Table of Contents

Benefits of setting up a Delaware LLC

Before we get into how to create an LLC, let’s take a closer look at the advantages of this type of business structure so you can be sure it’s worth your time and investment.

The biggest benefit you can get is privacy protection, you’re not required to disclose any information about company members to start your LLC, which helps ensure a high level of anonymity and privacy for your business.

Along with that, the requirement for maintenance is minimal, with very few filing and procedures to handle, easing the corporate burden for business owners, especially startups and SMEs.

You can also take advantage of the well-established legal system and favorable tax regime of Delaware that you cannot experience in most of the other states.

Now that you understand the benefits of LLCs in Delaware, it’s time you discover how to start one.

Preparation for an LLC registration in Delaware

Even if you live in another country, you can form a Delaware LLC by filling out only one form and submitting it to the government, without any additional documentation.

The only requirement you have to fulfill is to have a registered agent in Delaware for your LLC.

The agent can be an individual or a legal entity, but they must be Delaware residents. Consider a registered agent to be a point of contact for your LLC, receiving tax notices and other legal documents on your company’s behalf.

If you want to use an incorporation service to set up your company in Delaware, almost any service provider can easily assist you in meeting this requirement. Your LLC can act as its registered agent if it has a business office in Delaware.

Delaware LLC’s corporate structure

A Delaware LLC, unlike a Delaware corporation, is managed by managers and members rather than directors and shareholders. To register this type of entity, you must have at least one member, there is no limit to the number of members.

Another factor to consider is the Operating Agreement, which defines the LLC’s corporate structure, formalities, and internal procedures. You have complete control over your Operating Agreement as the owners.

If the LLC incurs debts or experiences other types of financial or legal instability, the assets of the members are well protected. Furthermore, an LLC is a pass-through entity for tax purposes, which means it is not taxed at the corporate level.

An LLC also provides its owners with greater privacy than a corporate structure. Names and addresses of your LLC members would not be made public, both in the formation documents and in public filings.

Delaware LLC’s costs and requirements

Below are keynotes of Delaware LLC requirements and costs you should consider:

- Costs included

Two must-pay costs are the filing fee for the Certificate of Formation and the fee of reserving your company name with the Delaware Division of Corporations.

You may save time and get things done quickly by engaging an incorporation service but make sure you consider the additional costs for such convenience.

- Naming requirement

When registering your business name in Delaware, you must satisfy certain legal requirements.

- Registered office and registered agent

You must have a registered office (not mandated to be a place of business in Delaware) and a registered agent within the state. As a compliant duty, also need to maintain a registered agent annually.

5 steps to register an LLC in Delaware

You can set up an LLC by yourself in a few simple steps, but if you’re a foreigner or non-resident, it’s highly recommended that you engage a Delaware company registration service.

With the help of professional service, you can be sure to submit the correct form to the government and effectively handle internal documents (e.g. the Operating Agreement, which will be discussed later in this blog)

You can learn how to form a Delaware LLC by following the 5-step guide below:

Step 1: Appoint a registered agent

You must have a registered agent working on your behalf, who acts as an intermediary to receive legal documents and notices from the state of registration.

A registered agent must be an individual who is at least 18 years old or a registered legal entity, your agent must also have a physical address or office in Delaware.

Step 2: Choose the name for your Delaware LLC

Based on the Delaware Code (local law), here are some criteria for you to name the LLC:

- Must include the suffix “limited liability company”, “LLC”, or “L.L.C”.

- May contain your name or another member’s name.

- Must be a distinguishable name. It should not be the same as other businesses and should not be confused with the name of any government agency

It is always a good practice to check the availability of your LLC name in advance (via the government’s name check service). You should also check the availability of the domain for your company’s website (if you intend to build one).

Once the name is approved by the Secretary of State, you can reserve it for 120 days. You can further extend the reservation for another 120 days (subject to an additional fee).

Step 3: Obtain an Employer Identification Number (EIN)

EIN stands for Employer Identification Number, also known as FTIN (Federal Tax Identification Number). You can think of this number as the identification for your LLC in Delaware, for both entity and tax purposes. An EIN will allow your business to apply for a corporate bank account and employ staff in the U.S.

