Singapore has earned a global reputation as a premier destination for startups and international businesses, thanks to its strategic location, strong economy, and business-friendly environment.

Singapore company registration is a popular choice for entrepreneurs due to its streamlined setup process, attractive tax incentives, and transparent, robust legal framework. Whether you’re a local entrepreneur or a foreign investor, starting a business in Singapore offers unparalleled opportunities for growth and expansion.

In this comprehensive guide, we’ll walk you through the entire Singapore company registration process—covering legal requirements, key documents, registration timelines, and estimated costs—to help you make informed decisions and get your business up and running quickly and efficiently.

Why register a company in Singapore?

Registering a company in Singapore offers compelling advantages under its pro-business policies. Entrepreneurs benefit from 100% foreign ownership, enabling complete control without needing local partners.

Singapore’s corporate tax rate is a flat 17%, with generous tax exemptions. Startups can receive up to 75% exemption on the first SGD 100,000 of chargeable income and 50% on the next SGD 100,000 for their first three years (1).

These incentives significantly reduce tax burdens during the critical early stages. Additional schemes, such as the Intellectual Property Development Incentive and sector-specific tax concessions, can further lower effective tax rates.

Opening a company in Singapore is not only tax-friendly but also remarkably efficient. The country consistently ranks among the world’s top jurisdictions for ease of doing business. It was named the world’s best place to do business in 2024 and holds the #2 global ranking in the World Bank’s Ease of Doing Business Index.

The nation is renowned for its political stability, rule of law, and a robust legal system, with Asia’s least corruption and one of the region’s top judicial frameworks.

Strategically located at the crossroads of Southeast Asia, Singapore serves as a gateway to booming ASEAN markets and beyond. Its extensive network of 80+ double taxation agreements and 26 free trade agreements gives local businesses tariff-free or preferential access to major markets like China, India, the US, and the EU.

These factors make business registration Singapore highly attractive for startups, SMEs, and foreign entrepreneurs. With streamlined online incorporation via

ACRA’s BizFile, minimal residency requirements, and a vibrant fintech and innovation ecosystem, Singapore is tailor-made for business launch, expansion, and sustainable growth.

How to register a company in Singapore?

Registering a company in Singapore is a straightforward process, but it’s important to understand each step to ensure compliance and avoid delays.

Whether you’re a local entrepreneur or a foreign investor, this section will guide you through how to open a company in Singapore and help you navigate the company registration process with ease and clarity.

Step 1: Choose a business structure

Selecting the right legal structure is the first decision when you register a new company in Singapore. The country offers several entity types of companies, including sole proprietorship, partnership, and company structures such as a limited liability company Singapore.

- Private Limited Company (Pte Ltd) is the most popular choice for entrepreneurs. It offers a separate legal entity, limited liability protection, up to 50 shareholders, and the flexibility to raise capital through shares. For smaller businesses with fewer shareholders, an exempt private limited company is also available, offering simplified compliance requirements.

- Sole Proprietorship suits solo entrepreneurs with minimal compliance but comes with unlimited personal liability and no separate legal identity.

- LLP combines aspects of partnerships and companies, providing limited liability to partners but taxed as individuals.

For scalability, credibility, investor appeal, and to reap the benefits of Singapore company registration, a Private Limited Company is often the best structure. Its benefits include more tax breaks, easier capital acquisition, perpetual existence, and the separation of personal and company assets.

Step 2: Reserve a company name

Once you’ve chosen a structure, use ACRA’s BizFile+ portal to register the company name in Singapore.

The name must be unique, not offensive, and should not infringe on trademarks. ACRA automatically checks availability upon submission. If approved, your reservation is valid for 120 days, giving you ample time to file for incorporation.

You can check company name availability in Singapore directly in the BizFile+ system. If your proposed name is taken or too similar to an existing one, revise and resubmit.

Additionally, you can use the BBCIncorp free built-in tool (here) to check your company name and confirm its business name availability instantly.

