It’s a well-known fact that Hong Kong stands close to the pinnacle of global business banking with hundreds of reputable institutions to its name.

But seeking entry, especially for foreigners, can be quite hard due to strict screening protocols and requirements for signatory presence.

Thus, arming yourself with adequate knowledge is crucial to getting your bank account started in this country. In this article, BBCIncorp will walk you through the registration process and useful tips for opening a Hong Kong bank account.

Opening a bank account in Hong Kong: Is it difficult?

Holding steadfast in the face of global competition, Hong Kong maintains its elite standing, ranking within the top 4 in the Global Financial Centres Index 34.

Without any doubt, Hong Kong is among the most reputed jurisdictions in the world for its image as an international financial mecca. Particularly, Its extensive network of banks and effectively transparent regulations are outstanding points.

Therefore, the reputation of banks in Hong Kong is well recognized, for instance, HSBC. As reported by HKMA, Hong Kong has more than 70 of the largest 100 banks worldwide, with nearly 30 multinational banks establishing their regional headquarters in Hong Kong.

Thanks to this, Hong Kong becomes one of the top pick offshore banking jurisdictions for foreigners. Having said that, notwithstanding, registering a Hong Kong bank account for foreigners is often met with some challenges.

Many ex-pats and non-residents, especially those with newly incorporated companies often face some difficulties when opening a bank account here.

In addition, some common problems are:

- Due diligence procedure in Hong Kong;

- Possible required in-person appointments;

- Significant impact of a company profile on the eligibility of bank account opening;

- Long processing time for the bank’s approval since banks in Hong Kong are extremely protective of their financial services.

Additionally, each bank can apply different criteria in evaluating the appropriateness of your case.

So the answer is YES if you are not a resident of Hong Kong.

Applicants can also be denied access to opening accounts with Hong Kong banks due to their nationality, business activities, etc.

How to open a bank account in Hong Kong

In this section, we’ll provide key factors of bank account opening in Hong Kong for you to consider.

Understand the fundamentals of Hong Kong bank account opening

As a new client, you must be confused about the registration process and requirements to start a bank account in Hong Kong.

Moreover, opening a bank account requires a high level of verification and security in this high-profile country, especially for Hong Kong corporate bank accounts.

To clarify, below are some key highlights concerning Hong Kong bank account opening:

Possibility to open a bank account for foreigners in Hong Kong

Whether you are a Hong Kong resident or non-resident, it is eligible to open a business bank account.

However, foreigners may be subject to more additional requirements for verification/identification purposes, compared to local residents. For instance, if you possess a Certificate of Resident Status, there is a higher chance your application will be approved due to the credibility this document offers.

Separate account types for individuals and business entities

From the perspective of an account holder, you may choose:

- Personal bank account type: Applicable for any individual who wishes to open a bank account in Hong Kong

- Corporate bank account type: Applicable for Hong Kong limited companies or overseas companies in Hong Kong

