Table of Contents

Choosing the right structure shapes every part of a small business, from taxes to personal liability. For many entrepreneurs, the decision often comes down to two common options: an S Corp or a sole proprietorship. Both support small business ownership, yet they operate very differently in terms of legal protection, tax treatment, and growth potential.

Understanding these differences is essential before setting up your entity. In this article, we break down S Corp vs. sole proprietorship in clear terms, explaining what each structure means, how they work, and what you should weigh when deciding. If you are unsure which model suits your goals, let us explore the key distinctions to help you move forward with confidence.

Key takeaways

Small business owners choosing between a sole proprietorship and an S-corp must weigh simplicity against protection.

- Sole proprietorships are easy to start, low-cost, and offer direct control, but owners face unlimited personal liability and limited growth potential.

- S corporations provide limited liability, pass-through taxation, and greater credibility for investors, though setup is more complex and administrative requirements are higher.

The main trade-off lies between convenience and legal protection: sole proprietorships suit small, low-risk ventures. Meanwhile, S-corps benefit growing businesses seeking scalability, tax efficiency, and long-term continuity.

Considering taxes, liability, and operational demands is key to making an informed choice.

Understanding the basics of S-corp and sole proprietorship

Small business owners deciding between a sole proprietorship and an S corporation should first grasp how each structure functions. Both provide legal ways to operate, yet they differ in liability, taxation, and administrative obligations. Knowing these distinctions lays the groundwork for comparing sole proprietorship vs. S corp later in the guide.

What is a sole proprietorship and how it operates

A sole proprietorship is the simplest business structure, owned and controlled by a single individual. It requires minimal setup, often just registering a business name and obtaining local permits or licenses. Earnings and losses are reported directly on the owner’s personal tax return through Schedule C, and all income is subject to self-employment tax.

This structure suits freelancers, consultants, small retail businesses, and independent contractors who prioritize simplicity and direct control. However, the major limitation is unlimited personal liability: the owner is legally responsible for all business debts and obligations.

For instance, if a client sues for damages or a loan defaults, personal assets such as savings or a home could be at risk. Additionally, sole proprietorships also lack continuity. The business legally ends if the owner retires, sells the business, or passes away.

What is an S-corporation and how it functions

An S corporation is a corporation that elects pass-through taxation under Subchapter S of the Internal Revenue Code. It separates the business from its owners, providing limited liability protection. Owners, or shareholders, receive income through a combination of salaries and profit distributions. The entity can reduce self-employment taxes compared with a sole proprietorship while preserving the pass-through benefits that avoid double taxation.

S corporations require formal procedures, including filing corporate bylaws, holding annual meetings, maintaining accurate records, and managing payroll if the owners take salaries.

Eligibility rules limit ownership to U.S. citizens or residents, a maximum of 100 shareholders, and a single class of stock. Despite these requirements, S corporations offer advantages for businesses expecting growth, seeking investors, or desiring a governance structure.

Key differences between S-corp and sole proprietorship

Below, we break down the core distinctions between S-corp and sole proprietorship to help entrepreneurs and small business owners make an informed decision.

| Feature | Sole Proprietorship | S Corporation |

|---|---|---|

| Ownership & Formation |

|

|

| Liability Protection |

|

|

| Taxes & Profit Distribution |

|

|

| Complexity & Cost |

|

|

| Potential & Scalability |

|

|

Ownership, formation, and setup

Sole proprietorships are attractive for entrepreneurs seeking simplicity. Starting the business often involves no registration beyond local permits, making it inexpensive and fast to launch.

In contrast, S corporations require additional steps, including creating a legal entity, registering with the IRS, and submitting the S-corp election.

These steps entail filing fees and administrative work, but they establish a formal structure that is suitable for investors and expansion.

Liability protection

The difference in personal liability is significant. Sole proprietors face unlimited risk, meaning personal assets can be used to settle business debts or legal claims.

S corporations shield owners’ personal finances from most business obligations, providing peace of mind for higher-risk ventures.

