Table of Contents

To register a company in Cyprus is not only a strategic decision for entrepreneurs but also a process that requires careful compliance with local regulations. As one of the most attractive business destinations in Europe, Cyprus offers favorable tax policies, access to international markets, and a straightforward incorporation framework. However, understanding the legal requirements and potential pitfalls is essential to ensure a seamless registration journey.

This article provides a comprehensive guide on how to register a company in Cyprus, highlighting the essential procedures, compliance obligations, and practical tips to help business owners avoid common challenges.

Overview of Cyprus business context

First and foremost, let’s look at all the crucial facts associated with doing business in Cyprus.

Cyprus has established a reputation for being a safe and reliable jurisdiction. The country has one of the most beneficial tax plans in the world, including more than 60 double-tax treaties.

A non-Cyprus tax resident company is only taxed on certain income from permanent establishments (PEs) within Cyprus, making it particularly favorable for SMEs and startups. Moreover, Cyprus is one of the jurisdictions with the lowest corporate tax rate in the European Union (12.5%).

Furthermore, Cyprus offers a business-friendly environment that embraces business potential and development.

The simplicity of opening and running a company in Cyprus is also worth a mention. Incorporating a company is normally low-cost and can be done within a few working days.

Cyprus company legal requirements

Company formations in Cyprus are generally linked with certain legal requirements. Any businesses in Cyprus need to comply with the following mandatory factors:

- Registered office: The company is required to have an official address in Cyprus, where notices are sent (e.g. letters from the Registrar of Companies), company registers such as members and director details, charges, and other relevant documents are maintained.

- Directors: Businesses in Cyprus must have two directors (or one director if it is a private company), who can be residents or foreigners. It is advised to appoint local directors to create effective management and control in Cyprus.

- Audit: Under the International Accounting and Auditing Standards, Cyprus businesses must be audited annually by a firm of auditors.

- Secretary: Every company is required to appoint an individual or secretarial company for this position. The secretary of the company can be a Cyprus resident or a foreigner.

- Share capital: Under Cyprus Company law, there is no minimum share capital requirement for private companies, while the minimum capital of a public company is €25,629.

- Annual general meeting: All Cyprus corporations must hold a meeting of shareholders at least once a year within 18 months from the incorporation date. To better understand the concept, read our guide to the annual general meeting in Cyprus to make sure you handle it properly.

COMPLYMATE

Tired of sifting through endless paperwork to understand jurisdictions’ compliance requirements? Our guide can help!

Try Now

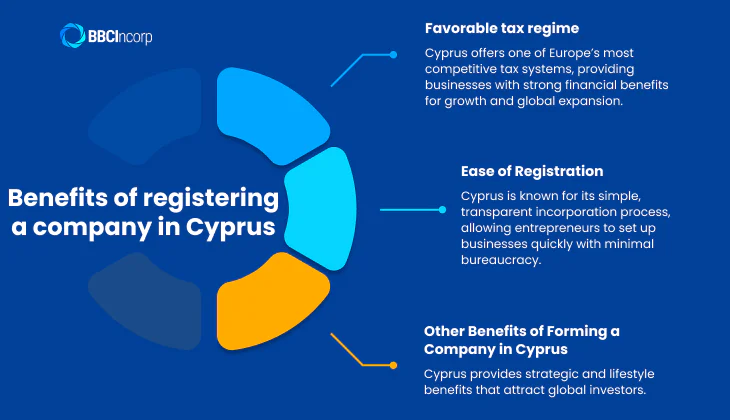

Benefits of registering a company in Cyprus

Cyprus has emerged as a leading jurisdiction for international company formation, attracting entrepreneurs who value both efficiency and long-term stability. Its membership in the European Union, combined with a transparent legal framework and modern infrastructure, ensures that businesses incorporated in Cyprus operate within a secure and reputable environment.

