Table of Contents

Why is an offshore holding company an ideal structure for international businesses seeking global expansion? Many entrepreneurs choose this setup because it offers strategic advantages, including efficient tax planning, centralized asset management, and enhanced protection of investments. The key factor, however, is selecting the right jurisdiction, as certain locations provide access to extensive tax treaties and regulatory flexibility, which can be highly beneficial for long-term business growth.

In this article, BBCIncorp provides insights into the common uses and advantages of an offshore holding company. We also highlight important considerations to keep in mind when deciding where to establish your holding company to optimize its benefits.

Key takeaways

- An offshore holding company helps centralize ownership of shares or assets, generating passive income from dividends, interest, rent, or royalties, while improving tax efficiency and asset protection.

- Selecting the right jurisdiction is crucial. Popular destinations include Hong Kong, Singapore, BVI, Cayman Islands, Ras Al Khaimah, Belize, Cyprus, Mauritius, Seychelles, and the Netherlands.

- Investors should consider the economic substance requirements, privacy rules, and compliance obligations in each jurisdiction to ensure their holding company structure is legally compliant and efficient.

Offshore holding company structure: How can it be used?

Simply put, a holding company does not engage in any trading activities but is established to hold shares or assets of other companies. Assets here can be financial instruments (e.g., stocks), intellectual properties, or real estate.

By extension, it’s also for holding intellectual properties, real estate, and many other instruments. The holding company would then receive passive income through such investment holdings. Examples of passive income of the holding structure are:

- Dividends, interests, and capital gains from stocks, bonds, and other financial instruments

- Rent from holding real estate

- Royalties for holding intellectual properties

Why incorporate a holding company offshore?

An offshore company has various uses, such as reducing withholding tax, increasing asset protection, and enhancing privacy. Incorporating your holding structure as an offshore company can further enhance its efficacy.

If properly structured, an offshore holding company can provide its subsidiaries with proper corporate tax optimization, enhanced liability protection, and more. Here are several perks you can look forward to when setting up an offshore holding company:

- Separate liability

If the subsidiary is at the receiving end of litigation, the parent company is not responsible. - Financial segregation

Losses incurred by the child companies are detached from the parent company.

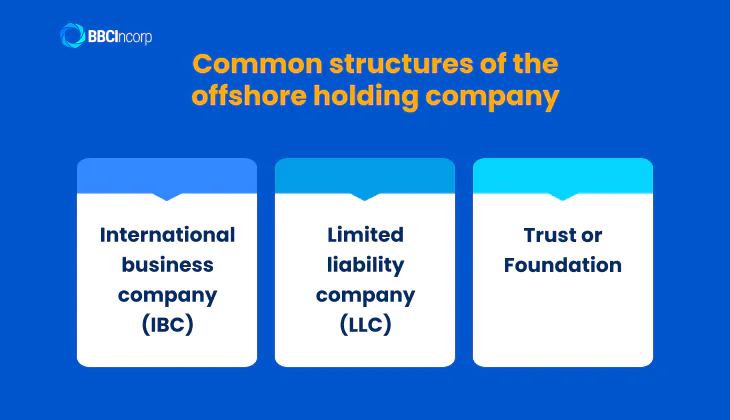

Common structures of the offshore holding company

An offshore holding company structure is set up under the following forms:

- International business company (IBC)

As an IBC, the offshore holding company can partake in international trading or financial investments.

- Limited liability company (LLC)

LLC setups are more straightforward than corporations. An LLC can help protect personal assets and is legally independent of its owners.

- Trust or Foundation

These entity types are effective for succession planning and even asset protection. Both a Trust and a Foundation are constructed based on different law systems. By order, they are the civil law system and the common law system, respectively.

You might also be interested in other types of holding structures, such as Seychelles Special License Company (CSL), BVI Segregated Portfolio Company, Belize Protected Cell Company, etc.

What are the advantages of an offshore holding company?

