Table of Contents

In today’s global economy, entrepreneurs and companies are increasingly turning to international banking to optimize cash flow, protect assets, and access new markets. However, choosing the best offshore bank for your business isn’t simply about finding low fees or attractive interest rates. It’s about identifying jurisdictions that offer financial stability, robust legal protection, and seamless international transactions.

This blog highlights the top countries with the best offshore bank accounts, including Switzerland, Belize, Singapore, Hong Kong, and more. Whether your goal is to streamline cross-border operations, manage global subsidiaries, or enhance financial privacy within compliance standards, this guide will help you make informed decisions and navigate the complexities of offshore banking with confidence.

If you haven’t started your business anywhere, consider incorporating an offshore company in these countries to maximize your global potential.

Key Takeaways

- Offshore banking offers strategic advantages for entrepreneurs — including global market access, asset protection, and efficient multi-currency management.

- Top offshore banking hubs such as Singapore, Hong Kong, Belize, Mauritius, Switzerland and Georgia combine stability, transparency, and business-friendly regulations.

- Caye International Bank, DBS, OCBC, and HSBC remain among the best offshore banks for corporate clients in 2025.

- Bank selection matters: compare fees, regulatory standards, remote opening options, and deposit protection before deciding.

- Work with BBCIncorp to streamline every step, from choosing the right jurisdiction to opening your offshore corporate bank account quickly and compliantly.

Understanding offshore bank accounts

If you are unfamiliar with doing business offshore, here is a concise introduction to the key definitions of offshore banking.

- Offshore bank: an offshore bank is situated in another jurisdiction outside your company.

- Offshore banking: the act of safeguarding your assets in other countries through financial institutions to prevent abrupt circumstances to your fund stored in the home country.

- Offshore bank account: an account held by offshore banks for financial and legal advantage purposes.

Registering offshore bank accounts holds significant appeal for various reasons. Primarily, it enables entrepreneurs to minimize their tax burden, protect assets, maintain privacy, and take advantage of currency diversification opportunities.

When it comes to offshore bank accounts, there are crucial aspects to be aware of.

First, you should assess whether a bank’s product offerings align with your company’s needs and objectives.

For instance, you can ask about features such as expedited lending, transaction thresholds, remote account opening, and the level of privacy. Most banks are open to addressing these inquiries and offering additional guidance.

Next, you should know if there are any fringe benefits. These include cash bonuses, payroll services, accounting software, travel agent services, and tax prep help. Due to the fierce competition in the banking industry, some banks might offer incredibly generous perks to attract businesses.

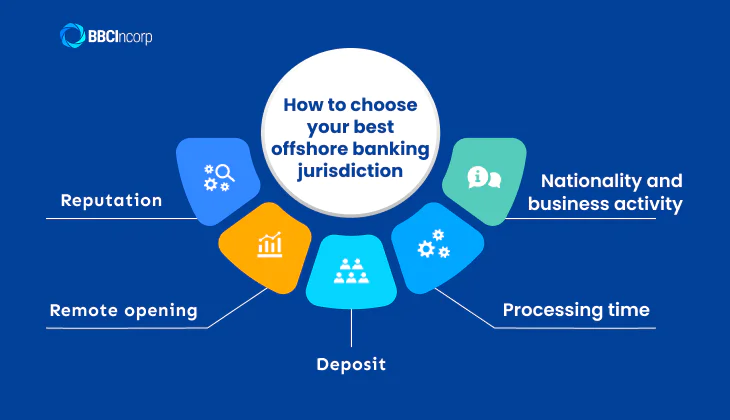

How to choose your best offshore banking jurisdiction

What factors will you need to look into when deciding on the jurisdiction? Let’s start exploring several criteria.

Reputation

Generally, the reputation of a jurisdiction reflects the quality of its banking system.

A well-regarded banking country typically signifies a highly favorable and stable environment for conducting business.

However, it might be challenging for you to open a business bank account in such countries as a foreigner.

That is why we recommend opening a bank account in Hong Kong or Singapore. Their processes are much simpler than those in other jurisdictions, thus they have a positive reputation.

