Table of Contents

Starting a new business often involves navigating a maze of crucial decisions, and one of the earliest dilemmas many new limited liability company owners face is: Can I use my home address for my LLC? While seemingly straightforward, this choice carries significant implications for your personal privacy, business professionalism, and even legal compliance. Your LLC’s address becomes a matter of public record, potentially exposing your home to unwanted solicitations and impacting your company’s image.

This comprehensive guide will delve into the pros and cons of using home addresses for LLC. Here are the necessary details and expert tips to determine the best course of action and explore viable alternatives.

Can I use my home address for my LLC?

Many business owners consider using their home address when forming an LLC. It can be convenient and cost-effective, especially in the early stages. Legally, this option is allowed in most states, but there are important details to understand before moving forward.

Federal and state-level legality

There are no federal laws that prohibit the use of a residential address for LLC registration. Most states also permit this, provided the address is a physical location where official mail and legal documents can be received during business hours. A P.O. Box is not sufficient. This is why most business formation documents specifically ask for a street address.

If you are asking, “Can I use my personal address for LLC registration?” or “Can your LLC address be your home address?” The short answer is yes, in most cases. However, using a home address may raise questions about zoning, privacy, and future scalability. It is important to be aware of local rules that may affect your ability to legally operate from your residence.

What about local restrictions?

Many states generally allow you to register your LLC at a home address, local governments may impose restrictions. These often appear in zoning ordinances or homeowners’ association rules. Some cities limit commercial activity in residential zones to protect neighborhood character and avoid disruptions.

For example:

California allows home-based businesses, but cities like Los Angeles require a home occupation permit. Local laws restrict signage, client visits, and noise levels. See Los Angeles Municipal Code Section 12.05 for details.

New York City permits certain business activities from home, such as consulting or computer work. However, it prohibits activities like manufacturing, storage of hazardous materials, or anything that changes the residential nature of the property. Refer to the New York City Zoning Resolution Section 12-10 for specific language.

In Florida, counties such as Miami-Dade allow home businesses under certain conditions. These include restrictions on employees, customer visits, and any visible indication that a business is being operated from the property. See Miami-Dade Code Section 33-25.2 for more information.

To answer the questions “Can I use my home address for LLC?”, “Can I register my LLC to my home address?” or “Can I use my home address as my business address?”, it depends not only on your state but also on your city or county. To avoid legal issues, check with your local planning department or search zoning codes with tools like the Municode Library.

Pros and cons of using your home address for an LLC

Using a home address for your LLC can make business formation quicker and less expensive. Still, this approach also comes with trade-offs that may affect privacy, professionalism, and compliance. To help you decide, here is a balanced look at the pros and cons of registering your home address for your business.

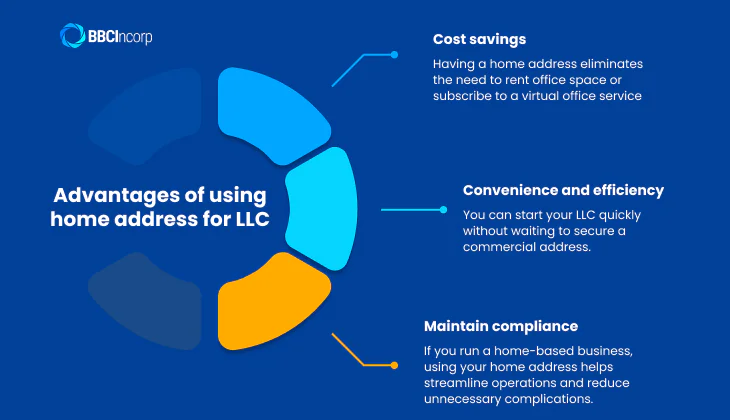

Advantages of using your home address

Many entrepreneurs choose to use their personal residence for business registration because of simplicity and affordability. This is especially common for small-scale or home-based operations.

