- What is a company limited by guarantee?

- Use cases and real-life examples

- Responsibilities and rights of CLG members

- Advantages and disadvantages of a CLG

- How to set up a CLG in Singapore

- Governance and compliance requirements

- Dissolution and what happens to the remaining assets

- How BBCIncorp can support your CLG setup

A company limited by guarantee in Singapore (CLG) is a legal structure mainly used by non-profit and charitable organizations. It has no share capital or shareholders, only members who agree to contribute a set amount if the company is wound up. This makes it ideal for societies, clubs, and charities that reinvest profits into their causes.

In Singapore, CLGs are widely used in the non-profit sector due to their clear legal framework and limited liability. In this article, we’ll cover the formation process, legal structure, governance, benefits, and examples of CLG Singapore.

What is a company limited by guarantee?

CLG meaning and legal definition

A company limited by guarantee in Singapore (CLG) is a business structure designed for non-profit and charitable purposes. Under the Singapore Companies Act and the Corporate Regulatory Authority (ACRA), a company is a separate legal entity that does not issue shares and has no shareholders.

Instead, it is formed by members called guarantors who pledge a fixed amount, commonly S$1–S$10, to cover liabilities if the company is wound up. This setup provides the benefit of limited liability while supporting transparency and accountability in mission-driven activities.

Key features of a CLG Singapore

Unlike a typical limited liability company in Singapore, a CLG does not have share capital or shareholders. Instead, it operates through members who agree to contribute a nominal amount in case of winding up.

To understand a CLG more clearly, it’s essential to explore its core attributes as follows.

- No profit distribution: Any income or surplus must be reinvested to fulfill the organization’s stated objectives, so members cannot receive dividends.

- Limited liability: Guarantors are only liable up to the amount they pledged, reducing personal financial risk.

- Separate legal entity: A CLG can enter into contracts, own assets, and operate independently of its members.

- Perpetual succession: The organization continues to exist even if members leave or change.

Comparison with other structures

Choosing the right legal structure depends on your organization’s goals and operations. Taking a look at the different types of companies in Singapore to get a broader perspective.

Private limited company (Pte Ltd)

A Pte Ltd Singapore is a profit-driven business owned by shareholders, with profits distributed as dividends. In contrast, a CLG Singapore has no share capital and does not distribute profits, making it more suitable for non-profit or charitable purposes.

Society

Both societies and CLGs can serve community-focused missions. However, they are governed by different laws. Societies are regulated under the Societies Act and often face more restrictions in operations and fundraising. CLGs, on the other hand, are registered under the Companies Act, offering greater operational flexibility and legal standing.

Organizational trust

Trusts are managed by trustees and are often used for single-purpose funding or asset management. While suitable for specific financial goals, they lack the structured governance of a CLG, which is better suited for long-term growth, larger budgets, and team management.

Company limited by shares

A CLG does not issue shares. Its members agree to contribute a set amount only if the company is wound up. This differs from companies limited by shares, where shareholders invest capital and are liable up to the amount they contributed. Profits in a CLG are reinvested into the organization’s mission rather than distributed.

Use cases and real-life examples

The CLG Singapore model is widely adopted by organizations that prioritize public benefit over profit. Its flexibility, legal recognition, and limited liability protection make it a preferred structure for various non-profit initiatives across sectors.

Typical uses for CLGs in Singapore

A Singapore company limited by guarantee is commonly used by:

- Charities and NGOs: Organizations providing social services, advocacy, or community development projects often choose the CLG structure for its governance transparency and ability to apply for Institution of a Public Character (IPC) status.

- Social enterprises: Businesses that reinvest profits to address social challenges often operate as CLGs to build trust with donors and stakeholders.

- Religious institutions: Churches and temples may register as CLGs to formalize operations and manage donations responsibly.

- Clubs and associations: Sports clubs, trade associations, and special-interest groups use the CLG model to operate independently while limiting member liability.

- Educational and research bodies: Private education providers, training centers, and think tanks use CLGs to manage programs and collaborate with public institutions.

Examples of company limited by guarantee in Singapore

To illustrate how this structure works in real-world settings, below are anonymized examples of companies limited by guarantee in Singapore:

- Community services provide social support, such as food aid, mental health outreach, and job placement.

Example: South Central Community Family Service Centre Ltd.

- Arts and culture promote contemporary arts through exhibitions and workshops.

Example: The Substation Ltd.

- Sports and youth development manage national aquatic sports, training programs, and competitions.

Example: Singapore Swimming Association.

- Education and learning support deliver specialized programs and collaborate with public institutions.

Example: Dyslexia Association of Singapore Ltd.

