Table of Contents

Two globally respected low-tax offshore jurisdictions for company formation are the British Virgin Islands (BVI) and the Cayman Islands. Both levy no direct corporate income tax and operate under internationally recognised regulatory frameworks. Yet, important differences in regulation, cost, compliance, and business focus can significantly influence which jurisdiction best suits your needs.

When comparing the Cayman Islands with the BVI, it becomes clear that each offers distinct regulatory and operational advantages, along with specific limitations.

In this article, we explore the similarities and differences between the BVI and the Cayman Islands, examining how each jurisdiction can shape your offshore company’s setup, compliance obligations, and growth potential.

Below is a concise comparison of the Cayman Islands vs. British Virgin Islands to highlight their key distinctions at a glance.

| Criteria | Cayman Islands | British Virgin Islands |

| Time to set up a business | 3–7 working days for standard incorporation 4–6 weeks if licensing or physical presence via Cayman Enterprise City is required. | 1–3 working days for incorporation Banking and compliance may extend the total setup time up to 3 months. |

| Set-up cost / physical presence | Starts from around US$14,750, covering office space, utilities, and comprehensive business support. | Approx US$1,000 – 1,500 for incorporation; additional costs for office, compliance, and local services. |

| Legal framework | Based on British Common Law. | Based on British Common Law. |

| Ease of doing business | Highly efficient incorporation process; globally recognized regulatory standards. | Simple and straightforward setup with minimal ongoing requirements. |

| Economic environment | Strong financial sector with robust funds and fintech ecosystems. | Popular hub for holding companies and SMEs with cost-efficient maintenance. |

| Ease of travel | Over 30 direct international flight routes, including major hubs across North America, Europe, and the Caribbean. | Approximately 12–15 direct regional flight routes, with connections primarily via major Caribbean transit hubs. |

| Population & community | ~65,000 residents; diverse, internationally oriented business environment. | ~30,000 residents; smaller, close-knit community. |

| Business networking | Active pro-business government, regular networking events, and a strong international investor base. | Strong local business community and supportive regulatory environment. |

| Lifestyle | Cosmopolitan, high standard of living with top-tier education and healthcare. | Relaxed island lifestyle with good living standards and accessible services. |

| Cost of living | High, partially offset by tax advantages. | Moderate, with some tax incentives available. |

The BVI and Cayman Islands business landscape

How do these two jurisdictions differ from each other at first sight? Let’s look at the following comparisons.

Both the British Virgin Islands and the Cayman Islands are globally recognised offshore financial centres and British Overseas Territories situated in the Caribbean Sea.

Moreover, both jurisdictions boast independent legal and judicial systems, adding to their allure for investors and businesses alike.

The business landscape in the British Virgin Islands

The British Virgin Islands (BVI) is famous for its exceptional stability in political and economic aspects. Historically, global investigations such as the ICIJ and the Panama Papers revealed the BVI as the world’s largest offshore incorporation hub.

Today, the jurisdiction continues to hold a leading global position in cross-border corporate structuring. Global businesses often choose the BVI Business Company structure, valued for its flexibility, efficiency, and strong commercial confidentiality.

Notably, per the data from the BVI Financial Services Commission (FSC) and related industry reports, over 361,000 active companies were registered in the British Virgin Islands as of September 30, 2025.

The business landscape in the Cayman Islands

The Cayman Islands is another standout choice thanks to its reputation as a top offshore financial hub for international businesses and the ideal location for offshore investment funds.

This jurisdiction projects a quite similar legal system to the British Virgin Islands. This is because both are founded on the English common law system.

A Cayman Islands LLC is one of the most common business structures in the country. This model can be used for many purposes, such as investment funds, joint venture companies, private equity transactions, securitizations, and more.

Key similarities between the BVI and the Cayman Islands

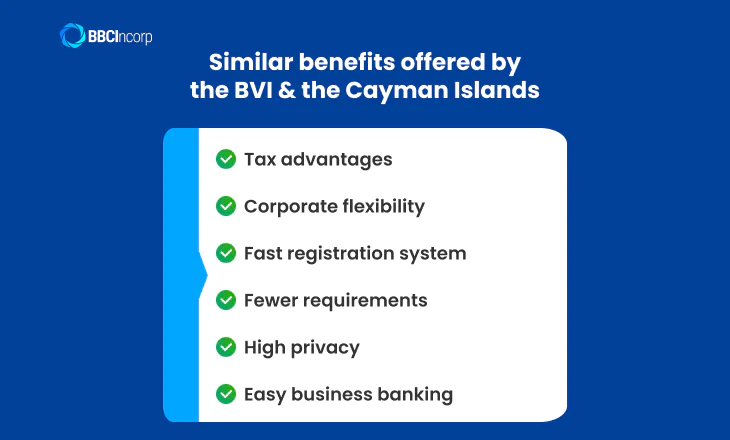

When comparing these two jurisdictions, it’s important to note some key similarities. Beyond their renowned reputations, both regions present various advantages for your offshore enterprises, such as:

Tax advantages

Both countries impose no corporate tax, capital gains, gift tax, inheritance tax, sales tax, or value-added tax.