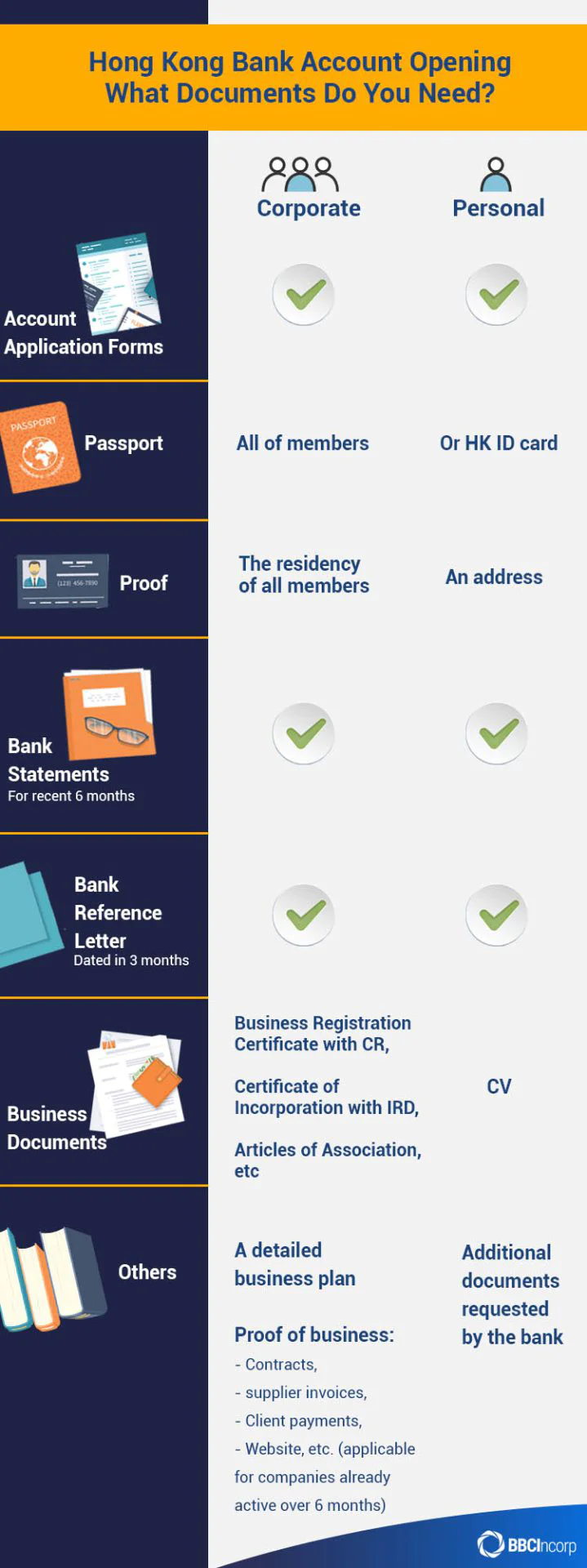

Required documents for opening a bank account in Hong Kong

Below are some documents you shall need to prepare for the Hong Kong bank account opening

Hong Kong set out strict anti-money laundering regulations. Under the guidance of the Hong Kong Monetary Authority and in line with international best practices, all Hong Kong banks need to check due diligence on both new and existing customers before granting approval.

Note that requirements for this process may be varied, depending on your bank of choice. Moreover, setting up a corporate bank account has more requirements than opening a personal bank account.

In addition to knowing the KYC obligations, non-resident enterprises are required to attach additional documents like proof of business activities.

Also, a personal interview with the bank’s representative for bank account opening is possibly compulsory. All directors, beneficial owners, and shareholders with no less than 10% or other pre-specified rates of the company shares must participate.

In the meantime, the complete account opening process in Hong Kong can normally take up to 15 working days.

Applying for a business bank account can be a real challenge if you’re just starting out and have no substantial trading proof. For an exclusive summary of the background, problems, and solutions, check out the Case Study: Business Banking Application For Startup.

Fee and charges associated with bank account registration

In the table below, you will find an overview of different types of deposits and their associated fees (for reference only).

| Types of deposit/ charge/ fee | Payable amount |

|---|---|

| Initial deposit | HK$10,000 – 50,000 |

| Minimum balance | HK$50,000 – 500,000; otherwise a charge of HK$200 monthly |

| Processing fee | Up to HK$10,000 |

| Appointment meeting fee | HK$1,200 – 1,350 |

| Order of international credit card | HK$30,000 – 50,000 |

| Foreign transfer fee | HK$15 – 120 |

| Early closure fee | HK$200 |

Depending on the specific bank you select, fee requirements may differ. You should carefully review the structures of different banks and compare them to find the most suitable option for your specific needs.

If you wish to know more about why Hong Kong banks may reject your application, let’s explore the insights shared by our Relationship Manager, who boasts years of valuable experience in the field.