Responsibilities and rights of CLG members

Members of a company limited by guarantee constitution have important governance responsibilities in ensuring accountability and adherence to the CLG’s non-profit objectives, including:

- Financial liability is limited to the guaranteed amount (typically S$1–S$100) in the event of winding up.

- Not entitled to receive dividends; all profits must be retained and used solely for the organisation’s stated non-profit objectives.

- Have the right to attend and vote at Annual General Meetings (AGMs) and Extraordinary General Meetings (EGMs).

- May appoint a proxy to attend and vote on their behalf if unable to be present at meetings.

- Can vote on key resolutions, such as approving audited financial statements, appointing directors, or amending the constitution.

- Entitled to access corporate records, including the constitution, audited financial reports, and meeting minutes.

- Expected to help oversee that the organisation remains aligned with its charitable or non-profit purpose and complies with legal obligations.

- Do not automatically have a role in management unless appointed as a director.

- May request an EGM if the threshold (e.g., 5% of voting rights) is met, in accordance with the company constitution.

- When exercising rights, members are expected to act in the organisation’s best interests and avoid conflicts of interest.

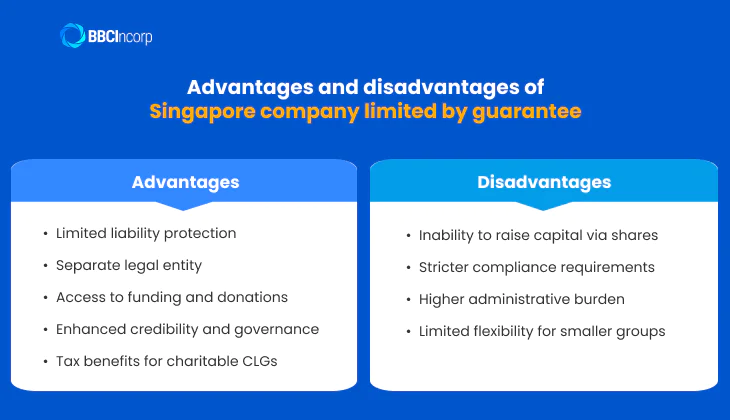

Advantages and disadvantages of a CLG

Understanding the key benefits and limitations of CLG structure is essential when deciding if it aligns with your objectives.

Advantages of incorporating a CLG in Singapore

Limited liability protection

One of the defining features of a company limited by guarantee in Singapore is the limited liability it offers to its members. Unlike companies with share capital, CLG members are only liable up to the guaranteed amount—often as little as S$1—in the event the company is wound up.

This setup provides personal asset protection while encouraging individuals to participate without the risk of financial loss.

Separate legal entity

A CLG is recognised as a separate legal entity, distinct from its members. This means it can enter into contracts, hold property, and initiate or face legal proceedings in its own name.

The independent legal status enhances the organisation’s credibility and provides greater operational stability, especially when engaging with external stakeholders such as funders, landlords, or vendors.

Access to funding and donations

Being a public company limited by guarantee positions the CLG as a trusted non-profit vehicle, often preferred by institutional donors and government agencies. CLGs are eligible to receive public donations and apply for various grants, sponsorships, or government funding schemes.

Their regulated status and accountability make them more attractive to funders seeking transparency and public impact.

Enhanced credibility and governance

Due to mandatory statutory filings, governance obligations, and audit requirements, CLGs in Singapore are often viewed as more transparent and professionally run than informal or unregistered nonprofit groups. This perception significantly boosts stakeholder confidence, encouraging support from partners, regulators, and the wider public.

Tax benefits for charitable CLGs

Although CLGs are subject to the standard corporate tax rate of 17%, those that register as charities or Institutions of a Public Character (IPC) can enjoy full tax exemption on qualifying income.

Moreover, donations made to IPCs are eligible for tax deductions, which incentivizes giving and improves fundraising effectiveness. These benefits allow CLGs to reinvest more resources directly into their causes.

Disadvantages of the CLG structure

Inability to raise capital via shares

A Company Limited by Guarantee cannot issue shares or pay dividends. This means it cannot attract equity investors like a for-profit company can. As a result, CLGs are not suitable for commercial ventures that require investment for growth or expansion.

Stricter compliance requirements

CLGs must meet higher regulatory standards compared to societies. This includes filing annual returns with ACRA, preparing audited financial statements, and fulfilling director duties. These obligations ensure transparency but require more effort and resources.

Higher administrative burden

Running a CLG involves maintaining proper corporate governance, holding regular board meetings, and following the Companies Act as well as the company’s constitution. For small organizations without dedicated admin support, this can be overwhelming.

