- What is a limited liability company in Hong Kong?

- Key characteristics of a Hong Kong limited company

- Advantages and disadvantages of limited liability company

- How to form a limited liability company in Hong Kong

- Taxation and compliance for Hong Kong limited company

- Establish your Hong Kong limited company with BBCIncorp

Setting up a limited liability company (LLC) is a smart move for entrepreneurs aiming to protect their assets while running a business. An LLC limits owners’ financial risk, separating personal liability from company obligations—a major advantage for startups and growing enterprises alike.

In Hong Kong, this structure is especially powerful, offering businesses a gateway to Asia’s dynamic markets with minimal barriers and an efficient regulatory system.

For both local founders and international investors, a limited liability company in Hong Kong unlocks opportunities for expansion, credibility, and long-term success. If you’re considering establishing your presence in Hong Kong, here’s everything you need to know about forming and operating a limited liability company successfully.

What is a limited liability company in Hong Kong?

A limited liability company (LLC) in Hong Kong is a business structure where the company is treated as a separate legal entity from its owners, protecting their assets from the company’s liabilities and debts.

An LLC company offers crucial advantages by separating the owners’ liability from business obligations. Owners are only liable for the amount they have invested, meaning personal savings or property are safeguarded if the business faces lawsuits or bankruptcy.

This structure makes the LLC highly attractive compared to sole proprietorships or partnerships, where owners bear unlimited liability and personal assets are at risk.

In Hong Kong, the term limited company is commonly used, specifically referring to a private company limited by shares. This is the most popular form of business entity, ideal for entrepreneurs who want flexibility, credibility, and protection without the complexities of a public listing.

Unlike sole proprietorships and partnerships, a limited company in Hong Kong enjoys continuity despite changes in ownership and offers easier access to funding and investment. It also boosts the company’s professional image, making it more appealing to partners, clients, and investors.

Choosing the right structure is vital for long-term success. Understanding how an LLC company works and how it differs from other business types helps entrepreneurs make informed, strategic decisions for their ventures in Hong Kong’s dynamic business environment.

Key characteristics of a Hong Kong limited company

Understanding the essential features of a Hong Kong limited company is crucial when deciding to set up a business in this dynamic market. Below are the key characteristics of this business entity:

Limited Liability Protection for Shareholders

One of the primary advantages of a limited company in Hong Kong is that shareholders’ liability is limited to their capital contribution to the company. This means that, in the event of business debts or lawsuits, personal assets of shareholders are protected, unlike sole proprietorships or partnerships, where owners bear full responsibility for the company’s liabilities.

Separate Legal Identity

A limited company has a legal identity distinct from its owners (shareholders) and directors. This means that the company can own assets, sign contracts, and conduct business independently of the individuals involved. It can also be held liable for its actions, not the shareholders personally, offering a layer of protection and professionalism for the business.

Flexibility in Ownership, Share Transfer, and Raising Investment

- Ownership Flexibility: Shareholders can transfer or sell their shares freely, depending on the company’s internal rules (articles of association). This offers great flexibility for attracting new investors or making ownership changes.

- Raising Capital: A limited company can raise funds more easily through the issuance of new shares. This enables businesses to scale more efficiently and access various sources of financing.

Succession Planning and Perpetual Existence

A limited company is designed to exist beyond the involvement of any particular individual. This provides perpetual existence, meaning the company can continue operations even if there are changes in ownership or management. This structure is ideal for long-term succession planning, offering stability and continuity for business growth.

In summary, the Hong Kong limited company structure is highly attractive for both local and international entrepreneurs. It offers protection, financial flexibility, and business continuity, all of which are essential for establishing a successful, long-term enterprise in Hong Kong.

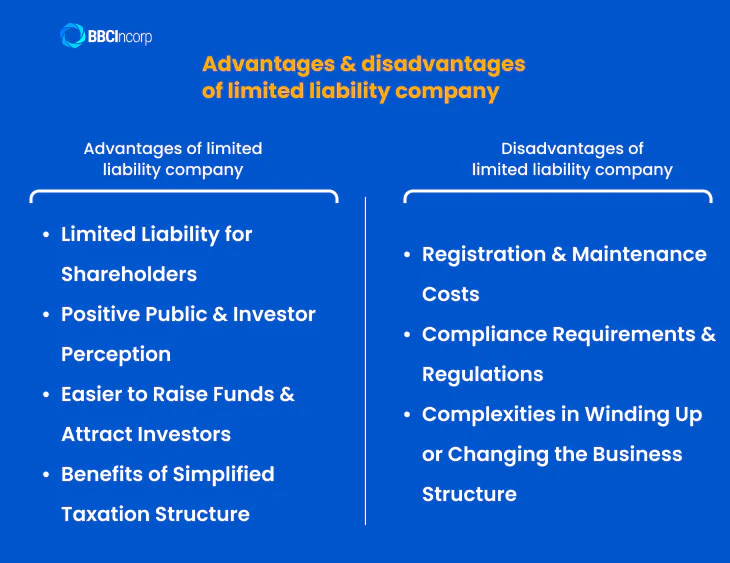

Advantages and disadvantages of limited liability company

An LLC provides a unique structure combining elements of corporations and partnerships. Let’s find out the pros and cons of an LLC:

Advantages of limited liability company

- Limited Liability for Shareholders

The primary benefit of an LLC is the protection it offers to its shareholders. Shareholders’ liabilities are limited to the amount of their capital contribution. This means their personal assets are safeguarded, and they are not held liable for the company’s debts or obligations, unlike in sole proprietorships or partnerships.

