Table of Contents

Starting a business today is easier than ever, but choosing the right structure can shape everything from how you pay taxes to how investors see you.

One option that’s quietly redefining entrepreneurship is the single-member limited liability company. It gives one owner the freedom of running a sole business with the protection usually reserved for larger corporations.

Across markets, from Hong Kong to the U.S., the entity model is helping founders build smarter and faster. So can an LLC have only 1 member, what is a single-member LLC, and why does it matter?

In this article, we will break down its meaning, structure, and taxation, along with its real benefits and trade-offs. Explore with BBCIncorp how to make it work for your business.

What is a single-member LLC?

A single-member limited liability company is a legally recognized business structure owned by one person. It combines limited liability with operational flexibility. It is a preferred choice for entrepreneurs who want simplicity without personal exposure to business risks.

The single-member LLC meaning is creating a distinct legal entity that separates the owner’s personal and business finances.

Legal framework of the LLC

Legally, a single-member limited liability company operates as an independent entity. It can own property, enter into contracts, and be held accountable for its obligations.

In most jurisdictions, including the United States, Singapore, and Hong Kong, the structure must be formally registered and comply with local company laws.

Is a single-member LLC a sole proprietorship?

No, it isn’t. Although both models involve one owner, the legal treatment is entirely different.

A sole proprietorship offers no legal boundary between the individual and the business, meaning personal assets are exposed to business liabilities.

The single-member LLC avoids this risk by granting the owner limited liability status.

Alternative names of the single-member LLC

Depending on the jurisdiction, the entity may also be known as a one-person LLC, sole owner LLC, or single entity LLC.

Regardless of terminology, each serves the same purpose: enabling one individual to run a fully recognized legal business while retaining safety and flexibility.

Global recognition

Many modern economies now accommodate a one-person company LLC to support small business development.

The U.S. treats it as a “disregarded entity” for tax purposes. Other jurisdictions, such as Singapore and Hong Kong, allow similar structures that adapt to local tax and reporting requirements.

The single-member limited liability company has evolved into a practical solution for globally minded entrepreneurs seeking efficiency and legal security.

Key features of a single-member LLC

Single-member LLCs’ structure suits entrepreneurs who want to run a professional, legally recognized business without the complexity of big-scale corporate formalities.

The following features explain why the sole owner LLC continues to attract founders in many markets.

Ownership and management structure

A one-person LLC, as the name suggests, can be fully owned by one individual or by another legal entity (e.g., corporation or trust). The flexibility makes it suitable for independent founders and for businesses that operate subsidiaries.

Ownership is represented through membership interest, which can be transferred or inherited if the founder leaves the company.

Management can follow two main formats:

- A member-managed company allows the owner to oversee operations directly and make all strategic decisions.

- A manager-managed company enables the owner to appoint another person or group to handle daily management, but still keeps final control.

Adaptability enables entrepreneurs to design a structure that matches their capacity and growth plan.

Liability protection and asset separation

One of the most significant advantages of a sole-member LLC is its liability protection. As mentioned, the company is recognized as a separate legal entity, meaning it is responsible for its own debts and obligations.

The owner’s personal assets, such as bank accounts, homes, or investments, remain secure from business risks.

As a result, mixing funds or ignoring compliance rules can cause courts to remove the liability shield, a process known as piercing the corporate veil.

It is essential to maintain dedicated business accounts, keep accurate records, and document major decisions in order to avoid unfavorable situations.

Pass-through taxation

A single-owner LLC is generally treated as a disregarded entity in the United States. The company itself does not pay federal income tax separately. Instead, all profits and losses are reported on the owner’s personal tax return under Schedule C. It simplifies administration and prevents double taxation.

Other jurisdictions apply similar approaches with different rules:

- Singapore: A one-shareholder private limited company can enjoy partial tax exemptions. If the company earns SG$100,000, the first 75,000 is taxed at an effective rate of about 4.25 percent. The rest is taxed at 8.5 percent. This keeps overall tax obligations low for small business owners.

- Hong Kong: Only profits sourced within Hong Kong are taxed. If a company earns HK$100,000, it pays 8.25 percent in profits tax under the two-tiered rate system. There is no additional tax when the owner withdraws those profits as personal income.

These single-owner LLC tax systems share the same goal as the pass-through model in the United States: making sure that income from a small business is taxed only once at the individual level.

