Table of Contents

The driving force behind groundbreaking inventions and burgeoning industries often lies within the dynamic realm of startups, young companies founded for selling a unique offering. These ventures, numbering over 150 million globally with over 82,000 launching in the US(1), serve as crucial catalysts for innovation and job creation, contributing significantly to economic advancement.

Nevertheless, the path to success is notably challenging, marked by a failure rate of approximately 90%(2). In today’s article, we will explore the fundamentals of “what is a startup company”, their economic contributions, and the obstacles they typically encounter. Let’s examine this high-stakes landscape.

What is a startup company?

Definition of a startup company

A startup or start-up is a new company created to develop a product or service that customers find essential. To define a startup company, these entities are usually known for their new ideas, ability to grow quickly, and potential to expand. They often start with a small team and limited funds, aiming to change existing markets or create entirely new ones.

Unlike traditional businesses, startups value speed and flexibility, working in a situation where there is a high chance of both failure and great success. They tend to pitch the products and raise money from investors who are looking for big returns.

Several of today’s leading corporations, including Microsoft (MSFT), Apple (AAPL), and Meta (META), formerly known as Facebook, originated as startups. These companies began with modest resources and ambitious goals, eventually evolving into publicly traded entities with global influence. Their trajectories underscore the transformative potential of startups to innovate, attract capital, and achieve sustained growth within competitive markets.

Startup vs. small business

While both startups and small businesses are about starting your own venture, they have different goals and ways of working. Startups aim for fast growth and the ability to expand, often wanting to shake up industries and quickly gain a large share of the market. They get funding by selling a part of their company to investors, accepting more risk for the chance of much bigger profits.

On the other hand, small businesses usually focus on staying in business for the long term and growing slowly. They serve local areas or specific groups of customers, getting money from personal savings, loans, or smaller investments. Their main goal is to make a steady income and have a stable business, rather than growing quickly or planning to sell the company later.

To better understand these differences, the table below summarizes how startups and small businesses vary across key aspects such as profitability timeline, market focus, funding methods, goals, and risk levels.

| Category | Startup | Small Business |

|---|---|---|

| Journey to Profitability | Needs a longer period to achieve profitability | Attains financial independence shortly after starting |

| Market Focus | Develops an entirely new market or disrupts an existing one | Functions within a pre-existing market or sector |

| Funding Approach | Obtains capital by trading equity in the business | Depends on conventional loans while founders maintain full control |

| Goals | Focuses on fast expansion, often targeting an IPO or acquisition | Aims to build a durable company through consistent revenue growth |

| Risk Profile | Entails greater risk but offers higher potential for growth | Involves less risk with more predictable, gradual growth |

If you are starting a startup firm, it’s important to understand these differences to plan business strategies based on the goals and the resources you have.

Lifecycle of a startup

The lifecycle of a startup shows how a company evolves from an idea into a scalable business. Each phase presents different priorities, decisions, and challenges. Understanding these stages gives founders and stakeholders the clarity to confidently move forward.

This section outlines key startup information to support a full understanding of the startup company definition.

Concept and discovery

This is the earliest stage, where the start up company definition and the business idea take shape. Founders research market needs, define the problem, and begin shaping a solution. Another key task at this stage is choosing a company name. This is both an important legal step and a branding decision, so it’s advisable to learn more in our related article on how to check if a company name is taken.

Navigating this first step often involves dealing with limited information and considerable uncertainty. However, the opportunity lies in the boundless creative freedom and the potential to be the first to effectively address an existing market void.

Validation and preparation

With the idea defined, the next step is to test it. This phase includes building a prototype, seeking user feedback, and confirming there is demand.

Business owners should begin looking for funding here. Options include private investment and public methods such as crowdfunding. Although validation entails much effort, it also results in traction and vital support for the future.

Launch and breakthrough

At this point, the product is gradually entering the market. Startups work to attract customers, promote the deal, and refine it based on feedback. The goal is to gain early momentum and establish a presence.