At the same time, the country offers one of the most competitive tax systems in Europe, streamlined registration procedures, and a wide range of incentives designed to support foreign investment. These features make Cyprus not only a cost-effective destination but also a strategic base for companies seeking access to global markets.

Favorable tax regime

The Cypriot tax framework is recognized as one of the most competitive in Europe, offering businesses a wide range of financial advantages that encourage both growth and international expansion. Its structure is designed to support corporate profitability while ensuring compliance with EU standards:

- Low Corporate Income Tax Rate: Cyprus maintains a corporate income tax rate of 12.5%, among the lowest in the European Union.

- No Dividend Tax: Dividends received by shareholders are exempt from taxation, allowing profits to be distributed or reinvested without additional tax obligations.

- Extensive Double Taxation Network: With more than 60 double taxation avoidance agreements (DTAAs), Cyprus enables companies to reduce withholding taxes and avoid double taxation on international income.

- Share Transfer Exemptions: The sale or transfer of shares is tax-free, except when linked to immovable property situated in Cyprus.

Together, these incentives make Cyprus an attractive hub for holding companies, trading entities, and international investors seeking tax efficiency.

Ease of Registration

In addition to its tax benefits, Cyprus is widely regarded for its simple and transparent company incorporation process. Entrepreneurs can establish a business with minimal administrative burdens and within a relatively short time frame. The process is characterized by:

- Straightforward Incorporation: Only essential documents are required, including the company’s Articles of Association, shareholder and director details, and proof of a registered office.

- Quick Processing Times: Most companies are incorporated within 1 to 2 weeks, enabling swift market entry.

- English-Friendly Procedures: English is commonly used in business and legal documentation, which significantly eases the process for international investors.

This efficiency, coupled with a transparent regulatory framework, makes Cyprus one of the most accessible jurisdictions for new business ventures.

Other Benefits of Forming a Company in Cyprus

Beyond tax advantages and easy incorporation, Cyprus offers a range of strategic and lifestyle benefits that make it appealing to global investors and entrepreneurs. These include:

- Strategic Location: Positioned at the intersection of Europe, Asia, and Africa, Cyprus provides unique access to global markets.

- EU Membership: Businesses incorporated in Cyprus enjoy the advantages of the EU single market, including regulatory protections and free movement of goods and services.

- Investor-Friendly Policies: The government promotes foreign investment through transparent legislation and supportive economic policies.

- Skilled Workforce: Cyprus offers a highly educated, multilingual labor force skilled in law, finance, shipping, and technology.

- Advanced Infrastructure: Modern transportation, telecommunications, and banking systems support international operations.

- Growing Sectors: Key industries such as fintech, shipping, tourism, and renewable energy are expanding, offering diverse opportunities.

- High Quality of Life: With a safe environment, excellent healthcare, reputable education, and a pleasant climate, Cyprus is an attractive destination for both companies and expatriates.

These factors collectively enhance Cyprus’s status as not just a tax-efficient jurisdiction, but also a secure, well-connected, and thriving business hub.

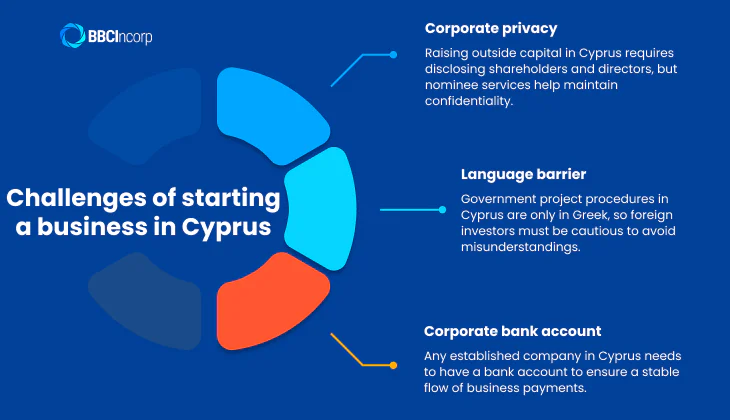

Challenges of starting a business in Cyprus

Besides many benefits, setting up a company in Cyprus has some flip sides. Here, we look into some challenges when incorporating your company in Cyprus.

