Table of Contents

In this article, BBCIncorp provides detailed guidance on Cayman Islands ES Requirements. including in-scope entities, compliance procedures, and related considerations.

Introduction to Cayman Economic Substance Rules

Having drawn much attention probably was the implementation of the OECD Forum on Harmful Tax Practices, aka FHTP. The forum came up with the global standard regarding substantial activity requirements to no or only nominal tax jurisdictions in November 2018.

As a member of the OECD BEPS Inclusive Framework, the Cayman Islands were among the very first ones to start their domestic law to meet the standard.

The International Tax Co-operation (Economic Substance) Law (2020 Revision), or Cayman “ES Act”, entered into force on 1 January 2019. The Act was then amended several times to further modify the requirements of ES notification, sharing of information, and other issues.

The Cayman ES (Amendment) Law, 2020 (Law 7 of 2020) published on 12 February 2020 is currently the latest version of the ES Act.

Other supplemented regulations and guidance, namely the Guidance on ES for Geographically Mobile Activities, and Cayman ES Regulations, 2020 were thereafter issued, on 13 July 2020 and 11 August 2020, respectively.

Accordingly, ES law requires in-scope entities with geographically mobile activities in the Cayman Islands to demonstrate ES as an annual requirement. For each relevant activity as prescribed in the law, entities must satisfy an ES test, including the CIGAs test, direction, and management test, and adequacy test.

Concerning filing obligations for those entities, the two primary duties are to submit an ES notification to the Authority and to file an ES return to the Authority.

The Tax Information Authority (the ‘Authority’), a functional unit of the Department for Internal Tax Co-operation (DITC) in the Cayman Islands, supervises the ES law in the Cayman Islands and guarantees compliance with the law.

In what follows, we will delve into the ins and outs of how to comply with the Cayman Islands Economic Substance Requirements!

Entities that must comply with Cayman ES

In-scope entities under ES Law

Under Cayman ES Act, in-scope entities, or relevant entities under ES law refer to:

- A company incorporated under the Companies Law (2020 Revision), or

- A Cayman limited liability company (LLC) registered according to the Limited Liability Companies Law (2020 Revision); or

- A limited liability partnership (LLP) registered according to the Limited Liability Partnership Law, 2017; or

- A company incorporated outside of the Cayman Islands and registered under the Companies Law (2020 Revision).

Entities excluded from ES Law

There are certain out-of-scope entities, and these cases don’t need to observe the ES test in the Cayman Islands.

Excluded cases are:

- A domestic company; or

- A company as an investment fund; or

- A company as a tax resident in an overseas jurisdiction

To be regarded as a tax resident in another jurisdiction outside Cayman, your company should provide evidence to the Authority that the company is subject to corporate tax on all of its income in another jurisdiction because of its tax residence, domicile, or other similar reasons.

And this same requirement goes for foreign branches of a relevant entity.

Example

You own a Cayman-incorporated company conducting on a relevant entity from a Hong Kong branch. Since the Hong Kong branch pays corporate taxes on all of the branch’s income in Hong Kong relating to the relevant entity, the branch is regarded as a tax resident outside Cayman.

Relevant activities under ES Law

There shall be a filing obligation imposed on each relevant entity conducting the relevant activity.

Like other legal jurisdictions implicating ES law, 9 relevant activities regarding the OECD and EU standards involve:

- Banking business

- Distribution and service center business

- Financing and leasing business

- Fund management business

- Headquarters business

- Holding company business

- Insurance business

- Intellectual property business

- Shipping business

It is worth mentioning that relevant income from one activity is not the sole factor in deciding whether an entity is engaged in that relevant activity. “Passive relevant income” is the income generated without participation in the business activity of the recipients.

Dividends, interest, royalties, or rental property are typical examples of this type of income. Activity with passive relevant income can be regarded as a relevant activity.

Uncertain whether your company is subject to the Cayman ES rule? Try our Economic Substance Self-Assessment Tool.

Cayman Economic Substance guidance: ES test and Reduced ES test

Cayman ES test

Under Cayman ES Law, every relevant entity carrying on a relevant activity must satisfy the substance test.

If your company has two or more relevant activities, you’ll need to demonstrate the ES test regarding each relevant activity.

The question is: what to include in an Economic Substance Test of the Cayman ES Law?

In-scope entities conducting relevant activities will meet the ES test in Cayman if they satisfy below three conditions:

Direction and management test, which means the entity is directed and managed appropriately inside the Islands with respect to its relevant activity;

Adequacy test, meaning the entity must guarantee:

- Having an adequate level of expenses for operating the relevant activity in the Islands;

- Having an adequate number of appropriate employees in relation to the relevant activity in the Islands;

- Having an adequate place of business and specific equipment on the Islands.

CIGAs test, meaning the entity is carrying out certain Core Income Generating Activities inside the Islands in respect to its relevant activity.

