Table of Contents

Cryptocurrency has evolved from a niche concept into a mainstream financial asset, reshaping how global investors and businesses store, trade, and transfer value. For those exploring international structuring, understanding how digital assets work is essential, especially when considering an offshore company for crypto trading.

This article provides a clear introduction to the fundamentals of cryptocurrency and explains how offshore structures can support trading activities, enhance asset protection, and offer strategic advantages for cross-border operations.

Key Takeaways

As of today, cryptocurrency is a trend, but it is also a topic for debate. The potentiality of cryptocurrencies is obvious, but you should take caution before engaging in crypto-based businesses.

Key takeaways

Below are highlights of what we have discussed about How to use an offshore company for cryptocurrency:

- Cryptocurrency is a “virtual” currency based on blockchain technology to facilitate the online exchange of goods and services.

- There are various types of cryptocurrency, Bitcoin is the most popular.

- Whether cryptocurrency is legal or illegal is still a matter of debate. Generally, it depends on each jurisdiction and the relevant business activities engaged in cryptocurrency to determine its legal status.

- Using an offshore company for cryptocurrency offers benefits such as privacy, asset protection, and tax savings. However, there are some challenges for you to bear in mind, including volatility risks, limitations, and more.

- International Business Companies (IBC), Limited Liability Companies (LLC), and International Trust are popular vehicles for cryptocurrency traders when moving offshore.

For some expert assistance in forming your offshore company for cryptocurrency, simply drop us a message or get in touch with us via service@bbcincorp.com

A brief overview of Cryptocurrency

What is cryptocurrency?

There has been a lot of buzz about cryptocurrencies and this booming trend seems to not stop soon. So, what is it?

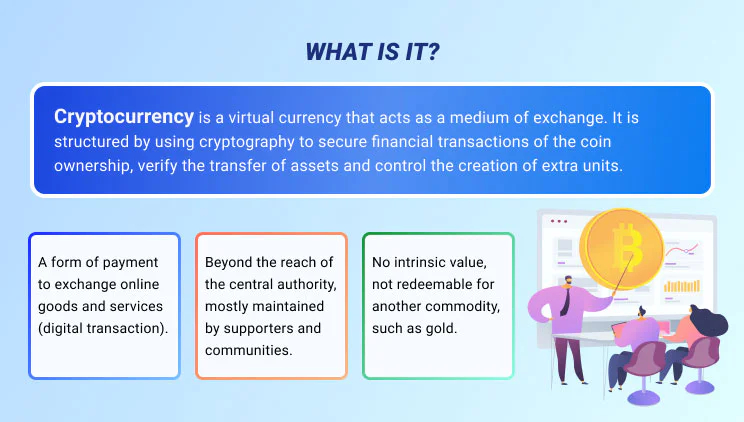

A cryptocurrency is simply a virtual currency that acts as a medium of exchange. It is structured by using cryptography to secure financial transactions of the coin ownership, verify the transfer of assets and control the creation of extra units.

Cryptocurrencies are a form of payment to exchange online goods and services (digital transactions). In most cases, cryptocurrencies are beyond the reach of the central authority but are mostly maintained by supporters and communities.

As opposed to cryptocurrency, “fiat currency” is a familiar term. Fiat currencies are used in physical transactions and would be all issued and managed by the central bank.

How does it work?

Cryptocurrencies work through a key technology called Blockchain. It is a digital ledger or a decentralized network including a large number of distributed computers to manage and record all transactions. It makes cryptocurrencies not depend on a central server/computer like central banking systems.

How many types of cryptocurrency are there?

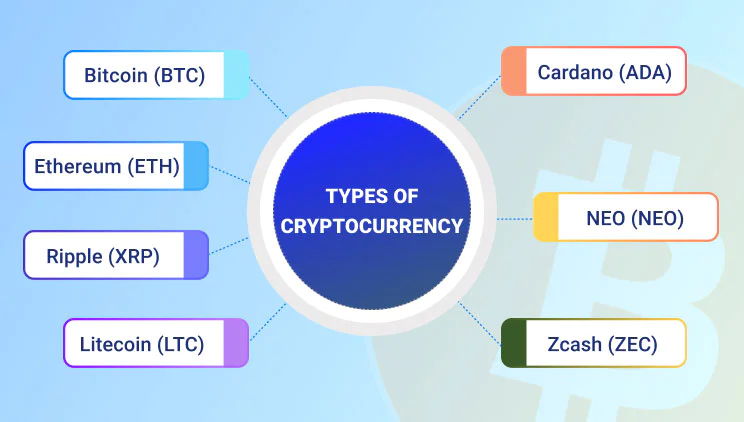

You cannot count how many exactly there are. Until now, there are more than 2000 different cryptocurrencies available publicly, according to CoinMarketCap.com, and it is interesting to know that a new cryptocurrency can be generated at any time.