During this period, startups might grapple with constrained resources and the pressures of initial market reception. It is crucial to establish a positive reputation and generate revenue streams.

Scaling and expansion

Once the business model proves effective, the company starts to grow. This may involve entering new markets, increasing staff, or upgrading its business structure.

For example, some entrepreneurs change from a sole proprietorship to a limited liability company to support expansion. You can find more guidance in our article on how to transfer sole proprietorship to LLC.

Expanding your business creates long-term value, but it can also introduce new levels of complexity if you don’t take the time to plan.

Maturity and decision point

At this stage, the startup achieves a level of stability, marked by consistent revenue and a defined market presence. Leadership now faces a pivotal decision regarding the company’s future course. Options for consideration include pursuing further growth initiatives, diversifying product or service lines, or optimizing and reinforcing current operational frameworks.

It is essential to run a rigorous analysis of key startup information and align it precisely to determine the most advantageous path forward.

Exit or renewal

In this final stage, certain startups opt for an exit strategy, often through acquisition by a larger entity or an initial public offering (IPO). Conversely, other startups choose a path of renewal, aiming for the development of novel concepts and expansion into adjacent or entirely new market sectors.

Regardless of the chosen direction, it represents a major milestone, presenting both unique challenges and considerable opportunities for evolution.

How do startups obtain funding?

Obtaining needed funds is a core challenge for any new firm aiming to turn its vision into a successful business. Unlike established companies with steady income, a new company usually needs outside money to grow, enter the market, and expand.

Knowing the various ways to get this money is key information for founders. Let’s explore how these inventive ventures find the financial resources they need.

Self-funding or personal circles

Bootstrapping

New business journeys can start with the founder’s own cash, called bootstrapping. This means using their savings to cover setup expenses. It allows complete control but limits how fast the company can grow.

The founders of Fundrr, a South African fintech startup, faced over 50 rejections from investors. Undeterred, they each invested $51,000 of their personal savings to launch the company. Their perseverance paid off when Fundrr was later recognized as SME Finance Company of the Year.(3)

Raising investment from personal networks

In addition, many startups begin by raising capital from personal networks as well. For instance, Airbnb’s founders financed their venture by selling cereal boxes to friends and family, raising $30,000 to keep the company afloat during its early days.(4)

Nevertheless, it’s vital to make these deals clear to avoid issues later.

Equity-based funding

Equity funding means offering ownership in exchange for capital. Key methods here include:

- Angel investors: High-net-worth individuals who provide early-stage investment. WhatsApp received early backing from Jim Goetz of Sequoia Capital, who helped guide the company to a $19 billion acquisition by Facebook.(5)

- Venture capital: Firms stepping in once the business shows traction. Stripe raised $2 million from investors like Peter Thiel and Elon Musk, which allowed it to scale into one of the leading payment companies globally.(6)

- Corporate Venture Capital (CVC): Involving funding from large companies that are interested. To exemplify, Slack received funding from Google Ventures, giving it both capital and interconnections during its expansion phase.(7)

Crowd-based funding

Crowdfunding is a modern method that allows a startup to raise small amounts of money from a large number of people. This approach builds early support and market validation.

Crowdfunding

Innovative online platforms empower startups to actively solicit smaller-scale investments or valuable pre-orders directly from the broader public, often in direct exchange for tangible rewards, exclusive early access, or even equity stakes. This approach, known as crowdfunding for business startups, allows them to bypass traditional funding routes.

Grants and competitions

Numerous governmental agencies, impactful non-profit organizations, and forward-thinking private entities implement valuable funding opportunities through structured business plan competitions. These frequently focus on targeted industries or ventures with significant social impact.

Notably, the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs within the U.S. represent avenues for non-dilutive grant funding specifically aimed at promising early-stage businesses.

Other funding methods

Incubators and accelerators

These invaluable programs furnish carefully selected early-stage startups with essential resources, experienced mentorship, and, in certain instances, crucial seed capital, often in exchange for a minority equity stake or a participation fee. Prominent examples of highly successful programs include Y Combinator and Techstars.

