Table of Contents

Limited Liability Companies (LLCs) are one of the most versatile and popular business entity types. But if you’re managing multiple businesses, you might be wondering, can an LLC own another LLC? The answer is yes. By setting up an LLC within another LLC, you can create a sophisticated structure that maximizes liability protection, asset management, and operational efficiency.

This blog explores everything small business owners and entrepreneurs need to know about LLC ownership structures, including legal frameworks, benefits, drawbacks, and how to set one up.

Legal framework of LLC owning another LLC

“Can an LLC be owned by another LLC?” Yes, it is entirely legal for one LLC to own another LLC in most states.

In this arrangement, an LLC can become a “member” of another LLC while gaining the same rights and responsibilities as an individual or business entity. State laws governing LLC ownership are quite accommodating, making it a popular choice for many business owners.

Some states enable additional flexibility by allowing Series LLC structures, which essentially functions as an “LLC within LLC” setup. Series LLCs are unique because they allow one parent LLC to create multiple “series” or sub-units within itself, each with its distinct liabilities and assets.

However, not all states recognize Series LLCs. States like Delaware and Nevada are popular due to their business-friendly laws, while other states may have specific restrictions regarding LLC ownership. Always check with legal advisers to ensure compliance.

What does it mean for LLC owning another LLC

When one LLC owns another, they form a legal relationship, with the owning LLC referred to as the “parent LLC” and the owned entity as the “subsidiary LLC.” The parent becomes a member of the LLC subsidiary, similar to how individuals or groups hold ownership stakes in an LLC.

Can an LLC be a parent company if it is smaller in size? Yes, an LLC can serve as a parent company regardless of its size compared to its subsidiaries. Factors like revenue, employee count, or physical presence do not impact its ability to function as a parent. What truly matters is ownership and control.

LLC ownership can be structured in various ways. Below is a breakdown of the most popular ones:

Parent subsidiary LLC structure

Definition

A parent LLC directly owns and controls one or more subsidiary LLCs, each responsible for different aspects of the business.

Advantages

- Liability protection: Limits legal or financial risks between the parent and subsidiary entities.

- Focused operations: This structure allows each subsidiary company to focus on different business functions independently.

Who should use this structure?

Large companies often use this structure to separate revenue streams, such as a retail company managing logistics and sales through separate LLCs.

Holding company structure

Definition

A holding LLC is specifically created to own and manage other LLCs without engaging in direct operations.

Advantages

- Administrative efficiency: Centralizes oversight while enabling operational independence for subsidiaries.

- Scalability: Easily add multiple subsidiary LLCs as your operations grow.

Who should use this structure?

Entrepreneurs managing multiple investments or businesses will find a holding company structure especially advantageous.

Series LLC structure

Definition

A series LLC allows a parent LLC to house separate “cells” (or sub-LLCs), each with its own members, assets, and liabilities.

Advantages

- Cost effective: Operates under a single filing while maintaining separate liability for each series.

- Simplified setup: Ideal for managing multiple business ventures or investments.

Who should use this structure?

This structure is excellent for real estate investors or businesses with several diverse but related operations.

Multi-member LLC structure

Definition

Multiple LLCs can jointly own another LLC, forming a multi-member LLC structure for shared control.

Advantages

- Shared investment risks: Multiple parent LLCs can pool resources to launch new business ventures.

- Collaborative decisions: Members share responsibilities, enhancing collective management.

Who should use this structure?

This structure is ideal for businesses formed through partnerships between multiple organizations, joint ventures, or groups of investors aiming to work together while maintaining some degree of individual autonomy.

It’s particularly useful for large-scale projects or industries that require diverse contributions and expertise.

Benefits of an LLC owning another LLC

Having an LLC own another LLC can be a strategic move for expanding operations, protecting assets, and streamlining your business.

Liability protection

One major advantage is enhanced liability protection. By structuring your business with a parent-and-subsidiary relationship, you can shield each company from the risks and debts of the other.

For instance, if one subsidiary faces legal or financial trouble, its liability is contained, protecting the parent LLC and other subsidiaries. This is especially valuable for businesses in high-risk industries or those managing multiple ventures.

Asset segregation

This setup also allows for better asset management. Each subsidiary can hold specific assets, such as intellectual property or real estate, while the parent LLC oversees them. This keeps assets protected and simplifies allocation.

Intellectual property like trademarks or patents could be held by one subsidiary LLC, while another oversees real estate. If one subsidiary encounters legal issues, these assets remain safeguarded in their respective entities.