There are some popular cryptocurrencies that you should know:

Trading cryptocurrency: Legal or Illegal?

There are many concerns about the cryptocurrency industry, which exists out of reach of national regulations, meaning it is not illegal.

Cryptocurrency used to be phenomenal due to a widespread crackdown in China on initial coin offerings (ICOs) and cryptocurrency exchanges (Bitcoin) in 2017. This action was in force by the government to prevent the possibility of tax and regulations evasions in their country.

However, the status of legality is different for each country. Countries like the US or Canada allow the use of cryptocurrency, but all digital currency-related transactions, are under observation of provisions and guidance by their governments.

Since the popularity of the e-commerce industry, the demand for online payment is significantly increasing. The potentiality of cryptocurrency is becoming more obvious. Many countries have recently shown positive stances on the cryptocurrency trend and allowed its legal presence in their territory.

Benefits of using the offshore company for cryptocurrency

There has been an increase in using offshore vehicles to enhance benefits for cryptocurrency transactions, especially Bitcoin.

Particularly, company setup in crypto-friendly offshore jurisdictions is one of the most recommended options for cryptocurrency traders.

Free ebook

New to offshore business landscapes?

All the essential information you need is right here.

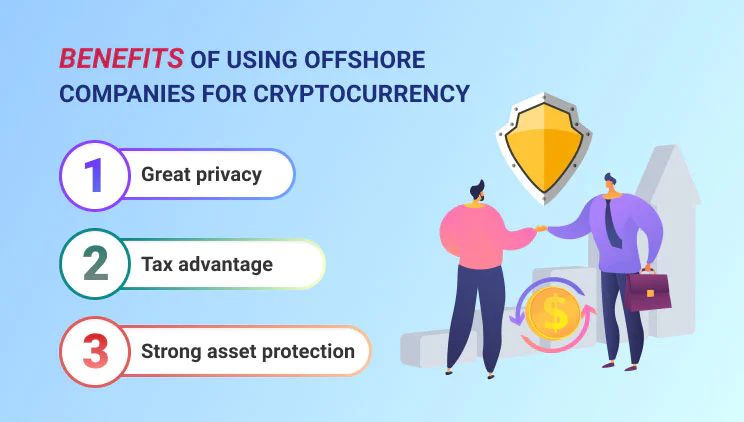

Greater privacy & asset protection

Privacy maximization is the top benefit that motivates crypto-based businesses to go offshore. It is common that if Bitcoin and its owners are separate, there will be stronger layers of protection for this kind of digital asset. For this reason, keeping Bitcoin and other cryptocurrencies in association with an international business company seems to bring the best of both worlds.

Other methods that people widely prefer include forming a limited liability company or an offshore asset protection trust.

Tax advantage

By having your coins stored by offshore companies, you can reduce tax obligations in your home country. However, it greatly depends on which jurisdiction you wish to incorporate your offshore company.

Many countries like Finland, Belgium, or some parts of the EU are more likely to consider cryptocurrencies, including Bitcoin just like a commodity or financial-related service, rather than a currency. As a result, they feel free to allow an exemption from VAT/Sales tax for such bitcoin businesses.

On the other hand, countries like the US categorize Bitcoin as assets for tax purposes and impose strict tax requirements for cryptocurrency businesses. As such, a lot of US-based bitcoin traders have increasingly kept their eyes on low or free-tax jurisdictions.

If you’re interested in setting up an offshore company in the crypto and forex business, St.Vincent is a great place to start. Head over to our St. Vincent & Grenadines Company Formation page for more information or drop us a message for practical support on your crypto company!

Challenges for offshore Crypto-based companies

New doors often go hand in hand with challenges!

Crypto-based companies moving offshore do not run beyond difficulties. Some challenges that are worth mentioning include:

Potential, but not yet practical

You will still need regular fiat money in your account. Because few companies use cryptocurrency for transactions in reality. Thus, it can be quite inconvenient.

Additionally, when you make payments or pay monthly salaries for your employees, cryptocurrencies are normally not allowed by the in-charge agencies.

