- Meaning of a company limited by guarantee in Hong Kong

- Pros and cons of a company limited by guarantee

- Legal framework and requirements in Hong Kong

- Responsibilities of members and directors

- Steps to register a company limited by guarantee

- Ongoing compliance: Accounting, auditing, and tax

- Estimated timeline and fees for setting up a company limited by guarantee

- How BBCIncorp simplifies company limited by guarantee registration in Hong Kong

A company limited by guarantee in Hong Kong is a unique type of legal entity widely used by non-profits, charities, clubs, and associations. Unlike traditional companies, this structure has no share capital and is not designed for profit-making purposes. Instead, members act as guarantors and contribute a symbolic amount in the event of winding up.

If you’re an entrepreneur, social innovator, or part of an organization aiming to establish a limited by guarantee company, understanding its features and compliance requirements is essential. This guide below will walk you through the process clearly and concisely.

Meaning of a company limited by guarantee in Hong Kong

What is a company limited by guarantee in Hong Kong?

A company limited by guarantee (CLG) in Hong Kong is a specific type of legal entity governed by the Companies Ordinance (Cap. 622) and registered with the Companies Registry of Hong Kong. Instead of shareholders, this company type has members who act as guarantors.

If the company is wound up, each member agrees to contribute a predetermined, nominal amount, often HKD 100 or less. This model offers limited liability while emphasizing purpose over profit.

The structure of Hong Kong CLG is not designed to generate returns for its members. Rather, it enables entities to operate with a formal corporate identity, enjoy legal protection, and pursue charitable, educational, cultural, or professional goals. It is particularly relevant for those seeking public trust and long-term governance stability.

Key features of a company limited by guarantee in Hong Kong

To assess whether this model aligns with your organization’s mission, it’s important to understand the core features of a limited company by guarantee:

- No share capital and no shareholders: A CLG does not issue shares and has no shareholders. Ownership is replaced by membership, and members do not receive dividends or profit distributions.

- Members act as guarantors: Members agree to contribute a symbolic amount in case the company is dissolved. This amount is fixed in the Articles of Association and forms the basis of their limited liability.

- Not-for-profit orientation: Any income or surplus of CLGs must be reinvested in the company’s operations or activities, rather than paid to members.

- Limited liability protection: Members’ liability is strictly limited to the guaranteed sum, providing a layer of legal and financial protection similar to that of shareholders in a company limited by shares.

- Perpetual succession: As a separate legal entity, the company continues to exist regardless of changes in its membership or management team.

Common uses and who should consider forming one

Forming a company limited by guarantee in Hong Kong is ideal for organizations that prioritize public service, compliance, and transparency. Typical examples include:

- Charitable foundations and non-profit organisations

- Religious or cultural institutions

- Educational and training bodies

- Professional associations and industry regulators

- Social or recreational clubs requiring legal standing

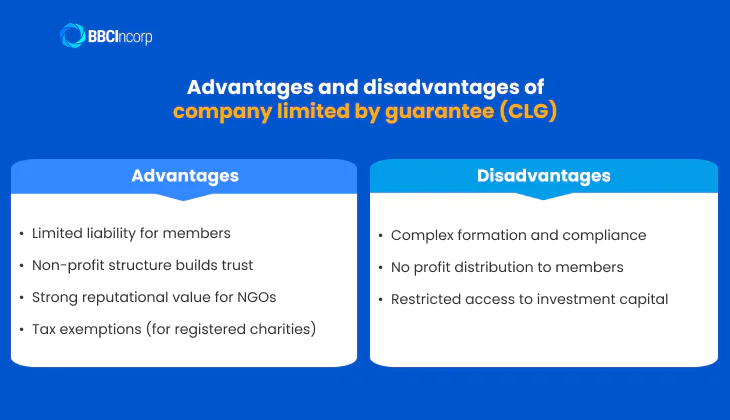

Pros and cons of a company limited by guarantee

Like any corporate form, it comes with specific constraints that may not align with all organizational models. Below is a summary of Hong Kong CLG pros and cons to help you evaluate whether this structure is suitable for your entity’s goals.

Key advantages of setting up a CLG in Hong Kong

A CLG is particularly suitable for organizations aiming to promote public or social interests. The structure offers several strategic benefits, especially in terms of governance and liability:

- Limited liability for members: Members are only liable up to a small, pre-agreed amount (e.g. HKD 100), offering protection against personal financial exposure.