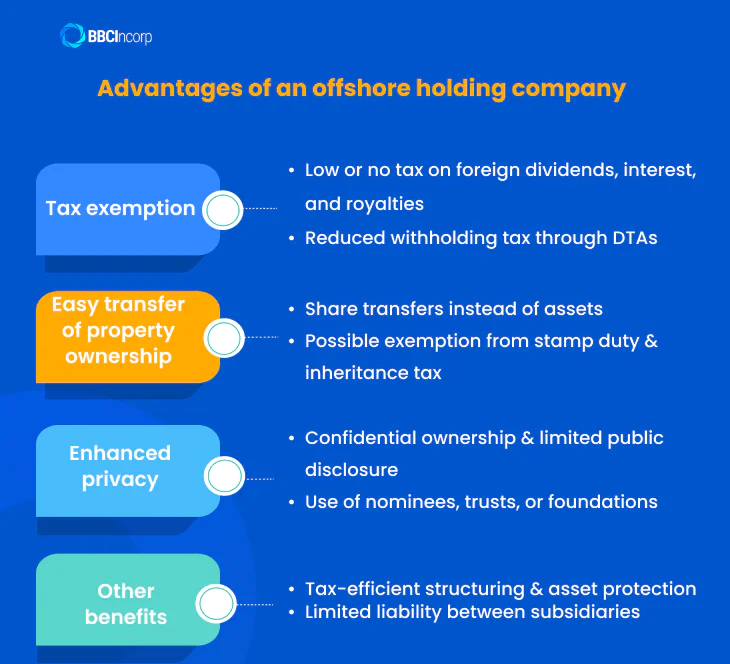

There are many benefits to offshore holding structuring options. Below are some of the highlights that you must know:

Tax exemption

A big part of an offshore holding company’s identity is its helpful tax breaks. Below are some fictitious scenarios on how offshore holding can help maximize your revenue streams.

Dividends and interest

Many offshore jurisdictions offer tax incentives for foreign investors with asset-holding structures. You can cut a considerable amount of tax liabilities on various revenue sources.

For instance, Belize has a territorial tax system that only targets income sourced domestically. By incorporating a holding structure here, your foreign-sourced income will not be taxed!

Now it’s just a matter of finding jurisdictions that have Double Tax Treaties (DTAs) with your own. Set up your subsidiaries (B) there, and you’ve got yourself a prime tax reduction line-up! Any dividends and interest payouts made by the subsidiary will get a reduced withholding tax treatment.

Since Belize doesn’t levy withholding taxes, your foreign-sourced income is in the clear. So, the offshore holding company in such cases pays no tax.

Royalties

The tax benefit also applies to royalties paid to intellectual holding companies. If we apply the same principle, the outcome stays the same.

Set up your IP holding company in a jurisdiction that imposes no withholding tax. License your IP to a company in any country that has the same tax incentive or at least a mitigation of it.

Easy transfer of property ownership

The flexibility of a holding company is also shown in the ease of ownership transference.

The worth-mentioning fact is that such transfers can be precluded from stamp duty and inheritance tax. In the case of transferring underlying properties owned by an offshore holding company to heirs, there would be no inheritance tax applied.

Moreover, associated payments during transactions, like stamp duty or similar legal charges of an overseas holding company, may not exist.

Generally, overseas holding companies allow business owners to maximize their profits efficiently when it comes to the transfer of ownership of property.

Enhanced privacy

Concerning confidentiality, setting up an offshore company for a holding structure is a good idea. By choosing an appropriate type of business, your company can gain another layer of protection for the company’s information.

Several offshore countries set out strict regulations on the guaranteed privacy of company ownership. Personal data is not allowed to be publicly disclosed unless there’s a legal request from the government. This, therefore, can enable a high level of privacy for offshore companies for holding real estate.

Recommended holding offshore structures for those concerned with these advantages is forming a trust or foundation. Some investors even expect better privacy, and in such cases, they can consider using nominee shareholder or director services.

By acting on behalf of the beneficial owners, the names of those appointed directors or shareholders would be present in the holding company’s papers instead of the owners’.