Once approved, ACRA issues a name approval number, enabling you to proceed to the next step efficiently—completing an essential part of business name registration Singapore.

Step 3: Appoint key roles

Under Singapore regulations, each Pte Ltd company must appoint key officers:

- Director(s): At least one must be a local resident—either a Singapore Citizen, Permanent Resident, EntrePass or Employment Pass holder—and must be at least 18 years old.

- Company Secretary: Appoint within six months of incorporation. This individual must be a local resident and responsible for statutory compliance, including maintaining registers and filing annual returns.

- Shareholders: You need at least one shareholder, who can be local or foreign. A Pte Ltd company may have up to 50 shareholders, who can be individuals or corporate entities.

These appointments satisfy Singapore director requirements and Singapore company secretary rules, establishing a strong governance foundation essential to ensuring regulatory compliance and corporate credibility.

Step 4: Prepare incorporation documents

Before filing your application, gather essential documentation as per ACRA requirements:

- Company Constitution: Previously called the Memorandum & Articles of Association; it outlines internal rules, shareholder rights, and director duties.

- KYC documents: Valid passport copies, proof of residential address for all directors and shareholders, and any additional identity documents for corporate shareholders

- Registered office address: Must be a physical Singapore address (residential addresses are acceptable, though many entrepreneurs use virtual office services).

Having these incorporation documents Singapore prepared in advance speeds the process and ensures compliance with ACRA’s ACRA requirements.

Step 5: Submit to ACRA and get approval

Finalise your application online via BizFile+. You’ll submit:

- Company name reservation number

- Details of directors, shareholders, and company secretary

- Company Constitution

- Registered office address

- Share capital information (minimum paid-up capital of S$1)

Upon payment—S$315 for company registration including name application—ACRA processes most applications within 1 to 3 working days. In straightforward cases, approval can be almost immediate. More complex submissions may require referral to another government agency and take between 14 and 60 days.

After approval, your company receives a Unique Entity Number (UEN) and a digital copy of its Business Profile, enabling you to operate legally in Singapore. This final step fulfills ACRA registration Singapore and answers the question: how long does it take to register a company in Singapore.

By following these steps, choosing a structure, reserving a name, appointing officers, preparing documents, and submitting through BizFile+, you can complete the process of opening a company in Singapore smoothly. This ensures your business is legally recognized, compliant with local regulations, and ready to thrive in Singapore’s dynamic business environment.

Costs and timeframe of registering a company in Singapore

Understanding both the expenses and time required for company registration Singapore helps new business owners plan effectively. Below, we break down the financial commitment and timeline, whether you’re handling it yourself or using professional services.

How much to register a company in Singapore

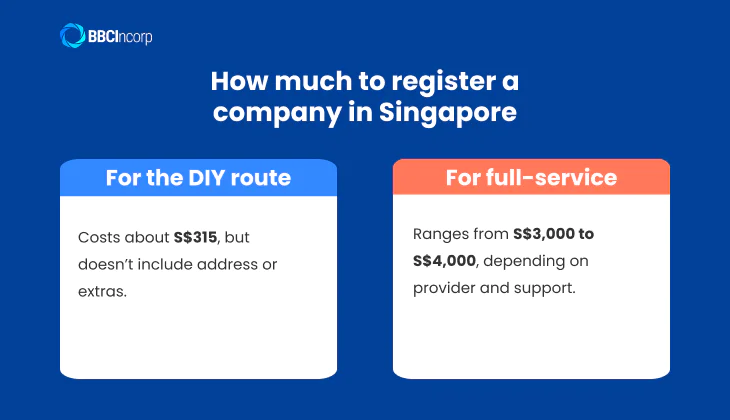

When considering how much to register a company in Singapore, there are two main options: DIY registration and engaging a service provider.

Government fees (DIY route):

- ACRA charges S$15 for the name application and S$300 for company incorporation. This brings the total to S$315.