Limited flexibility for smaller groups

For low-budget community groups, the CLG structure may be unnecessarily complex or expensive to maintain. In such cases, a society or informal group may offer a simpler and more flexible alternative.

How to set up a CLG in Singapore

Thinking of setting up a company limited by guarantee in Singapore? Here’s a clear, step-by-step guide to help you get started and stay compliant.

Pre-registration considerations

Before incorporating a Company Limited by Guarantee (CLG) in Singapore, several key factors must be addressed to ensure compliance and streamline the registration process.

- Select an appropriate company name that reflects the CLG’s non-profit purpose and meets ACRA’s naming rules. Ensure the name is unique and not already in use.

- Define clear, non-profit objectives such as education, religion, or community benefit. These goals must align with the purpose of a public company limited by guarantee.

- Appoint at least one local director, one company secretary, and two guarantor members who agree to contribute a set amount (usually S$1) if the company winds up.

- Draft a constitution that complies with the Companies Act. It should outline the CLG’s purpose, governance, and confirm that profits will not be distributed to members.

Registration process with ACRA

Registering a Company Limited by Guarantee (CLG) in Singapore requires submitting an online application to ACRA via the BizFile+ portal, along with supporting documentation.

- Submit the application via ACRA’s BizFile+ portal with a registration fee of S$300.

- Upload the company’s Constitution, which must clearly outline its non-profit objectives and comply with the Companies Act 1967.

- Provide signed consent forms from at least one director and one company secretary, confirming their agreement to assume their roles.

- Include identity details of all officers and guarantor members, along with the guaranteed amount each member agrees to contribute in the event of winding up (commonly S$1).

- Most applications are processed within 15–30 minutes, but the review may take longer, up to 60 days if further assessment is needed (e.g., name approval or regulated activities).

- If your CLG intends to conduct activities that require licensing, ensure to apply for the relevant licenses through the GoBusiness portal.

Post-registration compliance

After incorporation and having an ACRA certificate of incorporation, CLGs in Singapore must fulfil key post-registration requirements to remain compliant:

- Set up operational essentials, including opening a corporate bank account and appointing a qualified company secretary within 6 months.

- Maintain a registered office in Singapore and ensure all company records, such as statutory registers of members, officers, and guarantors.

- Apply for relevant licenses or permits if required by the business activity.

- Ensure financial transparency by preparing financial statements, holding an Annual General Meeting (AGM), and filing annual returns with ACRA.

- Comply with tax and payroll regulations, including corporate income tax, GST if registered, and CPF/SDL contributions when hiring employees.

- Report any corporate changes, e.g., directors, office address to ACRA promptly and maintain meeting minutes and company documents for at least 5 years.

Governance and compliance requirements

Once incorporated, a CLG must maintain proper governance and meet ongoing legal duties. This includes internal controls, statutory filings, and awareness of penalties for non-compliance.

Internal governance framework

A clear internal governance framework is essential for ensuring transparency, accountability, and operational efficiency within a Company Limited by Guarantee. Below are key components:

- The Company constitution is the foundational document regulating internal processes, powers of directors and members, and rules for decision-making.

- Annual general meetings (AGMs) are required to present financial statements, approve key resolutions, and report company performance to members.

- Written resolutions offer a flexible alternative to meetings for passing decisions, particularly useful for time-sensitive matters.

Statutory compliance

CLGs in Singapore must fulfil several ongoing statutory obligations to remain compliant with ACRA and IRAS regulations:

- AGM must be held within 7 months of the financial year-end unless exempted by their constitution or by passing a written resolution.

- Annual return filing must be submitted to ACRA within 7 months of the financial year-end or 1 month after the AGM, whichever is earlier.

- Financial records are required to maintain proper accounting records and prepare financial statements under the Singapore Financial Reporting Standards (SFRS) and must be retained for at least 5 years.

- Audit requirements for all CLGs, regardless of revenue size, because a public company is not eligible for audit exemption.

- Tax filers must file Estimated Chargeable Income (ECI) and Corporate Income Tax Returns with IRAS annually, even if a tax exemption is granted under Section 13(1)(e) of the Income Tax Act.

- Appoint an auditor within 3 months and a company secretary within 6 months of incorporation.

Penalties and consequences of non-compliance

Non-compliance with statutory obligations can lead to significant penalties for Companies Limited by Guarantee (CLGs) in Singapore:

- Late filing of Annual Return or failure to hold an AGM may result in late filing fees of up to S$600 per return and potential prosecution under the Companies Act.

- Failure to maintain proper accounting records for at least five years can attract fines of up to S$5,000 and/or imprisonment of up to 12 months.

- Non-submission of audited financial statements (mandatory for all CLGs) may lead to enforcement actions, including the disqualification of directors.