Corporate privacy

It can be a bit more challenging if you are planning to raise more capital from outside investors for your Cyprus company. The country requires you to publicize the details of all shareholders and directors. However, the country allows nominee services, so you can keep the information more confidential.

Language barrier

The regulations and procedures for government projects are carried out exclusively in the Greek language. International business owners should take notice to prevent any potential conflicts and misunderstandings.

Corporate bank account

Any established company in Cyprus needs to have a bank account to ensure a stable flow of business payments.

Banks in Cyprus normally have very detailed evaluations and strict procedures, which may pose challenges for businesses. One challenge is that Cyprus Bank may require face-to-face interviews.

Though the benefits of setting up a business in Cyprus outweigh the challenges, business owners should acknowledge the factors that may potentially cause problems before taking any further steps with company incorporation.

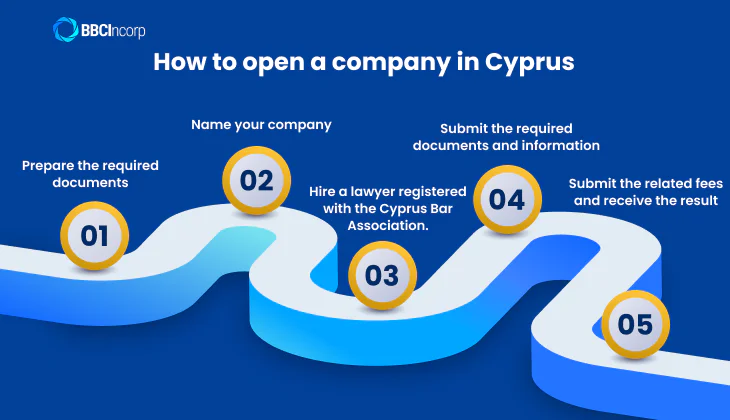

How to open a company in Cyprus

Before registration, you must determine the company’s business structure. It can be a Variable Capital Investment Company, Public Company, Limited Liability Company by guarantee, or Private Company Limited by Shares. A limited liability company is one of Cyprus’s most common types of businesses in Cyprus.

There are four main steps to forming a Cyprus company.

Step 1: Prepare the required documents

Careful preparation will help you have a Cyprus company registered faster. It also increases your chance to own the company. Below is a checklist of what documents you must have for the incorporation:

- Company type;

- Business scope;

- Registered office;

- Statement of capital; and

- Memorandum and Articles of Association (MAA).

Step 2: Name your company

Check your desired entity name if it is the unique name in the company registrar of Cyprus. The country will only accept a name that is different from other registered companies.

Step 3: Engage a lawyer who is registered with the Cyprus Bar Association.

Cypriot law requires that the company’s Memorandum and Articles of Association be drafted and filed by a qualified lawyer registered with the Cyprus Bar Association. This ensures that the legal documents comply with local regulations and reduces the risk of incorporation errors.

In practice, engaging a lawyer provides:

- Legal drafting and certification of the constitutional documents.

- Guidance on compliance with the Companies Law, Cap. 113.

- Representation before the Registrar of Companies, if required.

This step guarantees that the incorporation process aligns with the country’s legal standards and avoids potential liabilities.

Step 4: Submit the required documents and information

After having all the required documents, you must submit them to the Registrar of Companies in Cyprus and wait for approval.

Step 5: Submit the related fees and receive the result

The Cyprus incorporation process usually takes around 5 working days. If you submit all required papers, information, and fees, you are most likely to own a Cyprus company.

Interested in starting your Cyprus company?

BBCIncorp can help! Our support team is here to help you kick-start your business in no time, without any hassle or inconvenience.