You can entrust your LLC’s agent to register an EIN online via the IRS website or the submission of the form SS-4. You can also do it by yourself, but it would be time-consuming.

Step 4: Submit a Delaware certificate of formation for LLC

You have to fill in and submit a Certificate of Formation to the Division of Corporations.

If you engage an incorporation service for this step, they will fill in the form for you and submit it to the government on your behalf.

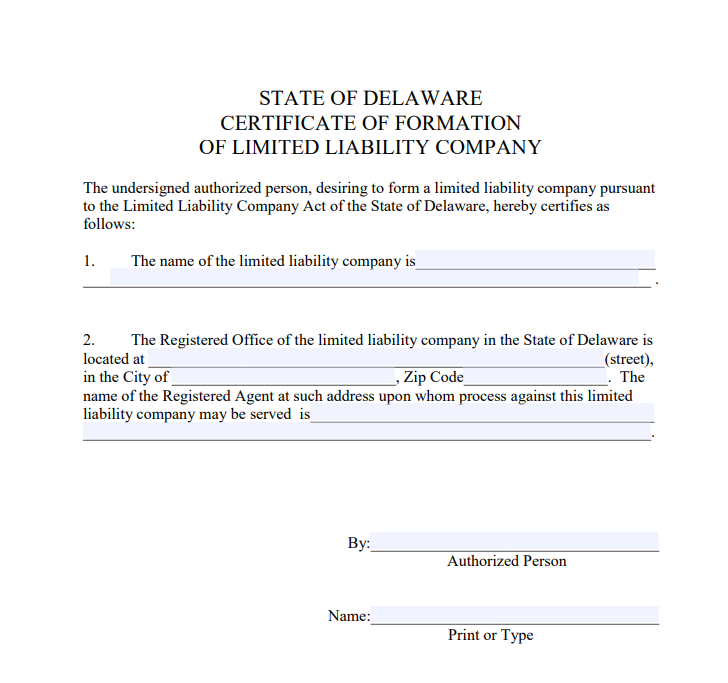

That said, here is the standard template for a Delaware LLC Certificate of Formation:

A Certificate of Formation for an LLC in Delaware must include two key pieces of information:

- The name of your limited liability company in Delaware

- The name and address of the registered agent of your Delaware LLC

You can use the template above to prepare your Certificate of Formation (for a traditional LLC) and submit this form by uploading the PDF file on the government website, by mail, or by post.

If you aim for a foreign LLC or LLC series (other than a traditional LLC), you must fill in the respective forms. If you send the application by post, you should include a cover memo along with the Certificate of Formation for contact purposes, which may contain your name, address, email, and phone number.

Step 5: Receive the result

After the submission of the Certificate of Formation, the Division of Corporation will take 3 to 4 days to process your application, and you can expect to receive the result in a couple of weeks.

You will have to pay an additional fee if you want the result sooner. The faster you want to receive it, the higher the fee will be.

If the application is approved, you will receive back a stamped Certificate of Formation, indicating that your company is officially formed in Delaware!

Things to consider after company registration in Delaware

Below are the things you need to do after you register an LLC in Delaware.

Apply for additional licenses and permits

Certain industries in the U.S. require additional licenses and permits. 3 tiers of authority manage different licenses and permits: federal, state, and local.

At the federal level, you can read this SBA guide to find out what activities need licenses from what agencies. At the state level, you can check out the Delaware Index Business Licenses. At the local level, contact and check with the local authority.

One more thing: if you establish your LLC in Delaware but want to conduct business in another state, you may need certification in that other state to do so. This certification is known as Foreign Qualification. You should do a little research to find out whether you need to obtain this certification in the state where you are about to do business. The process for application varies from state to state.

Design your LLC’s Delaware Operating Agreement

A Delaware Operating Agreement sets forth all matters of an LLC, including business structure, general rules, management, and operation. The agreement can come in written or oral form. Your LLC does not need to file this document with any department of Delaware.

However, to keep everything in order and under control, there has to be a written Operating Agreement, which is kept internally in the company. Every member must sign the agreement before joining the business.