Bank loans and Lines of Credit

Despite the difficulty of obtaining loans for startups without substantial collateral or an established revenue history, certain forward-thinking financial institutions provide specialized loan products or flexible credit lines tailored to promising high-growth ventures.

In fact, Tesla secured a $465 million loan from the U.S. Department of Energy in 2009 and repaid the loan less than 4 years later.(8) This funding was crucial for Tesla to produce its Model S sedan and expand its manufacturing capabilities.

Initial Public Offering (IPO)

Representing a later-stage funding event for highly successful and mature startups, an IPO involves the strategic offering of the company’s privately held shares to the broader public for the very first time. Zoom, a video conferencing platform, raised $751 million during its 2019 IPO, fueling its infrastructure expansion amidst surging demand.(9)

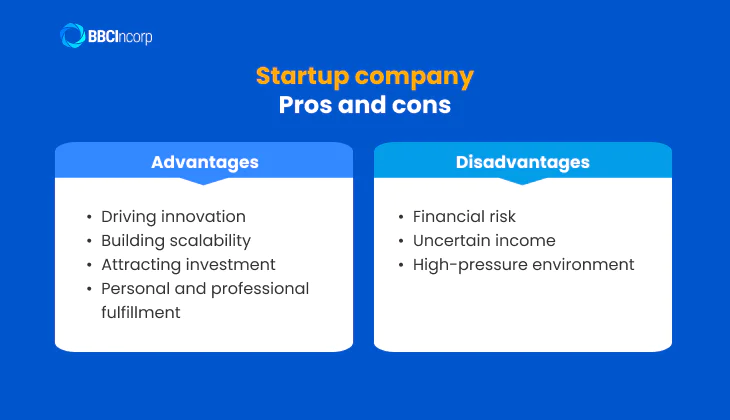

Pros and cons of running a startup company

To startup a company is to step into a space filled with both promise and pressure. The appeal lies in innovation, impact, and the possibility of building something from nothing. Yet the journey is equally defined by uncertainty, intense demands, and financial risk.

Those seeking to clearly define startup company dynamics must weigh both its potential gains and inherent risks. Below are key factors worth considering before starting the journey.

Benefits of startup a company

Driving innovation

Startups are built to challenge the status quo. They often pioneer new solutions, introduce disruptive technologies, and reshape customer expectations. This innovative drive creates lasting competitive advantages and contributes to real progress across industries.

Building scalability

Different from traditional small businesses that focus on stable, local markets, startups are designed to scale. Their models aim for rapid growth and wide market reach, positioning them to influence entire sectors and expand internationally.

Attracting investment

High-growth, disruptive startups often attract early-stage investors like angels and VCs. Funding is vital for building, testing, and scaling quickly. Though not simple, showcasing strong potential improves your odds.

Investors seek familiar markets, solid teams, scalable models, and clear revenue. Target the right investors, network, and create a compelling plan and pitch to boost appeal.

Personal and professional fulfillment

Founding a startup is more than launching a business. It is the pursuit of a personal mission. For many entrepreneurs, seeing an idea come to life and impact others offers a level of fulfillment that few other experiences can match.

Drawbacks of startups

Financial risk

Startups inherently carry significant financial risks. According to a CB Insights analysis featured by Statista, 29% of startups fail because they run out of cash, making it one of the top reasons for startup failure.(10)

Whether founders rely on personal savings, loans, or external investments, the capital invested is always at risk.

Uncertain income

Most startup firms experience unpredictable revenue in their early phases. Founders and their teams often work without a steady income while trying to prove the concept and attract customers. The instability can create both short-term strain and long-term financial pressure.

High-pressure environment

Startup life often comes with long hours, limited resources, and constant decision-making. Founders and early employees work under intense pressure, driven by the need to build, compete, and adapt quickly.

With limited staff and intense competition, founders and early teams often operate under sustained stress.

