Table of Contents

Located in the Indian Ocean, Seychelles is one of the most attractive tax havens for corporations and individuals alike. With favorable business laws, advantageous taxation, and a strong focus on privacy, the jurisdiction provides a reliable environment for offshore structures.

Among its options, the Seychelles international business company (Seychelles IBC) stands out as the most popular choice, offering a wide range of benefits for global entrepreneurs. In this article, we will highlight the key features and advantages that make Seychelles IBCs so appealing.

What is a Seychelles IBC?

International business companies (IBCs) are the most prevalent and flexible type of offshore entity in Seychelles. Like other offshore structures, a Seychelles IBC serves as an effective vehicle for international trade, investment, asset holding, and other cross-border business activities.

The framework governing incorporation, taxation, and corporate structure is set out in the International Business Companies Act, 2016.

This legislation has been refined through successive amendments, most recently under the IBC Amendment Acts of 2020, 2024, and 2025, which introduced stricter compliance measures, clearer rules on nominee shareholders, streamlined procedures for striking-off and restoration, and enhanced transparency obligations.

Today, Seychelles maintains a robust registry with hundreds of thousands of IBCs, and new incorporations continue steadily each year. This enduring popularity reflects the jurisdiction’s combination of flexibility, favorable regulation, and ongoing reforms that balance international compliance with business efficiency.

In the sections that follow, we will examine the key advantages that make Seychelles IBCs the preferred offshore vehicle for many global entrepreneurs and corporations.

Benefits of Seychelles IBCs

Entrepreneurs continue to prefer Seychelles thanks to its stable political system, independent democratic government, and business friendly environment. As a member of the Commonwealth with a sound legal framework, the country provides a secure foundation for offshore investment.

Seychelles is recognized as a modern and well regulated offshore jurisdiction, offering a broad range of services including IBC incorporation, offshore banking, insurance, and investment fund management.

For international investors, a Seychelles IBC provides clear advantages such as favorable tax treatment, reliable privacy protections, strong asset protection, and flexible corporate structuring. These benefits make Seychelles one of the most attractive offshore destinations worldwide.

Free ebook

New to offshore business landscapes?

All the essential information you need is right here.

Seychelles international business company key features

Below are some key features when it comes to a Seychelles international business company:

Tax benefits

Is Seychelles tax-free?

Seychelles is a well-known tax haven. The zero-tax regime for offshore companies in the Seychelles tax haven is guaranteed by legislation.

As complied with The Business Tax (Amendment) Act 2018, which came into force on 1st January 2019, the territorial tax system in Seychelles has allowed its IBCs that do not derive assessable income in the country to be exempted from any tax or duty on income or profits.

In other words, any IBC which derives its income outside Seychelles will not be taxed on dividends, interests, royalties, or other payments paid out to its stakeholders. There is also no capital gain tax in Seychelles.

Moreover, Seychelles IBCs are exempt from stamp duty on company formation, property transfers, or transactions involving shares, debt obligations, or other securities, unless these transactions relate directly or indirectly to real estate located in Seychelles.

No minimum requirements

A plus for registering a Seychelles business company is its minimal requirements. Here are a few:

- No requirement for any minimum paid up capital to operate a Seychelles IBC.

- No requirement to hold a regular Annual General Meeting. Meetings of the board of directors may take place outside Seychelles and can be conducted by telephone, teleconference, or other electronic means.

- No residency or nationality requirement for the shareholders or directors of a Seychelles IBC. They may be either individuals or corporate entities.

- Preparing accounts is mandatory, but there is no obligation to file accounts with the authority. No audit requirement applies.

With regard to annual fees, it is worth noting that international business companies in Seychelles are required to pay a government license fee, which remains more competitive than in many other offshore jurisdictions, including the British Virgin Islands.