Taxes and profit distribution

Tax treatment is a key distinction. Sole proprietorship income flows through to the owner’s individual return and is fully subject to self-employment tax.

S corporations allow owners to split income between salaries and dividends, potentially reducing overall self-employment taxes. Proper planning with a professional advisor ensures compliance and maximizes tax efficiency.

Complexity

A sole proprietorship requires minimal administrative work. There is no need for formal corporate meetings, complex record-keeping, or payroll setup.

In contrast, an S-corp demands stricter management, proper documentation of salaries, shareholder meetings, and adherence to IRS and state corporate compliance rules.

Operational cost

Sole proprietorships have very low startup and operational costs, typically limited to business licenses or permits.

S-corps, however, incur formation fees, annual state fees or franchise taxes, payroll services, bookkeeping, and accounting costs, which can add up, especially for businesses with multiple employees.

Growth potential

Sole proprietorships face limitations in attracting investors, raising capital, or scaling operations due to personal liability and limited credibility.

S-corps have higher potential by allowing up to 100 U.S. shareholders, issuing a single class of stock, and providing enhanced credibility with banks and investors. The entity also enables more efficient tax planning, which can foster reinvestment into the business.

In summary, sole proprietorships are small, low-risk operations that prioritize simplicity. On the other hand, S corporations provide legal protection, tax flexibility, and greater scalability for global businesses.

Advantages and disadvantages of sole proprietorship

Making the choice between a sole proprietorship and an S-corporation requires carefully evaluating the strengths and limitations of each entity.

Benefits of a sole proprietorship

A sole proprietorship comes with simplicity and accessibility, making it appealing for early-stage business owners or those testing new ideas. The main advantages include:

- Ease of startup requirements: Launching a sole proprietorship usually involves few fees or formal registrations, providing a quick path to operations.

- Full managerial control: The owner makes all operational and strategic decisions without needing board approvals or formal procedures.

- Streamlined tax reporting: Business profits and losses are included on the owner’s personal tax return, avoiding separate business filings.

This format is well-suited for freelancers, independent consultants, and small ventures seeking efficiency and flexibility. While some may wonder “is sole proprietor same as S corp”, these differ significantly in liability, taxation, and administrative obligations.

Limitations of sole proprietorships

- Personal liability exposure: Owners bear unlimited responsibility for debts, obligations, and lawsuits, putting personal assets at risk.

- Restricted access to funding: Securing investment or business loans can be challenging since sole proprietorships lack formal corporate credibility.

- Expansion constraints: Scaling operations is more difficult, and potential partners or clients may perceive the business as less professional.

Advantages and disadvantages of S corporation

Benefits of electing S-corp status

Although S corporation pros and cons, the potential benefits often outweigh the challenges, particularly for businesses aiming to expand or generate higher revenue:

- Asset protection: Owners’ personal property is generally shielded from business debts and liabilities.

- Pass-through taxation: Income flows to shareholders without corporate-level taxation, allowing potential savings on distributions beyond a reasonable salary.

- Professional reputation and continuity: S-corps often attract investors more easily and can maintain operations beyond the founder’s involvement.

These features make S-corporations ideal for entrepreneurs seeking liability protection, credibility, and growth potential.

Drawbacks of S-corps

- More complex formation and management: Filing Articles of Incorporation, electing S-corp status with IRS Form 2553, maintaining records, and holding formal meetings require additional effort.

- Compliance and payroll obligations: Owners must pay reasonable salaries, manage payroll, and meet federal and state reporting requirements.

- Higher operational costs: Accounting, legal services, and bookkeeping can be more expensive compared with sole proprietorships.

It’s important to note that many businesses find the long-term benefits of an S-corp, tax advantages, liability protection, and professional credibility, more valuable than the additional administrative requirements.

Read more on S corporation pros and cons in our dedicated article for more detailed information to assess whether this is the right choice for you or not.

Choosing S-corp or sole proprietorship

Deciding between an S corporation vs. sole proprietorship is a critical step for entrepreneurs. Making an informed choice requires evaluating multiple factors.