As the initial owner, you can create your own Delaware Operating Agreement. You may consult professionals or go over some online templates to get the outline. Generally, a Delaware Operating Agreement should include the following sections:

- Organization establishment and ownership

- Management

- Duties and rights

- Capital matters

- Distribution of profits and losses

- Membership change

- Company dissolution

Open a bank account for your Delaware LLC

Getting a corporate bank account is the best way to separate your personal assets from the company’s assets. However, if you are a non-US resident, it can be really difficult to get a corporate account with US banks.

BBCIncorp has closely partnered with Wise, Payoneer, and Mercury to offer effective banking solutions for Delaware LLCs.

Tax filing is also a matter of concern for most Delaware LLCs incorporated by non-US residents, and the good news is that TaxHub, our partner, can help with your tax situations efficiently. Privileges from TaxHub for BBCIncorp’s clients are a 10% discount code and a free 30-minute CPA consultation with specialists.

Stay compliant with the local laws

To maintain good standing at the state level, you need to comply with two main requirements. They are:

- Maintaining a registered agent in Delaware, and

- Paying Delaware LLC annual fees

Furthermore, if you register a multiple-member LLC and earn an income within the state, then the company needs to file a return with the Division of Revenue in Delaware. Individual members will then need to file Delaware personal income tax returns to the Division on the income attributable to the LLC.

At the federal level, your Delaware LLC and its members also need to file respective forms to the IRS.

COMPLYMATE

Tired of sifting through endless paperwork to understand jurisdictions’ compliance requirements? Our guide can help!

Try Now

Conclusion

You may now get the idea of how to open an LLC in Delaware, you only need to submit a Certificate of Formation to the Delaware Division of Corporations. This form must include the name of your LLC and the details of your LLC’s registered agent.

The processing time is around 2 – 6 weeks. Please engage an incorporation service to make sure everything flows on the right track.

After the Delaware LLC registration, a few more steps need to be completed. You need to get an EIN, additional licenses (need to check carefully if any), a corporate bank account, and maintain good standing by complying with local laws.

As a business owner, you tend to believe you can do everything on your own – from registering your Delaware LLC to filing returns and managing business compliance; yet, these back-office tasks may waste your time and effort. You can focus on your bottom-line growth by engaging a professional digital incorporator for your LLC incorporation. Feel free to drop us a message at service@bbcincorp.com.

Frequently Asked Questions

Do Delaware LLCs pay taxes?

Delaware LLCs are subject to an annual tax of US$300 before 1st June each year.

Depending on the company’s selected tax status, LLCs shall pay the corporate income tax at the state and federal levels accordingly.

In addition, limited liability companies in the State will need to pay gross receipts tax, payroll tax, etc., if the companies are selling goods or hiring employees in the State.

Do I need an EIN for my LLC?

Probably yes. Multi-member LLCs must have an EIN.

As a single-member LLC, you must obtain an EIN only when your entity gets involved in one of the following activities:

- Having employees (one or more)

- Paying excise taxes (that are taxes levied on certain goods or services relating to coal, fuel, oil, heavy highway vehicles, etc.)

What is the fastest way to set up an LLC?

Consider connecting with a trusted digital incorporator like BBCIncorp to walk you through all the steps that might be confusing for new business players to incorporate in Delaware. Our friendly and dedicated consultants are always ready to help you.

Which licenses and permits are required for Delaware LLC?

This will depend on a variety of factors, but typically, three types of licenses and permits may be required for your Delaware LLC: federal, state, and local.

For example, if you own a logistics company in Delaware, you may be required to obtain a federal license from the United States Department of Transportation, a business license from the State of Delaware, a building permit, a land use permit, a health permit, and so on.

What are annual reports and taxes for Delaware LLC?

Delaware LLCs are not required to file annual reports with the Division of Corporations, but they are required to pay a $300 annual tax, which is due on June 1, 2022.

Should I form an LLC or corporation?

The debate over LLC vs Corporation is contentious because both are popular types of entities in Delaware with distinct features.

For startups and small businesses, an LLC appears to outperform corporations in many ways, including lower taxation, fewer compliance requirements, and privacy protection.

Delaware corporations, which have investor-friendly features such as stock ownership and voting rights, are a good choice for capital raising.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.