Table of Contents

Businesses frequently encounter the terms tax avoidance vs. tax evasion, yet the distinctions between them remain widely misunderstood. Although tax evasion, tax avoidance, and tax planning are all connected to reducing tax liabilities, they operate on very different legal and ethical grounds. Misinterpreting these concepts can expose companies to unnecessary risks, from regulatory penalties to reputational damage.

This article breaks down each concept with clear explanations, practical examples, and the legal principles that govern them. By clarifying where unlawful behavior ends and where acceptable tax strategies begin, it helps businesses and investors recognize which approaches are defensible, which carry compliance risks, and how to structure their tax affairs responsibly across different jurisdictions.

Key takeaways

- Tax evasion is not a tax-saving strategy but a criminal act. It relies on concealment and fraud, undermines the integrity of tax systems, and exposes businesses to the harshest consequences, financial penalties, prosecution, and long-term reputational damage.

- Tax avoidance stays within the law but operates on fragile ground. While technically compliant, aggressive structures can be challenged, recharacterized, or penalized when they lack transparency or commercial substance. Avoidance minimizes tax, but it also heightens regulatory risk.

- Tax planning is the only approach that delivers sustainable tax efficiency. It aligns tax optimization with legal requirements, business purpose, and documentation standards, enabling companies to reduce tax responsibly, defend their positions, and build long-term compliance resilience.

What is tax evasion?

Tax evasion refers to the deliberate act of reducing or eliminating tax liabilities through illegal means. It involves intentionally misrepresenting financial information, hiding income, overstating expenses, or using schemes designed to deceive tax authorities.

Unlike tax avoidance or tax planning, tax evasion is always unlawful and is treated as a criminal offense in most jurisdictions.

Tax evasion can occur through different methods, each reflecting how individuals or businesses attempt to disguise their true financial position:

- Income-based evasion: concealing, diverting, or underreporting revenue generated from employment, business activities, or investment sources.

- Deduction or expense manipulation: misrepresenting, fabricating, or overstating deductible expenses to reduce taxable income.

- Reporting and structural evasion: hiding assets, maintaining undeclared offshore accounts, or intentionally failing to file required tax returns.

These categories describe the mechanisms behind the offense, while the specific behaviors associated with each become clearer through real-world examples.

Examples of tax evasion

In practice, tax evasion often appears through identifiable patterns of concealment or misrepresentation. Compliance resources such as Skillcast highlight several common behaviors that illustrate how taxpayers may deliberately avoid their obligations:

- Underreporting cash income, particularly in cash-intensive sectors such as retail, hospitality, or informal services.

- Operating unregistered or partially disclosed business activities to avoid declaring taxable revenue.

- Paying employees informally, allowing employers to circumvent payroll taxes and statutory contributions.

- Submitting falsified invoices or inflated expense claims to reduce taxable profit.

- Using shell entities or nominee owners to obscure the beneficial ownership of income-producing assets.

These examples show how tax evasion typically relies on intentional misrepresentation designed to hide the true economic reality from tax authorities.

Is tax evasion legal?

Tax evasion is universally treated as an illegal act because it involves deliberate fraud against the tax system. Most jurisdictions categorize it as a criminal offense, often linked to broader financial crimes when falsified documents or concealed assets are involved.

What is tax fraud, and how does it relate to tax evasion?

Tax fraud is a broader concept that refers to any intentional act of falsifying, manipulating, or withholding information submitted to tax authorities. It covers a wide range of misconduct, including fake documentation, concealed assets, and misrepresented financial statements.

Tax evasion is one of the most serious forms of tax fraud, distinguished by the deliberate attempt to avoid paying taxes that are legally owed. Because of its direct impact on government revenue and its reliance on fraudulent behavior, tax evasion is subject to strict enforcement and criminal prosecution.

What are the consequences of tax evasion?

The consequences of tax evasion are serious because most tax authorities classify intentional noncompliance as a criminal offense. Depending on the jurisdiction, enforcement actions may include financial penalties, criminal charges, and recovery measures aimed at deterring deliberate evasion.