Remote opening

This method is popular among foreigners due to its great convenience. You won’t need to visit the bank personally to open an account, saving both time and money.

The potential options for where to open an account online are Belize, BVI, Hong Kong, Singapore, Mauritius, Puerto Rico, and Switzerland.

Deposit

For start-ups, entrepreneurs, and SMEs, the allure of a low deposit jurisdiction can be irresistible.

Certain offshore banks offer the advantage of not initial deposit when registering a bank account. Others may ask for a minimal deposit, but the costs tend to be relatively low.

While Hong Kong, Singapore, or Panama may demand higher minimum deposits, there are always favorable options like Belize and Puerto Rico.

Processing time

The process is typically swift, with most offshore banks offering your account within only a few days. However, the processing time is, eventually, influenced by the reliability of your document submission.

For favorable options, consider Puerto Rico, Hong Kong, Singapore, Belize, and BVI.

Nationality and business activity

You might wonder how your nationality and business activity impact the success rate of obtaining a bank account. Here are some key deciding factors:

Merchant accounts

If you operate an e-commerce business, merchant accounts are crucial.

The requirements for registering such an account will depend on your chosen merchant provider, or your banking service provider.

Clients’ nationality

The nationality of clients plays a vital role when selecting an offshore bank.

Each bank has its list of prohibited countries. Therefore, you must review their policies and ensure compatibility with your nationality before proceeding with the account opening process.

Clients’ business category

Your business may qualify for preferential categories at certain banks. It might facilitate the process, but the benefit is not guaranteed.

Therefore, you must carefully assess the alignment between your business category and the bank’s policy beforehand.

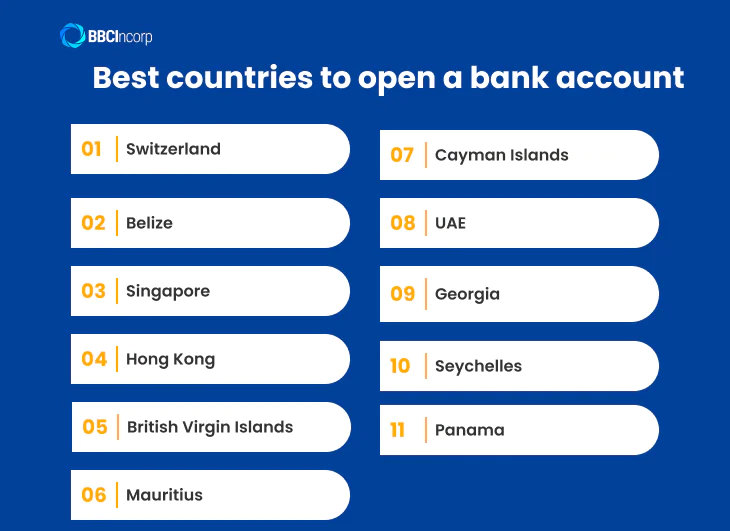

Best countries to open a bank account for 2025

If you are looking for where to open an offshore bank account, here we suggest some options for you to consider:

Switzerland – Good choice for asset protection

Switzerland is a top choice for the high level of its secure and privacy-oriented system.

According to The Swiss Bankers Association (SBA), Switzerland’s banks held assets of approximately USD 7 trillion in 2018, almost half of which is of foreigners.

Furthermore, this nation is home to many offshore banks well-known for asset protection, such as CIM BANQUE. Their strict privacy laws prohibit bankers from divulging customers’ account information without their consent. Any information leak can be deemed guilty and fined heavily.

Belize – Best choice for low deposit and remote opening

Generally, Belize is where you can set up a bank account with ease.

Another reason behind its popularity is the financial stability level. All banks in Belize are legally required to have at least a 24% liquidity ratio. This is much higher than that of U.S. banks (3 – 4%).

In addition, they offer low deposit options. If Hong Kong or Singapore requires an initial deposit of up to USD 100,000, Belize allows as low as USD 500 to a few thousand.

Overall, a Belize offshore account holds various advantages: free hassles of currency deflation, a fast account setup process, remote opening choices, etc.

