Table of Contents

In today’s article, BBCIncorp offers you a comprehensive guide to BVI economic substance requirements that you should know. Let’s navigate through the details now.

Reminder of the BVI Economic Substance filing deadline

All in-scope BVI companies and partnerships must submit their annual economic substance report no later than six months after the financial year end. This requirement applies to both entities that conduct relevant activities and those that claim an exemption, as the International Tax Authority expects every in-scope entity to maintain an updated filing record.

The table below highlights the key filing dates for common financial year-end periods to help entities plan and stay compliant.

Overview of BVI Economic Substance Act (BVI ESA)

Economic Substance remains a key focus for any jurisdiction classified as a “no or only nominal tax” center, including the British Virgin Islands. In response to its commitments under the EU listing process and the OECD BEPS Inclusive Framework, BVI introduced the BVI Economic Substance (Companies and Limited Partnerships) Act, 2018, which took effect on 1 January 2019.

To support consistent implementation, the International Tax Authority released the final Rules and Explanatory Notes on Economic Substance on 9 October 2019, followed by an updated version in February 2020. These Rules clarified important points raised by the Code of Conduct Group and provided greater detail on reporting obligations, submission timelines, and compliance expectations under the BVI ESA.

You can read more details on the ITA Rules for further information as well.

Updates on amendments to the BVI ESA

Since the enactment of the Economic Substance (Companies and Limited Partnerships) Act, 2018 (ESA), several amendments have clarified its scope and application:

- 30 January 2019: The Act was amended to refine certain provisions shortly after its introduction.

- 22 April 2019: The International Tax Authority released the draft Economic Substance Code (Guidance), providing further clarification on compliance requirements, reporting obligations, and definitions under the ESA.

- 29 June 2021: The Economic Substance (Companies and Limited Partnerships) (Amendment) Act, 2021 came into force, introducing key updates regarding limited partnerships and investment fund business.

Limited partnerships

The 2021 Amendment confirmed that all BVI limited partnerships, whether with or without legal personality, are treated as “legal entities.” Consequently, they fall within the scope of the Economic Substance Regulations and must comply with the reporting and substance requirements.

Investment fund business

The Amendment Act defined “investment fund” and explicitly excluded Investment Fund Business from the list of relevant activities under the ESA. Entities conducting only investment fund activities are therefore not required to meet economic substance obligations for relevant activities.

Entities within the scope of the BVI ESA

All BVI legal entities that carry on relevant activities fall under the BVI Economic Substance (Companies and Limited Partnerships) Act, 2018 (ESA) and its amendments, including the 2021 Amendment Act.

What is a “legal entity”?

Pursuant to the Amendment Act 2021, the “legal entity” refers to

- All registered BVI business companies and foreign companies; and

- All registered BVI limited partnerships and foreign limited partnerships, whether or not they have a separate legal personality.

An entity is generally out of scope if it is a non-resident company that meets both of the following conditions:

- It is a tax resident in a jurisdiction other than the BVI; and

- That jurisdiction is not on the EU list of non-cooperative jurisdictions.

What is a “relevant activity”?

The ESA aligns with OECD and EU guidance on geographically mobile businesses. The nine relevant activities are:

- Banking business

- Insurance business

- Fund management business

- Finance and leasing business

- Headquarters business

- Shipping business

- Holding company business

- Intellectual property business

- Distribution and service center business

What if you’re a within-the-scope entity?

Any legal entity that carries on a relevant activity must comply with the economic substance requirements and submit the annual economic substance report to the International Tax Authority (ITA). Notably, compliance involves demonstrating adequate management, staff, and operations in the BVI in relation to the relevant activity.

In the following section, we will outline the steps your entity must take to comply with the BVI Economic Substance regime.