Key consequences imposed by major tax authorities include:

- Substantial financial penalties

The U.S. Internal Revenue Service classifies tax evasion as a felony under Internal Revenue Code §7201, with fines up to US$100,000 for individuals and US$500,000 for corporations.

The Canada Revenue Agency can impose fines of up to 200% of the tax evaded.

- Interest charges on unpaid tax

Most jurisdictions require taxpayers to pay accumulated interest on outstanding liabilities until full settlement is made.

This applies across the IRS, HMRC, ATO, and CRA frameworks.

- Criminal prosecution and imprisonment

Tax evasion may lead to imprisonment of up to five years under U.S. federal law (IRC §7201).

HMRC and CRA also pursue criminal charges for deliberate evasion, often combined with additional financial sanctions.

- Asset seizure or recovery actions

HMRC applies confiscation orders under the Proceeds of Crime Act to recover unpaid tax. Other jurisdictions may freeze bank accounts or seize assets to enforce collection.

- Reputational damage and regulatory scrutiny

Public prosecution records and compliance monitoring can significantly affect a business’s credibility, especially in regulated sectors or cross-border operations.

Taken together, these consequences reflect a consistent international stance: deliberate tax evasion is treated as a serious financial crime, and authorities enforce strict penalties to safeguard tax integrity.

Understanding tax evasion and its consequences provides a clear foundation for distinguishing unlawful conduct from other tax-related behaviors.

However, not every attempt to reduce a tax burden is illegal. Many strategies operate within the law but can still raise ethical or regulatory concerns. To draw this distinction more accurately, the next section examines tax avoidance, a practice that is legally permissible yet often debated for the methods it employs.

What is tax avoidance?

Tax avoidance refers to the use of legal methods to reduce or defer tax liabilities by structuring transactions, investments, or business operations in a tax-efficient manner. Unlike tax evasion, which relies on deception or concealment, tax avoidance operates within the boundaries of the law, although some strategies may test the limits of legislative intent.

Tax avoidance can take different forms depending on the taxpayer’s strategy and the jurisdiction’s tax rules. Common forms include:

- Income shifting: allocating income to lower-tax jurisdictions, entities, or family members where permitted by law.

- Timing strategies: accelerating deductions or deferring income recognition to manage taxable income across periods.

- Entity or structure selection: choosing a business entity (e.g., partnership, trust, holding company) to benefit from lower tax rates or specific exemptions.

- Utilizing tax incentives and reliefs: making use of government-approved deductions, incentives, or credit programs to legitimately reduce tax liability.

These forms illustrate how tax avoidance focuses on optimizing tax outcomes without breaching statutory requirements, though its acceptability often depends on how transparently the strategies are applied.

Examples of tax avoidance

While tax avoidance remains legal, the strategies used can vary widely in complexity. Taxpayers often apply tax-efficient mechanisms such as:

- Contributing to tax-advantaged retirement accounts to defer taxation on earnings.

- Claiming eligible deductions and credits for education, home office expenses, or energy-efficient investments.

- Structuring income to qualify for lower tax brackets, such as shifting dividend income or capital gains to entities or individuals taxed at lower rates.

- Utilizing business deductions legitimately, including depreciation, allowable expenses, and incentive programs.

- Taking advantage of tax treaties to reduce withholding tax on cross-border payments.

These examples demonstrate how tax avoidance leverages existing tax rules without breaching compliance obligations.

Is tax avoidance legal?

Tax avoidance is generally considered legal because it relies on tax rules as written, rather than on concealment or fraud. Most jurisdictions permit taxpayers to arrange their affairs in a tax-efficient manner, provided the strategies remain transparent and do not involve misrepresentation.

However, the legality of tax avoidance often depends on intent and structure. Some aggressive forms, such as artificial arrangements lacking commercial substance, may be challenged by tax authorities under anti-avoidance doctrines.

Distinguishing tax avoidance from unlawful conduct requires careful attention to transparency and legislative intent. To further clarify how businesses can reduce tax liabilities responsibly, the next section examines tax planning, a structured and fully compliant approach to managing tax obligations.