Privacy and confidentiality

Privacy and confidentiality are essential considerations for investors when selecting an offshore jurisdiction, and Seychelles continues to rank highly in this regard. Key protections for Seychelles IBCs include:

- The identities of beneficial owners, directors, and shareholders are not publicly disclosed, with access permitted only through lawful enforcement or a court order.

- A register of beneficial owners must be maintained by the registered agent and filed with the Seychelles Financial Intelligence Unit, but it is not accessible to the general public.

- Only the Memorandum and Articles of Association are required to be placed on public record.

- Accounting records are kept privately and are not subject to public filing.

Note

Since 2021, Seychelles IBCs have been required to maintain accounting records at their registered office in Seychelles, in either original or electronic form, and to update them at least twice a year. Companies with an annual turnover exceeding USD 3,750,000 must prepare a Financial Summary within six months of their financial year end. For further details, see the latest Seychelles Accounting Records Keeping Obligations.

Amendments introduced in 2024 and 2025 have strengthened compliance. Companies with nominee shareholders must now declare nominee arrangements, identifying both the nominee and the nominator, and record these in the Register of Members.

Accounting records must also be retained for at least seven years from the date of the related transaction. These updates reflect Seychelles’ ongoing efforts to balance corporate confidentiality with international transparency standards.

Recommended reading: why and how to use a nominee director/shareholder service with BBCIncorp

Fast incorporation

Seychelles is a good option to go, especially when you are concerned about how fast your offshore company formation can be done. The registration process in Seychelles is regarded as one of the most flexible and fastest. More often than not, a new international business company in Seychelles can be set up for only 24 hours.

Flexible corporate structure

Ease of incorporation in Seychelles is partly attributed to its flexible corporate structure.

Below are common characteristics of a Seychelles IBC’s structure:

- Separate legal personality with the same powers as a natural person.

- At least 1 shareholder and 1 director required, both can be the same person.

- Directors or shareholders do not need to be Seychellois residents (Foreign persons or corporate bodies are acceptable).

Does Seychelles allow bearer shares? is another common question for IBC features. However, the jurisdiction hasn’t permitted the IBC to issue any bearer shares on or after its Amendment Act 2013. A Seychelles IBC may issue registered shares only.

Economic substance for Seychelles IBCs

The economic substance regime in Seychelles was introduced to meet international tax transparency and anti-base erosion standards.

These rules apply specifically to Seychelles International Business Companies (IBCs) that are part of multinational enterprise (MNE) groups and derive passive income from foreign sources.

Passive income includes dividends, interest, royalties, and rental income. When both conditions are met, the IBC becomes a “covered company” and must demonstrate adequate substance in Seychelles.

For standard IBCs that fall outside these categories, the traditional advantages remain intact. They are exempt from Seychelles corporate tax on foreign-sourced income and are not required to maintain a local office, hire employees, or hold board meetings in Seychelles.

For instance, an IBC engaged exclusively in active trading or overseas service provision continues to benefit from tax exemption without the need to establish a physical presence.

Covered companies, on the other hand, are required to meet a set of substance obligations to preserve their tax-exempt status. These obligations generally include:

- Fulfilling annual filing and reporting requirements with the Seychelles authorities.

- Maintaining a Seychelles presence through a registered office, and in some cases, local staff or directors.

- Conducting strategic decision-making within Seychelles, such as holding board meetings locally.

- Incuring local operating expenses proportionate to the scale of their income-generating activities.

Pure holding companies face a lighter compliance burden. They mainly need to maintain a registered office and agent in Seychelles, though more complex entities may require greater local involvement.

For example, a Seychelles IBC that manages overseas property investments and demonstrates real governance structures locally could continue to enjoy tax exemptions. However, if key decisions are made abroad, authorities may attribute part of the income as Seychelles-sourced, exposing it to corporate tax.

Failure to comply with economic substance rules carries significant consequences. Passive income that does not meet substance standards can be taxed at the prevailing Seychelles corporate tax rate, and the Seychelles Revenue Commission may impose penalties, interest, and information-sharing with foreign tax authorities.