Cost savings

Having a home address eliminates the need to rent office space or subscribe to a virtual office service. This can reduce startup costs and ongoing overhead, particularly for solo founders and small teams. According to the U.S. Chamber of Commerce, keeping fixed costs low in the early stages increases long-term flexibility and resilience.

Convenience and efficiency

You can start your LLC quickly without waiting to secure a commercial address. This is helpful if you are moving fast to secure licenses or banking services. All legal correspondence will also be delivered directly to you, which can reduce delays in receiving important documents.

Practicality for home-based businesses

If your business is already run from your home, such as consulting, freelance work, or e-commerce, the same address can simplify operations and avoid unnecessary complexity. It aligns with how the business is actually conducted.

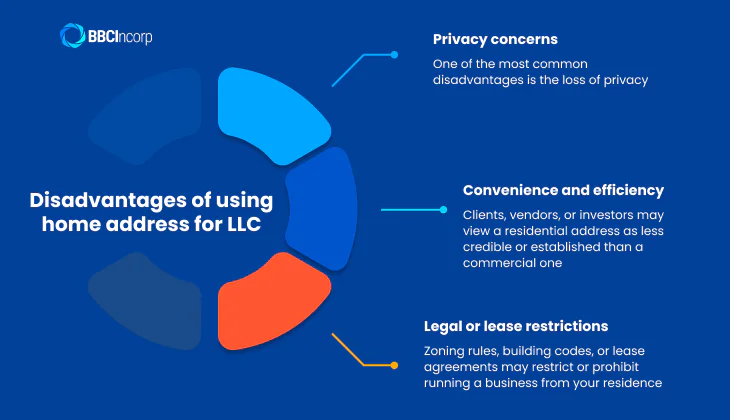

Disadvantages of using your home address

Despite the benefits, there are also serious drawbacks to consider. These involve both personal exposure and potential business limitations.

Privacy concerns

One of the most common disadvantages is the loss of privacy. Once filed, your LLC’s address becomes part of the public record in state databases. This means anyone can look up where you live, which could raise safety and security concerns. It may also result in an increase in unsolicited mail or sales calls.

Professional image

Clients, vendors, or investors may view a residential address as less credible or established than a commercial one. This perception varies by industry, but for some, it may influence trust and purchasing decisions. “Should I use my home address for my LLC?”. This is an important factor to weigh when deciding which way your business will grow.

Legal or lease restrictions

Zoning rules, building codes, or lease agreements may restrict or prohibit running a business from your residence. If you rent, your lease may require landlord approval. These restrictions can vary by city, county, or homeowners association.

In summary, there are clear cost benefits and logistical advantages, but it’s essential to carefully consider the potential drawbacks. Weighing privacy concerns, potential professional perceptions, and local regulations will help you determine if this is the best option for your business.

How to avoid using your home address for an LLC

If you are concerned about privacy, professionalism, or zoning restrictions, there are practical ways to not register your home address as your LLC’s office. Depending on your needs and budget, several alternatives can provide a commercial presence and help protect your personal information.

Understanding what address to use for your LLC is essential for both legal compliance and business credibility.

Use a virtual office or business address service

One of the key benefits of virtual office services is that they offer a commercial business address without the expense of renting physical office space. This allows your LLC to maintain a professional-looking principal address for registration, marketing, and client communication.

Most virtual office providers also include mail forwarding, a dedicated phone line, receptionist support, and access to meeting rooms when needed. These features highlight the benefits of virtual office solutions in bridging the gap between flexibility and professionalism, particularly for remote or small teams.

Affordable virtual office providers include:

- BBCIncorp – Offers virtual office services in business hubs like the United States, Singapore, and Hong Kong, with flexible pricing and multilingual support.

- Alliance Virtual Offices – Known for a large network of addresses and customizable packages that include live receptionists and mail handling.

- Regus – Offers business addresses in over 900 cities, plus access to coworking spaces and private offices when required.

- Opus Virtual Offices – Includes a business mailing address, live receptionist, and voicemail-to-email features as part of a flat-rate service.

Choosing a virtual office is one of the most effective answers to the question, “What address should I use for my LLC if I don’t want to use my home?”