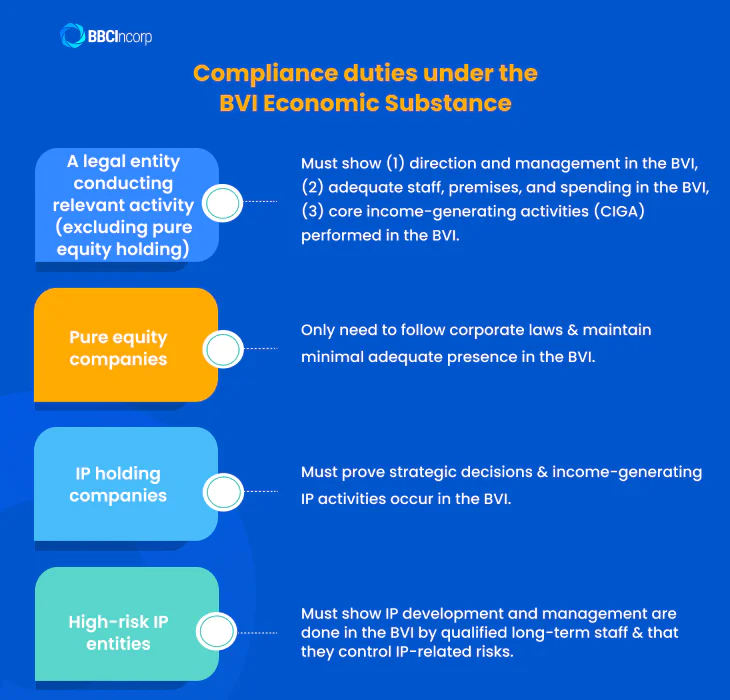

Compliance duties under the BVI Economic Substance

As stated, BVI legal entities carrying on relevant activities must comply with the Economic Substance BVI requirements under the Act. This includes BVI business companies, foreign companies, and BVI limited partnerships, regardless of whether or not they have legal personality. The specific requirements will depend on your particular type of business entity and business category.

For a legal entity that carries on relevant activity (except for a pure equity holding entity)

In the case of a legal entity (excluding pure equity holding companies), compliance with the ESA is demonstrated through three key tests.

Direction and management test

The entity must guarantee that its relevant activities are directed and controlled inside the territory of the BVI during its financial period.

Adequacy test

- The entity must have adequate employees, premises, and sufficient operational expenditure in the BVI relative to the nature and scale of its relevant activity.

- For intellectual property (IP) businesses, the necessary equipment must be located in the BVI if it is essential for conducting core income-generating activities (CIGA).

Core Income-Generating Activities (CIGA) test

CIGA are the central activities that generate relevant income for a legal entity. Under the BVI ESA, entities carrying on relevant activities must conduct these activities within the BVI. The specific CIGA for each relevant activity is defined in Section 7 of the BVI Economic Substance Act, 2018:

- Banking business: Raising funds, managing credit and currency risks, providing loans and credit, managing regulatory capital.

- Insurance business: Underwriting and reinsuring risks, calculating and managing insurance risks, managing insurance contracts and policies.

- Fund management business: Making investment decisions, managing portfolios, monitoring risks, executing trading strategies.

- Finance and leasing business: Agreeing on financing or lease terms, acquiring and managing assets, overseeing related agreements, and managing financial risks.

- Headquarters business: Making major management decisions, coordinating group activities, and allocating costs.

- Pure equity holding business: Holding equity participations and earning dividends or capital gains.

- Shipping business: Managing vessels, crew, voyages, and cargo operations.

- Intellectual property business: Developing, exploiting, maintaining, enhancing, and protecting IP assets (patents, trademarks, brands, copyrights, R&D), managing associated risks, and conducting income-generating licensing or trading activities.

- Distribution and service center business: Transporting and storing goods, managing inventory, processing orders, and providing administrative or consulting support.

For a pure equity holding company

Section 8(2) of the BVI Economic Substance Act, 2018 defines a pure equity holding company as an entity that “carries on no relevant activity other than holding equity participations in other entities and earning dividends and capital gains.”

A BVI pure equity holding company is subject to a reduced economic substance test. To comply, the entity must:

- Adhere to governing regulations under the relevant legislation, such as the BVI Business Companies Act, 2004, or the Limited Partnership Act, 2017.

- Maintain adequate premises and employees in the BVI necessary to passively hold or actively manage its equity participations.

For an intellectual property (IP) holding company

Under the BVI ESA, an IP holding company is presumed not to conduct core income-generating activities (CIGA) if the activities carried out in the BVI do not include the CIGA specified in Section 7 of the Act.

To rebut this presumption, the company must demonstrate that its BVI activities include:

- Strategic decision and risk management of principal risks relating to the development and exploitation of intangible assets, as well as the acquisition and exploitation by third parties of intangible assets.

- Underlying trading or other activities that generate income from the exploitation of intangible assets.

These requirements must be met both during the financial period under review and, where relevant, for any historical periods in which the entity carried on intellectual property business.

For a high-risk IP legal entity

A high-risk IP entity can challenge the presumption that it does not carry out core income-generating activities by showing that the development, use, maintenance, improvement, and protection of its IP are performed in the BVI by qualified employees on long-term contracts. The company must also demonstrate that it retains control of the main risks related to its IP business.

