company

The structure allows investors to manage portfolios, real estate, and other financial assets through a legally recognized entity. Offshore investment companies are often formed by high-net-worth individuals seeking asset diversification, confidentiality, and access to further markets.

Offshore banking company

Financial entities incorporated in stable jurisdictions such as Switzerland or the Cayman Islands offer specialized banking services. These institutions focus on wealth preservation, asset management, and privacy, providing secure environments for global capital.

Selecting the right structure requires a clear consideration of your objectives, the legal environment, and regulatory obligations in the chosen jurisdiction. So select carefully to make sure that your offshore entity supports your long-term growth and compliance needs.

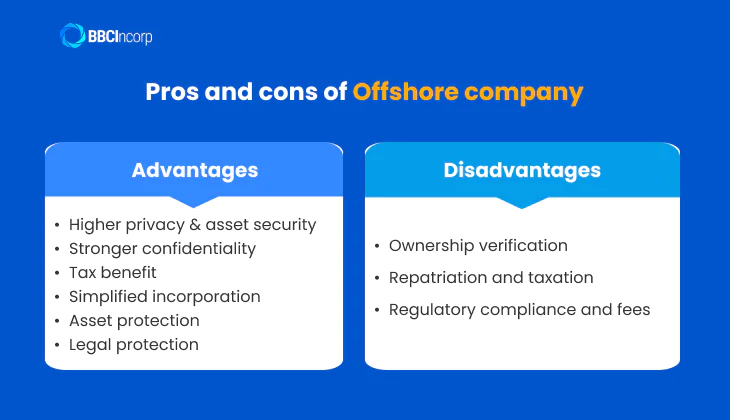

Offshore company advantages

While each offshore jurisdiction offers its own regulatory and financial framework, most share several common benefits that appeal to global entrepreneurs and investors.

Privacy

An offshore company provides a clear separation between personal and business assets, creating a protective barrier that enhances individual privacy and asset security.

Confidentiality

Unlike onshore companies, offshore entities often operate with stronger confidentiality provisions. Company information, including the identities of beneficial owners, remains private and inaccessible to the public unless a criminal investigation is involved.

Tax benefit

Top offshore company jurisdictions for foreigners tend to offer preferential tax treatment for non-resident companies. These entities are typically exempt from local corporate taxes, foreign income tax, and capital gains tax. However, tax obligations still apply under international rules such as Controlled Foreign Company (CFC) laws, depending on the owner’s country of residence.

Simplified incorporation

Offshore jurisdictions aim to attract foreign investors by minimizing administrative burdens. Many allow fast registration, limited reporting requirements, and no need for local directors, secretaries, or audits.

Asset protection

Forming an offshore company creates a legal buffer between the owner and their assets. This structure helps safeguard wealth from lawsuits, creditors, or political instability in the owner’s home country.

Legal protection

Since offshore companies operate under foreign legal systems, they benefit from jurisdictional separation. This adds an extra layer of protection against domestic legal claims and asset searches.

Other advantages

Offshore businesses enjoy flexible management requirements and can operate remotely without physical presence in the jurisdiction. Lower operational costs, such as reduced staffing and office expenses, also contribute to greater efficiency.

Offshore company disadvantages

Despite these advantages, offshore companies also present certain challenges that investors must consider.

Ownership verification

The anonymity that offshore structures offer can create difficulties when proving ownership. The absence of public registries may lead to delays or complications in transactions requiring ownership verification.

Repatriation and taxation

Income and assets transferred back to the owner’s country are usually subject to domestic taxes. This can offset the benefits of the offshore jurisdiction’s low-tax regime, especially for residents of high-tax nations.

Regulatory compliance and fees

Offshore companies must pay fixed annual fees and comply with specific local regulations. Some jurisdictions restrict certain business activities or require periodic renewals to maintain legal status.

Before proceeding with offshore company formation, it is essential to evaluate your goals and determine whether an offshore or onshore structure aligns better with your business needs.

Lastly, you should ask yourself the most important question before moving forward with the offshore company formation process: “What type of company should I choose? ”.

Choosing between an onshore and offshore company depends on your business goals, financial position, and long-term vision. Both models have unique strengths and challenges, so understanding what you aim to achieve will help determine which structure fits best. Consider your target market, operational needs, and level of control before making a decision.

To give a clearer picture, the table below highlights some key differences between onshore and offshore companies based on common business factors.

| Criteria | Onshore Company | Offshore Company |

|---|---|---|

| Taxation | Subject to local taxes and compliance requirements | Often benefits from low or zero taxes on non-resident income |

| Regulations | Governed by strict local rules and transparency standards | Operates under flexible laws with lighter reporting requirements |

| Privacy | Company and ownership details are publicly accessible | Ownership and financial information are kept confidential |

| Setup process | May involve more procedures and local presence | Usually fast and straightforward with minimal local requirements |

| Operational control | High, as operations are within the same legal and economic environment | Lower, due to distance and different jurisdictional systems |

| Reputation | Viewed as credible and transparent by investors and partners | Sometimes subject to greater scrutiny from regulators |

| Talent access | Local workforce understands the domestic market and culture | Access to a broader talent pool at more affordable costs |

| Cost | Higher due to taxes, wages, and compliance | Lower incorporation and maintenance costs |

| Ideal for | Businesses focusing on domestic markets and stability | Businesses involved in global trade or asset protection |

Although offshore structures attract global entrepreneurs for their flexibility, privacy, and tax efficiency, they are not suitable for every business model.

