Table of Contents

Is Delaware LLC required to file an annual report?

Delaware LLCs are NOT required to file an annual report with the State’s Division of Corporations.

Instead, Delaware LLCs are required to pay an annual tax, which is officially called the “annual franchise tax.” It’s a fee imposed by the state for the privilege of conducting business in Delaware as an LLC.

While “annual franchise tax” is the official term, it’s common for people to simply refer to it as the “annual tax” when discussing their Delaware LLC’s financial obligations to the state. So, whether you hear it called the “annual franchise tax” or the “annual tax,” it typically refers to the same payment that Delaware LLCs are required to make on an annual basis to maintain their good standing with the state.

While there is no formal annual report requirement, Delaware LLCs are still encouraged to keep their business information up to date with the Delaware Division of Corporations and to maintain accurate records of their company location, members, managers, and other crucial information.

What are Delaware LLC annual costs?

The annual fees associated with a Delaware LLC can vary depending on the specific needs and circumstances of your business.

Below are some common annual costs and fees you may encounter when operating a Delaware LLC:

Delaware annual tax

For Domestic and Foreign Limited Liability Companies registered in Delaware, the annual tax (or “annual franchise tax”) is a fixed annual amount of US$300. The payment needs to be made no later than June 1st every year. Late payment will cause a penalty of $200 plus monthly interest of 1.5% imposed on both tax and penalty.

Registered Agent fee

Delaware requires LLCs to maintain a registered agent in the state to receive legal documents and official correspondence on behalf of the company. Registered agent services typically charge an annual fee, which can range from $50 to $300 or more, depending on the service provider.

Delaware LLC Certificate of Formation

The Delaware Certificate of Formation is a legal document that is filed with the Delaware Division of Corporations to officially create a limited liability company (LLC) in the state of Delaware. To obtain this certificate, you’ll have to pay a one-time fee which is US$90.

Other costs

In addition to the above, there may be other costs associated with running your Delaware LLC, such as legal and accounting fees, insurance premiums, and any fees related to specific business activities or compliance requirements.

How to pay the annual Delaware LLC tax?

Here’s your guide on how to pay the annual Delaware LLC tax:

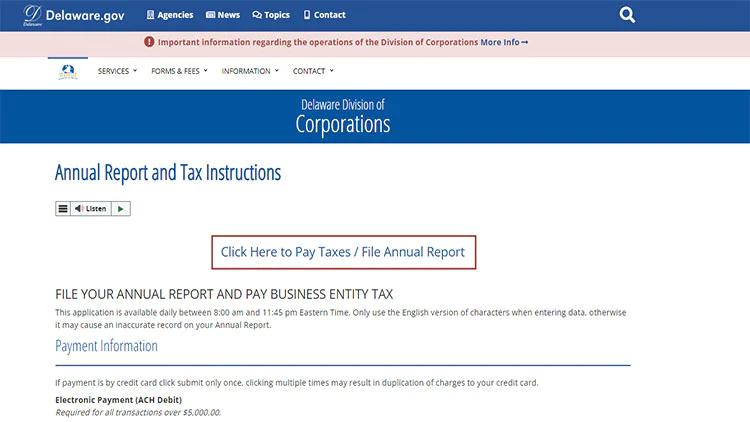

Step 1: Visit the Delaware Division of Corporations portal

Begin by visiting the official Tax Instructions page to initiate the payment process for your annual Delaware LLC tax.

Step 2: Log into the portal

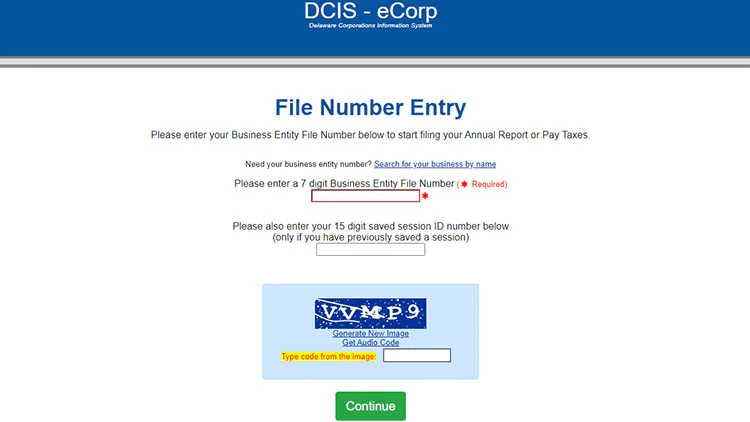

Once on the website, log in using your unique 7-digit Business Entity File Number. This number is essential for identifying your LLC and ensuring accurate payment processing.