- Positive Public and Investor Perception

Operating as an LLC can enhance the company’s credibility. It signals professionalism to potential customers, partners, and investors. The formal structure of an LLC can instill confidence, making it easier to attract investors and establish business relationships.

- Easier to Raise Funds and Attract Investors

LLCs have greater flexibility in raising capital. The company can issue new shares to attract investment and can also secure loans more easily compared to other business structures. Additionally, the ownership structure of an LLC can accommodate multiple investors, making it an attractive option for venture capital or angel investment.

- Benefits of Simplified Taxation Structure

LLCs typically benefit from a favorable tax regime, such as avoiding double taxation. In jurisdictions like Hong Kong, LLCs are subject to a “territorial tax” system, meaning they only pay tax on income generated within the region.

LLCs may also enjoy pass-through taxation, where profits and losses are reported on the owners’ personal tax returns, eliminating the need for corporate tax filings.

Disadvantages of limited liability company

- Registration and Maintenance Costs

Setting up and maintaining an LLC can involve significant costs. These include registration fees, legal expenses for drafting the operating agreement, and ongoing administrative fees. Moreover, LLCs are required to file annual reports and undergo auditing, adding to the operational costs.

- Compliance Requirements and Regulations

LLCs are subject to strict compliance regulations. In many jurisdictions, LLCs must maintain detailed records, submit annual reports, and comply with various local business laws. These requirements can be burdensome, especially for small businesses that lack dedicated legal and accounting teams.

- Complexities in Winding Up or Changing the Business Structure

While an LLC provides flexibility in operations, it can be challenging to dissolve or restructure. In the case of death or bankruptcy of a member, the company might need to be dissolved unless provisions for continuity are outlined in the operating agreement. Changing the business structure can also require significant legal and procedural steps.

How to form a limited liability company in Hong Kong

To establish an LLC in Hong Kong, you must follow a structured process. Below is a step-by-step guide to help you navigate the process.

Step 1: Business name reservation

The first step in forming an LLC in Hong Kong is choosing a suitable business name. The name you select must be unique and not identical to any existing business name already registered with the Hong Kong Companies Registry.

Additionally, it is crucial to ensure that the name does not infringe on the intellectual property rights of other entities, as this could lead to legal consequences.

To check the availability of your desired business name, use the Cyber Search Centre or the Company Search Mobile Service, which allows you to search the company register. For businesses that will use a Chinese name, ensure to search with traditional Chinese characters.

Additionally, you should conduct a trademark search to avoid conflicts with existing trademarks. If the name is available and free from infringement, you can reserve it for future use.

Step 2: Deciding shareholders and share capital

The next step is deciding on the shareholders and the share capital of the LLC. In Hong Kong, an LLC must have between one and 50 shareholders. These shareholders can be individuals or corporations and are typically the founders and investors in the business.

The share capital refers to the total amount of money that shareholders contribute to the company. For instance, if you form a company with 100 shares and contribute HK$10,000, each share would be worth HK$100.

Ownership of the business is determined by the percentage of shares held by each shareholder. Clear agreements should be made about the distribution of shares and the roles of each shareholder.

Step 3: Articles of Association

The Articles of Association are essential documents that outline how the LLC will operate. They serve as the company’s constitution, establishing the rules for managing the company and governing its internal affairs.

Articles of Association should clearly state key elements such as the company’s name, business objectives, shareholding structure, and internal governance procedures. It’s also essential to include provisions for resolving potential conflicts among directors or handling disputes between shareholders, ensuring smoother operations in the long run.

Although you can create your Articles, Hong Kong’s Companies Registry offers a Model Articles template, which can be adopted or modified as per your requirements. To better understand how to structure this document effectively, refer to this comprehensive guide to Articles of Association Hong Kong.

For added assurance, seeking legal advice is recommended, especially if your business has unique operational needs or a complex ownership setup.

Step 4: Company registration process

Once you have reserved the name, decided on the shareholders and share capital, and prepared the Articles of Association, you can proceed with the registration of the company. This can be done through Hong Kong’s e-Registry system, which allows you to submit your documents electronically. Alternatively, you can register by post.