Liability concerns

Businesses exposed to higher risks, such as professional services, product-based ventures, or enterprises handling sensitive information, may benefit from the limited liability protection through an S-corp.

Sole proprietorships provide no personal asset protection, leaving the owner fully responsible for business debts and legal claims.

Tax implications

Assessing income levels, expenses, and future forecasts is essential. S-corp taxation allows owners to draw a reasonable salary while distributing remaining profits as dividends, potentially reducing self-employment taxes.

In contrast, sole proprietorship profits are fully subject to self-employment taxes, which may be less favorable for higher-earning businesses.

Consulting a local tax professional can clarify which structure maximizes savings regarding S corp vs. sole proprietorship tax.

Business goals and longevity

For short-term projects or one-person operations, a sole proprietorship may suffice due to its simplicity and minimal setup.

For businesses planning expansion, seeking investors, or aiming for long-term continuity, the S-corp structure supports scalability and credibility.

Administrative capacity

S-corps require formalities such as maintaining corporate records, conducting annual meetings, and handling payroll and state filings.

Sole proprietorships involve less paperwork, making them easier for individuals managing operations alone.

Cost-benefit perspective

Although S-corps incur setup and ongoing compliance expenses, they offer potential tax savings, liability protection, and professional credibility that can outweigh the costs over time.

For instance, freelancers, consultants, and small-scale service providers often prefer sole proprietorships for simplicity. Expanding startups, companies hiring employees, or ventures seeking external funding generally benefit more from S-corp advantages, including structured profit distribution and limited liability protection.

By carefully evaluating these factors, entrepreneurs can select a structure that aligns with their business objectives, growth ambitions, and financial considerations, ensuring both operational efficiency and long-term security.

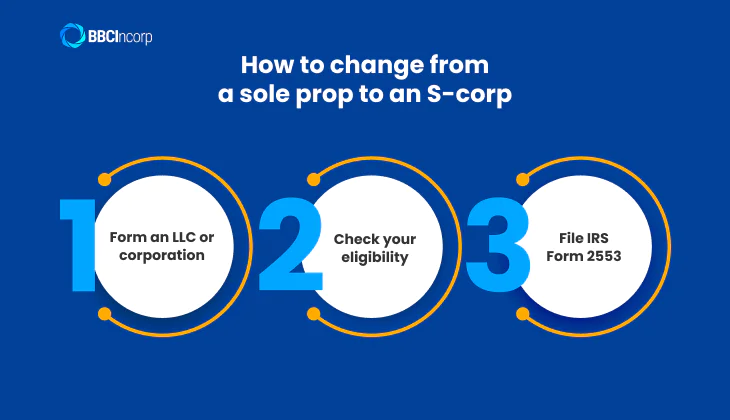

Transitioning from a sole proprietorship to an S-corp

Here’s a detailed roadmap to guide you through the process of transitioning from a sole proprietorship to an S-Corp.

Step 1: Form an LLC or corporation

Before you can elect S-corp status, you must first establish a formal business entity. Begin by selecting a business name and registering it with your state authority.

Then, file the Articles of Organization (for an LLC) or Articles of Incorporation (for a corporation), and create an operating agreement that outlines ownership, management responsibilities, and decision-making procedures.

Next, obtain an Employer Identification Number (EIN) from the IRS and secure any required licenses or permits.

You must complete these steps so that your business is legally recognized and fully prepared for the S-corp election.

Step 2: Check your eligibility

Once your entity is established, you need to verify that it meets IRS requirements for S-corp status. Specifically, your business must be a domestic corporation or LLC, have only one class of stock, and have no more than 100 shareholders.

Additionally, shareholders must be U.S. citizens, residents, estates, or certain trusts, as nonresident aliens are ineligible.

Confirming eligibility beforehand prevents delays or rejection of your S-corp election.

Step 3: File IRS Form 2553

After confirming eligibility, you can formally elect S-corp status by submitting Form 2553, Election by a Small Business Corporation, to the IRS. Be sure to fill in your business name, EIN, incorporation date, and the requested effective date of the election.