Ultimately, while most Seychelles IBCs remain out of scope, entities within multinational groups that generate passive income must carefully observe substance requirements to retain the jurisdiction’s zero-tax benefits.

Requirements of Seychelles International Business Companies

Certain restrictions for a Seychelles IBC

In accordance with the Seychelles International Business Companies Act, an IBC is allowed to conduct any business providing that it is in compliance under the law. However, it is a must to have the authority’s permission if your company intends to conduct some licensed activities as below:

- Carry on banking, insurance, and international corporate services business;

- Carry on securities business;

- Carry on business as a mutual fund;

- Carry on gambling business.

In terms of virtual assets services, Seychelles IBCs are required to obtain the necessary licenses from the Authority to operate legally. For more details in this regard, refer to the Virtual Assets Service Providers (VASP) Act 2024.

Naming requirements for a Seychelles IBC

Company name is one of the most significant steps for registering an international business company in any jurisdiction. Below are several criteria for naming a Seychelles IBC that you should take into account:

- Company name of a Seychelles limited company is required to include other following suffixes: “Limited”, “Corporation” or “Incorporated”, or the abbreviation “Ltd”, “Corp”, “Inc”.

- The name endings of a protected cell company need to include “Protected Cell Company” or with the abbreviation “PCC”.

- A Seychelles IBC’s company name can be rejected if it is similar or the same as another registered name; or include restricted words such as “Assurance”, “Bank”, “Building Society”, “Chamber of Commerce”, “Chartered, “Cooperative”, “Imperial”, Insurance”, etc.; or an offensive or ineligible name as in the opinion of the Registrar.

Tips

Wonder if your proposed company name is available? Try our NAME CHECK TOOL now.

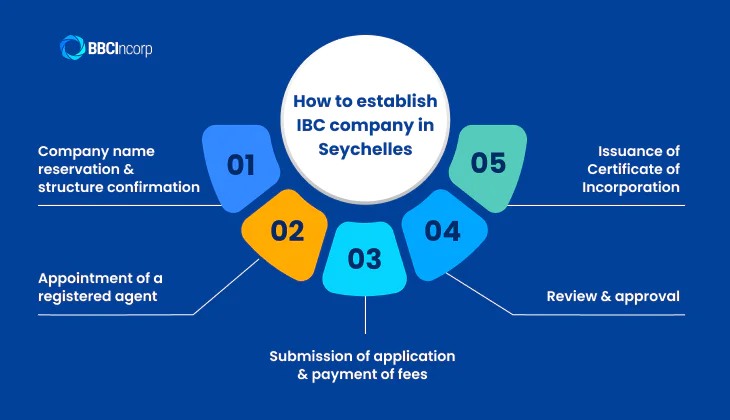

How to establish IBC company in Seychelles

Setting up a Seychelles international business company (IBC) is a straightforward process, designed to encourage global investors and entrepreneurs. The entire procedure can often be completed within a few days, provided that all documents are prepared correctly and the required fees are paid.

Below is a step-by-step guide to the main stages of incorporation.

Step 1: Company name reservation & structure confirmation

Choose a unique company name that complies with Seychelles naming rules and indicates limited liability (for example, “Limited” or “Ltd”). At this stage, you will also decide on the company’s structure, including the number of shareholders and directors, who may be either individuals or corporate entities.

There is no significant minimum share capital requirement, and many IBCs are incorporated with as little as USD 1.

Step 2: Appointment of a registered agent

Every Seychelles IBC must appoint a licensed registered agent based in Seychelles. The agent provides the registered office address, acts as the official liaison with local authorities, and ensures compliance with statutory obligations.

Step 3: Submission of application & payment of fees

The incorporation application must include the Memorandum and Articles of Association, details of shareholders, directors, and beneficial owners, as well as information about the registered office and agent. Government fees and service provider charges must also be settled at this stage.