Rent a coworking space or shared office address

Coworking spaces offer another way to meet the physical address requirement for an LLC without committing to a full office lease. Many of these shared spaces provide business mailing services, conference rooms, and networking opportunities.

Compared to traditional office rentals, coworking memberships are often more affordable. Providers like WeWork, Industrious, and local coworking hubs allow you to use their location as your LLC’s principal or mailing address.

This is especially useful for entrepreneurs who prefer a real-world presence with occasional in-person amenities. It answers a common concern: “Do you need a business address for an LLC to appear credible?”

Use a registered agent address

Every LLC must designate a registered agent who receives legal and official documents on the company’s behalf. Most states require this agent to have a physical address in the same state as your LLC.

While a registered agent address does not replace a principal business address, it helps maintain a layer of privacy. Professional registered agent services can prevent your personal address from appearing in public state records for legal correspondence. If you’re wondering, “What address can I use for my LLC that meets legal requirements but keeps my home private?”, this is part of the solution.

Choosing the right alternative depends on your business model, location, and need for privacy. Combining a virtual office or coworking space with a registered agent service can offer both professionalism and peace of mind.

What’s the best option for your situation?

If you’re a solopreneur or freelancer, your home address may be a practical starting point. You can combine it with a professional registered agent service to reduce public exposure and meet state requirements for legal correspondence. This setup is simple, affordable, and works well for those asking, “Should I use my home address for my business?” or “Can I use my home address for my LLC if I work from home?”

For growing businesses, a virtual office or coworking space may offer better support and credibility. These options provide a commercial address that enhances your professional image, allows for mail handling, and can support future expansion. If you’re aiming to scale or interact with clients directly, a more professional setup may be worth the added cost. In this case, the best address for LLC purposes is one that aligns with your business stage and customer expectations.

See more

Looking for a way to keep your home address private while maintaining a professional image? Discover the best virtual address for business solutions that offer mail handling, a commercial location for official registration, and enhanced credibility for your brand

Always factor in local zoning laws, state requirements, and the public nature of business filings. Some states are more flexible than others, but in every case, your LLC must list a physical address, not just a P.O. Box.

Before deciding, take a moment to review your business model, growth plans, and privacy needs. Whether you choose a home address, virtual office, or real office, make sure your decision supports both compliance and scalability. The right choice today will save time and effort later as your business evolves.

Affordable virtual office services for LLCs – BBCIncorp

Imagine launching your dream LLC, brimming with potential, but then facing the practical question: where should your official business address be? Many new entrepreneurs naturally consider their home. But is that the most strategic move? Your LLC’s address is a public-facing detail that can impact everything from your privacy to how seriously clients take you.

What is included in BBCIncorp’s virtual office package?

At BBCIncorp, we understand these crucial early-stage decisions. Our virtual office packages offer a smart alternative, providing not just a prestigious business address but a complete toolkit for professional operations. A recognized business address in a prime location, seamless mail management, a dedicated phone line answered professionally, and on-demand meeting spaces, all without the hefty price tag of a physical office.

Furthermore, we also offer remote company formation options in global jurisdictions. You can visit our site for more information on our virtual office solutions and incorporation services.

Ready to elevate your LLC’s image and streamline your admin so you can focus on core business operations? Let’s explore the jurisdictions available.

In which locations does BBCIncorp provide virtual office services?

BBCIncorp provides virtual office services in key business hubs worldwide, including Hong Kong, Singapore, and the USA. In particular, please refer to the table below:

| Country | Business address | Price |

| Virtual Offices in Singapore |

141 Middle Road #05-06 GSM Building, Singapore 188976

33 Ubi Ave 3 #108-61 Vertex Tower A, Singapore 408868 | $49 – $78 |

| Virtual Offices in Hong Kong |

6/F Yen Sheng Centre, 64 Hoi Yuen Road, Kwun Tong

25/F Langham Place Office Tower, 8 Argyle Street, Mongkok, Kowloon

15/F Millennium City, 418 Kwun Town Road, Kwun Tong

22/F Tower Two Times Square, 1 Matheson Street, Causeway Bay

11/F, Crawford House, 70 Queen’s Road Central, Central

Unit 907, 9/F Silvercord Tower 2, 30 Canton Road, Tsim Sha Tsui, Kowloon | $59 – $88 |