As long as your offshore company conducts business outside its territories, you don’t have to pay these taxes. Your dividends, interests, and royalties are also tax-exempt.

Corporate flexibility

BVI Business Companies and the Cayman Islands Exempted Companies are flexible corporate structures.

There’s no requirement for corporate directors to be ordinarily residents of the country. Consequently, you don’t have to hire a nominee director for your company.

Fast registration system

You can form a business company in the BVI or an exempted company in the Cayman Islands in only 2 to 3 working days.

Fewer requirements

No capitalization is required for your company. You don’t even have to hold an annual shareholder meeting or submit financial records.

High privacy

Both jurisdictions maintain high levels of commercial confidentiality while complying with international transparency standards. Beneficial ownership information is not publicly accessible but is available to regulators, law enforcement, and tax authorities under international exchange agreements.

Easy business banking

Due to increasing global compliance standards and international banking de-risking, companies in both jurisdictions often rely on offshore banks, fintech institutions, and EMI providers for operational banking.

In practice, BVI companies often experience higher approval rates with EMI providers and certain offshore banking institutions.

Get your offshore business bank account up and running

At BBCIncorp, we assist with business bank account opening. Our team connects you with renowned global banks and payment services that provide the best-suited option for your business. Get in touch today!

With the numerous benefits that these jurisdictions offer, how do they manage to maintain their reputation in terms of regulatory compliance and other aspects? The answer lies in their adherence to economic substance regulations.

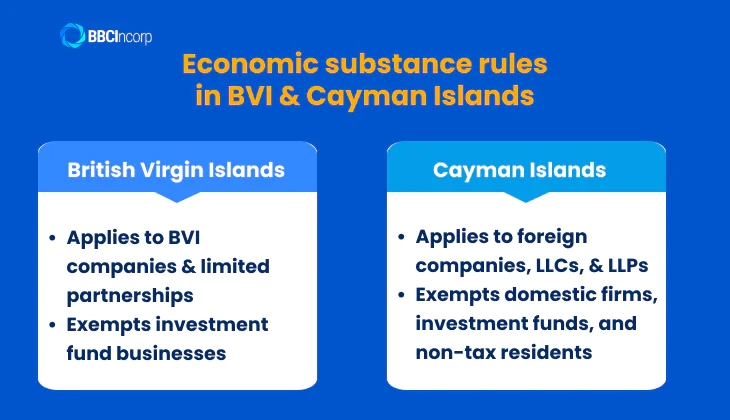

How economic substance rules affect the two jurisdictions

Relevant entities in the Cayman Islands vs. British Virgin Islands are now subject to Economic Substance rules. These are regulations implemented to make sure that companies operating within the jurisdiction have genuine economic activities and substance.

The rules encourage companies to conduct real business operations rather than just being used as vehicles for tax purposes.

Economic substance in the BVI

In the British Virgin Islands, economic substance requirements apply to BVI Business Companies and limited partnerships (with legal personality) that conduct one or more relevant income-generating activities.

In-scope entities include:

- BVI Business Companies

- BVI limited partnerships with legal personality

Exempt entities include:

- Pure investment fund businesses

- Entities that do not carry out any relevant activity, subject to annual economic substance declarations

- Entities that are tax resident outside the BVI, provided sufficient supporting evidence is submitted

These regulations ensure that companies conducting profit-generating activities maintain adequate operational presence, management control, and expenditure in the jurisdiction, in line with OECD and EU international standards.

Economic substance in the Cayman Islands

In the Cayman Islands, economic substance rules apply to exempted companies, limited liability companies, and limited liability partnerships that carry out one or more relevant activities.

In-scope entities include:

- Exempted companies

- Limited liability companies (LLCs)

- Limited liability partnerships (LLPs)

Exempt entities include:

- Investment fund businesses

- Domestic companies

- Entities that are tax resident outside the Cayman Islands, subject to appropriate documentation and annual reporting

Similar to the BVI, these regulations aim to ensure that companies maintain genuine economic presence and operational substance, supporting global tax transparency and regulatory compliance.

Economic Substance

See exactly what you need to do, by using this tool.

What are the factors that make them different?

