Table of Contents

Forming a limited liability company is only the first step. Business owners must also renew LLC status each year to maintain compliance and avoid disruptions. Renewal ensures your business remains in good standing with the state, keeps liability protections active, and supports uninterrupted operations. Whether you are managing a single-member entity or a growing company, renewing LLC status on time is essential.

This article outlines everything you need to know about the annual renewal process. We will discuss how to renew an LLC step by step, understand renewal timelines, and see what happens if deadlines are missed. We will also explain how BBCIncorp supports renewal LLC requirements so you can focus on running your business confidently.

Do you have to renew your LLC every year?

Starting an LLC is only the beginning of your business journey. To remain active and in good standing, most states require you to renew LLC status through periodic filings and payments.

Business owners often ask, Do I have to renew my LLC every year, or how often do you have to renew your LLC. And the answer depends on where the company is registered.

Is LLC renewal mandatory for every business?

LLC renewal is mandatory for every business in nearly all U.S. states. While the term renewal may not appear in official documents, most states require an Annual Report, a Franchise Tax filing, a Statement of Information, or a similar document that serves as the LLC renewal process.

Each jurisdiction uses slightly different terminology and procedures. For example, Delaware requires an annual Franchise Tax and report. California mandates a Statement of Information, while New York asks for a Biennial Statement. These filings help states verify your company’s ongoing existence, business address, and ownership structure.

No matter if you’re managing a small LLC or a growing entity, the answer to do you have to renew your LLC every year will almost always be yes. Nonetheless, the responsibilities are subject to state-level variations.

How often do you have to renew your LLC?

Renewal frequency varies by jurisdiction. In many states like Florida, New Jersey, and Texas, you must renew your LLC every year. Others, such as California and New York, follow a biennial schedule, requiring updates every two years.

Several states combine the annual report and tax filing into one submission. For example, in Illinois, the annual report includes a filing fee, while in Tennessee, franchise and excise taxes are tied directly to your LLC’s standing. These variations can create confusion, especially for foreign owners or those managing multiple entities across states.

The question do you have to renew your LLC applies equally to both single-member and multi-member LLCs. No matter the ownership structure, all entities must comply with renewal rules to retain liability protection and legal status.

If you’re asking yourself, ‘do you have to renew LLC every year?’ and are unsure where your business stands, seeking expert support is the next best step.

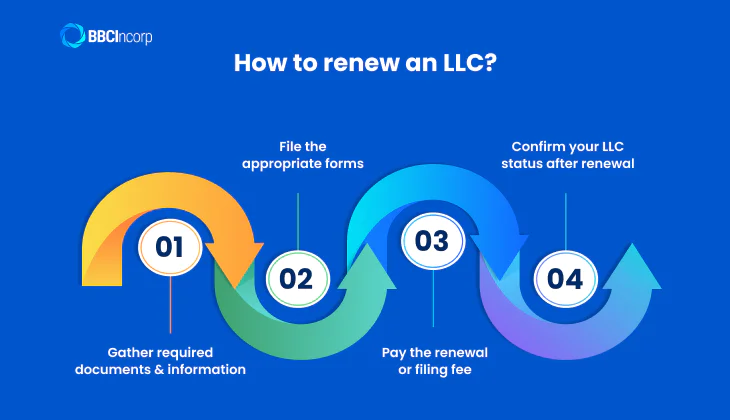

How to renew an LLC: Step-by-step guide

Renewing a Limited Liability Company is a vital process to keep the business legally compliant, maintain good standing with state authorities, and avoid costly penalties or dissolution.

While forming an LLC is a one-time event, renewal is a recurring requirement that varies slightly by state. This section provides a practical, state-agnostic framework for how to renew an LLC efficiently.

Step 1: Gather required documents and information

Before beginning the renewal process, prepare essential LLC documents. Most states request the same core details:

- Legal business name and registration number: This helps the state match your LLC’s records accurately.

- EIN (Employer Identification Number): This is the federal tax ID assigned to your business by the IRS. For LLCs with multiple businesses or entities, refer to our guide: can you have multiple EIN numbers.

- Registered agent information: You must confirm or update your registered agent’s name and address as the state might mandate a resident agent located in-state.

- Principal business address: This should reflect your primary place of operations or management. P.O. boxes are not accepted in many jurisdictions.

Step 2: File the appropriate forms

Each state requires different forms for LLC renewal. The most common include:

- Annual Report: Lists ownership, registered agent, and principal address. Filed in states like Florida, New York, and Washington.