What are business startup challenges?

Opening a startup demands a good understanding of intricate legalities, administrative duties, and financial responsibilities. These are the challenges you must approach with careful consideration.

Comprehending legal obligations

Emerging ventures must select an appropriate legal structure, such as a Limited Liability Company (LLC) or a corporation (C-Corp or S-Corp), as each entails distinct implications concerning liability, taxation, and regulatory compliance.

Furthermore, the protection of intellectual property through mechanisms like trademarks and patents is vital for safeguarding innovative assets and sustaining a competitive advantage.

Addressing administrative requirements

The effective management of administrative responsibilities, encompassing tasks such as scheduling, internal communications, and operational workflows, can demand a substantial allocation of a founder’s time and resources. This administrative burden may potentially divert focus from core strategic initiatives and crucial growth endeavors.

The implementation of streamlined organizational systems and project management tools can prove instrumental in mitigating this challenge and optimizing valuable time.

Ensuring sound financial management and tax compliance

Diligent financial management represents a cornerstone of sustainability. Common pitfalls include inaccurate expense categorization, the oversight of tax obligations, and the neglect of essential financial reporting. Such errors can lead to significant penalties and detrimental cash flow disruptions.

The early establishment of robust accounting practices, coupled with the proactive engagement of professional financial counsel.

How to launch your startup firm?

Below is a concise roadmap to guide you through the process of launching your startup firm:

Step 1: Validate your idea

Before investing significant resources, ensure there’s a real market need for your product or service. Conduct thorough market research, actively gather feedback from potential users, and test your core concept with prospective customers to confirm its viability and desirability.

Step 2: Craft a business plan

A well-structured business plan serves as your foundational document. It should outline your company’s mission, clearly defined target market, competitive landscape analysis, chosen revenue model, and detailed financial projections.

Step 3: Build the right team

Assemble a talented team characterized by complementary skills, diverse expertise, and a shared, compelling vision for the company’s future. A cohesive and collaborative team enhances overall productivity and fosters crucial innovation.

Step 4: Establish your startup’s legal structure

Carefully choose a legal entity framework (e.g., Limited Liability Company, C-Corporation, etc.) that aligns with your business goals and long-term aspirations. This decision will directly affect aspects such as taxation, personal liability protection, and future fundraising options.

Step 5: Develop your product or service

Adopt an agile approach by starting with a Minimum Viable Product (MVP). The drafted version allows you to efficiently gather valuable user feedback early in the development cycle and iteratively refine your offering based on real-world usage and preferences.

Step 6: Build a marketing strategy

Create a comprehensive plan to effectively reach your identified target audience. Leverage a diverse range of digital channels, develop engaging content, and utilize social media platforms to consistently drive brand awareness and cultivate customer engagement.

Step 7: Launch your startup and operate

Execute your launch plan and continuously monitor performance, gather ongoing customer feedback, and remain adaptable to market dynamics.

Keep in mind that the startup journey demands constant learning and evolution, requiring continuous innovation and expert guidance, like that offered by BBCIncorp, for optimal outcomes. Why navigate this complex path alone when you can simplify your business growth by leveraging BBCIncorp’s expertise?

Start your company with BBCIncorp business formation services

The journey of a startup business demands constant learning, agility, and the right support system. Partnering with experienced professionals can make a significant difference, and that’s where BBCIncorp comes in.

BBCIncorp offers a seamless and efficient business formation process across various jurisdictions, helping entrepreneurs set up their companies with clarity and ease. Whether you are targeting tax-friendly destinations like Cyprus company registration, Panama company formation, or setting up a Cayman Islands company, BBCIncorp ensures a smooth experience from start to finish.

What sets BBCIncorp apart are

- Seamless and easy service delivery that minimizes administrative burdens

- All-in-one solutions through a centralized digital hub for incorporation, compliance, and beyond

- A reliable network of external experts to support specialized business needs

- Responsive customer support that guides you at every step

- Transparent pricing with no hidden fees

Please visit our service sites today or get in touch with our team for more information on how we can help with setting up your global company.