- Non-profit structure builds trust: Since CLGs do not distribute profits, they reinforce credibility with donors, grant-makers, and stakeholders seeking mission-aligned partnerships.

- Strong reputational value for NGOs: Operating under a CLG signals good governance, transparency, and accountability that are increasingly important in the non-profit sector.

- Tax exemptions (for registered charities): CLGs registered as charities with the Inland Revenue Department (IRD) may be eligible for tax relief under Section 88 of the Inland Revenue Ordinance.

Main challenges and limitations to consider

While the CLG model offers long-term benefits, it is not without restrictions. Organizations should consider the following limitations before choosing this structure:

- Complex formation and compliance: CLGs must adhere to formal registration procedures, prepare audited financial statements, and comply with ongoing filing obligations, which may require professional support.

- No profit distribution to members: Surpluses must be reinvested into the organization’s activities, limiting financial incentives and return potential for members.

- Restricted access to investment capital: CLGs cannot issue shares or attract equity investors, making them reliant on grants, donations, or government support—sources that may fluctuate over time.

Legal framework and requirements in Hong Kong

Below is a breakdown of the essential requirements and statutory duties relevant to CLGs.

Registration under the Companies Ordinance

In Hong Kong, registering a company limited by guarantee (CLG) must be done following the Companies Ordinance (Cap. 622), including:

- Submit incorporation documents to the Companies Registry, including Form NNC1G and a well-drafted Articles of Association.

- Appoint at least two directors and a company secretary.

- Maintain a registered office address in Hong Kong.

- Comply with Sections 103 and 105 if applying for a licence to omit the word “Limited” from the company name, typically for public-benefit entities.

- Ensure the company name is not misleading, offensive, or identical to an existing name, following naming restrictions under the Ordinance.

- Include a clause in the Articles of Association prohibiting profit distribution to members.

Statutory compliance and annual obligations

To maintain good standing, below are the key annual obligations and compliance duties:

- Annual Return Filing: File Form NAR1 with the Companies Registry within 42 days of the incorporation anniversary

- Audited Financial Statements: All CLGs are required to prepare and submit audited accounts each year, regardless of whether they generate profits.

- Directorship Requirements: Maintain at least two individual directors; corporate directors are not allowed for CLGs.

- Registered Office: Maintain a physical registered office address in Hong Kong for receiving official communications like registers of members, directors, and significant controllers.

- Company Secretary: Appoint a qualified company secretary who is either a Hong Kong resident or a licensed corporate service provider.

- Statutory Records: Keep updated statutory books, including registers of members, directors, and significant controllers.

- Late Filing Penalties: Be aware of escalating registration fees for late annual return filings, as outlined in the Companies (Fees) Regulation (Cap. 622K).

- Not-for-Profit Licensing Conditions: If exempted from using “Limited” in the name, ensure ongoing compliance with licensing conditions under sections 103–105 of the Cap. 622.

Constitution and Articles of Association

The Articles of Association serve as the foundational legal document that defines the governance structure and operational rules of a company limited by guarantee in Hong Kong. Key elements to be addressed include:

- Purpose and non-profit status: Clearly state the company’s objectives and include a clause that prohibits profit distribution to members.

- Member liability and asset handling: Define the guaranteed contribution of each member in case of winding up and outline how residual assets will be allocated.

- Corporate governance: Set out procedures for director appointments, decision-making processes, and meeting protocols.

- Naming restrictions: Ensure the proposed company name is distinct, non-deceptive, and free from restricted terms unless prior approval is obtained.

- Legal compliance: All provisions must align with statutory requirements under the Companies Ordinance.

Responsibilities of members and directors

Clarify the roles of members (guarantors) and directors in a CLG. Help readers understand the governance structure.

Member liabilities and rights

Members of a CLG do not hold ownership rights or share in profits. Their liability is limited to the guaranteed amount specified in the Articles of Association, typically a nominal sum payable only upon the company’s winding up. While they are not entitled to dividends, members retain voting rights and can influence the company’s direction through general meetings.

Director’s duties and responsibilities

Directors are responsible for managing the company’s activities, making sure it follows its non-profit goals and complies with legal requirements. They must always act carefully, responsibly, and in the best interests of the company. This includes fulfilling their director’s duties in Hong Kong, such as acting with honesty and loyalty. A CLG must have at least one director, and there are no limits on their nationality or place of residence.

Role of the company secretary

Every CLG must appoint a company secretary, who is responsible for helping the company comply with legal requirements. The secretary must be either a Hong Kong resident or a local corporate entity. The roles of a company secretary include filing annual returns, maintaining company records, and advising the board on compliance and governance matters.