Other benefits

Establishing an offshore company for investment holding purposes brings you a more efficient tax position through tax restructuring. In addition, the international holding company can also act as a powerful tool for asset protection. This is achieved by separating legal and financial liabilities through each child company.

To be specific, each subsidiary of the offshore holding company is separated and has limited liability. It would not have the responsibility to take on any other subsidiary’s debts or liabilities if no solid proof of the illegal transfer of assets from the said subsidiary is found.

Best offshore jurisdiction for a holding company

Choosing the right jurisdiction for your offshore holding company has a significant impact on your tax efficiency, asset protection, and long-term operational flexibility. Each country follows its own rules for holding entities, so your structure should match your business model and your business needs.

When comparing options, two factors often guide the decision: how flexible and business-friendly the regulatory framework is, and whether the jurisdiction maintains double tax treaties. You can also use our offshore comparison tool to compare features, tax treatment, and compliance requirements in advance.

Below are the most attractive destinations for establishing a holding company, beginning with one of the strongest in Asia.

Hong Kong

Hong Kong stands out as a world-class hub for holding structures thanks to its territorial tax system, transparent regulations, and robust legal infrastructure. Dividends and capital gains from overseas subsidiaries are generally not taxed.

Hong Kong also maintains a wide network of double tax treaties with Europe, Asia, and other major markets, enabling reduced or zero withholding tax on dividend and interest flows. Combined with clear incorporation procedures and investor protection, Hong Kong remains a top choice for multinational groups seeking a stable base for global operations.

Singapore

Singapore is another high-quality jurisdiction for holding companies. There is reliable governance, strong corporate laws, and an extensive treaty network. The holding regime is favourable: dividends received from resident subsidiaries are exempt at the holding level, and dividends distributed abroad are not subject to withholding tax.

Furthermore, the nation’s position in Asia and its reputation for regulatory certainty make it ideal for companies managing regional investments or operating in high-growth markets.

British Virgin Islands

The BVI has long been preferred as the best jurisdiction for a holding company. for holding structures thanks to its tax-neutral system, flexible corporate legislation, and the privacy and asset protection framework. Although economic substance rules now apply to pure equity holding companies, the obligations for such entities remain minimal compared to other jurisdictions.

With simple annual requirements and global recognition, the BVI continues to be a leading choice for investment holding and group structuring.

Cayman Islands

The Cayman Islands is another premier jurisdiction for international holding structures, especially for funds, investment groups, and multinational portfolios. Cayman provides a tax-neutral environment, modern company laws, and a globally respected regulatory framework.

While economic substance requirements apply, pure equity holding companies typically face minimal obligations. The jurisdiction’s stable legal system and strong financial services sector make it suitable for complex investment structures and long-term asset management.

Ras Al Khaimah (RAK), UAE

RAK is increasingly popular among investors seeking the best country for holding companies, as a Middle East-based holding structure with flexible rules and cost-effective administration.

Companies in RAK International Corporate Centre (RAK ICC) benefit from a tax-friendly regime, incorporation, and access to the UAE’s expanding network of double tax treaties through proper structuring. The jurisdiction fosters asset protection and modern legislation, making it an appealing option for regional and global investment holding.

Belize

Belize provides a simple and affordable environment for setting up holding companies, with fast incorporation and straightforward compliance. Although Belize does not have a wide treaty network compared to larger financial centres, it offers efficient administration, privacy protections, and a predictable regulatory framework.

Belize has introduced economic substance requirements, so certain holding entities must meet basic compliance standards. The jurisdiction works well for groups seeking an uncomplicated structure for asset consolidation or ownership management.

In addition to the top 6 best offshore company jurisdictions, foreign investors often choose the following countries to establish holding structures:

Cyprus

Cyprus provides attractive benefits for investors seeking an EU jurisdiction. Its participation exemption regime allows dividends and qualifying capital gains to be tax exempt under certain conditions. Cyprus has signed more than 50 double tax treaties, giving holding companies access to reduced withholding taxes when repatriating profits.

As an EU member state, Cyprus also provides legal predictability, alignment with international standards, and straightforward corporate administration, making it a strong option for European investment structures.