- Annual filing fees are S$60, with additional administrative charges depending on your company’s activities.

- A local office address is also required. Virtual office plans typically cost between S$300 and S$600 per year. Physical office rental can range from S$2,000 to S$3,000 per month, depending on location and size.

- Miscellaneous: Minor costs for printing, notary, and KYC documents

If you choose to work with service providers or incorporation package specialists, the total setup costs are typically higher. These range from S$3,000 to S$4,000 and usually include government fees, preparation of incorporation documents, SingPass support, nominee director services if required, company secretary appointments, and initial compliance services.

As a result, the cost of registering a business in Singapore can vary significantly.

- For the DIY route, expect to pay around S$315, excluding address and incidental costs.

- For full-service assistance, the total cost usually falls between S$3,000 and S$4,000 depending on the provider and the level of support included.

How long does it take to register a company in Singapore?

Are you wondering how long it takes to register a company in Singapore? Timelines vary based on efficiency and completeness:

DIY or local-led applications:

If all documents are accurate and the company name is approved, ACRA typically approves the registration within 1 to 3 working days.

Foreign director scenarios:

- If you appoint a local nominee director or use a relocation service, you can still expect 1–3 days once all KYC documents are in order.

- If relying on Employment Pass approvals first, your incorporation might be delayed until work passes clear; this can extend the process by 1–4 weeks.

Common causes of delays:

- Name reservation issues: Name may be rejected or flagged for similarity or offensiveness, delaying the next step.

- Document errors: Missing or incorrectly formatted KYC documents, constitution, or address proof can trigger revisions.

- Address verification: Unverified addresses or improper office setup can hold up approval.

- Additional agency referrals: For businesses requiring special licenses (e.g. finance, healthcare), ACRA may refer the application to other agencies, adding weeks to the timeline.

In most cases, the company registration timeline in Singapore takes just a few days. However, if foreign directors or licensing requirements are involved, it’s wise to build in some extra buffer time. Proper preparation and high-quality documentation help ensure you complete the process in the shortest timeframe possible.

By understanding both how much to register a company in Singapore and how long it takes, you can choose the right approach—DIY for speed and cost-savings, or professional assistance for convenience and compliance.

Post-registration requirements and compliance

Once your company is registered, fulfilling post‑incorporation obligations ensures you remain compliant with Singapore regulations. Here’s what you need to know:

What to do after registering a business in Singapore?

After receiving your certificate of incorporation Singapore, you must act swiftly to meet regulatory obligations:

- Appoint a company secretary within six months of incorporation. This individual is mandatory, must be a local resident, and is responsible for maintaining statutory records.

- Maintain a local registered office address at all times—a physical or virtual address where official correspondence can be received.

- Annual filing obligations include holding an Annual General Meeting (AGM) unless exempted, filing an annual return with ACRA, and submitting corporate tax returns to IRAS.

- Obtain business licenses applicable to your industry—for instance, those required for food establishments, financial advisory services, or media operations.

- Open a corporate bank account to manage company finances, handle payroll, and receive payments professionally. Local and international banks in Singapore facilitate accounts for resident and foreign-owned companies.

These essential tasks define what to do after registering a company and form the core of post-incorporation Singapore compliance responsibilities.

Common compliance requirements for Singapore companies

Singapore companies must adhere to strict regulatory and tax filings:

- Annual filings to ACRA and IRAS: You are required to file an Annual Return (AR) with ACRA usually within a month of your AGM. Separately, your corporate tax return (Form C) is due by November 30 for e-filers.

- Holding financial statements and AGM: If exempt from an AGM, file the necessary notification; otherwise, annual meetings must be convened within a set timeframe—usually within 6 months of the financial year-end.

- Penalties for late submissions: ACRA imposes fines starting from around SGD 300 for late Annual Returns, with daily late fees. IRAS penalties range from late filing penalties of SGD 200 to higher fines or prosecution if returns are severely delayed.