- Statement of Information: Used in states such as California. It often serves the same purpose as an annual report.

- Franchise Tax Return: Required in states like Delaware and Texas. It calculates the annual tax owed for doing business in the state.

These documents can typically be submitted online through the Secretary of State or Department of Revenue portals. Look for official domains ending in “.gov” to avoid third-party service traps. Unauthorized sites charge excessive fees or may not file at all. Always verify you are using your state’s legitimate portal to protect your LLC.

Step 3: Pay the renewal or filing fee

The cost of renewing an LLC varies widely by state. On average:

- Low-cost states: Arizona and New Mexico typically charge around US$50.

- Mid-range: Most states, including Colorado and Georgia, fall in the US$100 to US$200 range.

- Higher-cost states: California and Massachusetts may charge US$300 or more.

If you miss the deadline, states often impose late fees, administrative penalties, or suspend your business status. These can range from US$25 to hundreds of dollars depending on how long the renewal remains outstanding. Some states may also revoke your business privileges or require a reinstatement application if delays continue.

Accepted payment methods include major credit cards, ACH transfers, or debit cards. In some jurisdictions like Texas and Illinois, fee waivers or reduced fees are available for veteran-owned or nonprofit LLCs.

Step 4: Confirm your LLC status after renewal

After submitting all documents and payments, you should receive confirmation of your LLC’s active status. This confirmation is usually emailed or made available through your state’s business portal.

It is also important to:

- Download and save your proof of renewal: The proof may be called a Certificate of Good Standing or Renewal Confirmation.

- Update business licenses and permits: The municipalities might require a copy of your renewed status to issue or extend local permits.

- Check for follow-up actions: The state will send notifications if errors are detected or if additional documents are needed post-submission.

In most cases, your LLC’s status will be updated within a few business days. However, processing times can extend during peak periods, such as early January or fiscal year-ends.

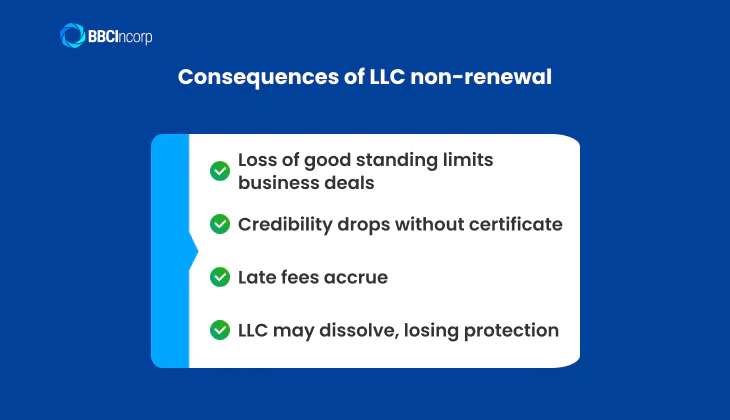

What happens if you don’t renew your LLC?

Not renewing your LLC on time can result in serious legal and financial issues. Each state requires LLCs to submit specific filings and payments every year or two. These are necessary to confirm your company is still active and compliant.

Consequences of non-renewal

When an LLC misses its renewal, it often loses its “good standing” status with the state. This loss may limit your ability to open bank accounts, apply for financing, or enter contracts. Many third parties require a Certificate of Good Standing before doing business, and lack of one may affect your credibility.

In addition to status loss, most states impose late fees or interest on missed filings. Over time, these costs can accumulate. If your business remains inactive long enough, the state may move to administratively dissolve the LLC, meaning the company can no longer legally operate. Any protections tied to the entity, such as limited liability, may no longer apply.

How to reinstate an administratively dissolved LLC

Administrative dissolution refers to the state’s formal removal of an LLC from its register due to non-compliance. Reinstating the LLC typically involves several steps. You will need to submit a reinstatement form, pay any outstanding fees, and file any missing reports. Some states also request a signed affidavit or explanation for the non-compliance.

Reinstatement timelines vary. In some states, it may take a few weeks, while others may require several months of processing. During this time, your business may not operate legally, which may delay contracts, licensing, or vendor relationships.

In more complex cases, you may need to update business licenses or re-register for tax purposes. Restoring full compliance often requires careful review of all filings and payments.

No matter if you aim to manage a single-member or multi-member LLC, regular maintenance protects your business operations and credibility. Renewal is not optional. It plays a central role in preserving your company’s legal and financial standing.