Upon successful login, you will be presented with the specific payment and filing requirements that you need to fulfill. These requirements are essential to complete the tax payment process accurately.

Step 3: Finalize your payment

After you have reviewed and fulfilled all the necessary requirements, you can proceed to make your payment. The State of Delaware provides electronic payment options, including the use of debit cards, to facilitate a convenient and secure transaction.

For a detailed explanation of the Delaware franchise tax for both LLC and Corporation, refer to our dedicated guideline.

State-level annual tax filing for Delaware LLC

Income taxes at the state level

Delaware provides a flexible tax treatment for LLCs, where the LLC’s tax status is determined based on the number of members. Depending on the number of members, it can be treated similarly to a sole proprietorship or a partnership. Additionally, LLC members have the option to file with the IRS to change their tax classification to either a C corporation or an S corporation.

For multiple-member LLC

By default, a multiple-member LLC will be treated as a pass-through tax entity (similar to a partnership). This means that the LLC itself does not have to pay income tax. Instead, the individual members of the LLC are responsible for reporting and paying income tax on the portion of the LLC’s income that they receive.

Below are specific tax filing requirements to be aware of:

- File Delaware Form 300 (Partnership Return) with the Division of Revenue: This requirement applies if an LLC earns any income or incurs losses from Delaware sources. However, if the LLC does not have any income or losses originating from Delaware, it is not required to file this return. Delaware-sourced income encompasses earnings derived from property situated in Delaware or income generated from any trade, business, or occupation conducted within the state.

- File personal income tax: In addition to the Partnership Return, the LLCs’ members must individually handle their personal income tax obligations by filing with the Division of Revenue. The specific form to file will depends on residency status:

- For US resident: Filing Form 200-01

- For US non-resident: File Form 200-02 NR

For single-member LLC

A single-member LLC is treated as a sole proprietorship for tax purposes. In this case, the LLC’s tax liability flows to its sole owner, who must pay tax and file a personal income tax return with the Division of Revenue. US residents use Form 200-01, while US non-residents use Form 200-02 NR.

It’s worth noting that non-residents of a single-member LLC are not taxed on foreign income, which is income not derived from the US. sources.

For LLC elected as corporation

An LLC might elect to be taxed as a corporation rather than as a partnership or sole proprietorship.

If so, the tax filing requirements will be the same as those for a corporation. C-corporation and S-corporation. There are two types of corporations: C-corporations and S-corporations.

C-corporations are subject to double taxation at both the corporate and personal levels, while S-corporation status cannot apply to LLCs with non-resident members. It’s important to carefully consider the implications before making such an election.

Get your LLC tax filed correctly!

We’ve got you covered. BBCIncorp collaborates with TaxHub to help you complete annual tax obligations and ensure all your accounts are filed on time.

Contact us now to speak to our support team and get the assistance you need today!

Gross receipts tax at the state level

In Delaware, any company engaged in the sale of goods or services must file and pay Gross Receipt Tax in the state.

However, if a company lacks a physical presence within the state and conducts its business solely by mailing orders to Delaware customers or storing inventory in an Amazon FBA warehouse within the state, it is exempt from this tax.

The specific tax rates vary depending on the type of business and its activities, ranging from 0.0945% to 0.7468%. Find more detailed information about these rates.

To fulfill tax obligations, an LLC must file tax returns online and make payments on a quarterly or monthly basis. New LLCs are automatically categorized as quarterly filers by default.

Withholding tax in Delaware

Withholding tax is imposed on the payments or wages paid by employers to their resident or non-resident employees. If an LLC hires staff in Delaware, it will be responsible for collecting and remitting withholding taxes to the State’s Division of Revenue.