To complete the registration, you will need to submit the necessary documents, including the business name reservation, Articles of Association, and identification of the directors and shareholders. You will also need to pay the application fee.

Upon approval, you will receive the Certificate of Incorporation and the Business Registration Certificate, which officially confirm the existence of your LLC.

Step 5: Obtaining additional licenses (if applicable)

Depending on the nature of your business, you may need to obtain specific industry licenses or permits before you can begin operations. Certain sectors, such as food services, financial services, or healthcare, require additional regulatory approvals. It is essential to research and apply for any relevant licenses to ensure compliance with Hong Kong’s legal requirements.

Forming an LLC in Hong Kong is a relatively straightforward process, but it requires attention to detail and adherence to legal procedures. To simplify the process and ensure a smooth company formation, you can consider establishing your Hong Kong limited company with BBCIncorp. Our all-in-one package will help you get started quickly and efficiently.

Taxation and compliance for Hong Kong limited company

Hong Kong offers several tax advantages that make it an attractive destination for businesses. One of the key benefits is the absence of capital gains tax, meaning that any profits from the sale of assets, such as shares or property, are not subject to taxation.

Additionally, overseas income is generally exempt from taxation, as Hong Kong operates on a territorial tax system. This means that only income derived from within Hong Kong is subject to tax, providing businesses with significant savings if they earn revenue internationally.

However, businesses in Hong Kong are required to comply with annual reporting and compliance obligations. This includes submitting tax returns to the Inland Revenue Department (IRD) and preparing audited financial statements.

The tax year in Hong Kong runs from April 1 to March 31, with returns typically due on the first working day of August. A business must also file an Annual Return with the Companies Registry to maintain its good standing.

Maintaining accurate financial records is crucial for both tax reporting and general compliance. These records must be updated regularly and kept for at least seven years. Failing to keep accurate and up-to-date records can lead to penalties or even legal consequences.

Moreover, proper financial documentation ensures that the company can benefit from tax deductions and credits, as well as avoid unnecessary complications during audits.

Establish your Hong Kong limited company with BBCIncorp

Starting a business in Hong Kong is a strategic move for many entrepreneurs. BBCIncorp offers seamless limited liability company formation with an all-in-one package that includes expert guidance, a registered address, and bank account setup assistance.

Our team of professionals specializes in handling all necessary paperwork and filings with the Hong Kong authorities, ensuring that your business complies with local regulations from day one. This means you can focus on growing your business while we take care of the legalities.

Additionally, BBCIncorp offers ongoing support for tax, accounting, and compliance matters, providing you with the resources you need to maintain smooth operations. Whether you’re a new entrepreneur or expanding your business, our comprehensive services help you navigate the complexities of Hong Kong’s business environment.

If you’re considering company formation in Hong Kong, explore our company incorporation services and take the first step toward establishing your business with confidence. You can read our article How to Start a Business in Hong Kong and contact us today via service@bbcincorp.com for more information!

Conclusion

In conclusion, forming a limited liability company in Hong Kong offers numerous advantages, including a favorable tax regime, legal protection for shareholders, and the ability to conduct business with flexibility and professionalism. The absence of capital gains tax and the exemption on overseas income make Hong Kong an attractive destination for entrepreneurs.

For those seeking a secure and reliable business structure, an LLC provides both financial protection and operational ease. Consider establishing a limited liability company in Hong Kong to unlock a range of opportunities while ensuring your business’s success and sustainability.

Frequently Asked Questions

Is a limited liability company a corporation?

No, a limited liability company (LLC) is not the same as a corporation. Both offer limited liability protection, but Hong Kong LLCs generally have more flexible structures and fewer regulatory requirements than corporations, which typically involve more complex governance and reporting rules.

What is the difference between a US LLC and a Hong Kong LLC?

A US LLC is a pass-through entity for tax purposes, meaning the owner and the LLC are treated as one for tax filings. In contrast, a Hong Kong LLC is considered a separate legal entity with its tax residency in Hong Kong, providing independent tax treatment from its shareholders or directors.

How to select the right company type for your goals?

The vast majority of foreign investors choose a Hong Kong private limited company (company limited by shares) because it offers full limited liability, a minimum of one shareholder and one director, and can be incorporated within 24 hours through the Companies Registry’s online company registration portal.

If your objective is a non-profit organisation rather than commercial trading, a Company Limited by Guarantee without share capital is the appropriate structure, commonly used for charities, clubs, and associations under the same company registration process but with modified articles and exemption from the word “Limited” in the name.

For a complete walkthrough of the entire setup journey—from name search to bank account opening—see our detailed guide how to start a business in Hong Kong.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- What is a limited liability company in Hong Kong?

- Key characteristics of a Hong Kong limited company

- Advantages and disadvantages of limited liability company

- How to form a limited liability company in Hong Kong

- Taxation and compliance for Hong Kong limited company

- Establish your Hong Kong limited company with BBCIncorp

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.