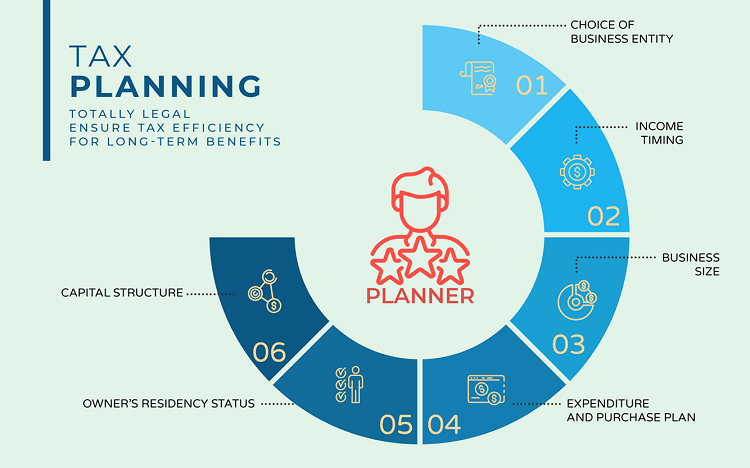

What is tax planning?

Tax planning, similar to tax avoidance, is legally allowed.

Generally, tax planning is the process of maximizing your tax benefits under eligible provisions of the tax framework. It reduces your tax liability through a variety of means, namely deductions, credits, rebates, and exemptions provided under the Income Tax Act or the corresponding tax laws.

To give an example, you can look for incentives from tax planning by saving via retirement plans. You can also make investments in fixed deposits, mutual funds, provident funds, or other similar accounts for the reduction of tax liability.

A key feature of tax planning is its relation to the future, whether short-term or long-term. To bring the best possible outcome for tax planning, you should take some essential factors into consideration:

- Choice of business entity

- Timing of income

- Size of business

- Planning for expenditures and purchases

- The owner’s residency status

- Capital structure

Among the three methods, tax planning is the most upright approach because it complies with the provisions of the tax laws. There are many strategies for good tax planning for your company, the key of which many startups and entrepreneurs have opted for incorporating an offshore company thanks to its great benefits of tax efficiency.

Tax havens

Tax havens, or “offshore financial centers” are efficient methods for tax planning purposes, offering an attractive tax regime and a high degree of secrecy for your business. Discover our latest findings on the Hong Kong tax haven and its future prospects!

A clear understanding of tax planning shows how tax obligations can be managed lawfully through structured and transparent strategies. To see its significance in context, it is helpful to compare tax planning alongside tax avoidance and tax evasion and understand how each one occupies a distinct place within the broader tax landscape.

What is the difference between tax evasion, tax avoidance, and tax planning?