The LLC’s withholding tax payments must be submitted to the Delaware Division of Revenue on a quarterly, monthly, or every eight-month basis, depending on the total amount withheld. This withheld amount represents the total money deducted from your employees’ wages for tax purposes.

- Withheld amount is less than $3,600: Employers must file Form W-1Q on a quarterly basis, due on the last day of the month following the end of each quarter.

- Withheld amount is between $3,600 to $20,000: Employers must file Form W-1 monthly, with a due date on the 15th day of the month following the end of each month.

- Withheld amount exceeds $20,000: Employers must file Form W-1A every eight months, due on the 3rd day after the end of each payment period.

In addition to making tax payments, the LLC is also required to submit an annual reconciliation report, known as Delaware Form W-3, to the Division of Revenue. The deadline for this filing is February 28th each year.

Furthermore, each year, the LLC must provide its employees with Delaware Form W-2, which is a statement detailing the employee’s total earnings and the amount of tax withheld. All copies of Form W-2 must be included when your LLC reports its annual withholding tax to the State government using Form W-3.

The matters of withholding tax are rather complicated. In addition to the State level, there are withholding-tax requirements at the federal level, too. You should consult with your registered agent or professionals to stay compliant with both local and federal regulations.

taxes to pay ?

forms to file ?

Find the answers you need in this guide.

Compliance requirements at the federal level

In addition to complying with state-level regulations, LLCs in the United States must also adhere to federal requirements.

Income tax at federal level

An LLC is obligated to report its income and losses to the Internal Revenue Service (IRS) using Form 1065, which is the return of partnership income. Furthermore, if the LLC is subject to federal employment taxes or excise taxes, it must also report and fulfill its obligations in these areas.

To ensure proper compliance, an LLC must provide its members with copies of Schedule K-1, found within Form 1065. Members can then use this information to file their annual tax returns with the IRS, using either Form 1040 (for residents) or Form 1040-NR (for non-residents).

For more detailed information on federal compliance requirements, it is advisable to review the relevant federal regulations. It is strongly recommended to seek guidance from your registered agent or professional advisors.

Other federal filing requirements

- File Form 5472: This form is mandatory for any LLC with 25% or more foreign ownership and foreign business entities engaged in activities within the United States. It serves as an Information Return and is used to report all transactions of significance between the reporting company and either foreign or domestic entities throughout the tax year.

- Form Foreign Bank And Financial Account Report (FBAR): Delaware companies with foreign accounts exceeding US$10,000 must file a Foreign Bank And Financial Account Report with the IRS and FinCEN by April 15th (extendable to October 15th) or face penalties.

- Foreign Account Tax Compliance Act (FATCA): The FATCA imposes two reporting obligations on specified domestic entities and US individuals in Delaware when specific reporting thresholds are met. Like the FBAR, it requires disclosing foreign financial accounts and assets to the IRS. To comply, individuals must submit Form 8938 along with their annual tax return by the due date.

Conclusion

In summary, Delaware LLCs are not required to submit annual reports, but they must fulfill specific financial and tax filing requirements.

By comprehending and efficiently handling these annual compliance, business owners can fully leverage the advantages provided by Delaware LLCs, positioning themselves for success in the competitive business environment.

If you have any inquiries regarding LLC annual compliance or company incorporation in general, please don’t hesitate to explore our Delaware company formation services.

Or, you can get in touch with our support team via service@bbcincorp.com for practical advice.

Frequently Asked Questions

When is Delaware LLC annual tax due?

The Delaware annual tax for LLCs is typically due on June 1st. However, if your LLC was formed after June 1st, the tax will be prorated based on the number of months remaining in the calendar year. For example, if your LLC was formed on September 1st, your annual tax would be due on December 1st.

How much is the Delaware LLC tax late?

If you skip the June 1st deadline, you will be charged a $200 late fee. On the tax and late payment, 1.5% interest is charged.

Who can file Delaware LLC annual tax?

The responsibility for filing annual taxes for a Delaware LLC typically falls on the LLC itself or its authorized representative. This authorized representative could be a member, manager, or any individual or entity designated as such in the LLC’s operating agreement or resolution.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.