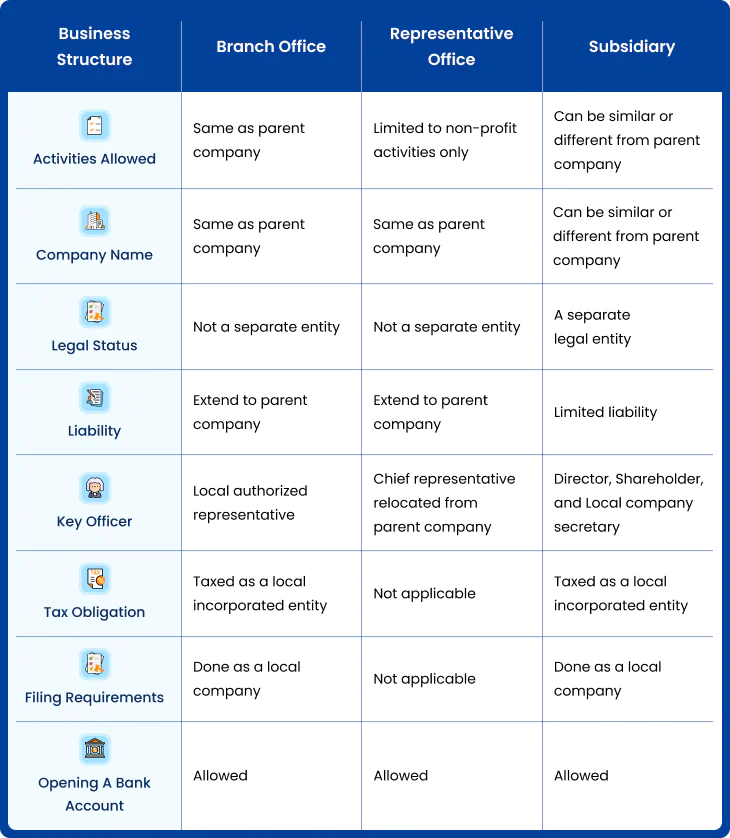

To establish a presence in Hong Kong, foreign companies tend to opt for one of three popular business structures: branch, representative office, and subsidiary. But how do these entities differ from one another, and which is the most beneficial for your business objectives?

This article will help you clarify striking differences between these types in terms of their liabilities, incorporation requirements, tax implications, and compliance requirements.

Making comparison: Branch vs Subsidiary vs Representative office in Hong Kong

Below are the main differences among the three widely used registration options for foreign companies in Hong Kong:

Subsidiary in Hong Kong

A Hong Kong subsidiary is a private limited company in nature. It can be owned by a maximum of 50 shareholders, each of whom can be an individual or a corporation.

The matter of liability

Since a subsidiary is a private company limited by shares, it is considered a distinct legal entity that has a legal status separate from its owners/shareholders. This means if a foreign parent company holds ownership of a subsidiary in Hong Kong, it will not hold any further liabilities other than the proportion of shares it owns.

This can be a significant advantage since it provides a given foreign parent company with a great deal of safety in case anything bad happens to the subsidiary in Hong Kong (insolvency for example).

Incorporation requirements

- Entity name: a subsidiary’s name can be similar or different to that of the parent company in another jurisdiction (however, subject to certain criteria).

- Business activity: a subsidiary can carry out activities that are the same or different from the parent company. This is an advantage over the types of branches and representative offices.

- Entity’s key personnel: a subsidiary company in Hong Kong needs to satisfy the requirement of appointing the following key persons:

- One either local or foreign director;

- One either local or foreign shareholder; and

- One local resident company secretary, a mandatory corporate position for all private limited companies.

The process of setting up a subsidiary is quite similar to establishing a private company in Hong Kong. It can be done within a couple of days.

Taxation

The taxation of a subsidiary is the same as a local private company in Hong Kong. Particularly, the profits of a subsidiary will be subject to two-tier corporate income tax (8.25% for the first 2 million HKD and 16.5% for remaining profits). Furthermore, it can be eligible for offshore tax exemption, meaning the profits earned from foreign sources will not be taxed in Hong Kong.