It is important to file within two months and 15 days of forming your entity or at the start of the tax year.

Once accepted, your business officially becomes an S-corp, enabling you to enjoy pass-through taxation while maintaining limited liability.

By following these steps carefully, you can transform a sole proprietorship into a structured S-corp in compliance with federal and state requirements.

BBCIncorp services for business incorporation and tax structuring

Many small business owners struggle with formation paperwork, tax registrations, and compliance deadlines associated with setting up a business, especially with the S-Corp election process.

BBCIncorp helps mitigate these issues by providing a clear, accurate setup process with expert assistance from the start.

Why professional incorporation services matter for small businesses

A large number of first-time founders file the wrong entity type, miss the IRS Form 2553 deadline, or set up their company without the necessary records to stay compliant. These mistakes can result in penalties, loss of tax benefits, or even rejected filings.

Our practical guidance lets you meet state rules, structure your taxes correctly, and avoid common errors that slow down operations. Working with us also saves time, especially if you are not familiar with U.S. state requirements.

How BBCIncorp simplifies your entity formation and compliance

BBCIncorp provides a complete formation and maintenance service designed for entrepreneurs who want a clean, compliant setup without unnecessary work. Our services include:

- LLC or corporation formation in the U.S.

- Evaluate whether S-corp status is suitable for your income level, risk profile, and long-term goals.

- Acting as your registered agent, which is required in states such as Delaware, to keep you compliant with state regulations.

- Assisting with EIN application and tax registrations.

- Lead sole proprietors through the full transition to an S-corp, including structure setup, required documents, and ongoing formalities.

BBCIncorp also offers a secure online platform where you can track your company records, deadlines, and updates in one place. This reduces manual follow-up and keeps your compliance organised throughout the year.

As our clients, you get access to various ways to focus on building your business while the administrative and regulatory work is handled professionally by our experienced team.

Explore BBCIncorp’s company incorporation services on our website today to see which option matches your needs, or chat with our team through our chatbox for more information.

Conclusion

Choosing between an S corp vs. sole proprietorship affects how you handle taxes, liability, and future expansion. In particular, a sole proprietorship keeps setup simple and costs low, making it suitable for smaller or early-stage businesses. On the other hand, S-corporation introduces limited liability, clearer separation between personal and business finances, and potential tax savings through salary and distribution planning.

After reading about the differences between S corporations and sole proprietorships, align your choice with your income needs, risk tolerance, and long-term goals. And since each option carries its own set of compliance rules, opting for expert support is beneficial and cost-efficient.

As a professional company service provider, BBCIncorp has been assisting entrepreneurs with business formation, as well as legal obligations to stay in good standing in the most potential jurisdictions.

For any questions, feel free to contact us at service@bbcincorp.com or discover how BBCIncorp streamlines your business needs today.

Frequently Asked Questions

What’s the difference between a Limited Liability Company (LLC) and a sole proprietorship?

An LLC creates a separate legal entity, giving owners limited liability protection. The owner’s personal assets are generally protected from business debts and legal claims. An LLC also allows for flexible taxation, either as a disregarded entity or as a corporation, depending on the elections made.

A sole proprietorship does not offer liability protection; the owner and business are legally the same, so personal assets are exposed. A sole proprietorship requires minimal setup and uses personal tax reporting (Schedule C), while an LLC involves state registration, fees, and potentially more ongoing compliance.

For a full comparison, kindly read our dedicated article Sole Proprietorship vs LLC.

Should a real estate agent choose an LLC or an S Corp?

A real estate agent may choose an LLC for liability protection and simplicity. An LLC shields personal assets if business-related liability arises (e.g., lawsuits or debt).

If the agent expects significant income, forming an LLC and then electing S-corp status could offer tax savings by splitting pay between salary and distributions, potentially reducing self-employment tax. However, S-corp status comes with extra formalities like payroll, record-keeping, and compliance requirements.

The best choice depends on income level, risk exposure, and willingness to manage administrative responsibilities. You can also see our article on LLC vs S Corp for real estate for more details.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.