Table of Contents

Cyprus has emerged as one of Europe’s most dynamic corporate centers, attracting entrepreneurs who value a stable business climate, a favorable tax environment, and access to European markets. Beyond its strategic advantages, the island’s appeal lies in its clear and comprehensive legal system.

The Cyprus Companies Law Cap 113 forms the backbone of this framework, setting out the rules for how every Cyprus law company is established, managed, and governed. Recent amendments have further aligned it with EU standards on transparency and corporate responsibility.

In today’s article, BBCIncorp explores the key principles of the Cyprus Companies Law, its practical impact on business operations, and why it remains central to building a compliant and sustainable company in Cyprus.

Overview of the Cyprus Companies Law

The Cyprus Companies Law provides the cornerstone of the country’s corporate management, shaping how businesses are created, governed, and regulated. Its foundation reflects a balance between local commercial needs and international business standards. This is why it became a trusted structure for both domestic and foreign investors.

Historical background

The law traces its roots to the UK Companies Act of 1948, reflecting Cyprus’s historical ties to the British legal system. When Cyprus gained independence, the system was adapted and codified into Cap 113, forming what is now known as the Companies Law Act Cyprus. Over the decades, it has evolved through significant amendments to address the demands of global trade and align with European Union directives.

Purpose and scope

The purpose of the Cyprus Companies Law extends far beyond company registration. It sets clear parameters for incorporation procedures, internal management, shareholders’ rights, and directors’ responsibilities. It also defines the processes for mergers, restructuring, and dissolution.

The law applies to a broad range of entities, including private and public limited companies, foreign company branches, and partnerships, providing a consistent legal system across all business forms operating in Cyprus.

Regulatory authorities

Supervision and enforcement fall under the Department of Registrar of Companies and Intellectual Property (DRCIP), the principal regulatory body responsible for maintaining corporate records, monitoring statutory filings, and fostering compliance with the provisions of Cap 113. The department plays a vital role in promoting transparency and corporate accountability by making company information publicly accessible and up to date.

Through its adaptability and clarity, the Companies Law Act Cyprus has established itself as a model for effective corporate regulation within the European Union. As a preferred destination for incorporation, it continues to provide entrepreneurs with the confidence that their operations have a solid and predictable legal foundation.

Legal framework of Cyprus Companies Law Cap 113

The Cyprus Companies Law Cap 113 serves as the primary legal system governing how companies are formed, managed, and regulated in Cyprus.

Key provisions of the Cyprus Companies Law 113

Under the Cyprus Companies Law 113, every company must maintain a clearly defined share capital structure. The law regulates the issuance, allotment, and transfer of shares to protect shareholders’ interests and prevent unfair dilution of ownership.

In addition, it also sets clear requirements for adopting a unique company name, so that each entity is distinguishable and compliant with the Registrar’s naming rules. Shareholders are granted essential rights, including the ability to vote, receive dividends, and inspect company records in accordance with statutory conditions.

The law outlines strict standards for directors’ duties and responsibilities, emphasizing integrity, diligence, and loyalty in decision-making. Directors are legally obligated to act in good faith and in the best interests of the company, avoiding conflicts that may harm the organization or its stakeholders.

Corporate governance obligations

Corporate governance is reinforced through Cap 113 requirements on management structure and reporting. In particular:

- Each company must appoint at least one director and a company secretary, both responsible for operations, compliance with the law, and the articles of association.

- Companies are required to submit annual returns and audited financial statements to the Department of Registrar of Companies and Intellectual Property.

- The law also codifies fiduciary duties, requiring directors to manage company affairs responsibly and maintain accurate records of decisions and transactions.

Interaction with EU directives

Cyprus’s legal framework continues to evolve in step with European Union regulations. The Cyprus Companies Law Cap 113 integrates key EU directives on corporate governance, anti-money laundering, and financial reporting, reinforcing Cyprus’s position as a reputable jurisdiction for international business. This alignment ensures that Cyprus companies meet the same high compliance standards observed across the EU.

For more details, you can access the full English translation of Cap 113 through the Department of Registrar of Companies and Intellectual Property’s website.