Registered office requirement

A CLG must maintain a physical registered office in Hong Kong. This address is used for receiving official government notices and legal documents, and is essential for ensuring continuous regulatory compliance.

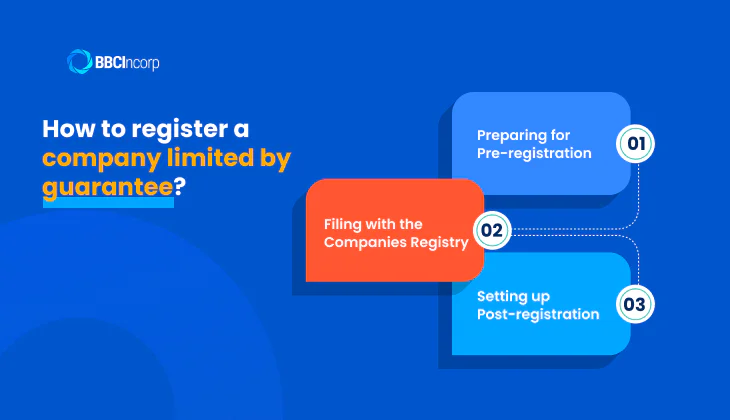

Steps to register a company limited by guarantee

The process of setting up a CLG in Hong Kong involves several key stages to ensure legal compliance and smooth incorporation.

Pre-registration preparation

Before incorporating a company limited by guarantee (CLG) in Hong Kong, several key steps must be completed to ensure compliance and readiness:

- Choose a company name: Decide whether to include “Limited” and conduct a name search via the Companies Registry to avoid duplication or similarity with existing entities.

- Define the company’s objects: Clearly articulate the company’s purpose, especially if it serves non-profit or public-benefit activities. These objects will guide governance and operational decisions.

- Draft the Articles of Association: Prepare a legally sound document that outlines the company’s internal rules, members’ liability (limited by guarantee), and overall governance structure. This is a core requirement for incorporation.

Filing with the Companies Registry

To incorporate a company limited by guarantee in Hong Kong, applicants must submit their incorporation documents either online via the e-Registry portal or in person at the Companies Registry office. The application typically takes four to six weeks to process, depending on the completeness and accuracy of the submission.

Required documents include:

- Form NNC1G (for companies not limited by shares), signed by all proposed directors and members

- Articles of Association, stating the company’s objectives

- Appointment details of directors and the company secretary

- Application for a Business Registration Certificate

Once accepted, the Companies Registry will process the application and, upon approval, issue a Certificate of Incorporation. Simultaneously, the Inland Revenue Department will issue the Business Registration Certificate.

Post-registration setup

After receiving the Certificate of Incorporation and Business Registration Certificate, CLGs must complete several essential setup steps before commencing operations:

-

- Open a corporate bank account in Hong Kong under the company’s name

- Set up an accounting system in accordance with Hong Kong Financial Reporting Standards (HKFRS)

- Appoint a qualified auditor to conduct annual audits as required by law

Learn more about the full process in our guide on How To Set Up A Company In Hong Kong.

Ongoing compliance: Accounting, auditing, and tax

CLGs in Hong Kong are subject to strict ongoing compliance requirements under the Companies Ordinance and Inland Revenue Ordinance.

Accounting and financial reporting

A CLG must ensure ongoing accounting compliance through:

- Maintaining proper books of accounts that accurately reflect all financial transactions

- Preparing annual financial statements by Hong Kong Financial Reporting Standards

- Retaining accounting records and supporting documents for a minimum of seven years

Annual audits and statutory requirements

Annual audits are a statutory obligation for not only to meet legal requirements but also to ensure financial transparency and accountability. Key compliance points include:

- Appointment of a certified auditor (CPA) to perform the audit in accordance with HKSAs

- Financial reports have to audited annually and presented at the Annual General Meeting (AGM)

- Audited accounts must be submitted alongside the Annual Return to the Companies Registry

Tax obligations and exemptions

Here are the key ongoing tax obligations and exemptions for a company limited by guarantee in Hong Kong:

- Required to file the Profits Tax Return (PTR) annually with the Inland Revenue Department (IRD).

- Providing sufficient documentation and demonstrating eligibility based on the Inland Revenue Department’s charitable criteria under Section 88 for tax exemption status

- Maintaining proper accounting records and fulfilling other statutory reporting duties.

Tax compliance can be complex, and professional assistance is recommended to ensure regulatory accuracy and optimize any eligible tax benefits.

