Table of Contents

Are you looking for a smart way to safeguard your investments and streamline financial management? These days, an increasing number of investors, from those focused on real estate to those active in the stock market and beyond, are choosing the Limited Liability Company (LLC) for its inherent flexibility and liability protection.

So, the fundamental question remains: Why should you consider setting up an investment LLC? This article will explain the core advantages and provide a practical, step-by-step guide to establishing your company in the U.S.

What is an Investment LLC?

Definition of LLC investing

An investment LLC is a limited liability company strategically formed with the primary purpose of holding and managing investment assets. It is a business structure, specifically a separate legal entity that acts as a shield between your personal financial affairs and your endeavors. This distinct legal separation is fundamental to the benefits an investment LLC provides.

The function of this entity is to provide a framework for investing in an LLC, whether individually or by pooling capital with other investors. Establishing clear rules and a legal structure facilitates collective investment.

This pooled capital then translates into joint ownership within the investing entity, granting members a proportional stake in the underlying LLC assets.

The assets used for investment generally cover property ventures, such as acquisition, rent, management, and growth of various property types. Furthermore, it enables private equity, allowing for investments in non-public companies and venture capital. The platform extends to intellectual property, such as the potential monetization of patents, trademarks, and copyrights.

What sets investment LLCs apart from other investment vehicles?

Investments LLCs offer a unique combination of flexibility, control, and liability protection that is often structured differently or less directly available in vehicles like mutual funds and REITs.

- Flexibility and control: Unlike the standardized structures of mutual funds and the real estate-specific nature of REITs, LLC investments let members tailor their strategies, management decisions, and the types of assets they can hold.

- Limited liability: An investment LLC generally shields members’ personal assets from the business debts and legal liabilities associated with the LLC’s activities.

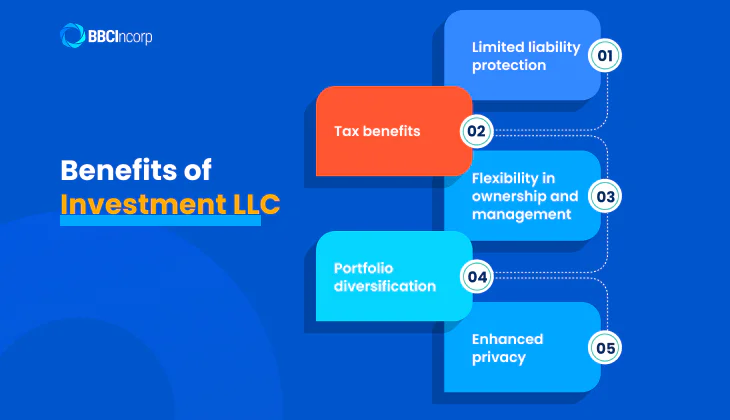

Benefits of using an LLC for investing

Understanding the core advantages of investing in an LLC is crucial before deciding on an investment vehicle.

Limited liability protection

One of the primary reasons why setting up an LLC for investing is the significant limited liability protection it offers. Legally, an LLC separates your personal assets from the business debts and legal liabilities of the company. For instance, if the LLC investment company incurs debt or faces a lawsuit, your savings, home, and other assets are generally shielded.

Investment LLC tax benefits

An LLC investment company offers considerably appealing tax benefits. Typically, an LLC benefits from pass-through taxation. This means that the profits and losses of the entity for investing can be “passed through” directly to the member’s personal income tax returns, avoiding taxation at the business level.

Furthermore, legitimate business expenses incurred by the LLC can often be deducted. An LLC also has the flexibility to elect to be taxed as an S-corp or C-corp.

Flexibility in ownership and management

LLCs offer considerable flexibility in their structure. This entity can accommodate multiple members with varying levels of ownership and management responsibilities, all clearly defined in a customizable operating agreement.

Moreover, an LLC for investment can be structured as either member-managed, where the owners directly oversee operations, or manager-managed, where appointed managers (who may or may not be members) handle the day-to-day activities.

Portfolio diversification

The structure of an LLC is highly conducive to portfolio diversification. By providing a framework for pooling resources, an investment LLC allows members to collectively invest in larger and more varied assets than they might be able to individually. This shared capital base opens doors to opportunities across different asset classes, potentially reducing overall investment risk.