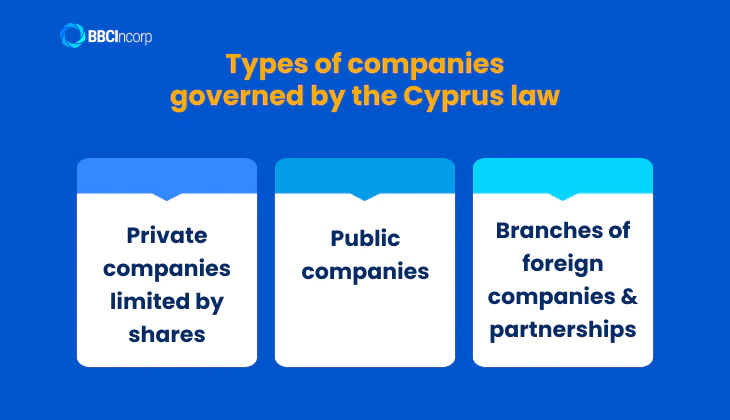

Types of companies governed by the Cyprus law

The Cyprus Companies Law offers several forms of business entities, each designed to serve different objectives and ownership needs. Choosing the right Cyprus law company is an important step that influences liability, governance, and long-term strategy.

Private companies limited by shares

The private company limited by shares is the most widely used option in Cyprus. It can be established with a minimum share capital of one euro, at least one shareholder, and one director. Liability extends only to the unpaid amount on shares, providing strong protection for individual assets.

Such entities cannot issue shares to the public and may not exceed fifty shareholders. They must also maintain proper financial records, hold annual meetings, and submit annual returns to the Registrar of Companies.

Public companies

Public companies are suited for larger organizations seeking external investment. They must have at least seven shareholders and a minimum issued share capital of approximately twenty-five thousand euros, as outlined in the Cyprus Companies Law.

These companies face higher reporting obligations, including publishing audited financial statements and adhering to rigorous governance practices. Shareholders have the right to vote, receive dividends, and review company documents.

Branches of foreign companies and partnerships

Foreign enterprises can operate in Cyprus by registering a branch under the Cyprus Companies Law Cap 113. The process requires submitting certified copies of the parent company’s constitutional documents to the Department of Registrar of Companies and Intellectual Property.

Branches must file annual financial statements that reflect the parent’s performance and comply with local tax and reporting obligations. Partnerships, governed under separate legislation, benefit from a simpler framework for smaller ventures or collaborations.

Together, these entity types give investors a clear and adaptable system to establish and expand operations in Cyprus with confidence.

Company registration process in Cyprus

Incorporation under the Cyprus Companies Law Cap 113 follows an organized legal procedure that fosters transparency. With proper preparation, businesses can establish a company efficiently and avoid regulatory complications.

Pre-registration requirements

Before applying, the founding members must prepare the Memorandum and Articles of Association, which set out the company’s objectives, structure, and internal rules. These documents must be signed by the subscribers and certified by a qualified Cypriot lawyer. Information about directors, shareholders, and the company secretary must also be provided.

In addition, applicants must submit a proposed company name for approval by the Registrar of Companies to confirm that it is acceptable and not identical to an existing one.

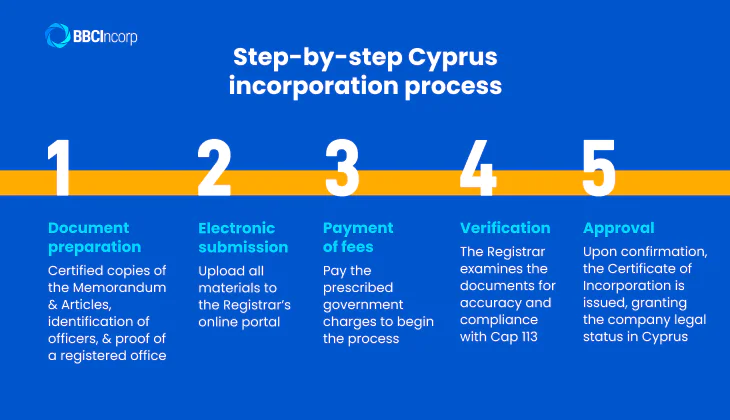

Step-by-step incorporation process

Once the documentation is ready, the application is filed with the Department of Registrar of Companies and Intellectual Property.

- Document preparation: Include certified copies of the Memorandum and Articles, identification details of officers, and proof of a registered office.