- Filing incorrect or incomplete tax returns with IRAS can incur penalties of up to 200% of the tax undercharged, plus late payment interest.

- Tax evasion or deliberate omission of income may trigger criminal investigation, prosecution, and court-imposed penalties, including fines and imprisonment.

- Failure to withhold tax where applicable may result in late payment penalties and interest charges.

- Not making a voluntary disclosure of past errors can remove eligibility for reduced penalties under the IRAS Voluntary Disclosure Programme.

Dissolution and what happens to the remaining assets

When a company limited by guarantee in Singapore is dissolved, it must follow a structured process to ensure compliance with legal and public interest requirements. There are three main methods: members’ voluntary winding-up, creditors’ voluntary winding-up, and striking off from the register.

Failure to properly dispose of assets or comply with legal procedures may lead to penalties or personal liability for officers involved.

- All liabilities must be fully settled before any remaining assets are considered for distribution.

- Remaining assets cannot be distributed to members, regardless of their contributions or role in the company.

- Assets must be transferred to another registered charity or nonprofit organization with objectives similar to the dissolved CLG, as stipulated in the constitution.

- This transfer ensures continued public benefit, aligning with the core purpose of a company limited by guarantee in Singapore.

- Directors and members have limited liability but must still fulfil obligations related to winding-up, including submission of final accounts and statutory filings.

How BBCIncorp can support your CLG setup

Why expert help matters

Forming a CLG in Singapore without the right guidance, the process can be more challenging than it seems because of 3 reasons below:

- Complex legal structure: A CLG requires a constitution tailored to nonprofit goals and regulatory standards set by ACRA and IRAS. One wrong clause can lead to delays or rejection.

- High compliance burden: CLGs must remain compliant with multiple agencies, from filing annual returns with ACRA to meeting tax exemption conditions with IRAS.

- Risk of costly missteps: Errors in documentation, unclear object clauses, or missing filings can jeopardize your tax-exempt status or force a complete reapplication.

To avoid unnecessary setbacks and ensure smooth registration, you should consider turning to BBCIncorp for professional support and compliance expertise tailored to Singapore’s regulatory landscape.

BBCIncorp’s company formation services

BBCIncorp provides end-to-end assistance to ensure your company incorporation in Singapore is structured correctly and stays fully compliant:

- Drafting a compliant constitution: We help you prepare legally sound documents that define clear nonprofit objectives, asset-handling clauses, and members’ limited liability.

- Filing with ACRA on your behalf: Our team handles all administrative work, including preparing documents, paying registration fees, and monitoring application status.

- Post-incorporation setup: We assist in maintaining legal registers, organizing the first Annual General Meeting (AGM), and ensuring initial compliance with corporate governance.

- Ongoing tax and accounting support: We provide expert advice to help your CLG qualify for tax exemption and stay aligned with Singapore’s nonprofit regulations.

In addition to company incorporation support, BBCIncorp also offers a comprehensive range of services to help your organization operate smoothly and stay compliant. From ongoing company secretarial service to ensure your statutory obligations are met, to professional bookkeeping company Singapore solutions that keep your financial records accurate and audit-ready

A company limited by guarantee in Singapore is a strong legal foundation for non-profits and public-interest organizations. It ensures that funds and assets are used strictly for the organization’s mission, offers limited liability for members, and supports long-term credibility.

However, setting up a CLG involves navigating strict regulatory requirements and coordination with multiple authorities. To avoid delays or costly errors, it’s essential to get it right from the start. If you’re looking to establish a CLG aligned with your public-good mission, let BBCIncorp support you with a smooth, compliant setup.

Frequently Asked Questions

How much does it cost to set up a CLG in Singapore?

Setting up a Company Limited by Guarantee in Singapore typically includes the following costs:

- Name application and registration with ACRA around SGD 300 – 400

- Professional service fees include drafting constitution, company secretary service, and compliance support.

- Bank account opening fees vary by bank

Administrative and document-related expenses such as printing, notarisation, and certifications.

Can a CLG apply for charity status in Singapore?

Yes. A CLG can apply for charity status via the Charities Portal within three months of incorporation, provided it meets the eligibility criteria set by the Commissioner of Charities.

What are the benefits of applying for charity status in Singapore?

Charity status grants full tax exemption, improves fundraising credibility, and opens access to exclusive grants and funding.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is a company limited by guarantee?

- Use cases and real-life examples

- Responsibilities and rights of CLG members

- Advantages and disadvantages of a CLG

- How to set up a CLG in Singapore

- Governance and compliance requirements

- Dissolution and what happens to the remaining assets

- How BBCIncorp can support your CLG setup

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.