Mauritius

Mauritius is widely used for investments into India and African markets due to its stable regulatory system and competitive treaty network of around 30 agreements. The jurisdiction fosters tax certainty, flexible company laws, and access to reduced withholding tax rates through treaty arrangements.

Mauritius has developed a strong reputation as a gateway for cross-border holding and investment activities, supported by a modern financial services infrastructure.

Seychelles

Seychelles suits investors looking for a simple, cost-effective structure in the best place for a holding company for asset holding or group ownership. Although its treaty network is limited, the jurisdiction provides fast company formation, low ongoing compliance requirements, and a supportive business environment. These features make Seychelles an attractive option for holding companies that prioritize administrative ease, flexibility, and operational simplicity over extensive treaty benefits.

The Netherlands

The Netherlands has one of the most sophisticated holding regimes globally. Its participation exemption allows most dividend income and capital gains from qualifying subsidiaries to be tax-free. The country’s extensive double tax treaty network provides significant withholding tax relief, and its legal system creates a high level of certainty for multinational enterprises.

These features make the Netherlands a strategic jurisdiction for complex or large-scale corporate groups seeking long-term stability and tax efficiency in the best countries for holding companies.

It is important to note that several jurisdictions previously considered tax‑friendly, including the BVI, Cayman Islands, Jersey, and low‑tax countries like Mauritius, now impose economic substance requirements (ESR) on holding companies. The scope and intensity of these obligations depend on the jurisdiction and on the structure of the holding company.

In some cases, reduced substance requirements may apply, while in others, full compliance duties are necessary. You can consult legal experts or get in touch with BBCIncorp support team before establishing a holding company as well.

For more information on Belize’s ESR, you can read our Belize Economic Substance Requirements Tax Guide.

For BVI’s ESR, please see our guide to the BVI Economic Substance Requirements.

Issues associated with an offshore holding company

The story of establishing an offshore holding company is not merely about how your company can reap tax benefits on capital gains, dividends, royalties, or interests. A network of double tax treaties available between the country where your holding entity is established and the country where your subsidiary company is located is the primary factor, but still not enough.

A secondary level of consideration should be taken into account. Tax residency tests and certain anti-avoidance international rules are worth mentioning. When it comes to the cross-border corporate structure, the fact that foreign owners are well-versed in anti-abuse regulations would never be useless.

Particularly, you should pay attention to the transfer pricing regime, hindrance of interest deduction, controlled foreign company (CFC) rules, or the recently hot issue – economic substance requirements, in certain offshore destinations.

If the setup is not in a proper manner, transactions between related entities of the holding group can be determined as non-arm’s length transactions. Further tax adjustments may be required thereafter, and more reporting tasks may be requested from competent authorities.

Along with transfer pricing documentation such as master and local files, the holding company can also be the qualifying entity subject to Country-by-Country (CbC) reporting. In Hong Kong, for example, 6.8 billion HKD would be the threshold to consider whether a Hong Kong ultimate parent entity of your multinational group needs to comply with CbC requirements.

To gain better insights into the Hong Kong transfer pricing regime, you can read here: https://bbcincorp.com/hk/articles/transfer-pricing-in-hong-kong-questions.

In some jurisdictions where you consider, tax residency tests can be another important issue. Holding companies with foreign ownership in Singapore can be required to obtain a Certificate of Residence from the Inland Revenue Authority of Singapore (IRAS).

The purpose of this application is to prove their tax residency in Singapore, which will allow them to legally enjoy the tax advantages from the signed DTAs between Singapore and other overseas tax authorities in the arrangement.

Economic Substance

Importantly, you should not disregard the presence of the economic substance (ES) rules in many offshore countries. To put in place ways to curb tax evasion, “treaty shopping’’ and other illegal practices for offshore structure benefits, ES regimes are now widely implemented in most offshore jurisdictions.

The key to note is that holding a business is one of the prescribed relevant activities to be under consideration in the economic substance test. Pure equity holding companies might enjoy reduced substance requirements.