BBCIncorp makes LLC renewal fast and stress-free

At BBCIncorp, we understand that maintaining an active and compliant LLC requires more than just formation. Annual renewal is a critical step. To help clients meet state requirements and avoid unnecessary penalties, we offer a streamlined solution for managing renewal LLC obligations efficiently.

Our role is to take the guesswork out of how to renew your LLC. We monitor annual deadlines, prepare the required filings, and submit documentation directly to the appropriate state agencies.

This includes annual reports, franchise tax returns, and updates to registered agent details where applicable. Clients benefit from structured reminders and professional support that reduces administrative risks and saves valuable time.

Our renewal services include:

- Custom alerts based on jurisdiction-specific deadlines

- End-to-end document preparation and submission

- Ongoing compliance review and support

BBCIncorp’s approach allows business owners to concentrate on growth, knowing their LLC remains in good standing throughout the year.

We support a wide range of jurisdictions. In the United States, Delaware remains a preferred choice for its legal protections and investor confidence. You can explore BBCIncorp Delaware LLC services and why many enterprises choose to establish their presence with our services.

We also serve clients expanding globally:

- Cyprus LLC: Ideal for those seeking EU market

- Cayman LLC: A preferred choice for clients with investment or fund structures thanks to its legislative flexibility

- Other countries such as Belize, BVI, St. Vincent,…: Suitable for specific offshore structuring needs depending on the client’s objectives.

Whether you are forming a new entity or asking how to renew your LLC effectively, our team is positioned to support you at each step. We act not only as a service provider, but as a long-term compliance partner.

If you are preparing to renew your LLC or need guidance on upcoming requirements, reach out to us or visit our site today for more details.

Conclusion

Renewing your LLC each year is not just a legal obligation. It helps protect your limited liability status, keeps your business in good standing, and avoids costly fines or administrative dissolution.

Understanding how to renew an LLC means knowing what documents to prepare, where to file them, and when payments are due. The process typically includes submitting an annual report, paying the renewal fee, and confirming your company’s active status with the state.

If your company operates in multiple jurisdictions, staying on top of compliance can be challenging. BBCIncorp helps business owners renew LLC registrations efficiently by handling filings, reminders, and regulatory updates.

Let us simplify the process and help you stay compliant year after year. Please send us a message at service@bbcincorp.com for timely support.

Frequently Asked Questions

Can I renew my LLC after the deadline has passed?

Yes, in most states it remains possible to renew your LLC after the deadline, though absolute reinstatement may be required depending on how long the business remains inactive.

Initial consequences often include late fees and interest. If the state has administratively dissolved your LLC, you will need to submit a reinstatement application. It typically includes filing past due reports, paying all owed fees and penalties, and possibly completing a statement for confirming compliance.

States generally allow reinstatement within a limited window, commonly two to five years. Acting quickly helps limit disruption and restores good standing more efficiently.

Do I need to renew my LLC if I haven’t started business yet?

Yes, you still need to renew your LLC even if you have not started operations. Once formed, an LLC remains a legal entity until it is formally dissolved. Most states require every active LLC to file regular reports and pay renewal fees to keep their records current. Not submitting these can result in penalties or even administrative dissolution.

In some cases, you may also need to submit a federal tax return, depending on your tax classification, even if no business activity occurred. Staying compliant helps preserve your LLC’s good standing and avoids unnecessary administrative issues.

Is LLC renewal the same as filing taxes?

No, renewing your LLC is a separate requirement from filing taxes. Renewal typically involves submitting an annual report or statement of information and paying a state fee to confirm your business details remain up to date.

This process keeps your LLC in good standing with the state. Filing taxes, on the other hand, involves reporting your income and expenses to the IRS and possibly your state tax authority.

While a few states combine the two processes, like Alabama, which includes LLC reporting in its Business Privilege Tax return, most treat them as distinct compliance obligations that must be handled separately.

What if I want to dissolve my LLC instead of renewing?

If you no longer plan to operate your business, you must formally dissolve your LLC to avoid ongoing renewal requirements and fees. The steps involve filing Articles of Dissolution with your state’s business authority and settling any remaining obligations, such as taxes or outstanding debts.

Simply letting your LLC expire does not end its legal existence and may result in penalties. Proper dissolution prevents confusion with the state and protects you from future liabilities.

In case you’re asking, “Do I need to renew my LLC every year?”, the answer is yes, unless it is properly dissolved. If you’re unsure whether to renew an LLC or close it, consider your long-term plans and consult with BBCIncorp team for support with the process.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.