Flexibility in operations

Unlike corporations, single-member LLCs are not required to hold board meetings or issue shares. The owner can make decisions quickly and adjust to market conditions with minimal administrative work. Even so, preparing an operating agreement helps define procedures and enhances credibility with partners, banks, and regulators.

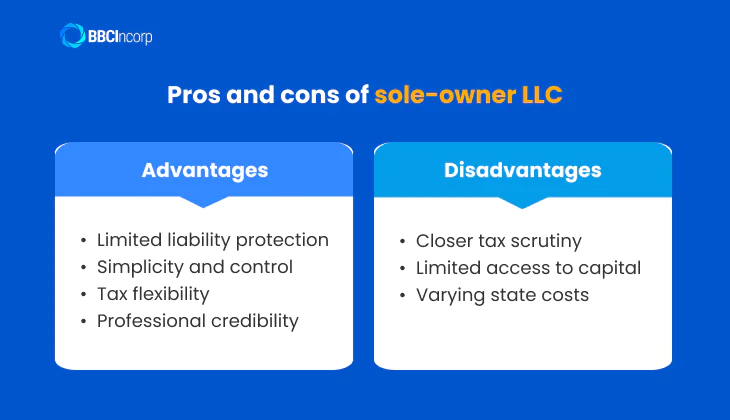

Advantages and disadvantages of a single-member LLC

A single-member limited liability company offers entrepreneurs a straightforward way to operate with legal protection and operational freedom. Yet, while the structure provides distinct advantages, it also comes with a few considerations that affect long-term success.

Benefits of a single-member LLC

Limited liability protection

A one-person company LLC keeps personal and business finances separate. The owner’s private assets remain safe if the company faces debts or legal claims. Such protection forms the foundation of trust and confidence for many independent founders.

Simplicity and control

Single-member LLC benefits include the ability to make quick decisions through simpler internal approvals. The owner oversees operations directly, allowing the business to respond fast to market opportunities.

Tax flexibility

By default, a single-member LLC enjoys pass-through taxation, meaning profits are taxed once on the owner’s personal return. However, the owner may elect corporate taxation if it proves more efficient. The flexibility supports better financial planning and strategy.

Professional credibility

Operating as a registered entity is beneficial for building stronger relationships with clients, suppliers, and financial institutions. A formal structure demonstrates accountability and stability, which are often key factors in business partnerships.

Potential drawbacks of a single-member LLC

Closer tax scrutiny

The IRS pays more attention to single-member LLCs to ensure that personal and business transactions stay separate. Inconsistent bookkeeping or fund mixing can and will surely raise compliance issues.

Limited access to capital

Since ownership rests with one person, attracting investors or expanding equity becomes more difficult. This may restrict growth opportunities that depend on external funding.

Varying state costs

Some states impose higher annual fees or reporting requirements for single-member entities. Although the amount differs, these costs add up over time for small operations.

With proper compliance and sound management, the benefits usually outweigh the challenges, making the structure a reliable choice for many modern businesses.

Single-member LLC vs. other business structures

Choosing the right business structure shapes how an entrepreneur manages taxes, liability, and growth. A single-member LLC sits between informal setups like sole proprietorships and more structured entities like corporations. Here are the detailed comparisons you should know.

Single-member LLC vs. sole proprietorship

A sole proprietorship is the simplest form of business ownership. It has no legal distinction between the owner and the business, meaning all profits and liabilities belong directly to the individual.

In contrast, a single-member limited liability company creates a separate legal entity that protects personal assets from business debts and lawsuits.

Legal liability

The most important difference lies in risk protection. A sole proprietor is personally responsible for all financial obligations. If the business faces legal claims, personal property such as savings or real estate may be at risk.

A single-member LLC, on the other hand, provides liability protection similar to larger entities.

Tax filing and compliance

Both structures use pass-through taxation, but compliance rules differ:

- A sole proprietor files business income on Schedule C of their individual tax return.

- A single-member LLC does the same, but it must file additional state documents to remain in good standing.

- The LLC may also elect to be taxed as an S corporation to optimize self-employment taxes. The added paperwork provides more flexibility but requires better recordkeeping and compliance awareness.

In summary, a single-member LLC offers stronger protection and more credibility for professional dealings, while a sole proprietorship remains the simplest choice for those with minimal risk exposure.

Single-member LLC vs. corporation

Structure complexity

Corporations, whether C or S, follow a more complex structure. A C corporation pays tax separately from its shareholders. This creates double taxation when profits are distributed as dividends.