Among many providers, CAYE International Bank Ltd. is highly recommended. Based in Belize and holding a full-scale Class A international banking licence from the Central Bank of Belize, it delivers genuine corporate-level services. Moreover, the bank’s strengths include:

- Multi-currency corporate account capability such as USD, EUR, GBP, and others, ideal for global operations.

- Enhanced privacy and asset protection standards within Belize’s jurisdiction.

- A streamlined online account opening process designed for non-resident corporations.

Singapore – Reputation is the key

Singapore has retained its position as the best business environment, according to EIU’s latest rankings for 2024.

This jurisdiction has an extensive banking system of more than 150 banks, 5 of which are locally incorporated. Most of them provide world-class bank account services. Furthermore, offshore banking in Singapore facilitates online account opening, internet banking, savings accounts, debit and credit cards, wealth management solutions, etc.

In short, Singapore, renowned as a global financial hub, stands as an ideal choice for offshore investors worldwide.

We recommend OCBC, Citibank, DBS, and UOB for your needs.

- OCBC: Be ideal for entrepreneurs who value stability and trust. As Singapore’s oldest bank (est. 1932), it combines heritage with digital innovation, earning the Best Digital Payment Service in Asia Pacific 2025 award. Known for its competitive multi-currency business accounts and low remittance fees, OCBC provides excellent value for SMEs managing frequent cross-border transactions.

- Citibank: Named among the best for wealth management and innovation for multiple years, Citibank leverages global scale and cutting-edge technology to deliver seamless cross-border banking and multi-currency solutions, perfect for high-net-worth non-resident investors seeking global connectivity.

- DBS: Stands out for integrated trade financing, FX hedging tools, and digital business banking. With one of Asia’s most advanced online banking platforms, DBS offers transparent, mid-range fee structures and excellent cross-border payment support ideal for fast-growing companies handling regional supply chains.

- UOB: Differentiates itself through personalized service and regional expertise. Its strength lies in tailored offshore packages, multi-currency current accounts, and customized corporate credit lines. Its fee structure is highly competitive for mid-sized businesses, and its focus on personalized advisory services makes it an excellent choice for entrepreneurs seeking a long-term, relationship-driven banking partner.

Hong Kong – Top financial center in Asia

Outstandingly, Hong Kong has ranked the fourth most competitive financial center in the world, according to the thirty-third edition of the Global Financial Centres Index.

Boasting the highest concentration of banking institutions globally, including 75 of the world’s largest 100 banks, this country offers a network of institutions adhering to international standards.

However, you might need to meet high deposit minimums and make a personal visit to the bank to open a Hong Kong business bank account.

Esteemed banks such as HSBC, DBS, Hang Seng Bank, and Standard Chartered Bank are among the top choices for non-resident entrepreneurs seeking best offshore banks in Hong Kong. Each offers distinctive strengths that cater to different business profiles.

- HSBC stands out for its global network and advanced international business services, making it ideal for companies managing multi-jurisdictional operations and high transaction volumes.

- DBS, though headquartered in Singapore, offers seamless regional banking integration and robust digital platforms, perfect for startups and SMEs expanding across Asia.

- Hang Seng Bank is renowned for its streamlined account opening process, competitive fees, and strong local market understanding, offering great value for trading and service-oriented businesses.

- Meanwhile, Standard Chartered Bank appeals to entrepreneurs prioritizing flexible multi-currency management, trade financing, and comprehensive global treasury services.

British Virgin Islands – High degree of privacy and confidentiality

The BVI is a well-regulated jurisdiction with a long history of financial stability. The jurisdiction also has a low tax regime and is not subject to exchange controls.

Most importantly, it offers a high degree of privacy and confidentiality. Bank records in the BVI are not publicly available and there is no requirement for banks to disclose your account information.

First Caribbean International Bank, for example, is a leading offshore bank in the BVI that offers a full range of banking services and competitive interest rates on savings accounts and term deposits.

Mauritius – Ease of account opening

Mauritius is another great option thanks to its stable political and economic environment, as well as its low taxes.

There are fewer restrictions on who can open an account in Mauritius, except the ‘high-risk’ nationality list. Still, if you’re not a resident, you may need to provide proof of your income and assets.