Sometimes, you can only make payments in cryptocurrency through specific platforms like Revolut, Mister Tango, or Kraken, which leads to difficulties in use.

We recognize the great potentiality of cryptocurrency to many traders, but its practicality and availability in purchasing goods and services may be a big matter of concern in the near future.

Few banks of choice

The first presence of cryptocurrency – Bitcoin has emerged for just over 10 years. There are still many countries with no regulation on the legal uses of this form of currency. The absence of such regulations has limited the number of financial institutions for crypto-related transactions.

So far, it seems impossible for individuals and companies engaging in crypto-related business to open an offshore bank account, let alone banking in large and reputable banks.

Many traders solve this problem by setting up a virtual account or wallet with a financial institution, mostly a fintech-oriented company to receive and withdraw money from their brokerage account.

Recommended fintech options for your consideration are Wise and Airwallex.

These institutions put in place a really simple procedure so that you rarely receive a rejection.

A big drawback of this is that not like traditional banks, the financial institution is less regulated, and most of them were just open recently. So, a wise way to cope with this situation while still benefiting from its openness to risky business is not to put all eggs in one basket.

EMIs are good alternatives for traditional banks, offering multi-currency accounts and cross-border payments for your crypto-based offshore company.

Visit our Banking Support page to find out more about this emerging type of banking.

Or, you can try our Banking tool to get a quick list of your chances.

High risk of volatility

Bitcoin and other “virtual” assets are often considered “risky assets”. Due to the fact that digital currencies are not kept under the surveillance of governments, price volatility often appears as a major consequence thereafter. Without any protection, traders of cryptocurrency may suffer potential losses.

The price of cryptocurrency may go up and down very suddenly. Key players in crypto trading probably still remember the historical case of bitcoin volatility in the year 2017. This first blockchain-based cryptocurrency reached its peak of around $20,000 per bitcoin in December 2017. But just four months later, a dramatic three-fold plummet to no more than $7,000 in the price of bitcoin was witnessed.

How to use an offshore company for cryptocurrency

Below are some cases of using offshore vehicles for cryptocurrency that you can take as reference:

Establishing an international business company (IBC) and activating a wallet to keep your cryptocurrency in.

This digital wallet has similar functions as offshore bank accounts, enabling transactions to be secure and confidential. Many offshore jurisdictions with stringent privacy laws can even offer maximum protection from civil creditors.

Moving your cryptocurrency offshore by forming two different IBCs.

The first offshore company can store Bitcoin as a long-term investment, while the second one will function as a trading company funded by the first company.

The combination of private foundations and international business companies.

You can form an IBC as a private foundation for charitable purposes. The IBC can receive bitcoins as its share capital, provided that the offshore foundation allows donations sent in bitcoin as well.

Setting up an offshore trust

High-net-worth investors with coin funds of more than $1 million prefer starting international trusts for the best estate and asset protection.

Forming an offshore LLC

For US citizens who want to avoid IRS audits of their crypto account, the most common option is to take their self-directed IRA offshore and invest in cryptocurrency by forming an offshore LLC owned by their IRA.

These structures tend to add more layers between you and your assets, creating better privacy and asset protection. Your tax obligation is still hanging and you can only defer it when repatriating your profit. With that being said, earnings from your cryptocurrency investment can be reinvested 100% tax-free as long as you leave it offshore.

Important Note

Note that the outcome of these strategies depends significantly on:

- your business structure

- incorporation jurisdiction

- tax residency status

So you should better consult your lawyer for legal advice.

And a guide to setting up an offshore company in four steps may be of help if your concern is about offshore companies.

How to Start an Offshore Crypto Company

Establishing an offshore crypto company requires careful planning, regulatory awareness, and a solid operational foundation. Below is an improved and structured overview of the essential steps and considerations involved.

Choose a suitable jurisdiction

Evaluate countries that offer clear regulatory frameworks for digital assets, favorable tax treatment, political stability, and strong asset-protection laws. Consider licensing requirements, banking accessibility, and long-term compliance obligations.

Incorporate the company

Select an appropriate legal structure (such as an LLC or IBC) and complete the incorporation with the relevant authority. Prepare the required documents, including director details, shareholder information, and corporate governance rules.

Assess licensing obligations

Regulatory requirements differ widely:

- Some jurisdictions offer specific cryptocurrency or virtual asset service provider (VASP) licenses.

- Others may require a money transmitter, exchange, fintech, or brokerage license depending on your services.