Check out our Cyprus company formation package today!

Register a company in Cyprus online

The Registrar of Companies in Cyprus provides a comprehensive e-filing system that enables entrepreneurs and legal representatives to submit incorporation applications entirely online. This system covers every stage of company formation, from filing statutory documents to making electronic payments, ensuring compliance with the Companies Law while reducing administrative delays.

Required Documentation

When submitting an online request to incorporate a company, applicants must prepare and upload the following:

- Statutory Declaration (Form HE1): Signed and sworn before a court by the entrusted lawyer handling the incorporation.

- Memorandum and Articles of Association: Drafted according to the chosen company type, signed in Greek. If a private or public limited liability company adopts the model regulations in Table A of Schedule I of the Companies Law, a relevant reference document must also be submitted.

- Solemn Declaration of Witness of Signatures: Confirming the validity of signatories on the documents.

- Certified Translation (if applicable): Where a file of translations is required, the memorandum and articles must be translated by affidavit or a sworn translator of the Republic of Cyprus, enabling certified copies to be issued in a foreign language.

- Pre-approval or Consent (if required): Certain names, phrases, or business activities may need clearance from a competent authority or regulatory body if not already submitted during the name approval stage.

- Payment of Fees: €165 for companies with share capital, or €235 for companies without share capital, payable online by credit card. Optional fast-track registration requires an additional €100. Creating a translation file incurs a further €160 fee. For public companies, submission of Form HE5 is mandatory with an extra €20 fee.

Submission and Approval

To access e-filing services, users must first be registered on the Registrar’s platform. Once all documents and payments are submitted electronically, the Registrar reviews the application. To avoid rejection, applicants are encouraged to consult the main criteria for review and the most common reasons for refusal, as published by the Registrar.

If the application is complete and compliant, the Registrar issues a Certificate of Incorporation electronically, officially confirming the company’s legal existence in Cyprus.

Other jurisdictions for offshore companies

While Cyprus is a popular choice for company incorporation within the EU, many entrepreneurs also explore non-EU offshore jurisdictions for additional benefits. Below are three prominent options: British Virgin Islands, Bermuda, and Antigua and Barbuda. Each jurisdiction offers unique advantages concerning taxation, privacy, speed, and regulatory requirements.

British Virgin Islands

The British Virgin Islands (BVI) have long been considered a premier offshore destination, valued for their flexibility, privacy, and internationally recognized framework. Entrepreneurs and investors are drawn to the BVI for its efficiency and well-established reputation in global corporate structuring. Among the main features that make this jurisdiction appealing are:

- No corporate income, capital gains, VAT, or withholding taxes on foreign-sourced profits.

- Strong confidentiality, as beneficial ownership details are not publicly disclosed.

- A quick and straightforward incorporation process supported by a well-recognised legal framework.

Taken together, these features make the BVI particularly suitable for entrepreneurs who seek tax neutrality and discretion, while benefiting from a jurisdiction with strong global recognition.

Bermuda

Bermuda stands out as a stable and respected offshore jurisdiction, particularly suited for businesses that require a high level of regulatory credibility. Its strong financial services sector and English-influenced legal system have built a reputation for reliability. When establishing a company in Bermuda, businesses can benefit from several characteristics, such as:

- A tax-free regime for non-resident entities, covering corporate, dividend, and capital gains taxes.

A respected English-influenced legal system with robust oversight. - Flexible ownership rules and efficient incorporation procedures.

As a result, Bermuda is often chosen by enterprises in highly regulated industries, where both stability and international credibility are critical to long-term operations.

Antigua and Barbuda

For entrepreneurs who prioritize speed and simplicity, Antigua and Barbuda provide one of the most straightforward offshore regimes available. Its legislation is designed to attract international businesses with minimal bureaucracy and comprehensive tax exemptions. In practice, companies incorporated here typically enjoy:

- Full exemption from corporate tax on foreign income.