Open a Hong Kong bank account online

Some say foreigners cannot open a bank account remotely in Hong Kong. In reality, overseas customers may have several ways to open bank accounts in Hong Kong.

Yet, the in-person visit requirement for opening a Hong Kong bank account creates difficulty and inconvenience for foreigners.

Furthermore, all applicants (and relevant company directors) wishing to open a bank account in Hong Kong must be present for the application interview in Hong Kong.

Having said that, opening a bank account remotely is still possible with the following solutions:

Branch application

Non-residents can opt for “branch application” as one viable solution to minimize the complexity. They can find an international bank with a foothold in Hong Kong (HSBC for example).

In this way, they can visit the bank right in their home country to fulfill all the needed paperwork before arriving in Hong Kong to complete the final steps for the opening process. Do note that only some banks provide this option, and the individual branch has its policy regarding this matter. So you should better consult your desired bank or a trusted banking introducer to get everything sorted out first.

For more valuable information for your business, check out our dedicated article on the best bank options in Hong Kong.

Digital account opening

Digital solutions for opening a bank account have become increasingly popular as it allows remote registration and virtual call with banks. Modern technologies would be effectively utilized to streamline the traditional process and everything completely done online.

By all means, some most recommended fintech companies that offer high-quality digital account opening services are Airwallex, Wise, or Statrys.

Some Hong Kong banks allow businesses to open their corporate bank account without a direct presence in Hong Kong. Still, the case may vary depending on each bank’s policy at that time and your business circumstances as well.

In any event, you should engage a professional service provider in Hong Kong who will help them to get everything done in advance with the Hong Kong bank account opening.

Open offshore bank accounts for Hong Kong companies

If you are planning to form a company in Hong Kong and wondering about the difficulty of opening a bank account there, you are recommended to think of offshore bank accounts.

In general, opening a bank account is one of the key requirements for incorporated companies in Hong Kong. However, Hong Kong companies are NOT compulsory to own a corporate bank account in Hong Kong. Instead, they can register a bank account in other countries.

Overall, because of its good reputation, Hong Kong companies are typically welcomed in most foreign countries, allowing them to easily open a bank account.

4 steps to set up a typical Hong Kong bank account

- Gather required documents, including certified true copies if requested

- Submit all required documents to your chosen banks

- Wait for approval to schedule a meeting or virtual call with bank representative

- Activate your bank account by following bank’s requirement for initial deposit

How we can help you open a bank account with ease

BBCIncorp has a broad partnership network with both local and international banks in Hong Kong, which offers the best banking solutions for your needs. We guarantee a one-time fee for multi-bank support. With our premium package, you can get up to 5 times of bank applications, or till the account is opened successfully, whichever comes first.

In case you fail to register with your initial bank of choice, we’ll continue to support you with other viable options in Singapore, the BVI, Belize, and other jurisdictions.

At the moment, Hong Kong companies are not required to open a local corporate bank account. Thus, you may want to consider overseas bank accounts for your Hong Kong companies.

If you’re new to the concept of corporate banking and don’t know where to start, feel free to get in touch with us via service@bbcincorp.com or visit our banking support to get the full list of banking options, guidance, and practical advice.

Frequently Asked Questions

What are the Telephone and Online Banking Options?

Telephone banking and Online banking are services provided by a bank or other financial institution that help customer to do transaction without visiting the bank and most likely 24/7 available.

How to open a bank account in Hong Kong from the UK?

The most important things you should do is to acquire all the essential document for opening a bank account in Hong Kong. You will a Hong Kong Identity Card or a valid passport; proof of address in Hong Kong or your home country); and a completed application form.

Why is it difficult to open a bank account in HK remotely?

The most common cause is due to a need to prove your identity. Hong Kong bank will need to be able to verify whether you are a real person/entity or not and that you do not involved in any suspicious action.

Is international capital transfers free in HK?

Hong Kong does not impose control on international capital transfer. Therefore, foreigner investor are allowed to invest into or repatriate capital or convert and remit profit deprive from direct investments.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.