Tax efficiency

LLCs are known for their tax advantages, and when an LLC owns another LLC, you retain the flexibility to tailor the tax treatment to fit your needs.

A parent LLC can consolidate profits and losses from its subsidiaries to streamline tax reporting or allow each subsidiary to file taxes independently. This adaptability ensures you can optimize your tax obligations based on your specific business structure.

Operational flexibility

One major benefit of this structure is the ability to adapt quickly. With a parent LLC overseeing subsidiary LLCs, each entity can focus on a specific function, market, or strategy. This separation allows autonomy, making it easier to pivot and redirect resources.

The parent LLC can create new subsidiaries for business ventures without affecting existing ones, minimizing risk and supporting growth while protecting each subsidiary from liabilities.

Simplified ownership and oversight

Consolidating ownership under the parent LLC creates a single point of management for all subsidiaries. This enhances clarity, accountability, and alignment with overall business goals.

Centralizing activities like accounting, compliance, and governance under the parent LLC reduces administrative complexity, saving time and money while ensuring consistency across subsidiaries.

Disadvantages of an LLC owning another LLC

While an LLC owning another LLC can offer several advantages, it’s not without its challenges. Below are some of the key disadvantages of this setup.

Administrative complexities

Managing multiple LLCs is more complicated than running a single entity. For instance, if a parent LLC owns three subsidiaries, each must have separate bank accounts, records, and legal filings.

This requires strong systems, skilled staff, and extra time, which can strain small businesses or startups. Poor management can lead to errors or missed deadlines.

Higher operational costs

The layered structure of an LLC owning other LLCs often leads to increased costs. Each LLC may involve filing fees, legal expenses, ongoing compliance costs, and potentially higher accounting and bookkeeping expenses.

Even seemingly minor costs, such as state fees for maintaining LLC status, multiply quickly with multiple entities, creating a substantial financial burden.

Potential liabilities

One significant risk is the possibility of “piercing the corporate veil.” In this scenario, a court might disregard the legal separation between the parent LLC and its subsidiaries, holding the parent LLC and even its owners personally liable for a subsidiary’s debts.

To minimize this risk, each subsidiary must function as a distinct business entity. This includes maintaining separate financial accounts, operating under its own name, and strictly adhering to its governing documents and bylaws.

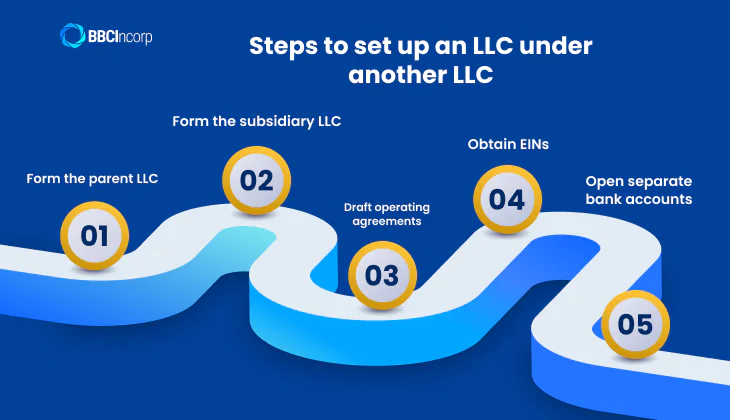

Steps to set up an LLC under another LLC

If you’re wondering how to put an LLC under another LLC, this guide will walk you through forming a parent-subsidiary structure.

Step 1: Form the parent LLC

The LLC parent company needs to be legally formed before it can own the subsidiary LLC. To form the parent LLC, you’ll need to:

- Choose a name: Select a unique name that adheres to your state’s naming requirements and isn’t already in use.

- Appoint a registered agent: Designate an individual or service to handle legal and official documents on behalf of your LLC.

- File Articles of organization: Submit key documents to your state’s business office, typically the Secretary of State, along with the required fee.

Once the parent LLC is officially established, it can become the legal owner of the subsidiary LLC.

Step 2: Form the subsidiary LLC

The process for forming a subsidiary is similar to forming the parent company but with a key difference regarding ownership.

When drafting the Articles of Incorporation for the subsidiary, you must list the parent LLC as the owner, either in part or in whole, depending on how you plan to structure ownership.

Key considerations for this step include:

- State laws compliance: Some states may have specific rules for forming LLCs owned by other LLCs, so verify any requirements early on.