In contrast, a single-member LLC allows profits to flow directly to the owner’s tax return.

In the case of an S corporation, it avoids double taxation by passing income to shareholders, but it has eligibility restrictions. The company must have fewer than 100 shareholders, all of whom must be U.S. citizens or residents.

A single-member LLC faces none of these limits and can be owned by individuals or entities, including foreign persons.

Compliance and administration

Corporations require formalities such as issuing shares, appointing directors, and holding annual meetings. A single-member LLC has simpler reporting duties and greater decision-making flexibility.

In short, corporations may appeal to those planning to raise large-scale investment or eventually go public. The single-member LLC fits smaller, independent operations that value speed and control.

Single-member LLC vs. multi-member LLC

The main difference between a single and a multi-member LLC lies in the number of owners and how decisions, profits, and responsibilities are distributed.

Number of owners

A single-member structure concentrates ownership and control in one person or entity, which allows quick decision-making and full profit retention.

In contrast, a multi-member LLC includes two or more owners who share authority, investment, and liability according to the terms in their operating agreement.

Taxation and operational management

LLCs all provide limited liability protection, yet the two types diverge in taxation and operational management.

- A single-member LLC is treated as a disregarded entity by default, with income reported on the owner’s individual tax return.

- A multi-member LLC is generally treated as a partnership by default, requiring the business to file Form 1065 and issue Schedule K-1 to members.

Furthermore, multi-member LLCs can access broader funding since ownership can be divided among investors. They also enable easier succession planning and continuity when one member exits.

However, this setup requires clearer governance rules to manage profit sharing, voting rights, and dispute resolution.

Below is a summary comparing both models for better reference:

| Criteria | Single-member LLC | Multi-member LLC |

|---|---|---|

| Number of owners | One | Two or more |

| Decision making | Sole authority | Shared among members |

| Taxation | Pass through by default, reports on personal return | Partnership returns with K-1 forms |

| Liability protection | Full protection for the owner | Full protection for all members |

| Capital raising | Limited to the owner’s resources | Easier through member contributions |

| Succession | Ownership transfer can be complex | Transfers are easier, through operating agreements |

For a more detailed analysis of ownership, flexibility, and succession, kindly explore BBCIncorp’s comparison of single-member vs. multi-member LLCs.

To conclude, entrepreneurs should evaluate their long-term vision, funding needs, and risk tolerance before deciding. The right structure balances protection, compliance, and operational freedom, ensuring the business can grow sustainably and expand with expertise.

How to set up a single-member LLC

Establishing a single-member limited liability company follows a structured process.

Step 1: Choose the setup location

Select the state where your company will operate. Many entrepreneurs form their LLC in the state where they live and do business, which streamlines tax filings and local licensing.

Others may opt for business-friendly jurisdictions such as Delaware, Nevada, or Wyoming due to favorable laws and efficient filing systems.

It is essential to assess where most activities will occur, as operating in multiple states can require additional registration.

Step 2: File the Articles of Organization

Prepare and file the LLC Articles of Organization with the state’s business filing office, typically the Secretary of State. This document includes basic company information such as the LLC name, principal address, and ownership details. Filing fees vary by state but usually range between 50 and 500 US dollars.

Once approved, the LLC officially becomes a legal entity.

Step 3: Appoint a registered agent

Every LLC must have a registered agent who receives official notices, legal documents, and tax correspondence on behalf of the business. The agent must have a physical address within the formation state.

The owner can serve in this role, or hire a professional service for convenience and privacy.

Step 4: Create an operating agreement

Even when not legally required, an operating agreement is vital. It defines management procedures, outlines how profits are distributed, and clarifies what happens if ownership changes.

This internal document also strengthens the company’s separate legal identity, supporting the liability protection that distinguishes an LLC from a sole proprietorship.

Step 5: Obtain an Employer Identification Number

Next, apply for an Employer Identification Number (EIN) from the Internal Revenue Service. The EIN acts as the company’s tax identification number and is required for filing taxes, hiring employees, and managing financial accounts.

The process is free and can be completed online through the IRS website. If the EIN has already been issued, business owners can retrieve it through several reliable sources.

How can I find my EIN?

How to find the Employer Identification Number starts with checking the original IRS confirmation notice. The EIN also appears on previously filed federal tax returns, payroll filings, and bank account opening documents.