Estimated timeline and fees for setting up a company limited by guarantee

Understanding the timeline and fees before setting up a company limited by guarantee in Hong Kong helps organizations plan ahead and meet compliance deadlines effectively.

Expected incorporation timeline

The incorporation of a company limited by guarantee in Hong Kong typically takes 4-6 weeks, provided that all required documents are accurately prepared and submitted.

However, if the organization intends to apply for charitable status under Section 88 of the Inland Revenue Ordinance, the approval process by the IRD may take 6 months or longer, depending on the complexity of the case and supporting documentation.

Incorporation fees for CLG registration

Government fees for registering a company limited by guarantee (CLG) in Hong Kong vary based on membership size, as follows:

- Under 25 members: HKD170

- 26–100 members: HKD340

- Beyond 100 members: HKD20 per 50 members

In addition to the incorporation fee, businesses are also required to obtain a Business Registration Certificate from the Inland Revenue Department. While non-profit entities like CLGs may be exempt from paying the Business Registration Fee, it is still a standard step in the incorporation process and should be factored into planning.

See More

About the limited liability company to protect your personal assets while operating your business with confidence.

How BBCIncorp simplifies company limited by guarantee registration in Hong Kong

Navigating the incorporation of a company limited by guarantee (CLG) in Hong Kong requires a detailed understanding of regulatory procedures, especially for organizations seeking charitable status. BBCIncorp streamlines this complex process with deep expertise in Hong Kong’s legal framework.

Expert support with tailored company setup

BBCIncorp combines technology, legal insight, and international experience to deliver seamless incorporation services for companies limited by guarantee in Hong Kong. Here’s how we stand out:

- Digital-first experience: Our smart platform minimizes paperwork and speeds up turnaround time, with no need for in-person submissions.

- Specialized CLG knowledge: From Form NNC1G to tailor-made Articles of Association, we handle every legal nuance of CLG formation with precision.

- Built-in compliance support: Receive timely alerts and hands-on guidance to help your organization stay compliant with Hong Kong regulations year-round.

- Multilingual, global service team: Our experienced advisors support clients across time zones with prompt and professional assistance.

For a broader range of business structures, discover our full suite of Hong Kong company incorporation services designed to help you launch with confidence.

End-to-end service for a smooth process

BBCIncorp provides an end-to-end service covering all key stages of CLG setup:

Step 1: Consultation & Pre-Incorporation Planning

BBCIncorp begins by assessing your organization’s purpose, governance structure, and eligibility for setting up a CLG. We advise on key aspects such as whether the CLG qualifies for charity tax exemption and whether it’s the best structure for your goals.

Step 2: Name Reservation & Document Preparation

We handle the company name search and reservation. Our legal experts draft the required incorporation documents, including the Form NNC1G and customized Articles of Association tailored to your organization’s objectives.

Step 3: Submission to Companies Registry

All documents are filed on your behalf with the Hong Kong Companies Registry. BBCIncorp ensures accurate submission to avoid delays or rejections.

Step 4: Business Registration Certificate Application

We assist in obtaining the Business Registration Certificate from the Inland Revenue Department—required for legal operation in Hong Kong.

Step 5: Post-Incorporation Setup

BBCIncorp offers additional services, including:

- Facilitate registered office address services

- Support for setting up accounting or compliance systems

- Assist with opening a corporate bank account at reputable banks or fintech platforms

Step 6: Ongoing compliance support

We provide annual compliance reminders and offer ongoing assistance with accounting services, audit coordination, and company secretary services to help maintain your company’s long-term regulatory in Hong Kong.

A limited company by guarantee Hong Kong is well-suited for non-profits, community organizations, and charitable initiatives that do not distribute profits to members. This structure offers legal protection and credibility, but also comes with specific compliance duties that require proper planning.

To ensure accuracy and avoid costly delays, organizations should consider working with experienced incorporation service providers. BBCIncorp offers expert guidance and compliance-focused solutions tailored for non-profit needs. Contact our team today to get started with a smooth and reliable incorporation journey.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

- Meaning of a company limited by guarantee in Hong Kong

- Pros and cons of a company limited by guarantee

- Legal framework and requirements in Hong Kong

- Responsibilities of members and directors

- Steps to register a company limited by guarantee

- Ongoing compliance: Accounting, auditing, and tax

- Estimated timeline and fees for setting up a company limited by guarantee

- How BBCIncorp simplifies company limited by guarantee registration in Hong Kong

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.