- Electronic submission: Upload all materials to the Registrar’s online portal.

- Payment of fees: Pay the prescribed government charges to begin the process.

- Verification: The Registrar examines the documents for accuracy and compliance with Cap 113.

- Approval: Upon confirmation, the Certificate of Incorporation is issued, granting the company legal status in Cyprus.

Post-registration compliance

Following incorporation, every company must meet ongoing obligations under Cap 113. These include maintaining statutory registers, designating a registered office, preparing financial records, and filing annual returns with audited accounts.

Adhering to these legal duties shall sustain good standing with authorities and reinforce corporate credibility within the Cypriot business environment.

You can find more detailed guidance on how to register a company in Cyprus through BBCIncorp’s professional resources and advisory support as well.

Financial reporting and auditing requirements

The Cyprus Companies Law 113 sets clear standards for financial reporting and auditing to ensure transparency and accountability in all registered companies. Following these requirements strengthens credibility with regulators and investors alike.

Accounting standards and thresholds

All companies must keep proper accounting records and prepare annual financial statements according to International Financial Reporting Standards (IFRS). This requirement, consistent with the Companies Law Act Cyprus and EU accounting directives, promotes accuracy and comparability.

Smaller entities may submit simplified reports, while medium and large companies must provide full statements, including balance sheets, profit and loss accounts, and explanatory notes that reflect the company’s true financial position.

Auditing obligations

Each Cyprus company must appoint independent auditors licensed by the Institute of Certified Public Accountants of Cyprus (ICPAC). Auditors review the financial statements to confirm compliance with IFRS and local regulations.

The audited accounts, together with the company’s annual return, must be filed with the Department of Registrar of Companies and Intellectual Property (DRCIP) within twelve months after the end of the financial year. Timely filing under the Cyprus Companies Law 113 demonstrates strong governance and legal compliance.

Consequences of non-compliance

Failure to meet reporting or audit obligations can lead to significant penalties. Late filing of annual returns attracts a fixed fine of €50, plus €1 for each day of delay, capped at €500.

Companies or officers that fail to maintain proper records or submit audited accounts may face fines of up to €8,000, with further daily penalties until compliance is restored. Persistent default may result in the company being struck off the register.

By following the reporting and audit rules set out in the Companies Law Act Cyprus, businesses show financial integrity, maintain good standing with the Registrar, and strengthen their position in Cyprus’s well-regulated corporate environment.

Recent amendments to Cyprus Companies Law

On 15 March 2024, Cyprus enacted Law 26(I)/2024, which amends Cyprus Companies Law Cap 113 to transpose Directive (EU) 2019/2121 (the Mobility Directive). The amendments enhance procedures for cross-border conversions, divisions, and mergers among EU entities.

Cross-border conversions, divisions, and mergers

New sections 201HA to 201HK introduce a legal regime for cross-border conversions of limited liability companies. Companies may convert their legal form and transfer their registered office to another EU state without dissolving, while preserving legal continuity.

Sections 201ΛΑ to 201ΛΚ establish rules for cross-border divisions. The existing framework for cross-border mergers (sections 201Θ to 201KZ) was also revised to align with the new directive.

The prior redomiciliation provision remains available, particularly when a conversion cannot apply (for example, relocating to or from a non-EU jurisdiction). The amendment law clarifies that any conversion or reorganization commenced before the effective date is not invalidated, so long as certain filings were already made.

Stakeholder protections and procedural safeguards

The revised law mandates both the Registrar of Companies and Intellectual Property and the Court to oversee cross-border conversions. In addition:

- Directors must prepare a draft conversion plan covering new legal form, registered office, compensation, impacts on stakeholders, and timeline.

- A report to shareholders and employees must highlight legal and financial implications.

- An independent expert is required to review and comment on the adequacy of cash compensation for dissenting members.

- Creditors dissatisfied with safeguards may petition the court within three months.

- A pre-conversion certificate must be obtained from the Cyprus Court and then forwarded to the relevant EU authorities.

In summary, these Cyprus Companies Law amendments strengthen alignment with EU corporate mobility standards, adding procedural clarity and protection for stakeholders under Cyprus Companies Law Cap 113.

Rights and duties under Cyprus Companies Law

Companies, directors, and shareholders have distinct roles and responsibilities under Cyprus Companies Law 113. Here are the key rights and obligations that form the foundation of sound corporate governance and compliance in Cyprus.