| Virtual Offices in Shanghai, China |

25/F Wheelock Square, 1717 Nanjing West Road, Jing An District

25/F Central Plaza, 381 Huai Hai Middle Road, Huang Pu District

15/F L’Avenue Shanghai, 99 Xian Xia Road, Chang Ning District | $59 – $88 |

| Virtual Offices in New York, USA |

100 Park Avenue, Manhattan, New York, 10017

104 West 40th Street, Suites 400 and 500, New York City, New York, 10018

165 Broadway, 23rd Floor, New York, New York City, 10006

260 Madison Avenue, 8th Floor, Manhattan, New York, 10016

80 Broad Street, 5th Floor, Manhattan, New York, 10004

200 Vessey Street, 24th Floor, New York City, New York, 10281 | $129 – $158 |

To wrap up

Leveraging your home address for your LLC involves significant trade-offs. Although it can save initial time and costs, it risks exposing your personal information and potentially creates privacy and zoning conflicts. Carefully consider these pros and cons, and explore alternatives like virtual offices, coworking spaces, or registered agent services to better align with your business goals.

Prioritizing privacy and future growth is crucial for a sustainable business. Selecting the appropriate address setup now can prevent compliance issues and enhance your professional image in the long term.

If you need guidance, consulting legal or business formation experts is recommended. BBCIncorp offers expert advice and reliable solutions to help you determine the optimal setup for your business and location. Contact us with your inquiries at service@bbcincorp.com for more details.

Frequently Asked Questions

Is it safe to use my personal address for my business?

If you’re asking “Should I use my personal address as my business address?” it’s important to consider both the convenience and the potential risks involved. While it is legally allowed in most jurisdictions, using your home address connects your private residence directly to your business.

This can compromise your personal privacy, as the address becomes publicly accessible through business registration databases. It may also lead to unwanted solicitations or uninvited visitors. Additionally, depending on your industry, it could affect how professional your business appears to clients or partners. Before deciding, weigh the ease of use against the possible privacy and security concerns.

Will my home address be public if I use it for my LLC?

Yes, in the majority of states, if you use your home address as your principal place of business and/or registered agent address for your Limited Liability Company (LLC), it will likely become part of the public record. This information is typically filed with the Secretary of State or a similar state agency and is accessible to the public through online business entity search tools. This means that anyone can potentially find your home address by searching for your LLC name.

While this fulfills the legal requirement of having a registered address for service of process and official correspondence, it significantly impacts your personal privacy. If maintaining the confidentiality of your home address is a priority, consider utilizing a registered agent service or a virtual office.

Are there any states that don’t allow using a home address for an LLC?

Although most states permit the use of a personal address for an LLC, there aren’t typically outright bans. However, some states might have specific regulations or interpretations that could make it less practical or advisable.

For instance, certain jurisdictions might have zoning ordinances that restrict commercial activities in residential areas, potentially creating compliance issues if your business operations are significant from your home. Furthermore, some states strongly encourage or practically necessitate the use of a commercial address for certain types of businesses to maintain a professional image or meet specific industry regulations.

I’m currently using my home address for my LLC. Can I switch to a virtual office?

Yes, in most cases, you can absolutely switch from your home address to a virtual office or a registered agent’s address. The process generally involves filing an amendment to your LLC’s formation documents with the relevant state agency, such as the Secretary of State. This amendment will update your principal place of business and/or registered agent address to the new virtual office or registered agent’s physical location.

Ensure that the virtual office or registered agent service you choose meets the state’s requirements for a registered agent, which typically include having a physical street address within the state and being available during regular business hours to receive legal and official documents. Promptly updating your address with all relevant entities, such as banks and the IRS, is also crucial to ensure you receive all important communications without disruption.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.