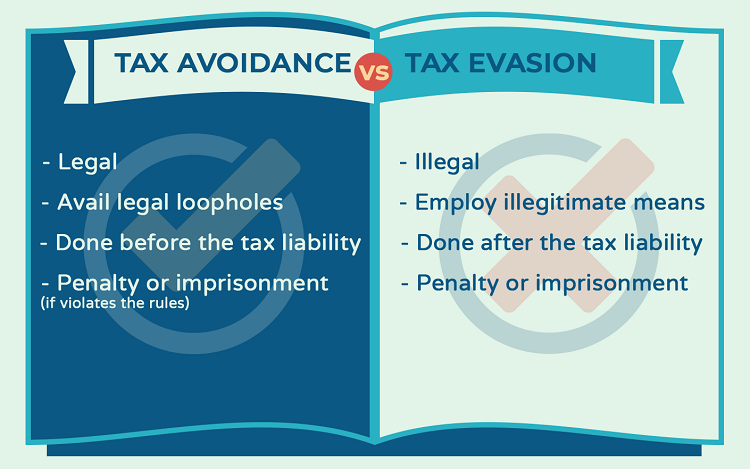

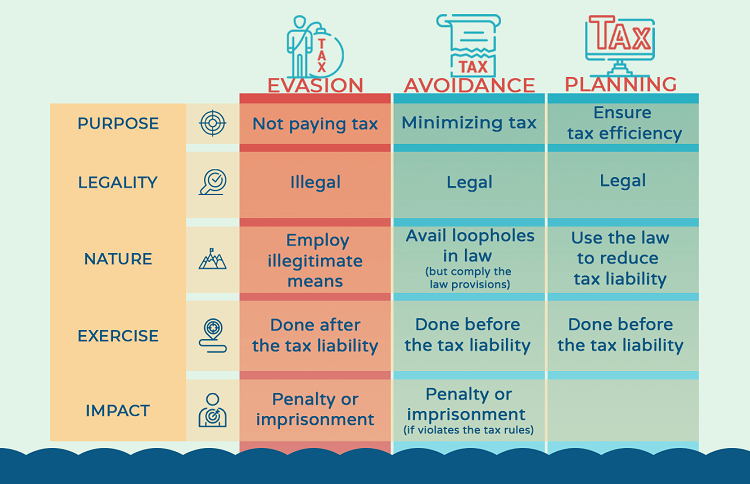

Although tax evasion, tax avoidance, and tax planning all relate to how businesses manage their tax liabilities, the three concepts operate on entirely different legal and compliance foundations.

Misunderstanding these distinctions can lead to unintended regulatory risks or the application of strategies that fall outside acceptable tax practice.

By examining their purpose, legality, and underlying nature, it becomes easier to identify how each approach fits within the broader tax framework.

We have created a comprehensive summary video that you might find interesting. Please feel free to view it at your convenience to glean valuable insights and helpful information for your business.

The distinctions can be summarized as follows:

| Aspect | Tax Evasion | Tax Avoidance | Tax Planning |

|---|---|---|---|

| Purpose | Reduce or eliminate tax unlawfully through concealment or misrepresentation. | Minimize tax by taking advantage of provisions in the law, sometimes in aggressive ways. | Optimize tax efficiency through lawful and transparent strategies. |

| Legality | Illegal and considered a criminal offense. | Legal in principle, but may be challenged if lacking commercial substance or violating anti-avoidance rules (GAAR). | Fully legal and encouraged when aligned with both the letter and spirit of the law. |

| Nature | Relies on deception, falsified information, or concealment. | Exploits gaps or favorable interpretations in tax rules, while remaining technically compliant. | Based on clear documentation, compliance, and economic purpose. |

| Common Practices | Underreporting income, hiding assets, falsifying records. | Income shifting, treaty shopping, timing strategies. | Choosing efficient structures, using incentives, planning transactions. |

| Consequences | Subject to heavy fines, interest, asset seizure, and criminal prosecution. | May be re-characterized by tax authorities and result in adjustments or penalties if deemed abusive. | No penalties when executed properly. |

Understanding these differences helps businesses evaluate how tax strategies align with their risk tolerance, transparency requirements, and long-term compliance obligations.

Important Tips

The taxes you pay will depend greatly on your business jurisdictions. You must understand the tax system of the countries you’re operating in, to take advantage of and maximize your tax benefits.

Take a look at our guidelines for Hong Kong Tax System or Singapore Corporate Tax for more reference!

Special considerations for choosing the right tax reduction manner

While the nature of tax planning is quite obvious, there seems to be some confusion over the difference between tax evasion and tax avoidance. As such, you should be fully aware of the tax practices being used.

In this regard, two essential tips that you need to take into account are as below:

- Acquire knowledge of tax laws and methods for the reduction of tax liability in the most efficient way. Keep in mind, differentiating such methods based on their purpose, legality, and features is very crucial as this would help you stay out of trouble and penalty.

- Seek advice from a professional tax expert or service firm. This is also a good idea as the person with his/her area of expertise will always know how to apply the tax law to decrease your tax burden and maximize your benefits. Tax regulations are constantly changing, and whether your tax-saving instrument is correct or not should be put under specific advice upon circumstances by tax experts as well.

Conclusion

In a nutshell, there are three instruments that taxpayers usually opt for to minimize their tax liability, including Tax planning, Tax avoidance, and Tax evasion. Each method provides a different manner for tax reduction. Note, however, that tax avoidance and tax planning are legal practices. By contrast, tax evasion is deemed as a means of fraud in most cases.

Should you have any further inquiries or require additional assistance, please do not hesitate to reach out to our friendly and experienced consultants via service@bbcincorp.com for more practical advice!

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.