Shareholder rights

Shareholders hold fundamental entitlements that protect their financial and decision-making interests. They can attend general meetings, vote on significant matters, and receive dividends once declared.

Access to essential records, such as financial statements and statutory filings, also supports accountability and informed participation. Minority shareholders further benefit from judicial protection in cases of unfair treatment or mismanagement.

Key takeaways:

- Right to vote and participate in general meetings

- Entitlement to declared dividends

- Access to financial and statutory information

- Legal remedies against unfair prejudice

Directors’ duties

Directors carry fiduciary responsibilities to act in good faith and in the company’s best interests. They must apply due care, skill, and diligence in managing operations, proper recordkeeping, and comply with reporting obligations. Neglect or misconduct may result in financial penalties or legal liability.

Key takeaways:

- Duty of care, skill, and loyalty

- Obligation to act in the company’s best interests

- Responsibility for maintaining accurate records and filings

- Liability for breaches of statutory or fiduciary duties

Navigating these responsibilities alone can be complex. BBCIncorp provides the clarity and expertise businesses need to meet Cyprus law company obligations efficiently. Discover how in the next section.

BBCIncorp support for Cyprus company formation

Registering a Cyprus law company under Cyprus Companies Law requires nuanced handling of local processes, verification, and ongoing compliance. BBCIncorp offers a seamless and professional solution for businesses seeking reliable support in Cyprus.

End-to-end incorporation services

With BBCIncorp, you benefit from a streamlined registration process that typically completes in just a few working days. We handle name reservation, preparation of the Memorandum and Articles of Association, and electronic filing to the Registrar.

Our Cyprus offshore company packages also include registered office services and nominee director or shareholder options when needed.

Compliance and maintenance support

After registration, BBCIncorp continues to assist with ongoing statutory duties. In particular, we provide services such as maintaining statutory registers, filing annual returns, and fulfilling mandatory KYC and accounting obligations. Further, you will gain access to our Client Portal for real-time visibility into tasks and deadlines, with automated notifications and dedicated support.

Why BBCIncorp professional support

Attempting to navigate these obligations alone introduces risk. BBCIncorp helps you avoid common mistakes, ensures full regulatory compliance, and accelerates time to market. With our global advisory network and local expertise, your business gains confidence and operational resilience in Cyprus.

Conclusion

Cyprus Companies Law Cap 113 is central to building transparent and well-governed businesses. Compliance enhances credibility, secures investor confidence, and supports access to the EU market. A compliant Cyprus law company enjoys the advantages of a strong legal system and a favorable business environment.

With professional guidance, companies can meet these obligations efficiently. BBCIncorp offers expert assistance in Cyprus company registration, compliance, and maintenance to ensure smooth operations from start to finish.

For personalized support or more information about doing business in Cyprus, contact BBCIncorp team at service@bbcincorp.com today to receive timely assistance.

Frequently Asked Questions

What are the common compliance challenges businesses face in Cyprus?

Businesses operating under the Companies Law Act Cyprus often face compliance issues related to timely filings, maintenance of statutory registers, and adherence to accounting standards.

Frequent mistakes include delays in submitting annual returns, incomplete financial documentation, and inadequate updates to company records. Companies also face increasing regulatory scrutiny concerning anti-money laundering controls and cross-border transactions.

These challenges are more common for entities with international structures or multiple shareholders, where consistent monitoring and record accuracy are critical to meet the requirements of the Cyprus Companies Law amendments.

What is the minimum share capital required under Cyprus Companies Law?

The Cyprus Companies Law Act sets no strict minimum share capital for a private limited company, making incorporation accessible to both local and foreign investors. Most companies start with an authorized share capital of €1,000, divided into 1,000 shares of €1 each, though even one share is sufficient. Public companies, however, must maintain a minimum issued share capital of €25,630.

What are the penalties for non-compliance with Cyprus Companies Law?

Non-compliance with the Cyprus Companies Law Cap 113 can result in administrative fines and legal consequences. Failure to submit annual returns or audited financial statements on time typically leads to penalties starting from €50, with additional daily fines for continued delay. More serious breaches, such as failure to maintain statutory records or provide accurate information to the Registrar, can lead to prosecution or the company being struck off the register.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.