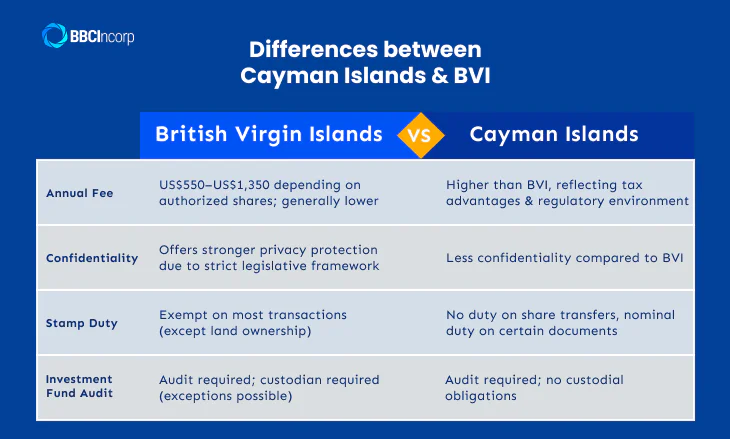

Despite their shared reputation as leading offshore centers, the British Virgin Islands vs. Cayman Islands distinction becomes clear when evaluating annual fees, regulatory frameworks, and fund management policies.

Annual fee

The annual government fees for BVI companies range from US$550 to US$1,350. In Cayman, annual government fees generally range from US$850 to over US$3,000, depending on authorised capital and structure.

In particular, annual fees for a BVI Business Company range from US$550 to US$1,350, depending on the number of authorized shares. In comparison, fees for a Cayman Islands exempt company are generally higher, reflecting the jurisdiction’s unique tax advantages and regulatory environment (See more details on upcoming fees available as of January 1, 2025).

Stamp duty

In the BVI, stamp duty on transactions to or by your business company is free of tax (e.g., transfers of property or assets, shares, debt obligations, or securities). Do note that you still have to pay tax for your land-ownership transactions.

For the Cayman Islands, no stamp duty is payable on transfers of shares. However, you shall pay stamp duties on certain documents at a nominal rate.

Investment fund

Cayman Islands funds benefit from flexible custody structures, particularly for hedge funds, where prime brokerage arrangements often replace traditional custody models. You must appoint an approved auditor and file audited financial statements annually.

BVI companies, however, are exempt from domestic audit requirements. In addition, in the BVI, approved and incubator funds typically require a custodian, unless a formal exemption is granted by the FSC.

Free ebook

New to offshore business landscapes?

All the essential information you need is right here.

Offshore company formation made simple with BBCIncorp

At BBCIncorp, we simplify the complexity of offshore company formation into a process that is efficient, compliant, and globally trusted. If you’re still unsure which jurisdiction best suits your goals, our specialists can help you evaluate your options based on your structure, industry, and long-term strategy.

For entrepreneurs seeking flexibility and cost efficiency, BVI company formation remains one of the most practical routes for building an offshore entity. On the other hand, those focused on fund management, international finance, or institutional credibility may find Cayman Islands company formation a more strategic choice.

We provide professional company services to make your incorporation process effortless:

- Guidance on selecting the right location for your offshore structure based on regulatory stability, tax advantages, and operational needs.

- End-to-end handling of documentation and reporting in line with each jurisdiction’s requirements.

- Gain access to our Client Portal and essential Compliance Tool to manage their offshore formation and compliance with greater accuracy and speed.

- Advice on building a compliant, long-term framework for your cross-border operations.

- A dedicated team providing clear, practical guidance throughout your incorporation journey.

Through this approach, BBCIncorp continues to be a trusted partner for enterprises seeking secure, scalable, and compliant offshore structures.

To wrap up: which jurisdictions should you choose?

Both the BVI and Cayman Islands offer remarkable opportunities for offshore company formation and business growth.

As the Cayman Islands vs. British Virgin Islands comparison often comes down to your business model and level of regulatory preference, the best choice is the one that supports your long-term structure and growth plan. Carefully assess these factors before making a decision.

If you still find yourself uncertain and need more guidance on setting up your offshore companies, don’t hesitate to reach out to us via service@bbcincorp.com. We are here to provide timely assistance and support!

Frequently Asked Questions

Are there differences in privacy and confidentiality laws between Cayman and BVI?

Yes. While both the Cayman Islands vs. British Virgin Islands maintain strong standards for safeguarding client and corporate confidentiality, their legal frameworks differ in scope and implementation.

Each jurisdiction applies its own data protection legislation, regulatory procedures for handling sensitive corporate information, and compliance protocols for international information exchange. In practice, both maintain high levels of commercial privacy while meeting global transparency and regulatory obligations.

Which is more reputable for hedge funds and investment funds between Cayman and BVI?

For hedge funds and investment funds targeting institutional investors, the Cayman Islands is widely regarded as the preferred jurisdiction due to its mature regulatory framework, global investor familiarity, and extensive fund administration ecosystem.

The British Virgin Islands remains a strong alternative, particularly for emerging fund managers, private funds, and smaller or less complex fund structures.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.