Compliance after company registration includes maintaining accurate financial records and submitting timely reports. To ensure proper accounting and auditing, businesses must adhere to regulatory standards. Failing to comply risks enforcement actions such as fines, compliance notices, or disqualification of company directors—highlighting the importance of Singapore business compliance.

By keeping up with these core obligations, your company remains in good legal standing and benefits from the full advantages of Singapore’s progressive business environment.

At BBCIncorp, our professional accounting services are designed to provide businesses with the clarity and confidence needed to thrive in a competitive landscape. From meticulous bookkeeping and timely financial reporting to navigating complex tax compliance, our expert team transforms your financial data into a powerful tool for strategic decision-making.

BBCIncorp Singapore Company Incorporation Services

At BBCIncorp, we specialize in business registration in Singapore with a focus on making the company incorporation process simple, fast, and fully compliant. With over a decade of experience and a trusted presence in the global market, we’ve helped thousands of entrepreneurs and businesses launch successfully in Singapore.

Why choose BBCIncorp for an incorporation company in Singapore? Our incorporation process is designed for convenience and efficiency. With our user-friendly online platform, clients can submit documents, verify their identity, and track progress—all digitally. Our team of experts provides step-by-step support throughout the entire registration journey.

We offer transparent and competitive pricing, ensuring you know exactly what you’re paying for. Our incorporation of company in Singapore packages covers everything you need, including:

- Company name availability check

- Preparation and filing of incorporation documents with ACRA

- Provision of a registered office address in Singapore

- Optional nominee director services for foreign clients

Beyond incorporation, we offer comprehensive post-registration support—including guidance on regulatory compliance, assistance with opening a corporate bank account in Singapore, and reliable corporate secretarial services in Singapore to keep your business compliant year-round.

With BBCIncorp, you gain a reliable partner committed to helping you navigate the Singapore company registration process with confidence and clarity. Whether you’re a local entrepreneur or an overseas founder, we provide the right tools, knowledge, and support to help your business succeed from day one.

Conclusion

Singapore continues to be one of the most attractive destinations for entrepreneurs looking to start and grow a business. Its pro-business environment, competitive tax rates, and global reputation make new company registration here a smart and strategic move.

With a transparent and efficient process, it’s never been easier to register a company in Singapore. Whether you’re a local founder or a foreign investor, the country offers strong legal support, modern infrastructure, and easy access to regional markets.

To ensure a smooth Singapore company registration journey, it’s essential to stay compliant from the start and seek expert guidance where needed. Partnering with a trusted provider like BBCIncorp can simplify the process and set your business up for long-term success.

Frequently Asked Questions

Can foreigners register a company in Singapore?

Yes, foreigners can register a company in Singapore. The country welcomes foreign ownership, allowing 100% foreign shareholding for most business types. If you are a non-resident looking into starting a business in Singapore as a foreigner, you can do so without needing Singaporean partners. However, you must appoint at least one local resident director as required by the Companies Act.

Do I need to be in Singapore physically?

No, you don’t need to be in Singapore to start the incorporation process. If you’re wondering how to open a company in Singapore remotely, the process can be completed entirely online through a corporate service provider like BBCIncorp. However, certain post-incorporation steps, such as opening a bank account, may require physical presence depending on the bank’s policy.

What if I don’t have a local director?

If you’re registering a company in Singapore and don’t have a local director, you can engage a nominee director service. This allows foreign entrepreneurs to meet the local directorship requirement while retaining full ownership and control of the company.

Do I need a physical office address?

Yes, to register a company in Singapore, a local registered office address is mandatory. It must be a physical address (not a P.O. Box) and available during standard business hours. Many service providers offer registered address services if you don’t have your own office space.

Can I register a company without a business activity?

Yes, you can complete the new company registration process even if your business is not yet operational. However, you must still declare a proposed business activity and choose the appropriate SSIC code during incorporation. The company can remain dormant until operations begin.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.