Some options that you might be interested in are Bank One Limited, Mauritius Commercial Bank, and Investec Bank.

Bank One Limited is well-regarded for its efficient offshore account setup and strong digital banking ecosystem, making it ideal for international entrepreneurs seeking agility and lower maintenance fees.

In comparison, Investec Bank caters to high-net-worth and institutional clients with tailored investment solutions, wealth management, and cross-border corporate banking. Together, these institutions make Mauritius a strategic, business-friendly hub for offshore banking.

Cayman Islands – Popular choice for offshore banking

The Cayman Islands are one of the most popular choices for offshore banking due to its political stability, low tax rates, and strong financial regulation.

Many Cayman banks allow seamless remote account opening. In this case, certified documents such as your identity proof, your overseas address, bank references, and the source of your funds will be required.

UAE – Favorable tax laws

UAE offshore banking can be a great way to diversify your portfolio and protect your assets.

The UAE is home to many world-class financial institutions. Additionally, the UAE’s tax laws are very favorable for offshore investors. This jurisdiction is an excellent choice if you are looking for a safe and stable place to invest your money.

RAK Bank, ADCB, and Emirates NBD are the three most well-known UAE banks.

RAK Bank stands out for its accessibility, with a relatively low initial deposit starting from USD 10,000 and simplified account opening for foreign-owned entities.

ADCB is preferred for its advanced digital banking and strong international payment network, while Emirates NBD appeals to larger corporations seeking premium relationship management, multi-currency accounts, and extensive trade finance support.

Georgia – An Ideal Country for U.S. Citizens to Open a Bank Account

Georgia has rapidly become a preferred offshore banking destination for U.S. citizens seeking flexibility and efficiency. Known for its liberal economic policies, low taxes, and straightforward regulations, Georgia offers a seamless banking experience without excessive bureaucracy.

Opening an account, often within a single business day, is simple, even for non-residents. Leading institutions like the Bank of Georgia provide multi-currency accounts, online banking, and strong financial privacy, making Georgia an attractive option for entrepreneurs and investors.

Seychelles – Confidential and business-friendly offshore banking

Seychelles has become one of the most attractive jurisdictions for offshore banking, thanks to its pro-business laws and zero tax on foreign-sourced income. Banks here specialize in supporting international entities such as IBCs and offshore companies.

The best offshore banks in Seychelles including Nouvobanq, MCB Seychelles, and ABSA Bank Seychelles offer remote account opening, multi-currency corporate accounts, and competitive fees. Through licensed service providers, entrepreneurs can open accounts seamlessly from abroad.

While deposit protection is limited, Seychelles remains a top choice for global businesses seeking flexibility, confidentiality, and efficient international banking solutions.

Panama – Convenient USD-based offshore banking destination

Panama stands out as a top offshore banking hub for US-based businesses due to its territorial tax system and the use of the US dollar as legal tender. It offers a stable, business-friendly environment ideal for managing cross-border transactions across the Americas.

While remote account opening may be supported via licensed intermediaries, many banks require an in-person or attorney-assisted process. Banco General is among the most reputable options, offering secure multi-currency corporate accounts and efficient online banking.

Still unsure which bank might fit your business?

Try our Banking Tool and work through a few simple questions to get personalized recommendations.

The quick guide to opening an offshore bank account

The process of opening an offshore bank account is relatively simple.

To begin, you can select the appropriate jurisdiction based on the aforementioned suggestions or your own evaluations. Next, identify a bank that offers your desired account type. Then, complete an application form and submit the necessary documentation.

Note that government regulations and the bank will require a certain level of due diligence on your part to open your offshore account.

Need more information on the full process?

Establishing your business involves a series of crucial steps, each with its own set of significant considerations.

Visit our article on how to set up your offshore bank account for more helpful insights!

What to Avoid When Selecting an Offshore Bank Account

Weak or unreliable regulatory frameworks: Avoid banks in jurisdictions with poor oversight or lax compliance. Weak regulation increases the risk of fraud, instability, and asset loss especially during international disputes or financial crises.

Absence of deposit insurance or protection: Banks without deposit insurance leave your funds fully exposed in case of insolvency. Choose institutions offering government-backed or private protection schemes to safeguard your deposits and reduce potential financial loss.