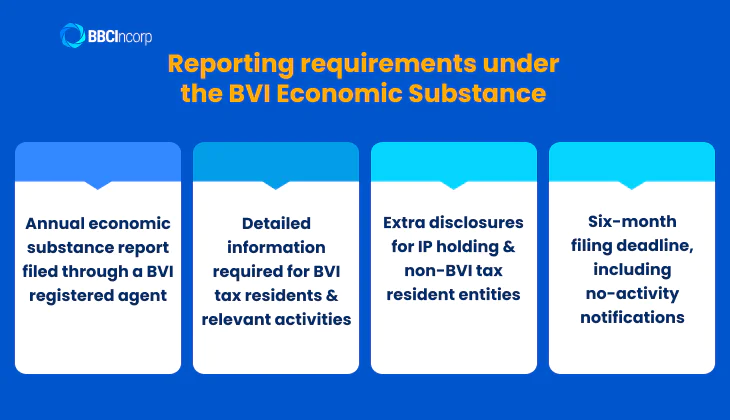

Reporting requirements under the BVI Economic Substance

BVI legal entities must submit an annual economic substance report through their registered agent in the British Virgin Islands under the BVI economic substance requirements. The documents required depend on the entity’s business category, type of relevant activity, and tax residency status.

BVI tax residents conducting relevant activities

Entities that are tax resident in the BVI and carry out one or more relevant activities must provide information on:

- Revenue generated by the relevant activity in the BVI.

- Expenditure incurred in the BVI for the relevant activity.

- Number of employees in the BVI engaged in the relevant activity.

- Address of premises used for the relevant activity.

- Equipment located in the BVI for the relevant activity.

- Individuals responsible for directing and managing the activity, and their BVI residency status.

- Outsourced activities (if any), including details of the service provider and resources used.

Intellectual property (IP) holding companies

For intellectual property holding companies, additional information is required.

These entities must indicate whether they qualify as high-risk IP entities and, if applicable, whether they wish to contest the rebuttable presumption that they do not conduct core income-generating activities. Any supporting documents must also be provided.

Entities conducting relevant activities but not tax resident in BVI

Entities that carry out relevant activities but are not tax residents in the BVI must supply details and evidence of their tax residency in another jurisdiction, as well as any other information necessary to demonstrate compliance with the Economic Substance Act.

Submission deadline

Reports must generally be submitted within six months after the end of the entity’s financial year, and the registered agent is responsible for timely submission.

Entities not carrying out relevant activities

Entities that do not engage in any relevant activity under the Economic Substance Act are still required to submit a notification confirming this to their registered agent. In such cases, no other supporting documents are necessary.

Non-compliance penalties

If a BVI legal entity fails to comply with its economic substance BVI obligations, the International Tax Authority (ITA) will issue a Non‑Compliance Notice through its registered agent. The notice will specify the reason for the non-compliance, the penalty amount, the payment deadline, and the corrective actions required, including the timeframe for taking these actions.

Penalties are structured based on whether it is a first or second determination, and whether the entity is a high-risk IP entity. If an entity continues to fail to comply after the second determination, the ITA may recommend that the entity be struck off the register.

In exceptional cases, the ITA may bypass the first determination and go directly to strike-off if it deems compliance unrealistic. Additionally, entities that provide false or misleading information, or refuse to provide required data, may face criminal penalties including fines of up to USD 75,000 or imprisonment of up to five years, or both.

Entities have 30 days to appeal any determination or penalty to the BVI High Court. During the appeal, the obligation to pay or remediate may be suspended.

The following table summarizes the key penalties:

| Determination / Action | Minimum Penalty (USD) | Maximum Penalty (USD) | High-Risk IP Maximum (USD) | Notes |

| First determination | 5,000 | 20,000 | 50,000 | Issued when an entity fails initial ESA compliance. |

| Second determination | 10,000 | 200,000 | 400,000 | Issued if the entity fails to correct non-compliance after the first determination. |

| Strike-off | N/A | N/A | N/A | ITA may recommend removal from the register if non-compliance continues. Exceptional cases may skip the first determination. |

| Criminal penalties | N/A | 75,000 | N/A | Providing false information or failing to provide required data may include up to 5 years imprisonment. |

Exchange of information

The International Tax Authority (ITA) in the BVI may share economic substance information with overseas tax authorities under specific circumstances. This typically occurs when a BVI entity fails to comply with the economic substance requirements or, in the case of an intellectual property (IP) entity, falls under the rebuttable presumption of not carrying out core income-generating activities (CIGA) within the BVI.

If a company is proven to be a non-tax resident in the BVI, the ITA will notify the competent tax authority in the country of the entity’s tax residence.

