Table of Contents

What is a PLLC, and why does it matter if you’re a licensed professional? A PLLC, or professional limited liability company, is a legal structure created for individuals in regulated fields, namely doctors, lawyers, accountants, and architects.

These professions face stricter state requirements and liability risks, which a standard LLC may not fully address. That’s where the PLLC comes in. It offers liability protection and compliance with industry regulations.

In this article, we will break down what a PLLC is, how it differs from a regular LLC, and why choosing the right structure is crucial for industry experts.

What is a PLLC?

A Professional Limited Liability Company (PLLC) is a specialized type of legal entity designed for licensed individuals in fields such as law, medicine, accounting, engineering, and architecture.

If your profession requires state licensure, you may need a PLLC instead of a general LLC. This allows you to operate a formal business while complying with licensing rules specific to your field.

Legal definition of a PLLC

To define PLLC in legal terms, it is a type of limited liability entity that protects members from personal responsibility for the debts and obligations of the business, as well as malpractice committed by other members. However, it does not protect an individual from liability related to their own misconduct or negligence.

In practical terms, when someone asks what a professional LLC is, the answer is that it’s a legitimate identity with the benefits of a traditional LLC, thus aligning with jurisdiction laws and licensing rules.

How a PLLC differs from a standard LLC

A standard LLC can be formed by anyone, including individuals, corporations, or other entities. On the other hand, a PLLC is limited to licensed professionals who are authorized to provide services in regulated industries. In many states, every member of the PLLC must be licensed in the profession the company represents.

This structure maintains the flexibility and tax advantages of an LLC but adds a layer of expert oversight. For example, lawyers forming a practice would pick a PLLC to stay compliant with state bar requirements and foster personal safety.

State-by-state rules

The rules surrounding PLLCs vary by state. Some states recognize and permit the formation of PLLCs, while others do not. In states where PLLCs are allowed, professionals typically need to get approval from their licensing board before registering the business.

- States that allow PLLCs: Alabama, Arizona, Arkansas, Colorado, Connecticut, District of Columbia, Florida, Idaho, Illinois, Iowa, Kansas, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Montana, Nebraska, Nevada, New Hampshire, New York, North Carolina, North Dakota, Oklahoma, Pennsylvania, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia.

- States that do not allow PLLCs: Alaska, California, Delaware, Georgia, Hawaii, Indiana, Louisiana, Maryland, Missouri, New Jersey, New Mexico, Oregon, Rhode Island, South Carolina, Wisconsin, and Wyoming.

In states where PLLCs are not recognized, you may be required to form a professional corporation or another equivalent option.

Why it matters

Understanding what a PLLC is and how it works is essential for any licensed professional looking to start a practice. Making the right decision on the correct structure ensures compliance with state regulations and supports long-term business credibility.

Please always check with your state’s Secretary of State and relevant licensing board before moving forward.

Pros and Cons of a Professional LLC

For licensed experts, forming a Professional Limited Liability Company is a smart move to manage liability and comply with legal regulations. Like any business decision, it comes with advantages and trade-offs.

Knowing the advantages and limitations of a PLLC business structure helps you determine whether it is the right fit for your practice.

Advantages of a PLLC

Limited liability protection

One of the biggest advantages of this entity is protection from the actions of others in the business. If you are a licensed attorney in a PLLC and your partner is sued for malpractice, your personal assets are not at risk from that claim. The PLLC separates business liability from your finances, which is essential in high-risk professions.

Credibility and trust

Clients want reassurance that they are working with qualified professionals. A PLLC adds credibility to your practice by showing that your business is formally registered. It can also strengthen your position when working with banks, investors, and other partners who expect a certain level of legal structure.

Simplified compliance

Compared to corporations, PLLCs usually require fewer formalities. You are not required to issue shares or hold shareholder meetings, and the management map is more flexible. This means fewer distractions and more time to focus on delivering your services.

Disadvantages of a PLLC

No protection from personal malpractice

A professional LLC protects you from liability tied to other members’ mistakes, but it does not shield you from your own negligence. For example, if a patient sues a doctor for malpractice, the doctor can still be held personally liable. Malpractice insurance remains essential.

More steps to set up

Starting a PLLC is not as simple as forming a regular LLC. Most states require approval from your licensing board before you can register, which adds complexity and time to the process.

Restricted ownership and structure

This requirement makes it unsuitable for ventures involving non-licensed partners or mixed services, such as a firm selling both legal and consulting services.