If you use a registered agent or accountant, you may request the number directly from them. When none of these records are available, the IRS Business and Specialty Tax Line can verify the company’s details and provide the EIN to an authorized individual as well.

Step 6: Open a business bank account

Finally, you can open a business bank account using your approved Articles of Organization and EIN.

Keeping personal and company finances separate helps maintain limited liability protection and simplifies bookkeeping.

State-specific compliance requirements for single-member LLCs

After setting up a single-member limited liability company, owners must maintain compliance to keep the entity active. LLC state requirements vary across jurisdictions but generally include reporting duties, maintenance fees, and state taxes.

Annual report filings

Most jurisdictions require an annual or biennial report to update ownership, address, and registered agent information. By requiring this, it is intended to ensure that public records remain accurate and that the company is still operating.

- Filing fees: Typically range from US$50 to US$500. However, the amounts vary by state, so consulting local experts is recommended to confirm the exact fee for your LLC.

- Penalties: Late filings can lead to fines from US$50 to US$400, depending on the jurisdiction. If reports remain unfiled, the entity may be placed in administrative suspension or dissolution, which removes its right to operate and can affect liability protection. Reinstatement often requires payment of outstanding fees plus a reinstatement charge.

State franchise taxes and fees

Certain jurisdictions charge an annual franchise tax or flat maintenance fee for the right to operate. Examples include:

- Delaware: Flat annual tax of US$300.

- Texas: Margin tax applies when annual revenue exceeds US$1.23 million.

- Wyoming: Minimal annual license tax based on assets in the state.

Key variations by state

Moreover, compliance obligations might differ by jurisdiction:

- Delaware: Streamlined filing and predictable costs make it popular for holding companies.

- California: Requires both the US$800 franchise tax and an annual statement of information.

- Texas: Offers online reporting with a generous revenue threshold before the tax applies.

It is important to understand these obligations in order to avoid penalties and maintain the full advantages of setting up a single-member LLC. Hence, make sure to do due diligence research before setting up your company.

How taxation works for a single-member LLC

Taxation is a defining factor that sets a single-member limited liability company apart from other business structures.

How is tax treatment for single-owner LLCs?

In the United States, a single-member LLC is automatically classified as a disregarded entity. The business’s income and expenses are reported directly on the owner’s personal tax return using Schedule C, meaning there is no separate federal tax filing for the company.

For example, if a U.S. single-member LLC earns US$100,000 in net income, that amount is added to the owner’s individual taxable income. The owner then pays tax based on the personal income tax rate, which ranges from 10 percent to 37 percent depending on the income bracket. The company does not pay a second layer of tax, so the same earnings are not taxed twice.

Notably, the owner can elect to be taxed as a C corporation or S corporation by filing Form 8832 or 2553. This is often used when the business reaches a size where reinvesting profits or drawing structured salaries becomes more tax-efficient.

What are self-employment and ongoing obligations?

Profits earned through a single-member LLC are subject to self-employment tax, which covers Social Security and Medicare contributions. The current combined rate is 15.3 percent on net income. To stay compliant, owners typically make quarterly estimated payments to avoid penalties and interest.

Can a single-member LLC have employees?

Yes. A single-owner LLC can hire employees just like any other business. Once staff are onboarded, the owner must:

- Obtain an Employer Identification Number (EIN)

- Withhold income and employment taxes

- File quarterly payroll reports such as Form 941

- Issue annual wage statements using Form W-2

Does a single-member LLC get a 1099?

Whether a single-member LLC receives Form 1099-NEC depends on its tax classification and the nature of payments.

- Disregarded entity: If the LLC provides services worth US$600 or more to another business, the payer must issue a 1099 under the owner’s name and taxpayer identification number.

- Elected as a corporation: Once a single-member LLC chooses corporate taxation (C or S corporation), it no longer receives 1099 forms for payments related to business services, since corporations are generally exempt from this rule.

Do single-member LLCs need an EIN?

Obtaining an Employer Identification Number (EIN) is not always mandatory for single-member LLCs, but it becomes essential in several situations:

- The LLC hires employees and must report payroll taxes.

- The owner opens a business bank account, as most financial institutions require a separate tax ID to distinguish business and personal funds.

- The business needs to apply for certain licenses or permits at the state or federal level.

- The LLC participates in vendor contracts or government tenders that require a business tax ID for verification.

Owners who run small operations with no employees and no corporate election can use their Social Security Number (SSN) for tax reporting instead. Regardless, obtaining an EIN is still recommended even when not legally required, as it enhances privacy by keeping the owner’s SSN off business documents and public filings.