- Proper documentation: Ensure all filings clearly identify the parent LLC as the owner to legally establish the parent-subsidiary relationship.

Step 3: Draft operating agreements

Operating agreements are essential for both the parent and subsidiary LLCs. They outline roles, rules, and financial arrangements.

When drafting these agreements, consider the following:

- Parent LLC: Define its management responsibilities, ownership rights over the subsidiary, and decision-making protocols.

- Subsidiary LLC: Specify profit flow to the parent LLC, management structure, and the relationship between the two entities.

Clear operating agreements ensure everyone understands their roles, reduce disputes, and show the courts that both LLCs are legally distinct, maintaining liability protection.

Step 4: Obtain EINs

Each LLC, whether parent or subsidiary, is a separate legal entity and needs its own EIN. This nine-digit tax ID from the IRS is required for taxes, business accounts, and hiring employees.

To apply for an EIN:

- Visit the IRS website for a free application.

- Submit separate applications for each LLC. Ensure that the parent LLC is listed as the responsible party for the subsidiary LLC application.

Even if you don’t have employees, having an EIN for each entity is essential to maintaining proper separation and streamlining financial management.

Step 5: Open separate bank accounts

Each LLC needs its own bank account to maintain financial separation and protect the liability shield.

For example:

- The LLC parent company should have an account for its own expenses and revenues, including funds from the subsidiary.

- The subsidiary LLC should have an account for daily operations, payroll, and revenue.

When setting up the accounts, you’ll need copies of the LLC’s articles of organization, EIN, and operating agreement. Keeping financial boundaries between entities helps prevent commingling funds, which can jeopardize liability protection.

Full-service LLC formation at BBCIncorp

Launching an LLC can be complex, but it doesn’t have to be. With BBCIncorp’s full-service LLC formation, you’ll have a team of experts by your side to handle every step for you.

We specialize in LLC setups in tax-friendly jurisdictions such as Delaware, offering businesses the advantages they need to thrive.

Looking to expand offshore? We also provide expert assistance in forming offshore companies, including:

- Cayman LLC: Ideal for premium asset protection.

- Cyprus LLC: Perfect for leveraging favorable European tax treaties.

With BBCIncorp, you gain access to a comprehensive solution for your LLC venture, including:

- Comprehensive solutions: From offshore company formation and a registered address to bank account setup and legal compliance, we handle every detail.

- Clear, upfront pricing: No hidden fees, just complete transparency.

- Ongoing support: Post-incorporation services like annual filings, accounting, and administrative assistance to keep your business running smoothly.

Conclusion

An LLC owning another LLC offers immense advantages, from liability protection to tax efficiency and operational scalability. The question, “can an LLC own another LLC?“, is answered with a resounding yes, though these benefits come with increased administrative and legal responsibilities. Make sure to carefully evaluate your business goals and consult legal professionals to decide the best setup for your enterprise.

Take the time to explore how LLC ownership structures can amplify your business potential. And if you’re ready to take the next step, BBCIncorp is here to guide you every step of the way!

Frequently Asked Questions

Can one LLC own another LLC?

Yes, an LLC can own another LLC or multiple LLCs as a member, creating what is commonly referred to as an LLC subsidiary. This structure is often used by businesses to manage risk, organize operations, or separate different lines of business. However, the rules for forming an LLC subsidiary may vary depending on state regulations.

Can an LLC fund or invest in another LLC?

Yes, an LLC can fund or invest in another LLC. This is a common practice, especially in “LLC owning another LLC” structures or when an LLC acts as an investor in other businesses.

“Can an LLC be a member of another LLC if it does not make a financial investment?” Yes, it still can. Membership in an LLC is not solely tied to monetary contributions; it can also be based on other forms of value or agreements.

Can I run two businesses under one LLC, or should I create an LLC within an LLC?

If you’re wondering can you have multiple businesses under one LLC, the answer is yes. You can operate two businesses under a single LLC, but the best structure depends on your goals, liability concerns, and operational needs.

If the businesses are closely related, such as offering different products or services within the same industry, managing them under one LLC using DBAs (Doing Business As) can be a practical and cost-effective solution.

However, if the businesses are unrelated or one involves significant risk (e.g., operating in a high-liability field), then instead of simply asking can you have multiple businesses under one LLC, it may be wiser to consider forming a parent LLC with separate subsidiary LLCs for better protection and strategic management.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.