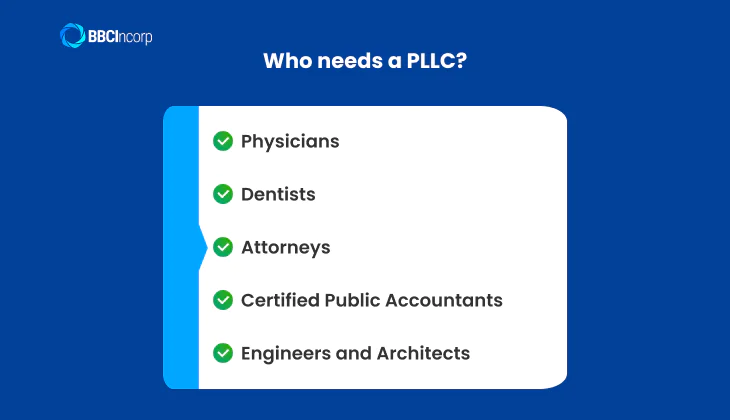

Who needs a PLLC and why?

Following the pros and cons, it is clear that a Professional Limited Liability Company is not a one-size-fits-all solution.

In many cases, whether you can or must use the PLLC depends entirely on your profession and where you plan to operate. State laws often require licensed individuals in certain fields to organize under a domestic professional LLC, rather than a general LLC.

Those required to form one

Several licensed occupations are either required or strongly encouraged to adopt this model. These include:

- Physicians: Medical practitioners handle sensitive patient matters and carry a high liability exposure. States with strict medical board oversight often mandate this venture for private practices.

- Dentists: As healthcare providers, dentists fall under similar regulatory expectations and benefit from the risk separation.

- Attorneys: Legal professionals are governed by state bar associations that frequently prohibit general LLCs for law practices. A PLLC for lawyers meets those standards while offering a liability shield from partners’ actions.

- Certified Public Accountants: In a field where financial responsibility is critical, structuring correctly is essential for maintaining compliance and professional standing.

- Engineers and Architects: These professionals are often held liable for the safety and integrity of physical structures. A compliant business entity helps address these risks.

In jurisdictions like New York, Florida, and Texas, the PLLC is widely used due to tight professional regulation. State boards in these areas typically require approval before formation, adding an extra step but ensuring that ethical and legal requirements are met from day one.

A PLLC for professional services is not just a technical distinction. It reflects how seriously a state takes the licensing and accountability of service providers. If you are entering a regulated field, structuring your practice properly from the start can prevent legal complications and signal credibility to clients, partners, and licensing bodies.

Knowing what a PLLC company is and when it applies helps professionals set a strong and compliant foundation for success in the long run.

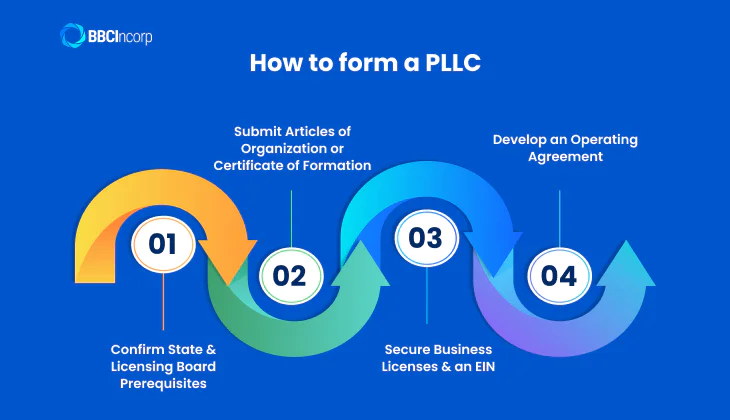

How to form a professional limited liability company

Starting a Professional Limited Liability Company goes beyond merely registering a name. Each state sets specific rules for licensed professionals forming and operating such entities.

The path often requires multiple steps to ensure full compliance. Grasping these steps proactively helps reduce delays and assures your business is built on a solid legal foundation.

Confirm State and Licensing Board Prerequisites

The initial action involves verifying if your state permits a professional limited liability corporation and what specific conditions apply. Not every state allows PLLC creation. Those that do typically mandate approval from the relevant licensing board before filing. This clearance confirms that all members satisfy professional standards and possess valid licenses.

For instance, in New York, lawyers must first secure written consent from the Office of Court Administration before submitting any documents to form a PLLC business. Likewise, in Florida, licensed professionals must register with the Department of Business and Professional Regulation before organizing under the entity.

Such approvals are non-negotiable; they affirm that all members meet professional standards and hold valid licenses. Recognizing these preliminary requirements is critical.

Submit Articles of Organization or Certificate of Formation

Once you’ve satisfied state and board-level requirements, the next move is to file formation documents with the Secretary of State. This document is commonly termed the Articles of Organization or Certificate of Formation, depending on your locale. It serves as the official public record of your PLLC’s creation.