Enhanced privacy

In certain investment scenarios, particularly real estate transactions, using an LLC can offer a degree of enhanced privacy. When the company investing acquires property, the public record may list the LLC as the owner rather than the individual investors. While not absolute anonymity, this provides a layer of separation between the LLC investors and their investment activities.

How are investment LLCs taxed in specific cases?

Navigating the tax landscape for this type of LLC in the U.S. requires understanding the distinct classifications offered by the Internal Revenue Service.

Single-member LLC

For an LLC with a single owner, the standard tax treatment mirrors that of a sole proprietorship. The business itself does not file a separate federal income tax return. Instead, the owner reports all income and expenses on their personal tax return.

- Schedule C (Form 1040) applies if the LLC is engaged in an active trade or business.

- Schedule B (interest and ordinary dividends) and Schedule D (capital gains and losses) are typically used for investment-related income.

- Schedule E is used for rental real estate, royalties, and certain pass-through income but does not apply to traditional stock investments.

When taxed as a sole proprietorship, self-employment tax will only apply to active business income, not passive investment income such as dividends or capital gains.

Multi-member LLC

An LLC with multiple members defaults to partnership taxation and must file Form 1065, which details its earnings, deductions, gains, and losses. The LLC itself does not pay income tax. Instead, it issues Schedule K-1 to each member. Then, the members must report this information on their personal tax returns.

Similar to single-member entities, the self-employment tax for members applies only to active income, such as business earnings, but not to passive income like dividends or capital gains.

Is it better to set up a single-member LLC or multi-member LLC for investment? Read more on the two structures’ pros and cons in our dedicated article.

Corporate structure: S-corp election

An LLC can elect S-corp taxation status by filing, allowing profits and losses to pass through to owners without a corporate income tax. This election can reduce self-employment tax liability if the entity satisfies these requirements:

- The LLC is taxed as an S corporation and must file Form 1120-S.

- Owners must take a “reasonable salary”, subject to payroll taxes (Social Security and Medicare).

- The remaining profits can be taken as distributions and are not subject to self-employment tax.

S-corps are useful for businesses generating substantial active income, but they require careful compliance with IRS rules.

Corporate structure: C-corp election

An investing LLC can elect C-corp taxation by filing Form 8832. Under this structure:

- The LLC is taxed separately as a corporation and must file Form 1120.

- Profits are subject to corporate income tax, and dividends paid to owners face double taxation at both the corporate and personal levels.

- Unlike other structures, a C-corp can retain earnings without immediate tax consequences for owners, offering flexibility for reinvestment.

- Certain fringe benefits, such as health insurance and retirement contributions, can be deductible.

While a C-corp election may not suit smaller LLCs, it can be advantageous for companies planning to scale or reinvest profits.

What can you invest in with an investment LLC?

An investment LLC gives you the flexibility to manage and grow your wealth while keeping your personal assets protected. Whether you’re looking to invest in real estate, stocks, or even digital assets, the investing LLC can serve as a structured vehicle for your investments.

Can you invest in an LLC different from yours? Below are some common assets you can hold within this type of entity:

Real estate

- Rental properties, from single-family homes to multi-unit apartments

- Commercial real estate, like office buildings and retail spaces

- Vacant land for development or long-term speculation

- Agricultural land

Stocks and bonds

- Shares of publicly traded companies (common and preferred stock)

- Corporate and government bonds, including municipal bonds

Pooled investments

- Mutual funds (equity, bond, international)

- Exchange-traded funds (ETFs) tracking broad market indices like the S&P 500

- Sector-specific ETFs focused on industries like technology or healthcare

Digital assets

- Cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH)

- Other blockchain-based investments

Private businesses

- Ownership stakes in privately held companies

- Membership interests in other LLCs

- Partnership shares in various business ventures

Can an LLC hold retirement accounts?

While a U.S. LLC is a great tool for investing, it cannot directly own tax-advantaged retirement accounts such as:

- Traditional or Roth IRAs

- 401(k) plans (Traditional, Roth, SEP, SIMPLE)

These accounts have strict IRS regulations requiring a qualified custodian to hold assets. However, a self-directed IRA (SDIRA) can invest in an LLC, as long as it follows IRS rules to avoid prohibited transactions.

In short, entrepreneurs should consider the strengths, limitations, and tax implications of an LLC before investing in one. Investment LLCs can be powerful tools for building wealth if they are structured correctly.