Why choose BBCIncorp services for your single-member LLC formation

Building a business should start with clarity, confidence, and the right support. BBCIncorp has assisted global entrepreneurs in setting up and managing global companies since 2017.

Our LLC formation services cover every essential step, from entity registration to ongoing compliance. We handle the preparation and filing of organizational documents, assist in obtaining an Employer Identification Number (EIN), create business accounts, and provide registered agent services to meet state-level requirements.

With a network spanning major business hubs, BBCIncorp supports founders worldwide who wish to register a single-member LLC in the U.S., or even in other leading jurisdictions. Whether you are forming a Cayman Islands limited liability company for asset protection or setting up an LLC in Cyprus, BBCIncorp provides a unified process to simplify international expansion.

Every incorporation project is managed with attention to detail, local compliance insight, and a focus on sustainable growth. Thus, we guarantee transparent pricing, expert guidance, and a secure digital platform where you can manage company records, receive compliance reminders, and track filings in one place.

Visit our website or chat with our team and take the first step toward establishing a credible business presence.

Conclusion

A single-member limited liability company combines simplicity, flexibility, and liability protection, making it one of the most practical structures for solo entrepreneurs.

Unlike a sole proprietorship, it separates personal and business assets, fosters stronger legal protection, and professional credibility. Compared with multi-member LLCs, it provides ease of management, all while preserving the same core benefits.

To maintain these advantages, founders must stay compliant with state requirements, obtain an EIN when necessary, and keep business and personal finances distinct.

Understanding what a single-member LLC is and how it functions allows entrepreneurs to grow with confidence and control. Contact BBCIncorp team at service@bbcincorp.com for more information on setting up your limited liability company today.

Frequently Asked Questions

What is the cost of forming a single-member LLC?

The cost of forming a single-member LLC depends on the state where it is registered. Filing fees typically range from US$50 to US$500, depending on local regulations.

Some states also require annual reports or franchise tax payments to maintain good standing. Additional expenses may include registered agent services, name reservations, or EIN applications.

Using BBCIncorp services shall streamline registration, ensure compliance, and prevent costly errors during the filing process.

What is a single-owner LLC?

A single-owner LLC, also called a single-member LLC, is a limited liability company with one owner, known as the member. It provides personal asset protection by separating the owner’s finances from the business while keeping operations simple.

Is a single-member LLC good for investing?

Yes. A single-member LLC can be an effective structure for holding investments such as real estate, intellectual property, or stocks. It allows investors to manage assets through a separate legal entity, protecting personal wealth from potential liabilities.

Income from investments flows through to the owner’s personal tax return, simplifying reporting. However, rules may differ depending on the asset type and jurisdiction, so investors should consult legal and tax professionals before using a single-member LLC for investing.

Do single-member LLCs file annual reports?

Most states require single-member LLCs to file annual or biennial reports to keep registration active. These reports confirm key details such as the company’s address, ownership, and registered agent. The fees vary widely by state, so engage with a local professional like BBCIncorp to know the total cost.

Missing a filing deadline can result in penalties or administrative dissolution. Some states, like Delaware and Florida, enforce strict cutoffs and late fees. It is recommended to utilize compliance management tools or service providers for safety and efficiency.

Can I convert a sole proprietorship to a single-member LLC?

Yes, you can change a sole proprietorship to a single-member LLC.

The process involves filing Articles of Organization, obtaining an EIN, and transferring business assets and contracts under the new entity. Notably, many entrepreneurs make this transition to limit personal risk and gain a more professional business structure.

How do I pay myself as the owner of a single-member LLC?

As the owner of a single-member LLC, you are typically paid through owner’s draws rather than a formal salary.

Profits from the business can be withdrawn directly from the company’s bank account and recorded as distributions. These withdrawals are not subject to payroll taxes but are included in the owner’s taxable income.

If the LLC elects corporate taxation, the owner may instead pay themselves a salary under payroll.

Disclaimer: While BBCIncorp strives to make the information on this website as timely and accurate as possible, the information itself is for reference purposes only. You should not substitute the information provided in this article for competent legal advice. Feel free to contact BBCIncorp’s customer services for advice on your specific cases.

Industry News & Insights

Get helpful tips and info from our newsletter!

Stay in the know and be empowered with our strategic how-tos, resources, and guidelines.