- What is a dormant company in Hong Kong?

- How to declare a dormant company in Hong Kong?

- The pros and cons of a dormant company in Hong Kong

- What are the annual compliances for a Hong Kong dormant company?

- Companies that are not allowed to claim dormant company status

- Can Hong Kong companies stop being dormant?

- Conclusion

As a business owner, you may wish to keep your company on hold for a particular reason. For instance, you’re tired of cost pressure, you move abroad temporarily, or you simply want to take a break. You can choose to permanently close down your company.

Or, you can take time to collect your thoughts before restarting fresh with a dormant company. In this article, we seek to provide insight into what a dormant company in Hong Kong is and how you can manage and apply for one.

What is a dormant company in Hong Kong?

A dormant company in Hong Kong refers to a limited company that has no significant accounting transactions recorded during a given fiscal year. The word “dormant” means the company is inactive or not carrying out any business operations, yet it remains on record as a registered legal entity with the Companies Registry.

Even though a dormant company does not trade or earn income, it keeps its corporate status intact and can resume operations in the future when the owners decide to reactivate it.

You can establish a dormant company by applying for dormant status through a formal process. This involves passing a special resolution by the shareholders, as stipulated under Section 5 of the Companies Ordinance.

Once the resolution is passed and filed with the Companies Registry, the company is officially recognized as dormant. The detailed procedure is explained in the next section.

How to declare a dormant company in Hong Kong?

If you’re considering pausing operations but want to retain your company structure in Hong Kong, declaring your company dormant is a practical step. Unlike some jurisdictions where inactivity can be established informally, Hong Kong has a formal legal process for declaring dormancy.

First, it’s important to note that a company cannot be incorporated as dormant from the outset. It must first be set up as a standard private limited company under the Companies Ordinance (Cap. 622). Once incorporated, you can apply for dormant status by passing a special resolution, as outlined in Section 5 of the Companies Ordinance.

To initiate the change:

- The company must ensure it has had no significant accounting transactions since its last annual reporting.

- A special resolution must be passed by shareholders declaring the company’s intent to become dormant.

- The resolution must then be filed with the Companies Registry using Form ND2A within 15 days of the resolution being passed.

- Once accepted, the Registrar updates the status, and the company becomes officially dormant.

A significant accounting transaction refers to any entry that impacts the company’s financial records, for example, receiving revenue, paying rent, or incurring expenses. Statutory filings, such as payment of fees to the Registrar or penalties, do not count as significant transactions.

Dormant companies are exempt from filing audited financial statements and profit tax returns. However, they must still maintain a registered office, a company secretary, and submit the annual return (Form NAR1). Dormancy helps reduce compliance costs while preserving the legal existence of the business.

This approach is particularly useful for entrepreneurs who want to pause business activities temporarily, such as during restructuring, market shifts, or when considering relocating operations.

In all cases, it’s advisable to consult a professional service provider to ensure full compliance when declaring dormancy. Missteps can and will result in penalties or continued compliance obligations.

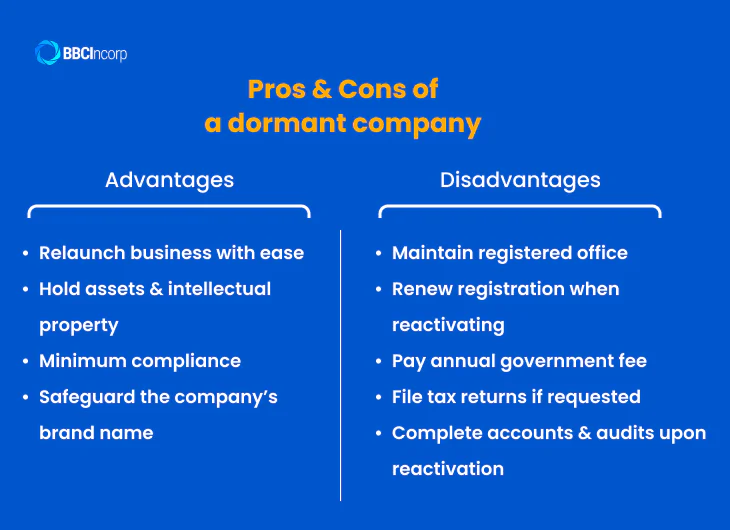

The pros and cons of a dormant company in Hong Kong

Benefits of a dormant company in Hong Kong

There are several benefits to establishing a dormant company or registering a standard company as one. Let’s walk through some of them:

Relaunch business with ease

You may sometimes consider closing your Hong Kong company, without being confident it’s the right thing to do.