The importance of an operating agreement in Investment LLCs

What sustains the effective function and safeguards member equity within an investment LLC? The answer is the operating agreement. This vital document sets forth the ownership structure, decision-making methods, and fiscal guidelines that manage the entity’s operations.

A precise operating agreement clarifies member authority, the distribution of earnings and deficits, and the procedure for member entry or departure. In addition, the joint agreement also strengthens the limited liability enjoyed by members and confirms the LLC’s status as a separate legal body.

Lacking this document, state default regulations could dictate the entity’s actions in a way that doesn’t align with member aims. With utmost importance, the operating agreement acts as a key instrument for protecting both the structural assets and the professional connections among its participants.

How to start an investment LLC

Setting up an LLC for investing requires you to follow several essential steps, designed to provide legal protection, operational clarity, and compliance with regulations:

Step 1: Choose your formation state

Begin by selecting the most suitable state for your investing LLC. Can you make an LLC for investing in your city or state? While your home state offers familiarity, you should also explore the advantages of states like Delaware or Wyoming, known for their business-friendly laws and established legal frameworks.

Step 2: Select a unique business name

As a business owner starting an investment LLC, you will need to select an official legal name for the venture. Your LLC’s chosen name must be distinct from existing entities within your selected state and comply with state-specific naming conventions. For example, it typically requires the inclusion of “LLC” or “Limited Liability Company.”

Make sure to conduct a thorough search through the state’s business registry to confirm the name’s availability. Conveniently, many states provide the option to reserve a name for a limited time while you prepare the formation documents.

Step 3: Appoint a reliable registered agent

Next, designate a responsible individual or professional service located within your formation state to act as your registered agent. This agent will be responsible for receiving crucial legal documents and official correspondence on behalf of your LLC. Notably, the agent must maintain a physical address in the state and be available during standard business hours.

Step 4: File your formation documents

Following that, you need to prepare and submit the Articles of Organization (or Certificate of Formation) to the appropriate state agency, often the Secretary of State.

This document generally requires you to provide:

- Complete name and principal address of your LLC

- Name and physical address of your registered agent

- Designated LLC management structure (either member-managed or manager-managed)

- A brief statement outlining the purpose of your LLC

You will also have to pay for state filing fees, which will vary depending on the jurisdiction. For reference, the current filing fee in Delaware is $110.

Step 5: Create an operating agreement

Next, develop a detailed operating agreement to outline the ownership structure, define the members’ roles and responsibilities, and establish the operational procedures for your LLC.

Although not always legally mandated by the state, this internal document is crucial for preventing potential disputes and ensuring smooth operations. Key provisions typically address:

- Capital contributions made by each member and their ownership percentages

- The agreed-upon methods for decision-making processes for the LLC

- The procedures to be followed when adding or removing members

- The specific conditions and steps for the LLC dissolution

Step 6: Obtain your federal EIN for tax purposes

An Employer Identification Number (EIN) is a unique nine-digit number issued by the Internal Revenue Service (IRS) to identify businesses for tax purposes. Even if your LLC has no employees, obtaining an EIN is essential for tax reporting purposes and opening business bank accounts.

You can apply for free directly through the IRS website using the online EIN application. The process is immediate, and you receive your EIN upon completion. Alternatively, you can apply by fax or mail using Form SS-4, though processing will take longer.

Step 7: Establish a brokerage account

Finally, you need a dedicated brokerage account to trade stocks and other securities for investing through an LLC. This ensures a clear separation between personal and business investments while maintaining compliance with legal regulations.

Documents typically required:

- Articles of organization

- Operating Agreement

- EIN confirmation letter

- Resolution authorizing account opening if the LLC is manager-managed or multi-member

Different brokerage firms may have additional requirements, such as member identification documents or a business license (if applicable)..

If you are considering how to start an LLC, you would want to proceed with more caution. Make sure you’re using the official government website for your specific state or jurisdiction.

Requirements and regulations for investment LLCs

Maintaining an investment LLC requires ongoing compliance to protect its legal status and financial benefits. Moreover, neglecting these obligations can result in penalties, loss of limited liability protection, or dissolution of the LLC.

Below are the general requirements you must keep in mind:

State filings and fees

Most states require LLCs to file an annual report and pay a renewal fee, which varies by jurisdiction. For example:

- California: $800 annual franchise tax & additional fees for LLCs with high revenue

- Delaware: $300 annual tax, regardless of revenue

- Florida: $138.75 annual report fee

Additionally, states may require LLCs to maintain a registered agent and keep up-to-date business records.