The appeal of offshore incorporation lies in its relaxed regulatory framework and reduced tax burden, which help companies reinvest profits and expand globally. Thus, offshore setups are increasingly popular in software development and IT outsourcing, where access to skilled professionals and lower operational costs are significant advantages.

However, offshore companies face certain limitations. Differences in language and culture may cause communication barriers. International regulations such as the Common Reporting Standard require greater transparency, which can reduce the privacy once associated with offshore structures.

In contrast, onshore companies provide greater control, responsiveness, and trust. Being located in the same jurisdiction as clients, suppliers, and service providers makes communication and decision-making faster.

An onshore structure also enhances reputation, which is essential for industries such as finance, healthcare, and government services that demand reliability and compliance.

Local staff are familiar with the domestic market, consumer behavior, and legal expectations, which helps companies adapt to regulatory or economic changes. Though costs are higher, many businesses find that the benefits of strong governance and transparency outweigh the expenses.

Offshore incorporation suits those seeking international reach and cost savings, while onshore entities offer stability and credibility. Notably, some global companies adopt a hybrid approach.

The answer mostly depends on your purposes, your financial status, and your business. Therefore, list out what your aims are, what your business is, and whether you are financially stable or not.

What is a Mid-shore company?

A mid-shore company bridges the gap between onshore and offshore structures. It blends the transparency and credibility of onshore jurisdictions with the tax efficiency and operational flexibility of offshore centers.

The hybrid setup has become increasingly attractive for global entrepreneurs seeking legitimate tax optimization without compromising compliance or reputation.

Mid-shore jurisdictions such as Hong Kong, Singapore, and the United Arab Emirates are among the most recognized. They offer moderate tax rates, efficient incorporation processes, and access to strong banking systems while adhering to international reporting standards.

Some of their core features include:

- Balanced taxation: Low to moderate corporate tax rates and access to double taxation treaties with many countries.

- Efficient incorporation: Simple setup procedures and supportive regulatory frameworks that encourage international business activities.

- Global reputation: Recognized as legitimate entities for trade, holding, and investment, which enhances trust with banks and investors.

- Compliance and privacy: Alignment with international standards such as CRS and AML laws while still offering reasonable confidentiality for owners.

- Operational flexibility: Ability to manage cross-border transactions smoothly and operate across multiple markets.

Mid-shore companies are often chosen by import-export firms, technology providers, and financial service companies that require both flexibility and transparency.

In short, a mid-shore company offers a strategic balance between the benefits of offshore freedom and the reliability of onshore governance. It is a practical solution for modern businesses looking for a global presence with a credible, compliant foundation.

How BBCIncorp supports your company formation

Establishing a company across different jurisdictions can be complex. BBCIncorp simplifies the process by offering a complete suite of incorporation services designed for global entrepreneurs. Whether you aim to register an onshore, offshore, or mid-shore company, BBCIncorp provides expert guidance from start to finish.

Seamless company formation

With a fully digital platform, you can form your company remotely in over 18 jurisdictions, including Hong Kong, Singapore, the British Virgin Islands, and the United States. The process covers name reservation, document preparation, and government filing, allowing you to set up quickly and efficiently.

Comprehensive compliance and banking support

Beyond incorporation, BBCIncorp also assists with essential post-formation services such as corporate bank account setup, accounting, tax filing, and ongoing compliance. Each step is handled in line with international regulations, so your business stays in good standing.

Transparent and reliable service

Every incorporation package provides clear pricing and inclusions, helping you understand exactly what you are paying for. Our team is known for professionalism, responsiveness, and customer satisfaction across a diverse client base.

Contact us today to begin your offshore company formation or explore other business incorporation options on our website for more information.

Conclusion

Deciding between offshore versus onshore, or mid-shore incorporation depends on your goals, business model, and long-term direction. Each option brings distinct benefits and responsibilities that can shape how your company grows and competes globally. With the right guidance, you can find the structure that maximizes both compliance and efficiency.

BBCIncorp’s experienced team is here to make that journey seamless, offering trusted support for offshore company formation in more than 18 jurisdictions worldwide.

This blog provides you with a simple approach to an onshore vs offshore company. For further and important decisions, it is best to consult with an expert or any trusted incorporation service provider. Should you have any questions or concerns, our experts are always willing to help. Contact us at service@bbcincorp.com.

Frequently Asked Questions

Which approach is more expensive, onshore or offshore software development?

Onshore software development is generally more expensive due to higher labor costs, taxes, and operational expenses in developed economies. Hiring local developers offers benefits such as easier communication, shared time zones, and closer cultural alignment, but this decision is rather costly.

In contrast, offshore development provides access to skilled professionals at lower rates, especially in countries with emerging tech industries like Vietnam or India. The cost difference can reach up to 50 to 70 percent depending on the project scope and location. Regardless, cost alone should not be the deciding factor. Quality, management, and long-term goals matter too.

When should you choose a nearshore software company?

A nearshore software company is ideal when you want the cost advantages of offshore outsourcing but still value proximity and smoother collaboration. Nearshore partners operate in neighboring or similar time zones, which allows real-time communication, quicker responses, and frequent updates.

The nearshore model reduces the cultural and language gaps often faced by offshore teams while maintaining lower costs. It works best for projects that require continuous coordination, agile development, or sensitive data handling.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.