Compliance requirements

There are several annual compliance requirements for a subsidiary in Hong Kong. Furthermore, yearly, the subsidiary must file a Tax Return together with audited accounts to the Inland Revenue Department and an Annual Return to the Companies Registry.

Branch in Hong Kong

A Hong Kong branch office is deemed as only an extension of its parent company established in another jurisdiction.

The matter of liability

Since it is only an extension, a branch office is not a separate entity in its rights and powers, even though it is a legal entity registered with the Companies Registry. Hence, the foreign parent company will hold full responsibility for all debts or liabilities incurred by the branch office in Hong Kong.

Incorporation requirements

- Entity name: the name of a branch office in Hong Kong needs to be identical to that of the parent company.

- Business activity: a branch can only carry out a business activity that is the same as that of the parent company.

- Entity’s key personnel: For a branch setup, only one authorized representative who is a Hong Kong resident is required.

The requirements for branch registration in Hong Kong are rather few and easy. However, it is quite restrictive since the name and activity must be the same as its parent company. Companies looking to open branch office in Hong Kong

should carefully consider these limitations before proceeding.

Taxation

This is another similarity to a subsidiary. A branch in Hong Kong will be taxed in the same manner as locally incorporated companies. It can also benefit from offshore tax exemption and Hong Kong’s network of international double tax treaties.

Compliance requirements

Likewise, a branch has to comply with many post-registration requirements. Furthermore, like local companies, it has to file annual reports to related Hong Kong regulatory authorities, sometimes a copy of the audited accounts of the parent company if requested.

the cost breakdown

for your

new business in Hong Kong

Representative office in Hong Kong

A Hong Kong representative office is not treated as a legal entity since it is the office of its foreign parent company to be set up temporarily for administrative tasks in another jurisdiction. It is worth noticing that a Hong Kong representative office can only serve non-profit purposes.

The matter of liability

In most cases, due to no legal standing, a representative office does not bear any liability in the event of debt costs. All the liabilities will be channeled back to its foreign parent company.

Incorporation requirements

- Entity name: the name of a representative office in Hong Kong needs to be identical to that of the parent company.

- Business activity: a representative is not allowed to earn profits, it is only allowed to carry out non-profit activities such as market research or administrative tasks.

- Entity’s key personnel: a representative office is only required to appoint a staff member from the overseas parent company to relocate to Hong Kong.

The requirements for branch registration in Hong Kong are rather few and easy. However, it is quite restrictive since the name and activity must be the same as its parent company.

Taxation

Since no profit can be generated from a representative office in Hong Kong, no tax is imposed on such an office.

Compliance requirements

Likewise, filing tax returns or annual returns with competent authorities is not required for this structure. Note, however, that application for a Business Registration Certificate (including renewals of Certificate) is still a mandatory requirement for the representative office in Hong Kong.

Notably, you can optimize the procedure of establishing a branch or representative office in Hong Kong by entrusting the powers to professionals or trusted parties through a Power of Attorney. This approach not only saves significant time and costs but also ensures a successful outcome.

Free ebook

Everything you need to start business in Hong Kong

Find out in a matter of minutes.

How to choose the best business structure for your foreign company

Whether you decide on a branch office, a representative office, or a subsidiary, you should consider your foreign parent company’s business goals in advance and the positives and negatives of each structure.

Keynotes you might need to make the right decision

- Large corporations prefer opening a branch office, while most SMEs choose a subsidiary or a representative office in Hong Kong

- Branch and subsidiary are allowed to engage in profit-earning activities but must follow compliance obligations such as audited accounts, filing annual returns and tax returns, AGMs, etc.

- Branches and subsidiaries bear no difference in the tax rates applied. Both are taxed as locally incorporated companies in Hong Kong.

- Representative offices act as temporary vehicles, they cannot generate any revenue for the foreign parent company.

- For a subsidiary, its parent company’s liability is limited to the amount of share capital contributed, whereas a branch and representative office have their liabilities extending to their parent company.

Still uncertain about branch vs subsidiary vs representative office in Hong Kong – which type of business presence is best suited for your foreign company? Feel free to email us your queries via service@bbcincorp.com for more details!

Our BBCIncorp support team is available to offer timely help.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.