- Minimal setup barriers, only one shareholder and one director, with no minimum capital.

- Same-day incorporation and strong asset protection measures.

This combination of low barriers and generous exemptions makes Antigua and Barbuda particularly attractive for small to medium-sized enterprises seeking a rapid, cost-effective, and discreet offshore solution.

Costs related to running a business in Cyprus

Running a company in Cyprus involves not only the initial incorporation fee but also several recurring expenses that ensure ongoing compliance with local regulations. Being aware of these costs in advance allows entrepreneurs to plan more accurately and avoid unexpected financial burdens.

Business Registration

The initial registration of a Cyprus company includes both government filing fees and service provider charges. Government fees vary depending on share capital but typically range from €165-€235, with an additional €100 for expedited processing. Professional service providers may charge between €1,300-€3,000 depending on the level of legal, compliance, and administrative support offered.

Name Approval

Before incorporation, the company name must be reserved and approved by the Registrar. The standard fee for name approval is modest, usually €10-€30, depending on the application method. If the proposed name contains restricted words or references to regulated activities, prior approval from the relevant authority may be required, which can extend both the timeline and cost.

Office Maintenance

All Cyprus companies must maintain a registered office within the jurisdiction. Service providers typically offer registered office services for about €250 per year. If nominee directors, nominee shareholders, or corporate secretarial services are included, annual packages may cost €1,000 or more, depending on the provider.

Annual Fee

Every company registered in Cyprus must pay an annual government levy of €350, due by 30 June each year. Late payment results in financial penalties. In addition, companies are required to file an annual return with the Registrar, which incurs further filing fees.

Accounting Service

Cyprus companies are required to maintain accounting records, file annual financial statements, and undergo an audit (unless exempt under specific small-company criteria). Fees depend on transaction volume and complexity but generally range from €1,000 to €2,000 annually for smaller entities. Services may include bookkeeping, VAT filings, payroll, tax compliance, and statutory audits.

Bank Account Opening

Opening a corporate bank account requires comprehensive KYC documentation, including incorporation certificates, shareholder details, and proof of business activities. While banks themselves may not charge incorporation-specific fees, service providers assisting with account opening often charge several hundred euros as part of incorporation packages.

Additional Proposed Costs

Beyond the standard incorporation and compliance expenses, companies in Cyprus may encounter several supplementary costs depending on their business model and regulatory obligations:

- VAT Registration and Compliance: Businesses engaged in EU trade or supplying taxable goods and services must register for VAT. Ongoing VAT filings add to accounting service costs.

- Translations and Legal Certification: If incorporation documents are not in Greek, certified translations or notarisation are required. These can involve affidavits or sworn translators of the Republic of Cyprus, with fees varying according to volume and language.

- Nominee Services: Many companies use nominee directors, shareholders, or secretaries to maintain privacy and meet local requirements. These services typically come at an additional annual cost, often bundled with registered office packages.

- Industry-Specific Licenses and Permits: Companies in regulated sectors such as finance, insurance, or healthcare may require permits or consents from relevant authorities. The application fees vary depending on the industry and the scope of the business.

- Expedited Processing Fees: To accelerate incorporation, applicants can pay an additional €100 fast-track fee, which significantly shortens processing times.

These additional costs, while not universal, can have a significant impact on a company’s overall budget. Entrepreneurs are advised to review their specific business needs in advance and set aside a buffer for ancillary expenses to ensure smooth incorporation and ongoing compliance.

Full-service Cyprus company formation for a global business with BBCIncorp

Cyprus has become an increasingly attractive hub for international entrepreneurs thanks to its strategic location, competitive tax regime, and strong legal framework. However, navigating the incorporation process and ensuring long-term compliance can be challenging for foreign investors unfamiliar with local regulations.

Choosing BBCIncorp means more than setting up a company, it means building a sustainable platform for long-term success.