Conclusion

Startups spark innovation and open doors to meaningful impact. They offer the chance to solve real problems, disrupt industries, and build something from the ground up. While the journey is tough, the rewards can be extraordinary, and founders have numerous opportunities to create lasting value.

To navigate this journey with confidence, it’s important to understand “what is a startup company” and start with the right structure and expert support from professionals like BBCIncorp. Our experienced team helps entrepreneurs lay solid foundations through services such as company formation, corporate compliance, accounting, and financial management. With reliable guidance at every stage, you can stay focused on growth while we take care of the essentials.

Please do not hesitate to reach out to BBCIncorp for timely assistance. Send us a message now at service@bbcincorp.com for any inquiries you may have.

—

References:

(1) https://www.demandsage.com/startup-statistics/

(2) https://startupgenome.com/article/the-state-of-the-global-startup-economy

(3) https://thefinancestory.com/chartered-accountant-launched-fintech-fundrr-south-africa-helping-small-businesses

(4) https://medium.com/@jasper_ribbers/the-airbnb-founder-story-from-selling-cereal-to-a-25b-company-244aeec18bc8

(5) https://techcrunch.com/2014/02/19/sequoia-and-jim-goetz-are-big-winners-in-facebooks-whatsapp-acquisition/

(6) https://bytebridge.medium.com/stripe-inc-a-comprehensive-report-d6c422b66ce1

(7) https://techcrunch.com/2014/10/31/slack-confirms-120m-fundraise-led-by-google-ventures-and-kpcb-at-1-12b-valuation/

(8) https://www.cnbc.com/2013/05/22/tesla-repays-465-million-loan-from-federal-program.html

(9) https://www.latimes.com/business/la-fi-zoom-ipo-eric-yuan-billionaire-20190418-story.html

(10) https://www.statista.com/chart/11690/the-top-reasons-startups-fail/

Frequently Asked Questions

What legal structure should I choose for my business?

Choosing your business’s legal structure (e.g., sole proprietorship, partnership, LLC, S corporation, or C corporation) is a critical early decision. It affects your liability, taxation, administrative burden, and ability to raise capital.

Simpler structures like sole proprietorships are easy to set up but offer no personal protection from business debts. Meanwhile, limited liability companies (LLCs) shield your personal assets while providing flexible taxation options. See more pros and cons of a sole proprietorship vs. LLC in our related article.

S corporations also allow pass-through taxation, but with potential tax benefits for owners alongside more stringent requirements. C corporations, though more complex with potential double taxation, are often favored by venture capitalists.

The best choice depends on your specific circumstances, risk tolerance, industry, and future growth plans, so make sure to consult with legal professionals like BBCIncorp.

What steps are involved in obtaining a startup business loan?

Securing a startup business loan typically involves several key steps. You can explore options from various sources, including specialized startup lenders, traditional banks, specific organizations, and even your personal network.

A recommended initial step is often to investigate the U.S. Small Business Administration (SBA). The SBA partners with nonprofit community lenders to offer microloans specifically designed for small businesses, which are more accessible than conventional bank loans.

Further steps generally include:

- Preparing a business plan with financial projections

- Gathering essential documents like your certificate of incorporation and certificate of good standing

- Researching and identifying suitable lenders

- Submitting loan applications

- Pitching your business to lenders, and

- Undergoing their review and approval processes

How do I expand into new markets?

Expanding your business internationally can take many forms, including:

- Identifying markets that align with your products or services

- Forming strategic partnerships or joint ventures

- Adapting your offerings to local customer needs

- Using digital platforms to reach a global audience

Another potential option is establishing an offshore company, which can provide access to new markets, tax advantages, and greater flexibility. To ensure a seamless and compliant expansion, you must work with experienced professionals from the beginning. Contact BBCIncorp team for more details on our comprehensive Offshore Company Formation service today!

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.