Furthermore, for entities with beneficial owners located in an EU member state, the ITA may provide relevant information about the entity’s tax residency and economic substance status to the corresponding EU authority. This is done in accordance with EU transparency standards and OECD BEPS reporting requirements.

Compliance timeline

Entities carrying out relevant activities must comply with economic substance requirements for each financial period, and submit their annual report by the BVI Economic Substance filing deadline.

Financial period

How a “financial period” is determined depends on the type of legal entity and when it was formed or incorporated. The ITA’s Rules (v4) set out specific rules for each different scenario as follows.

Provisional treatment

If an entity cannot provide proof of foreign tax residence by the filing deadline, it may apply to the ITA for provisional non‑resident status. During the provisional extension period, the entity is treated as a non‑resident for the purposes of the Economic Substance Act.

To qualify, the entity must submit evidence to the ITA, which can include:

- A certificate or letter confirming tax residency in a foreign jurisdiction.

- A tax assessment or self-assessment tax return from that jurisdiction.

- Documentation showing a tax demand or proof of tax payment (e.g., bank or credit card payment).

- Any other official proof issued by the competent foreign tax authority.

The ITA will set a reasonable period within which the entity must provide the required evidence.

Partner with BBCI for seamless BVI company registration

Incorporating a company in the British Virgin Islands (BVI) provides access to a well-regulated, business-friendly jurisdiction with modern corporate legislation, and full tax exemption on income earned outside the territory. The question is how to establish your company efficiently and in full compliance.

BBCIncorp offers comprehensive corporate services for forming and maintaining your BVI company with ease. Our services include everything you need:

- Company formation, including name reservation, submission of incorporation documents, and registration with the relevant authorities

- Assistance with opening business accounts for global transactions

- Full compliance support covering Economic Substance BVI guidance reports, annual filings, and other statutory obligations

- Access to our exclusive online Client Portal, providing centralized document management, automated reminders for key deadlines, and oversight of your company status.

- Streamlined procedures: digital KYC, e-signatures, and other essential services.

We combine professional expertise, efficiency, and transparency to complete BVI company registration in as little as two to three working days, ensuring all statutory obligations are met without delay.

Read more on our website on the British Virgin Islands company register or get in touch with us today for timely support.

Conclusion

Meeting BVI Economic Substance requirements is crucial for any company carrying out relevant activities in the jurisdiction. This includes understanding which entities fall within scope, the nine relevant activities, core income-generating activities, and reporting obligations, as well as special rules for pure equity holding and intellectual property companies.

Most importantly, you must ensure the timely submission of annual reports, accurate documentation, and compliance with financial period timelines. In case your business requires time to prove foreign tax residency, provisional non-resident treatment is available.

If you are unsure whether your company falls under the scope of BVI economic substance requirements, don’t hesitate to contact our team at service@bbcincorp.com so we can offer the assistance you need.

Frequently Asked Questions

What is the Economic Substance Act in the BVI?

The BVI Economic Substance (Companies and Limited Partnerships) Act, 2018, effective from 1 January 2019, requires certain legal entities to demonstrate “economic substance” in the British Virgin Islands. The law was introduced in response to EU and OECD pressures to make sure that companies domiciled in the BVI are not “shells” and genuinely carry out business activities locally.

Under the Act, entities must show that their relevant activities are directed and managed in the BVI, and they have adequate staff, premises, and expenses there.

Which entities are subject to BVI economic substance requirements?

The Act applies to BVI “legal entities,” specifically companies and limited partnerships, including foreign companies and foreign limited partnerships registered in the BVI. An entity must also carry on at least one of nine “relevant activities”: banking, insurance, fund management, finance and leasing, headquarters, shipping, holding, intellectual property, or distribution and service centre.

However, non-resident entities (i.e., tax resident outside the BVI in a jurisdiction not on the EU non-cooperative list) may be exempt, provided they submit evidence of their foreign tax residency.

What happens if a BVI company fails to meet economic substance requirements?

Non-compliance with the BVI economic substance rules can lead to heavy consequences. The International Tax Authority (ITA) can issue a determination of non-compliance, resulting in fines up to USD 20,000 for a first determination, or USD 50,000 if the entity is a high-risk IP business.

If the entity continues not to comply, a second determination can impose fines up to USD 200,000 (or USD 400,000 for high-risk IP), and the ITA may initiate strike-off from the register. Additionally, failure to file economic substance reports or provide required information may trigger separate offences under BVI reporting laws, which can lead to fines up to USD 75,000 or imprisonment for up to five years.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.