If you deregister a company in Hong Kong permanently, you cannot use it for future projects and must set up a new company. Moreover, company dissolution can be time-consuming and costly.

Applying for a dormant status allows you to restart easily when you want to, without further procedures or complications.

Hold assets and intellectual property

You can use a dormant company to hold assets or intellectual property. For instance, the dormant company can take responsibility for legal issues or staff management, without having significant accounting transactions.

In many cases, an investment holding company can also be set up as a dormant company to safeguard certain assets or intellectual property.

Minimum compliance

Your dormant company can be exempted from several legal requirements. That being said, you’re still required to prepare an annual return for the year in which the company registered as dormant.

Safeguard the company’s brand name

The longer your company exists, the greater your brand name is valued. If you close your company, its name will be available to the public, and you might lose it.

With a dormant company, you won’t need to be active, yet still stay legit in the eyes of the law and protect your company’s brand, name, and reputation.

Discover how you can register your Hong Kong company name in our dedicated article.

Downsides of a Hong Kong dormant company

While being inactive in business transactions, a dormant company is still seen as a legal entity. Therefore, it still needs to fulfill the requirements and provisions of the Ordinance. Specifically, such as:

- Have a minimum of individuals in the registered office or the process of the Registrar

- Renew the registration if the business decides to be active again

- Pay a yearly registration fee to the Hong Kong government

- File a tax return as requested by the Inland Revenue Department

- If an inactive business chooses to end its dormant status, it would still need to do management accounts, bookkeeping, and audits for the time it was dormant

What are the annual compliances for a Hong Kong dormant company?

Even though a dormant company in Hong Kong does not actively trade or carry out business operations, it remains a registered legal entity. As such, it is still subject to certain annual compliance requirements in Hong Kong under the Companies Ordinance (Cap. 622) and Inland Revenue Department regulations.

Staying compliant ensures your dormant status remains valid and avoids unnecessary penalties. Specifically, your dormant company must continue to fulfill the following obligations:

- Maintain a registered office: The company must keep an official registered office address in Hong Kong, which is publicly recorded.

- Appoint key officers: You are required to have at least one director, one shareholder, and a company secretary at all times to meet statutory duties.

- Report changes promptly: Any changes to directors, company secretary, or registered office address must be filed with the Registrar of Companies within 15 days using the appropriate forms.

- Renew the business registration certificate: Even when dormant, your company must renew its BR Certificate annually or every three years, depending on the term chosen at registration, and display a valid certificate at the registered office.

- Pay the business registration fee: A nominal annual fee is payable to the Hong Kong government to maintain your company’s registration.

- File Profit Tax Returns if required: The Inland Revenue Department may still issue a Profit Tax Return. If you receive one, you must file it, even if your company has no business activity to report.

While the compliance burden is lower than for an active company, you cannot neglect these essentials. Keeping your company in good standing is crucial, especially if you plan to reactivate it in the future or use it to hold assets.

For peace of mind, many business owners choose to engage a corporate service provider to handle these ongoing requirements professionally and efficiently.

Companies that are not allowed to claim dormant company status

Although declaring dormancy can be a practical way to maintain a Hong Kong company at minimal cost, not all companies are eligible to apply for dormant status. Under the Companies Ordinance, certain entities are not allowed to claim dormant company status due to their public or regulatory obligations.

For example, listed companies and their subsidiaries cannot become dormant, as they are subject to ongoing disclosure and compliance requirements that cannot simply be suspended.

Similarly, regulated financial institutions, such as banks, insurance companies, and securities firms, are not eligible because of the need to safeguard public interest and maintain financial stability.

Companies holding licenses or permits under specific ordinances, or those engaged in activities requiring regular reporting to regulatory bodies, are also excluded from declaring dormancy.