CIGAs refer to activities playing a central role in a relevant entity regarding generating relevant income. Importantly, CIGAs must take place in the Cayman Islands.

The Cayman government allows a relevant entity to outsource its CIGA to a third party. Still, the entity must guarantee control of CIGA in the Islands.

Reduced ES Test

The reduced ES test in the Cayman Islands is only applicable for pure equity holding companies.

Accordingly, a pure equity holding company can pass a reduced ES test if it meets the following criteria:

- The company complies with relevant filing obligations, as stated in the Companies Law (2020 Revision); and

- The company has adequate employees and premises in the Islands for holding and managing equity participation in other companies.

Example

HELO Co Ltd holds 100% of the shares in the other three companies. It receives dividends yearly through this holding structure.

HELO is considered to be an intermediary pure entity holding company in the Cayman Islands without engaging in any other different activity.

In this regard, HELO is a relevant entity conducting a relevant activity in the Islands. But, it would be subject to a reduced ES test instead of a much more complicated test of other relevant activities.

Other exceptions

Suppose you incorporated a relevant entity in the Cayman Islands. You conducted one of nine relevant activities required to satisfy the ES test by the ES Law, but that activity generated no relevant income.

As a result, your entity would have no obligation to fulfill the requirement of an economic substance test.

Note, however, that following annual reporting duties under the Cayman ES Law is ineluctable. Your entity still must complete the ESN and ES return to the Authority, and the ES return will be filed as a “nil” one.

Further clarifications of Relevant income can be found in Section II.D of the Guidance.

Filing requirements under Cayman ES (What to report)

According to Cayman Economic Substance Law, a relevant entity that carries on one or more relevant activities must satisfy certain filing obligations.

Particularly, these entities must:

- Send a notification of Economic Substance to the Authority; and

- File an Economic Substance Return to the Authority.

Keep in mind, that notification and reporting are two key compliance duties for any relevant entity according to the Cayman ES guidance.

And you must do this annually.

ES Notification

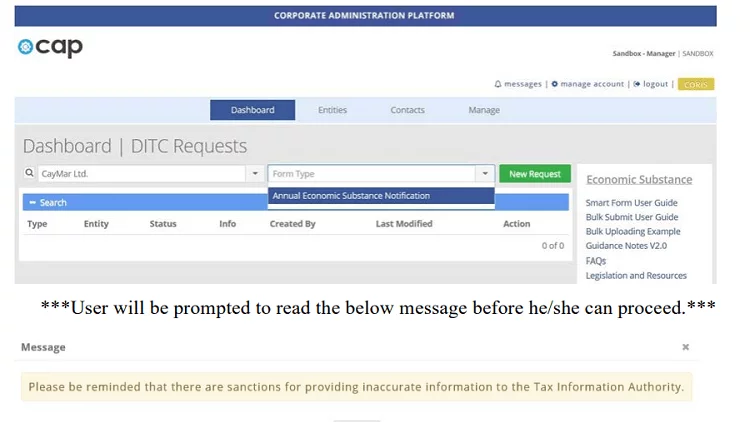

CAP system – the gateway for all legal entities in the Islands to file ES notifications

What ESN is

Economic Substance Notification (ESN) is an annual notification requirement for all entities. And this is not excluding any legal persons registered with the General Registry.

A key to mention is that ES notification acts as a sine qua non for filing the annual ES return for applicable entities.

How to file

Typically, there are two popular systems via which entities can file their ES notifications:

- CAP system (The General Registry’s Corporate Administration Platform)

- CBP system (Cayman Business Portal): applicable for certain cases (those submitting ESNs on CBP will need to confirm whether they are connecting to a relevant activity as per request)

Important update

According to the latest Practice Points on Economic Substance (11 Jan 2021 updated), entities with the financial year which starts in 2020 and 2021 can now submit their ES notifications via CAP. Meanwhile, the submission gate for filing ESNs via CBP is currently only open for the financial year starting in 2020.

What included in ESNs

Entities should involve the following information when submitting their ESNs to the Authority:

- Whether the entity is conducting a relevant activity;

- Whether the entity is a relevant entity (in case the entity is connecting with a relevant activity);

- When the entity is conducting a relevant activity and is NOT tax resident inside the Islands (below details will ONLY be required for those which have its owners classified as an immediate parent, ultimate parent, and ultimate beneficial owners (BO)):

- Name, address, and other verification details of the entity’s immediate parent, ultimate parent, and ultimate BO;

- Date from which the entity’s financial year ends; and

- The jurisdiction where the entity is tax resident, along with related supporting evidence

- When the entity is a relevant entity conducting a relevant activity:

- Date from which the entity’s financial year ends; and

- Name, and address of the representative notifying and providing the Authority with supporting documentation if required.

When to file

The deadline for ESNs submission is the same as the due date for filing the Annual Return, normally falling into 31 March annually. Note that the ES notifications will depend on your entity’s financial year.