But whatever the case may be, it is relatively necessary for the offshore company to be well prepared for appropriate economic substance when structuring its holding structure.

FATCA and FBAR

The International Account Tax Compliance Act (FACTA) compels US citizens to report their foreign financial accounts and assets to the Internal Revenue Service (IRS). Second, FATCA requires foreign financial institutions to comply with certain standards (also some non-financial organizations).

In short, this cross-collaborative effort aims to combat tax evasion and other harmful tax practices from offshore accounts specifically belonging to U.S. citizens. In conjunction with this regulation is the Foreign Bank and Financial Accounts Reporting (FBAR), which is to verify the legitimacy of your offshore earnings.

If you want to find out more about the compliance requirements of either regulation, refer to FATCA Reporting Requirements.

Free ebook

New to offshore business landscapes?

All the essential information you need is right here.

Offshore holding company registration made easy with BBCIncorp

Setting up an offshore holding company can help you centralize ownership, manage investments, and optimize tax efficiency. BBCIncorp makes the process simple and efficient, guiding you through every step so you can focus on growing your business while we handle the paperwork and lengthy processes.

In particular, we provide end-to-end support for offshore holding company registration, including:

- Company formation in reputable offshore jurisdictions

- Compliance guidance, including economic substance requirements (ESR)

- Preparation of corporate documents and filings

- Assistance with bank account setup and nominee services

- Advice on structuring your holding company for operational and tax efficiency

Additionally, BBCIncorp provides ongoing support to maintain compliance with annual regulatory obligations. Through our secure Client Portal, businesses can access and manage all corporate information, monitor the registration process, operations, compliance deadlines, retrieve essential documents with ease, and receive timely help from our team for any inquiries you might have.

Whether your holding company is in Hong Kong, Singapore, BVI, or other leading offshore jurisdictions, BBCIncorp delivers professional guidance and fast offshore company registration services. Visit our site or contact BBCIncorp today.

The bottom line

To sum up, establishing an offshore holding company offers numerous advantages, from centralizing investments and streamlining ownership to enhancing operational efficiency and strategic tax planning. However, selecting the right jurisdiction and ensuring compliance with local regulations are essential steps to maximize these benefits.

At BBCIncorp, our dedicated team provides professional guidance on choosing the most suitable offshore structure for your specific business needs, handling company formation, documentation, and ongoing compliance requirements. Get in touch with our team at service@bbcincorp.com for tailored advice and support on registering an offshore holding company.

Frequently Asked Questions

Can an offshore holding company own property or intellectual property (IP)?

Yes. An offshore holding company can legally hold both real estate and intellectual property assets. This includes owning buildings, land, patents, trademarks, and other intangible assets. Using a holding company for property or IP can simplify management, centralize ownership, and optimize tax planning, especially in jurisdictions with favorable rules for royalties or licensing.

However, companies must comply with local regulations and any economic substance requirements, which may involve maintaining offices, staff, and performing decision-making locally. This makes sure that the structure is recognized by tax authorities and avoids potential compliance risks.

What is the difference between an offshore company and an offshore holding company?

An offshore company is any business incorporated in a foreign jurisdiction, often to benefit from favorable regulations or taxation. An offshore holding company is a specific type of offshore company that primarily owns shares, assets, or investments of other companies, without engaging in active commercial operations. In contrast, a standard offshore company can conduct trading, services, or manufacturing.

The main distinction is functional: a holding company focuses on ownership and asset management, and a general offshore company may carry out operational business activities.

What are the economic substance requirements for offshore holding companies?

Certain jurisdictions, including the BVI, Cayman Islands, and Mauritius, require offshore holding companies to demonstrate real economic activity. This involves conducting management and decision-making within the jurisdiction, maintaining adequate premises and staff, and documenting core income-generating activities. These requirements ensure that holding companies are not merely shell entities and comply with OECD and EU international tax standards.

Please note that the specific obligations may vary depending on the jurisdiction and type of holding company, so contact us for more detailed advice on your specific needs.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.