These restrictions ensure that entities with public accountability or significant regulatory oversight continue meeting their obligations, even if business activities are temporarily reduced.

Before applying for dormant status, you must assess whether your company falls into any restricted category, often with professional advice.

Can Hong Kong companies stop being dormant?

A dormant company in Hong Kong can resume business activities and cease its dormant status at any time. Notably, the business must follow the proper legal procedures.

Pass a special resolution

To formally end dormant status, the company must pass a special resolution at a general meeting of shareholders. The resolution must declare the company’s intention to resume significant accounting transactions and business operations. Once passed, it must be filed with the Companies Registry within 15 days to officially update the company’s status.

Resume activity through a transaction

Alternatively, dormant status ends automatically if the company carries out any significant accounting transaction, such as issuing an invoice or paying for services.

This method does not require immediate notification to the authority. However, it is good practice to consult with shareholders and company members beforehand to avoid misunderstandings or internal conflicts.

File the annual return if required

If your company ceases to be dormant, you may still need to file an annual return for the year in which dormancy ends, especially if the effective date falls on or before the 42nd day after the anniversary of incorporation. Failing to do so can result in penalties, so ensure this compliance step is not overlooked.

Return to full compliance

Once active, your company must resume fulfilling all standard statutory and financial obligations, including preparing audited financial statements, holding annual general meetings, and filing tax returns.

Reactivating a dormant company is a practical way to relaunch operations when the time is right. Make sure the process is properly documented, communicated among shareholders, and compliant with the law to maintain your company’s good standing.

Free ebook

Everything you need to start business in Hong Kong

Find out in a matter of minutes.

Conclusion

A dormant company in Hong Kong is an ideal option if you want to put the company on hold with minimal costs. There are multiple advantages to becoming a dormant company, one of which is that you can continue operations anytime you want.

The statutory requirement for a Hong Kong-resident individual or local corporate body to act as company secretary cannot be waived, even for fully dormant companies, meaning the secretary remains legally responsible for filing the annual confirmation of dormancy and safeguarding statutory records.

For a detailed breakdown of these continuing duties—from updating the Significant Controllers Register to handling Companies Registry correspondence—read our comprehensive guide Company Secretary In Hong Kong: What Is Its Role?. By engaging an experienced company secretary from day one, dormant company owners avoid accidental breaches that could trigger fines or involuntary striking-off while keeping reactivation costs and timelines to a minimum.

Should you have further questions regarding setting up a dormant company in Hong Kong, feel free to contact us via service@bbcincorp.com.

Frequently Asked Questions

What is the difference between a non-trading and a dormant company?

“Non-trading” and “dormant” companies may appear similar, but they possess distinct legal and operational differences:

A non-trading company does not engage in any active business activities or accrue any legal obligations. Despite its inactivity, it is still required to maintain full accounting records, adhering to standard reporting requirements.

Conversely, a dormant company in Hong Kong is a company that has been officially declared inactive and registered as such with the relevant authorities.

This status permits it to record only minimal accounting transactions, as specifically allowed by the governing Ordinance (e.g., transactions related to its shares or minimum statutory fees).

The key distinction lies in the formal declaration of dormancy and the reduced accounting obligations that come with it, unlike a non-trading company, which, though inactive, must still comply with standard financial record-keeping.

Is a company permitted to cease being dormant?

Yes, a company in Hong Kong is permitted to cease being dormant.

To reactivate, a special resolution must be passed by shareholders, declaring the company’s intent to engage in an “accounting transaction.” This resolution must then be delivered to the Companies Registry for registration.

The company is also considered to have ceased dormancy if it simply performs an accounting transaction, even without prior notification to the Registrar.

Upon reactivation, all previous exemptions for dormant companies are lifted, and the company must fully comply with all statutory requirements, including filing annual returns if the reactivation date falls before the 42nd day after its incorporation anniversary.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is a dormant company in Hong Kong?

- How to declare a dormant company in Hong Kong?

- The pros and cons of a dormant company in Hong Kong

- What are the annual compliances for a Hong Kong dormant company?

- Companies that are not allowed to claim dormant company status

- Can Hong Kong companies stop being dormant?

- Conclusion

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.