Step 4: Review and approval

The Registrar of Companies reviews the submitted documents and may request clarifications if necessary. Once all requirements are met, the application is approved. Processing time depends on the completeness and accuracy of the documentation provided.

Step 5: Issuance of Certificate of Incorporation

Upon approval, the Registrar issues the Certificate of Incorporation, confirming the legal existence of the Seychelles IBC. The company will also receive its core corporate documents, such as the Memorandum and Articles of Association and statutory registers.

Simplify Seychelles IBC management with BBCIncorp

Establishing a Seychelles international business company is often the first step for entrepreneurs seeking a flexible and efficient offshore structure. With BBCIncorp, this process becomes simple, transparent, and reliable.

Our team specializes in Seychelles company formation, guiding you through every stage from name reservation and documentation to dealing with the Registrar of Companies.

With a proven track record of supporting global clients, we ensure that your Seychelles IBC is incorporated quickly, correctly, and in line with all legal requirements.

However, incorporation is only the beginning. To keep your company in good standing, annual renewal is a legal necessity. BBCIncorp offers a Seychelles Annual Renewal service package that covers the essential obligations, including:

- Government license fee payment

- Registered office and registered agent services

- Ongoing compliance reminders to help you avoid penalties

By combining company formation expertise with ongoing renewal support, BBCIncorp provides a complete solution for entrepreneurs who want to focus on expanding their business while leaving compliance in expert hands.

With our additional offerings such as nominee services, banking support, and accounting assistance, you also have the flexibility to scale and adapt your Seychelles IBC as your business grows.

BBCIncorp is not just a service provider but a long-term partner committed to helping you unlock the full advantages of Seychelles as a trusted offshore jurisdiction.

Conclusion

Seychelles has established itself as a leading offshore jurisdiction by offering a balance of flexibility, privacy, and compliance with international standards. The Seychelles international business company remains the most preferred structure, providing entrepreneurs with tax advantages, confidentiality, minimal setup requirements, and the ability to conduct business globally.

While the benefits are significant, maintaining good standing requires attention to compliance matters such as accounting record keeping, economic substance rules, and annual renewals. With the right support, these obligations can be managed smoothly and without disruption to your business operations.

For global investors seeking both opportunity and peace of mind, Seychelles IBC delivers a strategic platform for international trade, investment, and wealth management.

By partnering with a trusted service provider like BBCIncorp, you can ensure seamless company formation, reliable annual renewal, and comprehensive support for long-term success.

Frequently Asked Questions

What is the tax rate in the Seychelles IBC?

Seychelles International Business Companies (IBCs) benefit from a 0 percent corporate tax rate on income earned outside of Seychelles. This exemption applies to most foreign-sourced income, provided the company does not conduct business within the jurisdiction.

If an IBC earns Seychelles-sourced income, it becomes subject to local business tax under the Business Tax Act. The current rates are 25 percent on the first SCR 1,000,000 of taxable income and 33 percent on income above that threshold.

What is the insolvency law in the Seychelles?

Insolvency in Seychelles is governed by the Insolvency Act, 2013, which establishes the framework for handling companies that cannot meet their financial obligations. The Act provides detailed procedures for liquidation, rehabilitation, and administration, and also addresses cross-border insolvency issues.

It sets out rules for appointing liquidators, recognizing certain foreign insolvency proceedings, and establishing the order of priority for creditors when distributing company assets.

Is Seychelles tax free for foreigners?

Seychelles applies a territorial tax system, meaning that only income sourced within the country is taxable. For foreigners and IBCs, income earned abroad is generally exempt from Seychelles taxation.

Foreign-sourced passive income such as dividends, interest, royalties, and rents also remains tax-exempt, provided the IBC complies with economic substance requirements where applicable. If those requirements are not met, certain passive income may fall within the scope of Seychelles taxation.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.