For validity, the filing must:

- Include the full legal name of your business, typically ending in “PLLC” or “Professional Limited Liability Company.”

- Identify a registered agent for legal notices.

- List the principal office address.

- Provide professional license numbers and member credentials, where mandated.

Many states also ask for a brief description of the services to be offered, strictly limited to the licensed profession. Ensuring accuracy here prevents future compliance issues.

Secure Business Licenses and an EIN

Following state approval, your practice may require additional registrations to commence operations. Apply for an Employer Identification Number (EIN) from the IRS, even if you do not plan to hire employees immediately. An EIN is essential for opening a business bank account, filing taxes, and applying for permits. It functions as your business’s social security number.

Depending on your location and industry, specific types of business licenses may also be required at the local or state level.

For example, medical professionals might need to register with the state’s health department, in addition to holding a professional license. Thoroughly researching these specific requirements before starting operations can save significant headaches.

Develop an Operating Agreement

Although it is not always legally mandated, an operating agreement is a crucial internal document. It outlines how your professional limited liability company will be managed, how decisions will be made, and how profits and responsibilities are shared among members.

Consider it your PLLC’s internal constitution, governing its daily operations and member relationships.

In the case of single-member practices, it helps establish legitimacy with banks and tax authorities. In multi-member setups, it prevents misunderstandings and disputes by clarifying roles and procedures in writing. A well-crafted operating agreement is a powerful tool for dispute resolution and ensuring smooth governance.

Structuring and registering an LLC professional entity is pivotal for protecting your practice and maintaining compliance. Taking these steps carefully allows you to launch your business successfully, meet state requirements, and earn clients’ and regulators’ trust. Your PLLC defines the nature of your business.

PLLC vs. other business entities

Selecting the right structure is a critical step for any licensed professional launching a practice. The Professional Limited Liability Company (PLLC) is a popular option. Grasping how a PLLC compares with other business types helps clarify when it best fits your goals and regulatory needs.

PLLC vs. LLC

Both provide liability protection and allow pass-through taxation. Important distinctions exist, however. A PLLC is designed specifically for licensed individuals offering professional services such as law, medicine, or accounting. Most states require members to hold valid licenses. Ownership is restricted to professionals in the same field.

In contrast, a Limited Liability Company or LLC meaning is open to a broader range of business activities and owners. No professional license is required. Generally, there are fewer compliance steps.

To exemplify, an interior design studio could form an LLC without restriction, but a dental clinic would likely need to register as a PLLC in states regulating healthcare practices.

PLLC vs. Professional Corporation (PC)

A Professional Corporation (PC) or domestic professional corporation represents another common entity type for licensed providers. PCs demand more formal corporate structures, including a board of directors, shareholder meetings, and detailed recordkeeping.

A PLLC provides the liability protections professionals need but with fewer formalities. It functions more like an LLC in terms of tax flexibility and management. This makes it a more accessible option for solo professionals or small teams seeking simplicity without sacrificing legal protections.

PLLC vs. Limited Liability Partnership (LLP)

An LLP allows licensed partners to share management while protecting themselves from each other’s malpractice. Like PLLCs, LLPs are often used by lawyers and accountants.

However, LLPs may not provide the same level of asset protection or tax flexibility. In many states, PLLCs are preferred for newer practices or those with fewer partners because of their streamlined requirements.

PLLC vs. General Partnership

A General Partnership is the most basic form of joint business ownership. It requires no formal registration but exposes all partners to full personal liability for debts and legal claims. For licensed professionals, such risk is unacceptable, and a PLLC provides a formal entity that limits liability.

Understanding what a professional LLC offers becomes clear when examining these distinctions: a balance between legal protection, professional compliance, and operational flexibility. Ultimately, the professional limited liability corporation serves a vital role for regulated industries.

Conclusion

Is a PLLC right for your expert practice? As we conclude this article, several key points about the Professional Limited Liability Company (PLLC) bear emphasis. A PLLC is a suitable structure for licensed professionals who must meet specific legal and regulatory standards.

It provides personal liability protection, operational flexibility, and maintains compliance with state and licensing board requirements.

While entrepreneurs may set up a standard LLC, “What is a PLLC?” tends to be a question that must be addressed by professionals such as those in law, medicine, and accounting. Because rules vary by state and profession, seeking proper advice before selecting an entity is important.

If you are looking for expert guidance and assistance on growing your LLC business, please reach out to us. We are ready to provide comprehensive company services on LLC formation and ongoing compliance for your global venture.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.