Federal compliance and reporting

Beneficial Ownership Information (BOI) report

As required under the Corporate Transparency Act, this report must be filed with FinCEN to disclose ownership details. LLCs formed on or after January 1, 2025, must file their report within 30 days of formation.

Tax filings

- Single-member LLC: Reports income on Schedule C (Form 1040)

- Multi-member LLC: Files Form 1065 and issues Schedule K-1s to members

- S-corp election: Requires Form 1120-S

- C-corp election: Requires Form 1120

Other compliance considerations

In addition, you must ensure you identify and obtain all necessary state and local business permits. Maintaining separate bank accounts dedicated to the entity’s finances, and keeping accurate fiscal records are also important for tax obligations and legal conformity.

To navigate these requirements efficiently, you should engage a tax professional or business attorney with credible experience working in the U.S. business environment.

Key mistakes to avoid when using an LLC for investment purposes

While an LLC for investment offers numerous advantages, certain missteps can undermine its effectiveness and expose members to unnecessary risks. Avoiding these common errors is crucial for a successful strategy:

Mistake 1: Inadequate legal documentation

Failing to create a comprehensive operating agreement is a major pitfall. This vital document outlines ownership, management, and dispute resolution. A weak agreement risks internal conflicts and liability protection (Nolo.com).

Mistake 2: Poorly defined capital contributions

Lack of clarity on member contributions (amount, timing, form) creates financial and operational issues. The operating agreement must detail these and ownership stakes for equitable treatment and to prevent future disagreements.

Mistake 3: Neglecting regulatory compliance

Ignoring ongoing rules like licenses, annual reports, and tax obligations is a serious error. Non-compliance leads to penalties and potential dissolution. Stay informed and adhere to all applicable regulations.

Mistake 4: Overlooking exit strategies

Many entrepreneurs neglect how members can sell interests or how the LLC can dissolve. This can cause complex and costly issues later. A defined exit plan ensures orderly transitions and protects all members.

Conclusion

The LLC for investment provides a robust framework for asset management, delivering vital limited liability protection, adaptable taxation (investment LLC tax benefits), and versatile management structures. This entity offers a strategic edge for individuals and groups aiming to pool capital for diverse ventures, from real estate to LLC investing in stocks.

Explore whether setting up an LLC for investing aligns with your financial objectives and risk appetite with the BBCIncorp team! Our expert team at service@bbcincorp.com is ready to provide timely support and guidance through every step.

Frequently Asked Questions

Can I use my regular LLC for investing?

While technically possible, using your regular LLC for investment activities might not be optimal. A standard operating agreement may not adequately address the specific complexities and potential risks associated with investing, such as capital calls, diverse asset management, and specific profit/loss allocation methods relevant to investments.

Creating a dedicated LLC for investment with an operating agreement tailored to these activities can provide clearer governance, better liability protection specific to your investment ventures, and more suitable terms for your investment goals.

You should consult with a professional like BBCIncorp to assess your specific situation.

How to invest in LLC?

Investing in an LLC means becoming a member by contributing capital (cash or assets) for an ownership stake. The operating agreement details how new members are admitted and how their investment determines their ownership percentage.

Potential LLC investors should review this agreement and conduct due diligence before investing. You should examine legal documents like a Membership Interest Purchase Agreement, and formalize the investment terms and the new member’s rights and responsibilities.

Is an operating agreement required for an investment LLC?

While not mandated in every U.S. state, an operating agreement is highly recommended and considered a crucial document for your LLC. Even if your state doesn’t legally require it, the operating agreement provides significant benefits. It clearly outlines the ownership structure, member roles, responsibilities, profit and loss allocation, and decision-making processes.

For an investment-focused LLC, this clarity is vital for managing pooled capital, diverse investment strategies, and potential disputes among members.

Do I need a registered agent for an investment LLC?

Yes, you absolutely need a registered agent for your LLC in every state where it is formed or qualified to do business. This is a statutory requirement in all U.S. states for LLCs. The registered agent is responsible for receiving legal documents and official correspondence on behalf of your LLC.

You can act as your own registered agent if you meet the state’s requirements (including having a physical address in the state and being available during business hours), or you can hire a commercial registered agent service.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.