- In certain countries, no dedicated crypto license exists, but compliance with financial-regulation frameworks is still mandatory.

Open a corporate bank or payment account

Many traditional banks remain cautious toward crypto-related entities. You may need to work with specialized fintech institutions, EMI accounts, or banks in jurisdictions more open to blockchain businesses. Prepare enhanced due diligence (EDD) documents.

Ensure tax and regulatory compliance

Meet tax obligations in both the offshore jurisdiction and your home country, especially if Controlled Foreign Corporation (CFC) rules apply. Implement strong AML/KYC systems, internal controls, and reporting processes. Consult professionals experienced in offshore crypto regulations.

Establish secure operations and infrastructure

Develop reliable systems for crypto custody, transaction handling, cybersecurity, and risk management. Use audited smart contracts, secure wallets, incident-response plans, and regular penetration testing to mitigate fraud and cyberattacks.

Register with relevant regulators and maintain ongoing compliance

Fulfill ongoing reporting duties, renew licenses as required, file annual returns, and comply with international standards (FATF guidelines, sanctions screening, and transaction monitoring). Continuous compliance is essential to maintaining banking relationships and operational integrity.

Licensing and regulation matters of an offshore company for cryptocurrency

Obtaining a license: Is it necessary?

As aforementioned, many jurisdictions are still in the stage of analyzing how cryptocurrency should be treated in their countries, including the matter of licensing and regulating crypto-related activities.

There is no specific answer for what types of licenses are required for cryptocurrency businesses in all offshore countries, but it may be varied depending on each offshore jurisdiction as well as the nature of their business.

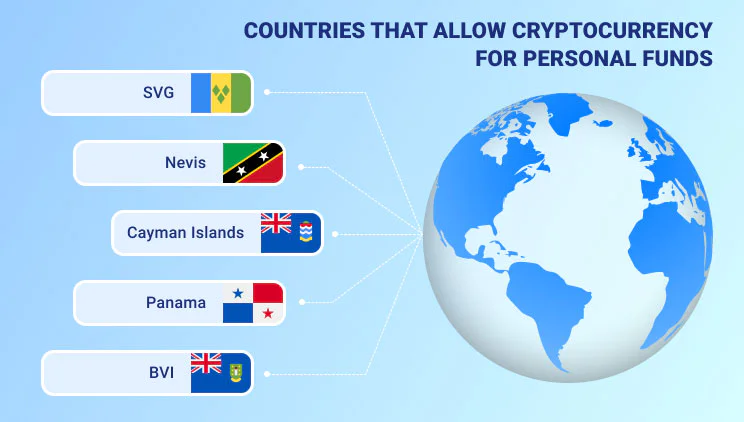

As a rule of thumb, if you are trading crypto for personal purposes, then a license is not necessary. Otherwise, opening a crypto-related business or trading cryptocurrencies on behalf of others will demand one.

If it is the case you need to obtain licenses for your crypto-storing/trading/exchange activities, some popular types of licenses that you should take into account are

- Cryptocurrency exchange licenses

- Offshore brokerage account licenses

- Financial Services License

- Money management Licenses, or

- Other financial permits if required

You should engage a professional corporate service firm to seek useful advice on how to move your cryptocurrency offshore legally!

Do you wonder what the application procedure for such a special license is like? We recommend you go into the Seychelles SDL guide, this might help!

CFC rules

Controlled foreign corporations (CFCs) refer to corporate entities owned and controlled by a resident of a particular country but registered and carrying out their business outside of that country.

CFC rules demonstrate how taxpayers should declare their foreign earnings. The requirements differ from country to country, but the main purpose is to prevent tax evasion.

Only some certain countries impose CFC rules. If you are living in a country of residence with CFC rules, please check them before moving offshore.

Conclusion

Establishing an offshore company for crypto trading can offer meaningful advantages, from tax efficiency and asset protection to greater operational flexibility across borders. However, the crypto sector remains highly regulated, and requirements vary significantly between jurisdictions. Success depends on choosing the right location, understanding licensing obligations, maintaining strong compliance systems, and building a secure operational infrastructure.

For businesses and investors looking to enter the digital-asset space with confidence, professional guidance is essential. A well-structured offshore crypto company not only enables smoother international transactions but also mitigates regulatory, tax, and banking risks in the long term.

Kindly reach out to our team today at service@bbcincorp.com to explore how BBCIncorp can support your business. We are ready to provide timely assistance!

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.