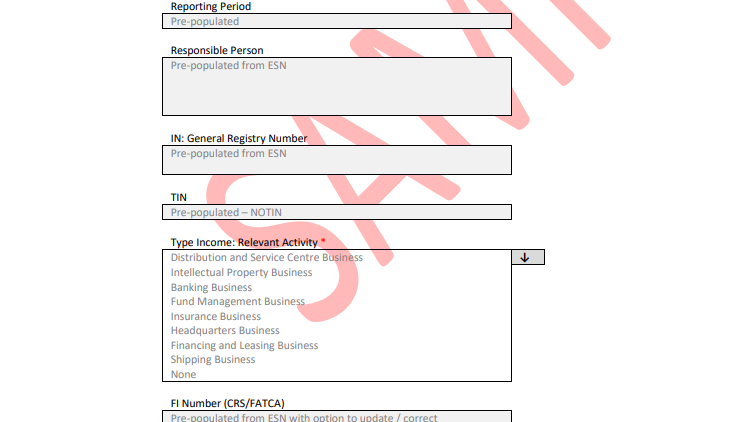

ES Return

A part of the ES return sample

What ESR is

Relevant entities conducting a relevant activity must meet the requirements of the ES test, and file an Economic Substance Return (ESR) to the Authority yearly. The main purpose of this reporting obligation is to identify if your entity satisfies the ES test.

How to file

Cayman ES Return, or simply a form, is done electronically via a DITC Portal (Department for International Tax Cooperation).

The Responsible Person (who can be your entity’s director or register office) confirmed on the ES notification will receive the link to access this portal via email. This Person can also appoint other secondary users via the DITC Portal to help finish the filing obligation.

Wish to get a sample of the ES return for your reference? You can get it here.

What to be included in ES return

Below are the fundamental documents you should prepare for reporting to the Authority:

- Type of relevant activity that the entity has conducted;

- Amount and type of relevant income concerning that activity;

- Amount and type of costs, properties relating to that activity;

- Information about premises, equipment, or property served for that activity in the Islands;

- Number of qualified employees for that activities;

- Description of CIGAs in relation to that activity;

- Information about any MNE Group (Groups with total consolidated revenue of at least US$850 million) (if applicable);

- Other prescribed information, as the case may be, for that relevant activity falling into a high-risk or non-high-risk intellectual property business;

- Additional documents as per request (on a case-by-case basis).

When to file

All entities domiciled or registered in the Cayman Islands must submit an Economic Substance Notification to the Cayman Islands Registrar prior to 31 January each year.

Relevant entities that carried out one or more relevant activities must submit an Economic Substance Return to the Cayman Islands Tax Information Authority (TIA) within 12 months after the financial year end.

Example

If your financial year ends on 31 December 2022, you must file your ES return by 31 December 2023 for the 2022 reporting period.

For entity claims to be a tax resident overseas and is engaged in relevant activities, it must submit an Economic Substance Return – tax resident in another jurisdiction form (TRO Form) to the TIA through the DITC Portal within 12 months after the financial year end.

Exchange of information

Under the ES Law (2020 Revision), the Authority shall share information collected by the Authority under the Economic Substance Law with other competent authorities as per signed agreements and associated global standards.

Accordingly, the entity will need to conduct the information exchange if the entity falls into the following cases:

- The relevant entity failed to fulfill the ES test regarding its relevant activities;

- The relevant entity relates to a high-risk IP business.

Be advised that information will also be shared between the Authority and the relevant authority of the jurisdiction in which the entity in question is proven to be a tax resident, and where the parent company, ultimate parent company, and ultimate beneficial owner of the relevant entity resides (as the case may be).

Non-compliance cases of Cayman Islands ES

Non-compliance with the ES test under Cayman Economic Substance Law can lead to a penalty of up to US$100,000.

Section 4(d), International Tax Co-operation (ES) (Amendment) Law, 2020 also clarified the fine of US$5,000 (plus US$500 for each day when the non-compliance continues) for those subject to ES test but then fail to comply with ES return submission during the prescribed time frame.

Furthermore, if one entity is determined to follow the ES test, but provides misleading information to the Authority during the process, that entity shall be subject to a financial penalty of US$10,000 or be jailed for 5 years, or even both (as the case may be).

Important notice

On 31 March 2022, the Cayman Islands Tax Information Authority (TIA) issued new Economic Substance (ES) Enforcement Guidelines, setting out the principles for taking enforcement action in relation to infringements under the Cayman’s ES framework.

This includes the imposition of administrative penalties for various breaches of an entity’s reporting obligations under the ES Act. Noticeably, a penalty of US$ 12,195 would be imposed for relevant entities that fail to meet the ES test in the first year of assessment.

On 14 April 2022, the TIA announced that it will begin enforcement actions in the coming weeks for the ES frameworks.

For more information, refer to the ES Enforcement Guidelines.

Should you need more information regarding the Cayman Islands Economic Substance requirements for your company, drop us a message via service@bbcincorp.com for practical advice!

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.