Unclear or hidden fee structures: Hidden fees can erode your profits over time. Always request a full fee disclosure, including account maintenance, transfer, and foreign exchange charges, before committing to an offshore bank.

Restricted access to your funds: Some offshore banks impose lengthy withdrawal times or strict approval processes. Prioritize options offering transparent access terms and reliable online banking platforms to ensure timely fund availability.

Dubious or controversial reputation: A bank’s reputation reflects its compliance and stability. Avoid those linked to scandals, poor governance, or legal issues, as such associations may complicate international transactions or damage your company’s credibility.

Unrealistic promises of absolute secrecy: Total secrecy no longer exists under global transparency laws such as CRS and FATCA. Banks promising complete anonymity may operate outside international standards, exposing you to legal or tax compliance risks.

Poor-quality investment opportunities: If a bank only offers a few investment options, your growth potential could be stuck in neutral. Look for offshore banks that provide access to a wide range of well-regulated global markets and portfolio choices, so your money can work smarter, not harder, for your business.

Insufficient multi-currency support: If your bank only works in one currency, every international payment turns into a hassle. Choose offshore banks that let you hold and transfer funds in multiple currencies like USD, EUR, and SGD to make cross-border transactions smoother and avoid losing money on exchange rates. For instance, a Singapore-based exporter dealing with US clients can benefit greatly from a USD account to handle payments directly.

BBCIncorp – Fast-Track Support for Opening a Corporate Bank Account

Opening an offshore corporate bank account can be complex, but with BBCIncorp’s Banking Support, the process becomes smooth, compliant, and worry-free from start to finish. BBCIncorp acts as your trusted partner, guiding you through every stage: from selecting the most suitable jurisdiction and bank to preparing documents, submitting applications, and coordinating directly with the bank’s onboarding team.

With strong partnerships across global financial hubs, BBCIncorp connects clients directly with the best offshore banks in trusted jurisdictions such as Belize, Hong Kong, Singapore, Mauritius, and the British Virgin Islands. Our established network including Caye International Bank, HSBC, OCBC, Standard Chartered, UOB, Citi Bank, and Mauritius Commercial Bank, ensures your company’s setup meets all international KYC and AML requirements without unnecessary confusion.

Typically, you’ll need to prepare essential documents such as:

- KYC form

- Bank statements

- Reference letter

- CVs of shareholders and directors

Business plan - Proof of trading and key client/supplier information

With BBCIncorp’s dedicated assistance, your corporate account opening becomes faster, and more transparent!

Now that you’ve understood various potential options for best offshore banks and ideal countries for opening offshore bank accounts, it’s time to evaluate your business requirements and make the right decision.

To simplify the process even further, don’t hesitate to utilize our banking account opening services. You can obtain an offshore company online quickly in days.

Skip the need to visit a bank in person because we’ll handle the account setup for you! Get in touch with us via service@bbcincorp.com now to explore your options!

Frequently Asked Questions

What is an offshore bank account?

An offshore bank account is an account held in a country outside your residence, often chosen for financial privacy, multi-currency access, and favorable tax or regulatory environments for international business operations.

Which countries offer the best offshore banking interest rates?

Interest rates vary by jurisdiction and currency. Emerging markets like Belize and Mauritius often offer higher returns compared to traditional financial centers like Singapore or Switzerland.

What are the best offshore banks for business owners?

Top choices include Caye International Bank (Belize), DBS and OCBC (Singapore), and HSBC or Standard Chartered (Hong Kong), all offering strong corporate banking, multi-currency accounts, and global transaction support.

Contact BBCIncorp today to get the best advice and choose the ideal offshore banking solution for your business.

Which offshore banks are recommended for high-yield savings?

For higher-yield savings, banks in Belize, Mauritius, and Georgia are preferred due to flexible deposit programs and favorable interest structures for both short- and long-term corporate accounts.

Is forming an offshore company required to open an offshore bank account?

It’s often recommended. Many offshore banks prefer or require a registered company in their jurisdiction or another recognized offshore location such as Belize, BVI, or Hong Kong to open a corporate account.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.