- Seamless market entry: We transform the complex legal procedures of company formation in Cyprus into a straightforward, transparent process, enabling businesses to start operations faster with minimal administrative burden.

- Reliable compliance assurance: Ongoing corporate governance and secretarial support safeguard companies from penalties or oversights, ensuring statutory filings and records are always maintained in accordance with Cypriot law.

- Enhanced privacy and flexibility: Through professional nominee director and shareholder solutions, clients enjoy confidentiality while retaining full control over strategic and financial decisions.

- Robust financial foundation: From opening corporate bank accounts to managing accounting, auditing, and tax filing, we provide the financial infrastructure required for stability and regulatory alignment.

- Global growth readiness: Our integrated approach combines local Cypriot expertise with international business experience, making BBCIncorp a trusted long-term partner for companies seeking scalability across multiple jurisdictions.

As a trusted provider of global business solutions, BBCIncorp delivers not only incorporation services but also a comprehensive suite of ongoing compliance and financial support. Our expertise helps clients overcome regulatory complexity, maintain operational efficiency, and safeguard their businesses against compliance risks.

By offering a wide range of company formation packages, BCI ensures that businesses of different sizes and industries can find a solution tailored to their specific needs and budgets. The following pricing options illustrate how our services can be adapted to support both startups and established enterprises seeking to expand in Cyprus.

| Package | Price | Included Services |

| Basic | US$2,999 |

** This Package includes everything for a foreigner to set up a new Cyprus Private Limited Company from the beginning * All-in renewal fee: US$2,799 |

| Standard | US$3,399 |

|

| Premium | US$3,699 |

|

Choosing to register a company in Cyprus can unlock significant advantages, from access to the EU single market and an attractive tax regime to a stable legal and business environment. However, these opportunities come with obligations, ranging from company registration and annual levy payments to proper accounting, auditing, and regulatory compliance. Failing to address these requirements can expose businesses to penalties, delays, and reputational risks.

By carefully planning your incorporation, choosing the right company structure, and staying vigilant with compliance, you can avoid common pitfalls and position your Cyprus entity for long-term success. Partnering with a trusted corporate service provider further ensures that every stage, from name approval and document submission to banking and tax filing, is handled with precision and efficiency.

Cyprus offers immense potential for global entrepreneurs, but success depends on getting the details right. With the right guidance and ongoing support, your business can thrive in this jurisdiction while remaining fully protected from regulatory challenges.

For tailored guidance or professional assistance with incorporation, feel free to reach out at bbcincorp@gmai.com and our team will support your registration process in Cyprus!

Frequently Asked Questions

How much time does it take to register a company in Cyprus?

The registration of a company in Cyprus is generally straightforward and efficient. Once the company name is approved, incorporation documents are filed through the Registrar of Companies’ e-filing system. In most cases, the process can be completed within 5-10 working days, provided all documentation is accurate and there are no additional requirements from the authorities.

Can a non-resident register a company in Cyprus?

Cyprus allows non-residents to register and own companies without restrictions on foreign shareholding. However, non-resident entrepreneurs must appoint a local registered office address and typically engage a licensed service provider or legal representative to handle the incorporation process, statutory filings, and ongoing compliance. This ensures that the company fully meets the requirements of the Registrar of Companies

Is it necessary to open a corporate bank account in Cyprus?

Open bank account for Cyprus Company is an essential step after incorporation, as it allows the company to conduct transactions, pay expenses, and receive income legally. Without a corporate account, the business cannot operate effectively or comply with anti-money laundering (AML) requirements.

Popular banks in Cyprus that provide corporate banking services include Hellenic Bank, Astrobank, and Alpha Bank. Service providers often assist with account opening to simplify the process and ensure compliance with local KYC regulations.

Is there a minimum share capital requirement?

Cyprus law does not impose a fixed minimum share capital for private limited companies, though at least one share must be issued. However, for public limited companies, there is a legal minimum capital requirement. Public companies must have a minimum share capital of approximately €25,630.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.